Gulcin Ragiboglu/iStock via Getty Images

The Apple Investment Thesis Is Still Intact

It is evident that Apple (NASDAQ:AAPL) is in the hot seat now, due to the rumored Manchester United takeover and the riot in Foxconn’s factory in Zhengzhou. While almost impossible, we suppose the massively popular soccer team may add some advertising and marketing value to the company, especially in the Apple TV segment. However, due to the potential cash burn and the odd timing coinciding with World Cup excitement, it is unlikely that the rumor is true. We’ll see, since Daily Star has also speculated Amazon (AMZN) and Meta (META) as prospective buyers.

On the other hand, we do not expect lingering issues from the Foxconn riot. Notably, iPhone 12 was released in October 2020 at a time when global economies were shut down and China under lockdown. And yet, AAPL and Foxconn went above and beyond in delivering 100M units by H1’21. Though the Zhengzhou plant was previously responsible for four in five iPhone production and assembly, we expect these deliveries to still be completed, albeit delayed with much controversy.

Moving forward, Foxconn is already diversifying its production locations to Vietnam and Thailand, with the factory in India already producing additional iPhone 14 models since early November. Though the iPhone 14 Pro model is still limited to the Chinese factory, we expect things to change in the short term, since the factory in India is reportedly close to achieving parity with China’s capacity. Therefore, safeguarding AAPL’s top and bottom lines ahead, no matter the temporal headwinds.

Even Mr. Market remains optimistic about AAPL’s forward execution, since the stock continues to trade above its 50-day moving average, significantly aided by the upbeat October CPI reports. Assuming that 75.8% of analysts are right that the Feds truly pivot earlier by December, we may see another wave of optimism lifting most boats up then. One word of caution though, it is uncertain if this recovery will be sustainable through 2023, as the Feds may also raise terminal rates to over 6%.

AAPL’s Performance Continue To Defy The Bears

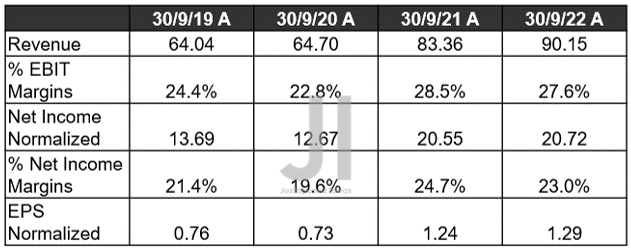

AAPL Revenue, Net Income ( in billion $ ) %, EBIT %, and EPS

S&P Capital IQ

In its latest earnings call, AAPL reported excellent YoY expansion in gross margins from 41.8% in FY2021 to 43.3% in FY2022, indicating its excellent pricing power despite the rising inflationary pressures. The company also recorded exemplary EBIT and net income margins of 27.6% and 23% in FQ4’22, respectively, representing excellent command of operating expenses over the past three years. This is impressive, despite the elevated stock-based compensation of $9.03B in FY2022, against $7.9B in FY2021 and $6.06B in FY2019. Then again, with $95.62B of share repurchases and $14.84B of dividends paid out at the same time, we are not overly concerned about the destruction of shareholders’ value.

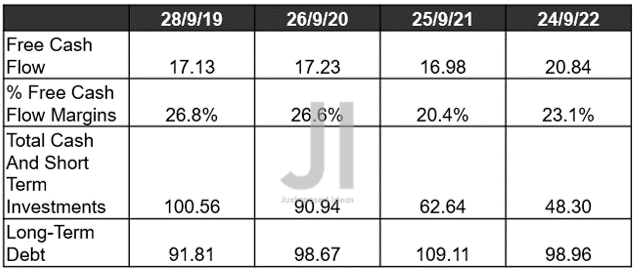

AAPL Cash/ Investments, FCF ( in billion $ ) %, and Debts

S&P Capital IQ

Thereby, also expanding AAPL’s Free Cash Flow (FCF) generation to $20.84B for the latest quarter, or $111.44B for FY2022, improving its margins by 2.9 percentage points YoY. However, long-term investors would be well-advised to monitor the health of its balance sheet, due to the continuous decline in its total cash/ investments to $48.3B by the latest quarter, indicating a -22.89% headwind YoY or -51.96% from FY2019 levels.

Furthermore, AAPL’s debt levels remain elevated thus far, with $11.13B due 2023, despite the growth in its FCF generation. Nonetheless, with its long-term debts well-laddered through 2062, the company is still well-positioned for the short term market volatility in 2023.

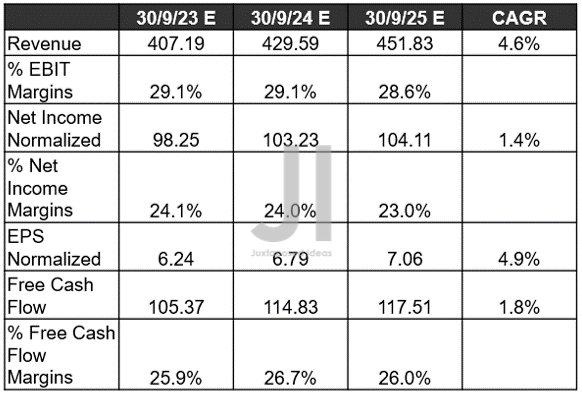

AAPL Projected Revenue, Net Income ( in billion $ ) %, EBIT %, and EPS, and FCF %

S&P Capital IQ

Furthermore, AAPL’s top and bottom line growth through FY2025 remains robust, despite the tragic market-wide correction thus far. Mr. Market has only discounted its forward execution by -2.06% and -7.96%, respectively, since May 2022. Furthermore, we may see an upwards re-rating ahead, assuming that its mixed-reality headsets are released in 2023 and Apple Car by 2025. Given its unique positioning in the tech market and loyal global fan base with higher spending power, it is not hard to see why AAPL is well-covered by market analysts.

In the meantime, we encourage you to read our previous article on AAPL, which would help you better understand its position and market opportunities.

So, Is AAPL Stock A Buy, Sell, or Hold?

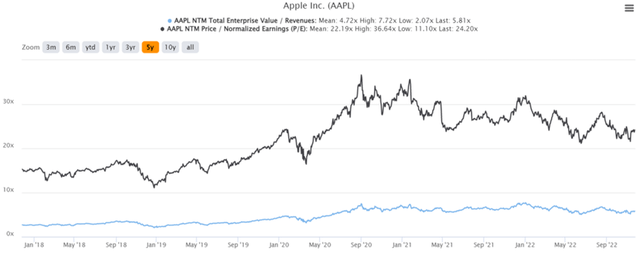

AAPL 5Y EV/Revenue and P/E Valuations

AAPL is currently trading at an EV/NTM Revenue of 5.81x and NTM P/E of 24.20x, higher than its 5Y mean of 4.72x and 22.19x. Otherwise, comparatively lower than its YTD mean of 6.15x and 25.46x, respectively. Otherwise, the stock has also recorded an excellent recovery of 12.01% since recent rock bottom levels in early November. Despite so, consensus estimates remain bullish about AAPL’s prospects, given their price target of $180.70 and a 19.61% upside from current prices.

AAPL YTD Stock Price

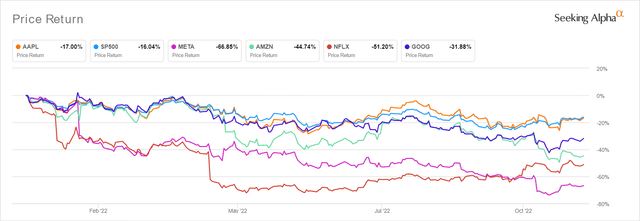

It is not hard to see why AAPL remains the king of the FAANG stocks, despite the market-wide correction thus far. The stock has suffered minimally in the past year by a moderate decline of -17%, compared to the S&P 500 Index by -16.04% and Meta by a tragic -66.85% at the same time. Investors must not forget the subscription plan previously reported by Bloomberg, since AAPL’s top and bottom lines remained mostly intact through FY2025, despite the peak recessionary fears.

Nonetheless, we have to also admit that investors should wait for a moderate retracement before adding at current levels. That is if one had missed loading up at the recent bottom of $134. There are still some uncertainties in the short term, since the Feds are due to meet by mid-December, with the circumstances still chaotic in Zhengzhou. While its long-term prospects are stellar, we expect to see another bottom retest soon. Especially by the FQ1’23 earnings call, since AAPL may fail to deliver part of its iPhone 14 orders, thereby, missing consensus revenue estimates of $125.85B and EPS of $2.04. Patience for now.

Be the first to comment