CHUNYIP WONG/iStock via Getty Images

REIT Rankings: Apartments

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on November 6th.

Hoya Capital

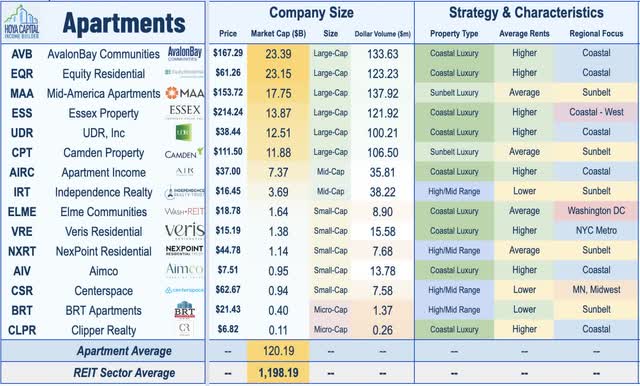

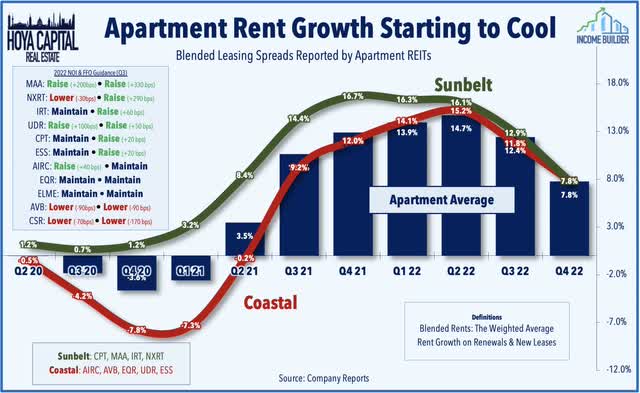

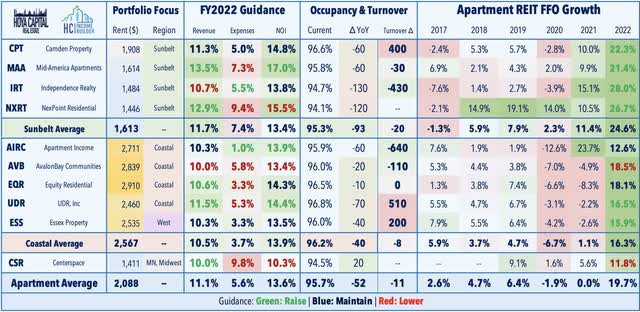

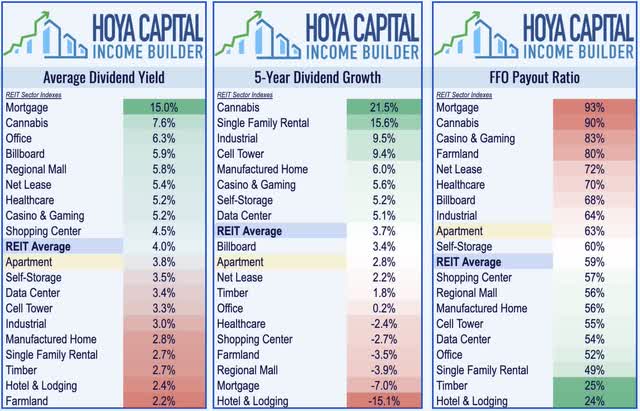

Apartment REITs have been among the weaker-performing property sectors over the past quarter despite achieving record-setting rent growth throughout the summer and despite a solid third-quarter earnings season. While the era of 15-20% rent increases on new leases has come to an end, there remains quite a bit of “embedded” rent growth in below-market renewals that should power another year of high-single-digit FFO growth in 2023 – even if new lease rates continue to decelerate and even turn negative on a year-over-year basis. The importance of regional selectivity will again become a key factor, however, and we’re seeing a return to the “Sunbelt outperformance” theme. Within the Hoya Capital Apartment REIT Index, we track the fifteen largest apartment REITs which collectively account for roughly $120B in market value, $300B in total asset value, and own over a million rental units across the United States.

Hoya Capital

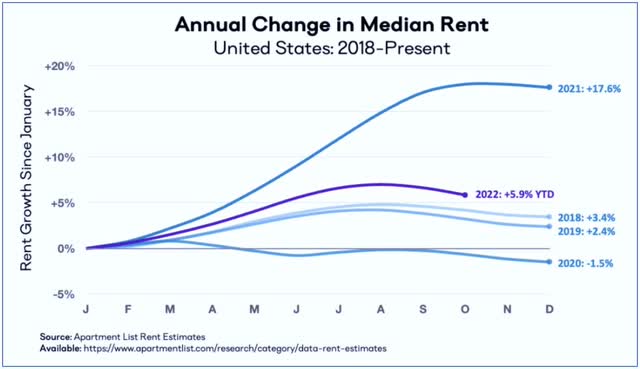

Renters across the nation have been receiving an unwelcome surprise at end of their lease term in recent quarters, many of which have seen a double-digit percentage increase on their renewal offer. After shopping the market, many renters soon realized they may be sitting on the best deal available with renewal offers that are – in many cases – significantly below market rates. The historic pace of rent growth on new leases has cooled quite significantly over the past two quarters from double-digit rates to levels more in-line with historic averages, however, but beneath the increasingly downbeat headlines, multifamily fundamentals remain on firm footing. Brokerage firm Apartment List released their National Rent Report last week that despite the recent cooldown, rent growth continues to outpace the pre-pandemic trend – higher by 5.9% since the start of the year – more the double the rate in 2019.

Hoya Capital

Data from Yardi shows similar themes with its survey noting that U.S. rent growth has decelerated from the mid-teens to a 9.4% year-over-year rate in September – the first month that rent growth fell below 10% since July 2021 – which Yardi notes is “partly the result of the cooling economy and the Federal Reserve’s actions to curb inflation.” Yardi’s data shows year-to-date rent growth of 6.6% – well above the longer-run average of 2.9% – while occupancy rates remain near record-high levels at 95.9%. Data from Zillow (Z), meanwhile, shows that annual rent growth stood at 9.3% in September with more than a third of Top-50 still seeing annual rent growth in excess of 10%. Zumper, another apartment data provider, provided further color on the underlying trends, commenting that “cities that’d previously seen drastic price increases are slowing down significantly” particularly many of the most popular “Zoomtowns” for digital nomads but the firm continues to observe “relatively strong competition for rentals and therefore don’t expect drastic price drops until supply and demand become more closely aligned.”

Hoya Capital

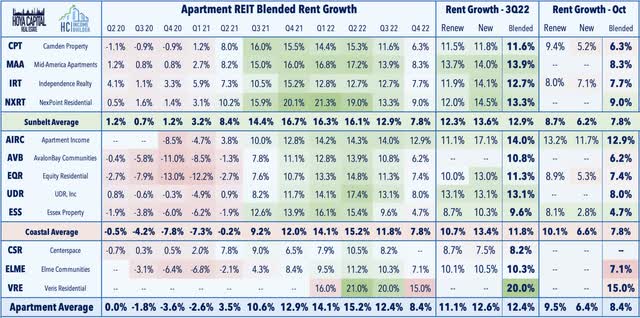

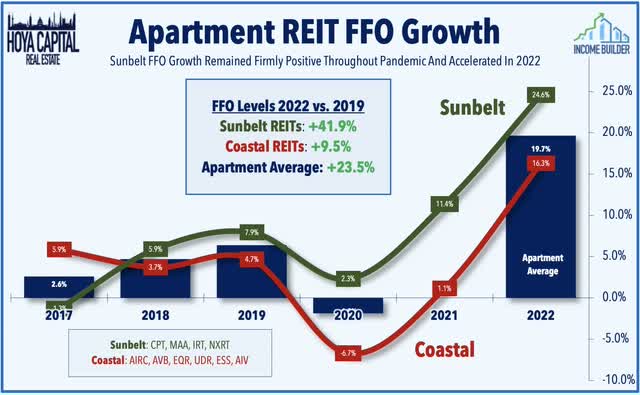

As discussed in our REIT Earnings Halftime Report, apartment REIT earnings results showed that despite the cooldown in the pace of rent growth, results remain quite impressive with six of the eleven largest REITs raising their full-year FFO growth outlook, but the importance of regional selectivity is again becoming a key factor, with a clear return to the “Sunbelt outperformance” theme. The four Sunbelt-heavy REITs – Mid-America (MAA), Camden (CPT), NexPoint Residential (NXRT), and Independence (IRT) all raised their full-year FFO growth outlook this quarter – and now expect average FFO growth of nearly 25% this year – while performance among the largest Coastal-heavy REITs – AvalonBay (AVB), Equity Residential (EQR) – have been less impressive with average FFO growth of about 16% for the subset of Coastal REITs. In fact, after a nearly perfect “beat and raise” earnings season the second quarter, just two Coastal-focused REITs raised their same-store NOI outlook this quarter – Apartment Income (AIRC) and UDR, Inc. (UDR).

Hoya Capital

Measures of market rents likely understate the “embedded” growth resulting from the historically wide spread between new lease rates and in-place rents as apartment owners have had to limit renewal increases in many states and cities due to regulatory limits. While new lease rates have seen a rather sharp sequential slowdown since peaking in Q2 at 17.5% before slowing to 6.4% by October, renewal rates held relatively steady near 10% throughout this period and the realization of this embedded rent growth should be enough to power another year of mid-to-high single-digit FFO growth in 2023. Even Essex – which recorded the steepest slowdown in rent growth in the sector – remained upbeat on its so-called “loss to lease” rent growth potential with rates that are “better than historical patterns” noting that “typically, around this time of the year, we’re at about 1% loss-to-lease and heading towards zero by year-end. So at 2.8%, we’re feeling pretty darn good about the portfolio.”

Hoya Capital

That said, results were more “hit and miss” compared to the past several quarters in which essentially all REITs across the sector boosted their guidance. One particularly soft report came from Midwest-focused Centerspace (CSR), which dipped nearly 10% last week lowering its full-year NOI and FFO growth outlook, citing “persistent cost pressures” and a “higher than usual volume of non-controllable unreimbursable losses” in its non-same-store portfolio. Driving the higher expenses, in part, was an uptick in turnover rates, something we’ve seen across several multifamily REITs in Q3 after hitting record-low levels earlier this year. AvalonBay (AVB) also reported weaker results and revised lower its full-year FFO and NOI growth outlook. Of note, AVB was the lone apartment REIT to downwardly revise its full-year outlook lower across FFO and same-store revenues, expenses, and NOI.

Hoya Capital

Among the coastal-focused REITs, the report from Apartment Income (AIRC) was the strongest of the group, with leasing results that were notably stronger than its peers, reporting 14.0% blended spreads in Q3 and 12.9% in October while recording an impressive 640 basis point decline in turnover rates. For the apartment REIT sector more broadly, if these full-year outlook targets are met, apartment REITs will have delivered average cumulative FFO growth of 23.5% since the start of the pandemic – quite an impressive feat considering the distress reported by Coastal-focused REITs early in the pandemic. Sunbelt REITs never skipped a beat during the pandemic and now expect 2022 FFO levels to be 41.9% above their pre-pandemic rate from 2019 while Coastal REITs now expect 2022 FFO levels to be 9.5% above 2019-levels.

Hoya Capital

Deeper Dive: Apartment REIT Portfolios

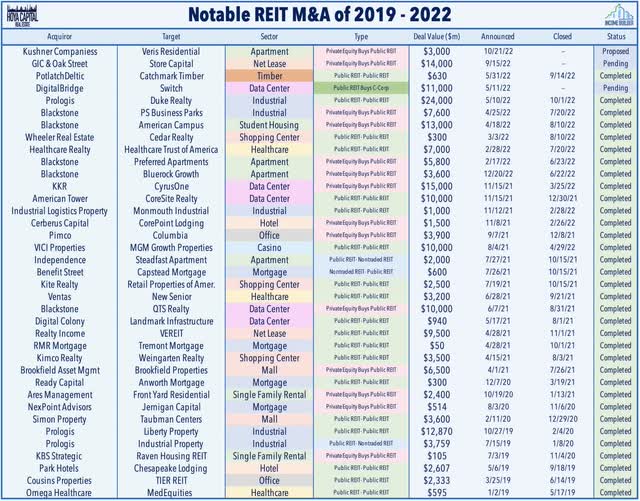

We didn’t expect M&A to be a major theme this quarter given the latent “animal spirits” in recent months, but dealmaking was certainly a theme this earnings season as Veris Residential (VRE) – which recently completed a strategy shift from an office REIT into a pure-play multifamily REIT – surged after an unsolicited takeover bid from Kushner Companies to externally manage the company or to acquire the company for $16/share – a premium of nearly 30% from its prior close – but was rejected by Veris the following week, commenting that the figure “grossly undervalues the company in its current form and denies shareholders the substantial value expected to be unlocked from the company’s strategic transformation.”

Hoya Capital

The now-rejected takeover bid comes after Veris – formerly known as Mack Cali – announced last month that it reached an agreement to sell its last remaining office assets. Since early 2021, Veris has closed on roughly $1.4B in office sales while adding approximately 1,900 units to its residential portfolio, which is now comprised of roughly 7,700 units – primarily in the NYC metro area. Multifamily now represents 98% of Veris’ Net Operating Income, up from 39% in early 2021. Veris is not alone in its strategy shift from office REIT to apartment REIT as Washington REIT completed its transition and rebranded as Elme Communities (ELME) last month. While we gained a pair of new apartment REITs through strategy shifts, Blackstone (BX) picked off a trio of multifamily REITs over the past year for its nontraded REIT – Bluerock Growth REIT, Preferred Apartments, and American Campus.

Hoya Capital

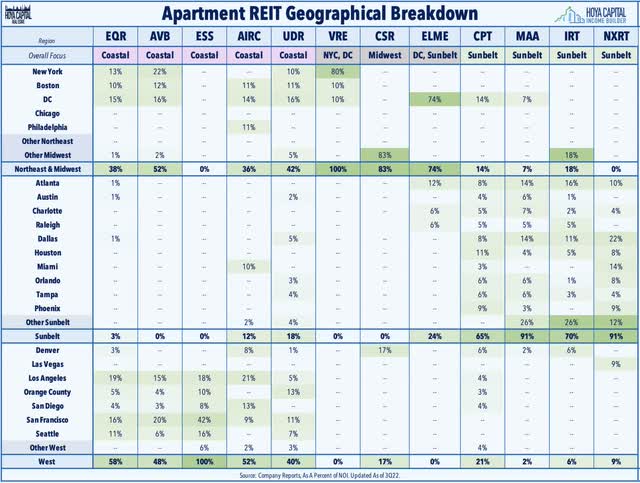

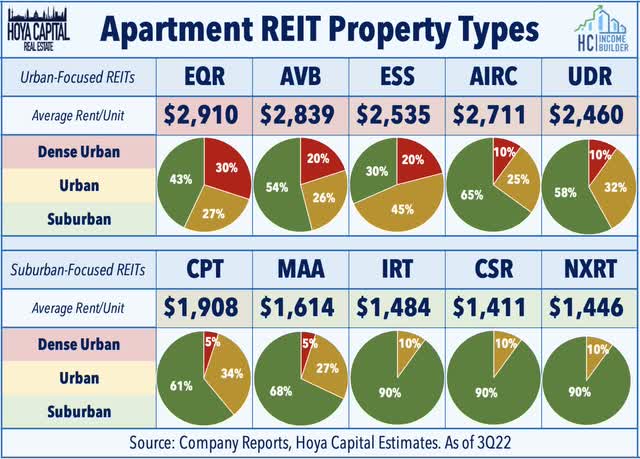

As a sector, apartment REITs collectively have fairly balanced geographical exposure across most of the major U.S. markets. Individual apartment REITs tend to focus on either coastal markets or sunbelt and secondary markets and own portfolios that typically include a blend of luxury high-rise, mid-rise, and garden-style apartment communities. Perhaps even more important than their geographical distribution, the distribution of portfolios towards either urban or suburban has taken on added significance throughout the pandemic as suburban properties surrounding the hardest-hit “shutdown cities” have seen some of the strongest rates of rent growth both in the multifamily and single-family rental categories. We’ve seen some modest reversals in these trends in 2022, however, as the post-pandemic reopenings have led to particularly strong rent growth in New York City.

Hoya Capital

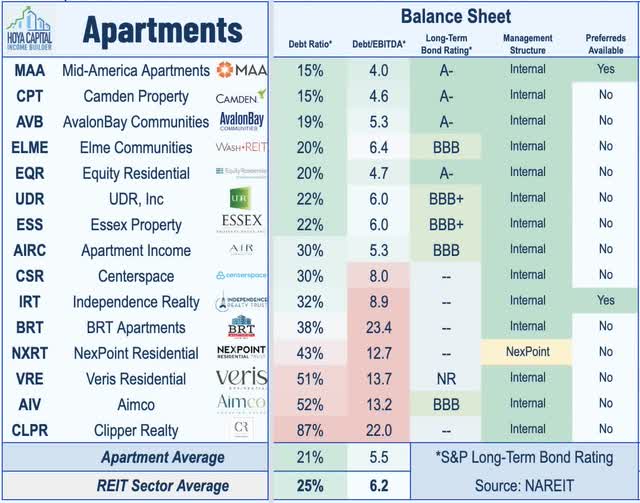

The larger apartment REITs are generally some of the most well-capitalized companies across the REIT sector – a critical attribute during the pandemic-related turbulence – but several of the small-cap apartment REITs do operate with elevated debt levels. The seven largest apartment REITs command investment-grade credit ratings from Standard & Poor’s, led by A- ratings by AvalonBay, Equity Residential, and Camden. The larger REITs in the sector also tend to rank high on the corporate governance scale with shareholder-friendly governance structures. NexPoint Residential is the lone externally-managed REIT in the sector but has nevertheless delivered sector-leading performance.

Hoya Capital

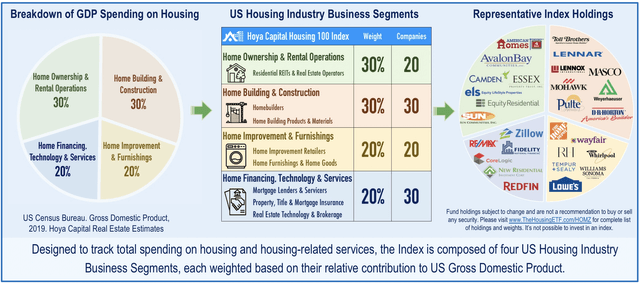

Deeper Dive: Macro Fundamentals

As goes the U.S. housing industry, so goes the U.S. economy. The $4-5 trillion U.S. multifamily apartment market is highly fragmented, with these fifteen REITs owning roughly 1,000,000 of the estimated 25 million multifamily rental units across the US, which is only about 2-4% of the total rental apartment stock. Multifamily rental units comprise roughly 15% of all housing units in the United States, and these apartment REITs comprise roughly 15% of the Hoya Capital Housing Index, the housing industry benchmark that tracks the performance of the U.S. housing sector.

Hoya Capital

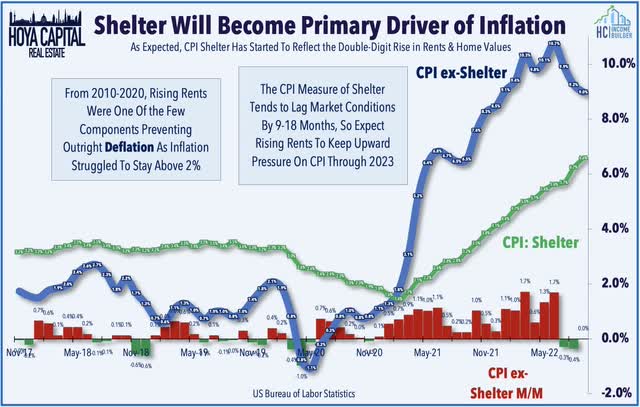

Taking a step back to a more macro-level, while goods shortages and the resulting inflation should gradually ease over the next year as economic growth cools and as supply chain headwinds finally ease, elevated levels of housing inflation will likely persist into the back half of the decade, and we expect that the Shelter component of CPI will resume its role as the primary driver of inflation. We’ve discussed for many months how the historic surge in rents was not being captured by the BLS inflation metrics which showed cumulative rent inflation of just 7.7% since the end of 2019 through mid-2022- substantially below the 24.1% cumulative rent growth reported in Zillow data. The delayed recognition of shelter inflation alone will add an estimated 0.6-1.2% to the Core CPI index in 2022 and 2023. That said, it appears that residential REITs will dodge immediate regulatory risks this election cycle – something that appeared less certain several months ago amid record-high rent growth and increased scrutiny on rents as contributors to inflation.

Hoya Capital

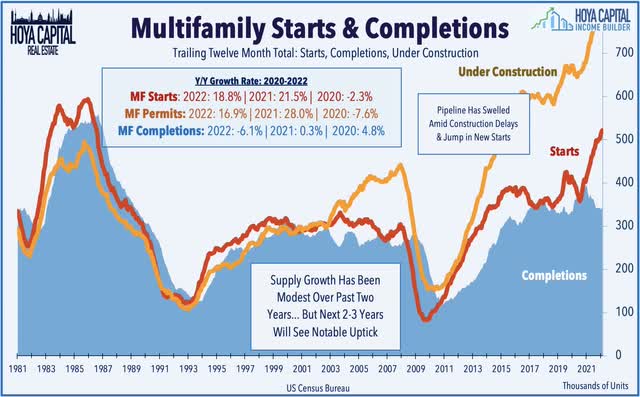

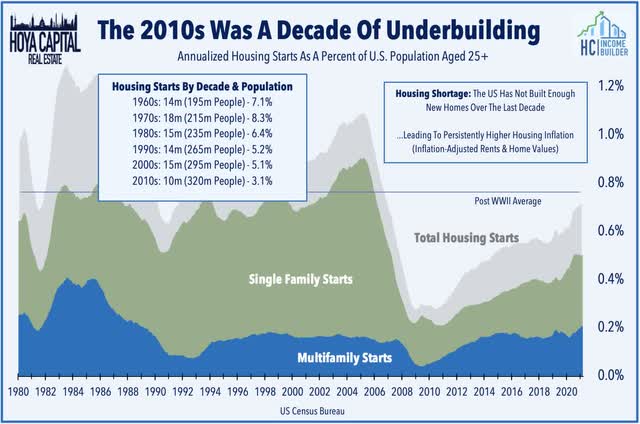

While the near- and medium-term outlook still remains compelling, supply growth is a potential looming longer-term headwind as soaring rent growth has sparked a new wave of development. After several years of muted supply growth, multifamily starts and units-under-construction have climbed to multi-decade highs, but elongated construction timelines and lingering supply chain issues continue to limit completions. Given the hearty fundamentals of near-record-high occupancy rates and record-low turnover rates – combined with the discounted valuations – apartment REITs appear well-equipped to outperform through the inevitable normalization.

Hoya Capital

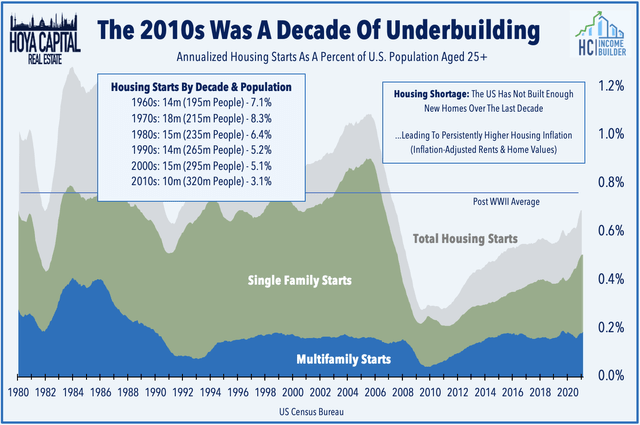

For the undersupplied housing industry, we expect the favorable supply/demand imbalance to persist for the foreseeable future amid ongoing constraints on new home construction while demographic-driven and WFH-driven demand remain resilient. Freddie Mac estimates that the U.S. housing market is 3.8 million homes short of what’s needed to meet the country’s demand, representing a 52% rise in the nation’s housing shortage compared with 2018. These record-low inventory levels of homes have resulted in rent growth and home price appreciation persistently above the rate of inflation throughout the past decade – a very positive fundamental backdrop not only for apartment REITs, but across the broader U.S. housing industry.

Hoya Capital

Apartment REIT Stock Performance

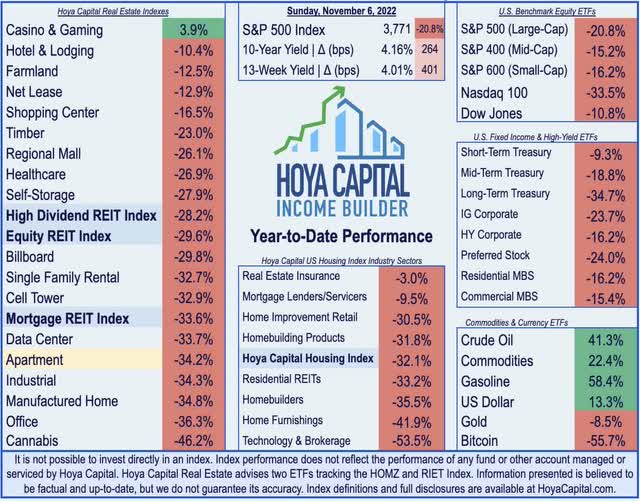

Despite a generally solid slate of earnings results from the apartment sector over the past two quarters, apartment REITs continue to lag the broader REIT Index this year amid concern that the rate-driven slowdown in the homeownership markets and the broader economic slowdown will bleed into the rental markets – concerns that we believe are unwarranted. The Hoya Capital Apartment REIT Index is lower by 34.2% this year, lagging the 29.6% decline from the broad-based Vanguard Real Estate ETF (VNQ) and the 20.8% decline from the S&P 500 ETF (SPY). The underperformance this year follows the best year on record for apartment REITs with total returns of 58%

Hoya Capital

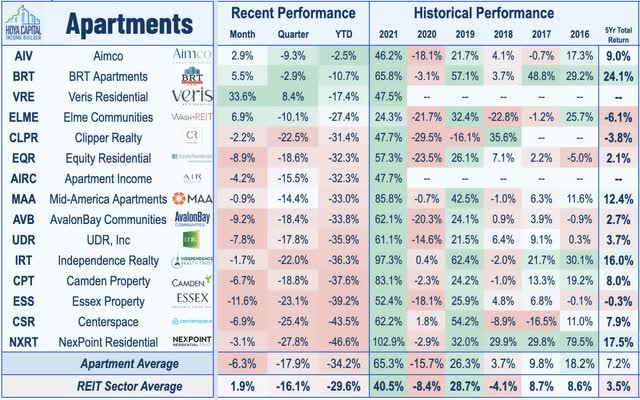

Apartment REITs have been some of the strongest-performing REITs over most long-term measurement periods. From 2010 through 2021, Apartment REITs delivered average annual returns of 16.4%, outpacing the 14.4% annual total returns from the broad-based REIT average during that time. Among the major apartment REITs, NexPoint (NXRT), Independence (IRT), Mid-America (MAA), and Camden Property (CPT) have delivered the strongest 5-year total returns, but all of the major apartment REITs have lagged their small-cap peers this year with the five small-caps leading the way this year, led by Aimco (AIV), BRT Apartments (BRT), Veris Residential (VRE), Elme Communities (ELME), and Clipper Realty (CLPR).

Hoya Capital

Apartment REIT Dividend Yields

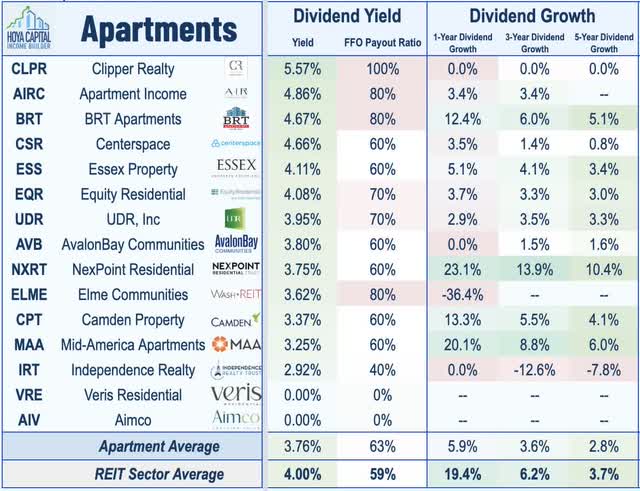

Apartment REITs pay an average dividend yield of 3.8%, which is slightly below the REIT market-cap-weighted sector average of 4.0%. Since the start of 2015, apartment REITs have delivered average annual dividend growth of roughly 3%, but pay out only around 65% of their available cash flow, giving these companies the flexibility to take advantage of external growth opportunities or to increase distributions.

Hoya Capital

Near-perfect rent collection throughout the pandemic allowed apartment REITs to not only avoid the wave of dividend cuts that swept through the REIT sector during the early stages of the pandemic but to also actually be among few REITs to raise their distributions in 2020 – a trend of dividend raises that continued in 2021 and 2022. The ten mid- and large-cap apartment REITs pay dividend yields ranging from 2.92% to 4.86%, while small-cap Clipper (CLPR) tops the charts with a dividend yield of 5.57% alongside a 100% payout ratio.

Hoya Capital

Takeaway: Regional Selection Key Amid Cooldown

Pressured by the broader housing cooldown, Apartment REITs have been among the weaker-performing property sectors over the past quarter despite achieving record-setting rent growth throughout the summer. While the era of 20% rent increases on new leases is over, there remains significant “embedded” rent growth in below-market renewals that should power another year of impressive FFO growth in 2023 and given the hearty fundamentals of near-record-high occupancy rates and record-low turnover rates – combined with the discounted valuations and lingering generational housing undersupply – apartment REITs appear well-equipped to outperform through a variety of macroeconomic scenarios.

Hoya Capital

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital

Be the first to comment