CHUNYIP WONG

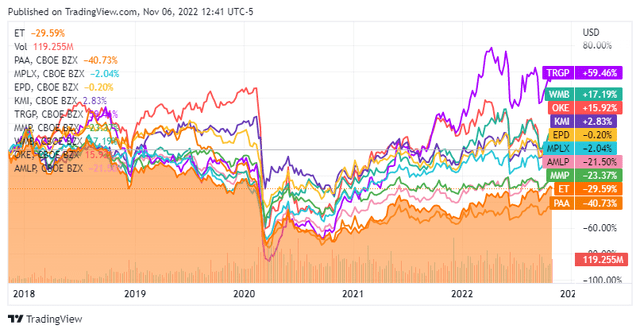

No matter what Energy Transfer (NYSE:ET) does, Mr. Market continues to discount them compared to its peer group. ET is delivering on its plan of deleveraging its balance sheet, as billions have been erased from its long-term debt, Enable Midstream was acquired, and the quarterly distribution has increased 73.77% over the past year. ET is delivering on its promises since taking a hardline approach to its financial health, leaving no reason for the bears not to turn bullish or the markets to punish the unit price continuously. The barriers to entry in the pipeline sector is immense and possibly the most fortified of any industry, from government permits and zoning regulations to the infrastructure required to become successful within the industry. Whether individuals want to admit it or not, energy infrastructure is one of the most important industries in our day-to-day lives, and ET plays a critical role in making sure that the supply of energy gets from A to B. There are a lot of aspects to like about ET, and its future looks promising as exporting will play a vital role in its growth. After reading through the earnings report and looking at the valuation, I believe $19.02 is a minimum fair value for units of ET.

Attacking my valuation for ET first, as all of the midstream operators I follow have reported Q3 earnings

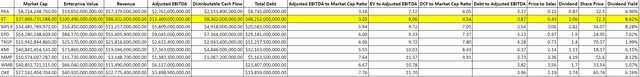

Many companies have reported Q3 earnings, and the midstream operators that I follow have all reported, so I updated my valuation model. I track the market cap, enterprise value, revenue, Adjusted EBITDA, distributable cash flow (DCF), and total debt so I can compare the following ratios, Adjusted EBITDA to market cap, EV to Adjusted EBITDA, DCF to Market Cap, Debt to Adjusted EBITDA, and Price to Sales. The midstream operators I track are:

Steven Fiorillo, Seeking Alpha

After compiling the data on a trailing twelve-month (TTM) period, the peer group traded at the following ratios:

- 5.76x Adjusted EBITDA to Market Cap

- 9.76x EV to Adjusted EBITDA

- 7.02x DCF to Market Cap

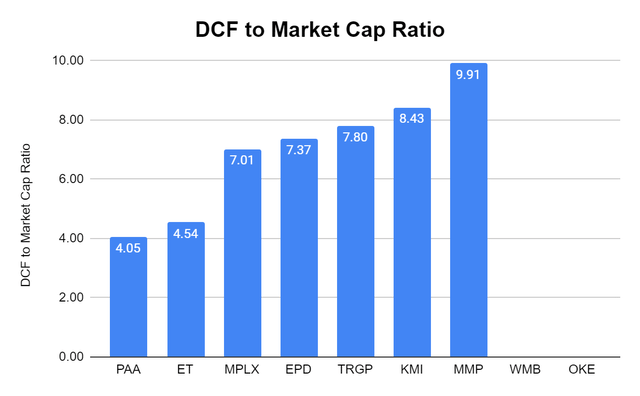

- Excludes WMB and OKE as they don’t report DCF in their statements

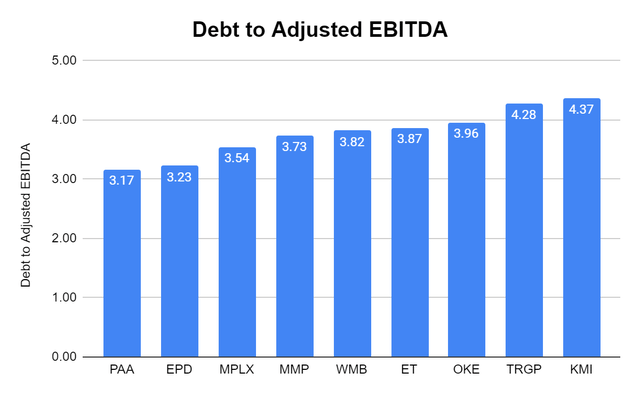

- 3.77x Debt to Adjusted EBITDA

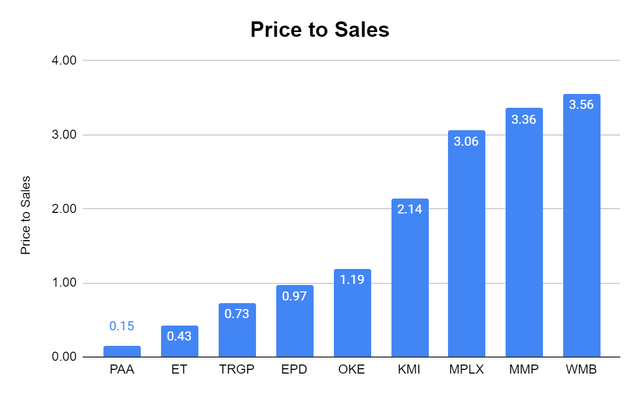

- 1.73x P/S

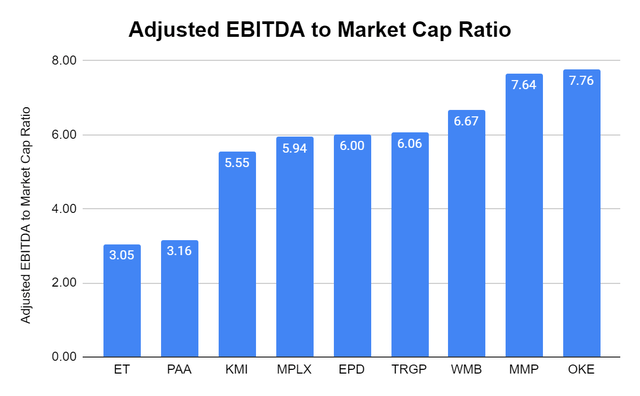

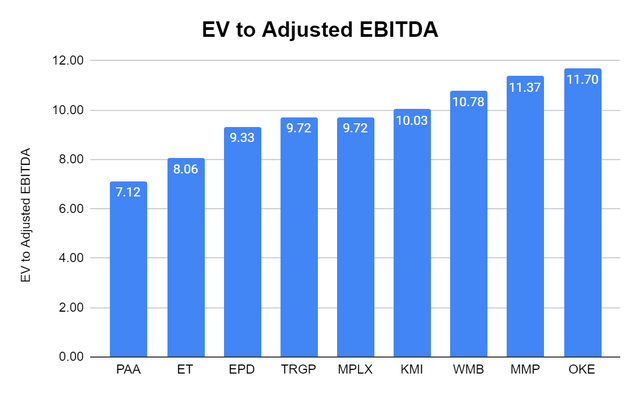

ET traded under the peer group average in every category except Debt to Adjusted EBITDA, where they were a tenth of a point higher than the group average. ET trades at a -88.85% discount to the group’s Adjusted EBITDA to Market Cap ratio at 3.05x compared to 5.76x. ET also trades at a -54.63% discount to the group average DCF to Market Cap ratio at 4.54x compared to 7.02x. In addition, ET trades at a -21.09% discount on an EV to Adjusted EBITDA ratio compared to its peers.

There isn’t a perfect way to evaluate companies, so I am trying to take a logical approach and putting my bias aside since I am a unit holder of ET, and I am bullish on the company. Of its peers, ET has the largest enterprise value, generates the largest amount of revenue, Adjusted EBITDA, and DCF, while having the largest debt load that is in-line with the peer groups debt to Adjusted EBITDA ratios.

If ET was a leader in these categories at the expense of overleveraging, my conclusions would be much different, but that’s not the case. The debt to Adjusted EBITDA ranges from 3.17x to 4.37x, and ET falls slightly above the group average of 3.77x at 3.87x. ET has a market cap of $37.97 billion. ET’s market cap would need to be $58.71 billion for its DCF to market cap ratio to reach 7.02x and $71.71 billion for its Adjusted EBITDA to Market Cap ratio to reach 5.76x. The minimum fair value that I believe units should trade at is $19.02 as this would put its DCF to Market Cap multiple in-line with its peer group average while keeping its Adjusted EBITDA to Market Cap multiple at 4.71x, which is still significantly below the peer group average of 5.76x. I believe there is certainly a case to be made that units of ET are more than -54.63% undervalued, and that’s why I said a minimum fair value on this valuation. If ET traded at a 1:1 ratio with the peer group average on Adjusted EBITDA to Market Cap, its DCF to Market Cap ratio would exceed the group average by 22.22%. In my mind, a reasonable minimum valuation of $19.02 per unit keeps the Adjusted EBITDA to Market Cap under the peer group average while having ET’s DCF trade at a 1:1 ratio.

Below are the current graphs for the metrics I am looking at, and my conclusion is that ET is undervalued by at least -54.63%.

Steven Fiorillo, Seeking Alpha Steven Fiorillo, Seeking Alpha Steven Fiorillo, Seeking Alpha Steven Fiorillo, Seeking Alpha Steven Fiorillo, Seeking Alpha

Energy Transfer had a good quarter and there is a lot to be bullish about

Two of the main numbers to focus on, the DCF and Adjusted EBITDA generated, both increased YoY in Q3. ET’s Adjusted EBITDA came in at $3.09 billion, up 19.74% YoY, while its DCF attributable to its partners increased 20.67% YoY to $1.58 billion, and its consolidated DCF increased 20.50% to $2.08 billion YoY. ET raised its guidance for 2022’s total Adjusted EBITDA from $12.6 billion – $12.8 billion to $12.8 billion – $13.0 billion. ET expects to reach its leverage target range between 4 – 4.5x by the end of 2022 as the allocate retained DCF accordingly. ET lowered its total debt by $699 million (1.43%) QoQ, and YTD, ET’s total debt, has declined by $2.31 billion or 4.58%. This has been achieved while increasing its distribution by 73.77% throughout 2022. In Q3, ET retained roughly $760 million in excess DCF after its distributions were paid, and when this is extrapolated out on an annualized basis, they are retaining roughly $3.04 billion of DCF, which significantly exceeds their 2022 allocated $1.3 billion toward growth projects and $485 million toward maintenance.

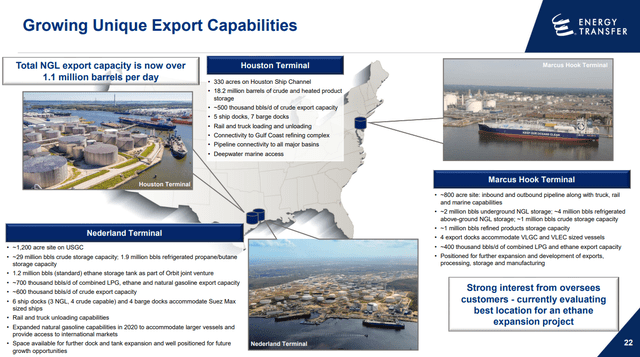

Operationally, ET is firing on all cylinders as new records in intrastate natural gas transportation volumes, midstream gathering, and NGL fractionation reached new records in Q3. ET’s NGL export business is the largest in the country as they are responsible for approximately 20% of the NGL exports hitting the world market. ET completed the sale of its 51% interest in Energy Transfer Canada for cash proceeds of approximately $300 million. The sale reduced ET’s consolidated debt by approximately $850 million, allowing them to divest these non-core assets at attractive valuations. In September, ET completed its acquisition of Woodford Express LLC, which owns a Mid-Continent gas gathering and processing system, for approximately $485 million. The Woodford Express assets provide approximately 400 million cubic feet per day of cryogenic gas processing and treating capacity in Grady County, Oklahoma, in addition to more than 200 miles of low and mid-pressure gathering lines in the heart of the SCOOP play. What makes this so attractive is that these assets are already connected to ET’s interstate and intrastate systems and is supported by dedicated acreage with long-term, predominantly fixed fee contracts.

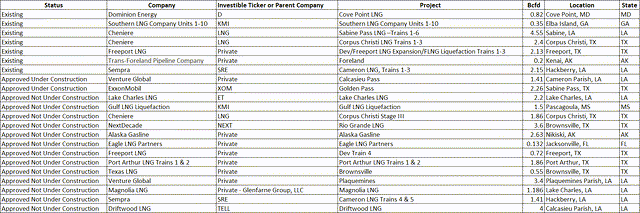

I have been bullish on exporting American energy for quite some time and believe this will be an incredible opportunity for ET going forward. I went through the data from FERC and identified every investible company for LNG export facilities. In my table below, I have existing facilities, approved facilities that are under construction, and approved facilities where construction hasn’t started. I identified the parent company of each facility, listed the investible ticker symbol or if the company is private, and listed some other critical information.

LNG has been all over the news as the energy situation overseas tightens and more countries secure long-term supplies of American LNG. ET will have the sixth largest exporting capacity out of the Lake Charles facility from the publicly traded companies that have approved LNG export facilities. The Lake Charles facility has 2 existing deep-water docks on a 152-acre site with 4 LNG storage tanks with a capacity of 425,000 m3. Its estimated exporting capacity is roughly 16.5 million tonnes per year. ET has executed 7.9 million tonnes per year of sale and purchase agreements to 6 companies. The purchase price for these agreements is indexed to the spot price based on the Henry Hub benchmark, and ET will generate a fixed liquefaction charge. ET has the following agreements in place:

- Shell LNG 2.1 million tonnes per annum for 20 years

- China Gas 0.7 million tonnes per annum for 25 years

- SK Gas 0.4 million tonnes per annum for 18 years

- Gunvor Group 2.0 million tonnes per annum for 20 years

- ENN Energy 0.9 million tonnes per annum for 20 years

- ENN Natural Gas 1.8 million tonnes per annum for 20 years

There is little chance that the Lake Charles Export Facility won’t reach an FID and be constructed. This facility has been approved and is fully permitted. The beautiful aspect is that this facility already exists as an LNG import facility. ET will be converting it to an LNG export facility. ET is also in active negotiations with several customers for long-term offtake contracts for large volumes of LNG.

Conclusion

I am still bullish on units of ET and believe that the minimum fair value should be roughly $19.02 per unit. I believe there is still significant upside potential even after its recent unit appreciation. ET is making good on its promises to deleverage the balance sheet, while evaluating distribution increases quarterly with the goal of restoring the distribution to its prior levels. I think anyone who is still bearish on ET is incorrect, and the future looks promising. The transition to renewables isn’t going to occur anytime soon, and we will need ET’s infrastructure to deliver fuels for decades to come. I will continue to reinvest and compound each distribution that gets paid as I believe ET is significantly undervalued, and they will bring the distribution back to its former level in 2023.

Be the first to comment