Editor’s note: Seeking Alpha is proud to welcome Tim Wolf as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

imaginima/iStock via Getty Images

Among the cryptocurrencies I follow, Helium (HNT-USD) has been a huge success so far. I believe it will outperform other major digital assets like Bitcoin (BTC-USD) and Ethereum (ETH-USD) in the coming years. The reason behind my thesis is the exponential network growth of 31x in 2021 and the huge gain in momentum of the ecosystem as outlined in this article. But, given the high volatility in the crypto space and short-term downside risk related to the macro environment, I would generally suggest starting your investment now and spreading it out over several tranches in the months ahead.

About Helium

Helium Inc. was founded in 2013 by Shawn Fanning (co-founder of Napster), Amir Haleem (video game industry veteran) and Sean Carey (former IT consultant). Helium’s mission is to leverage the power of wireless technology and blockchain to build the “People’s Network” – the world’s first peer-to-peer wireless network that empowers anyone to become a network operator and unleash new classes of devices and applications that are impossible today.

By utilizing a digital token to power real-world use cases, Helium is doing something dramatically different while most other cryptocurrencies and blockchain projects are just aiming to replace or enhance Bitcoin or Ethereum. People can earn HNT by running physical hotspots – LoRaWAN, 5G, Wi-Fi 6, etc. – that provide wireless coverage, and share their bandwidth with the Helium network. HNT can be converted (“burned”) into non-transferrable data credits (1 data credit = $0.00001 fixed), which allows users to transfer bytes of data via the Helium network and use for blockchain transaction fees.

Typical Helium Outdoor Hotspot and Antenna (sharespot.pt)

Environmental impact

While Helium hotspot owners are simply rewarded with HNT, the actual process is called “mining” as it is with Bitcoin. But in contrast to proof-of-work blockchains, the mining of HNT is based on the proof-of-coverage consensus algorithm, which requires about the same energy per hotspot as a typical LED lightbulb (5W).

Investment Case

Helium is all about connectivity and the Internet-of-things (IoT). IoT devices can be anything like temperature sensors, tracking devices, home-security assets, industry robots, smart refrigerators and lightbulbs, etc. McKinsey expects a potential IoT economic value of up to $6.3 trillion in 2025 and up to $12.6 trillion in 2030, compared with a total value captured of $1.6 trillion back in 2020. All IoT devices require network connectivity to transfer their payload in form of data messages. The biggest wireless networks today are operated by large cellular companies, using closed-source technology to dictate cost and coverage. These centralized infrastructures require large amounts of funding, take a long time to build, and are costly to maintain and update.

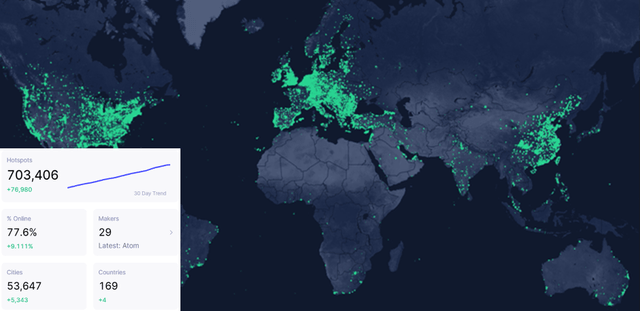

Since the Helium blockchain was launched in August 2019, the network has become the fastest growing decentralized wireless network in the world. It has grown from 14,000 to 450,000 hotspots in 2021, delivering a growth rate of more than 3,100%. As of April 6, 2022, there are over 700,000 hotspots in over 53,000 cities and 169 countries, while continuously adding over 75,000 additional nodes each month. At this staggering growth rate, I expect the network to scale to over 1 million hotspots in the third quarter of 2022.

Global Network of Helium Hotspots (explorer.helium.com)

The Ecosystem

Beyond network growth, the ecosystem seems to flourish as well. There are over 29 manufacturers on board and the Helium Discord community counts over 160,000 members. In January 2022, Greyscale announced that they are actively considering HNT for its product family of digital assets. And in March 2022, the non-profit Helium Foundation has taken stewardship of Helium’s brand assets, which allows the brand to be used more openly. Meanwhile, the community keeps exploring additional use cases and the developers are expanding the network capabilities by adding more technologies like 5G and Wi-Fi.

Some known companies within the Helium ecosystem are as follows:

- DISH (DISH), first major carrier to deploy Helium 5G hotspots

- Semtech (SMTC), leading supplier of LoRa bases IoT technology for Helium hotspots

- Lime, using Helium for tracking its bikes and scooters

- Salesforce (CRM), connecting sensors to its Salesforce IoT Cloud platform

Companies among the top users on Helium are Volvo Group (OTCPK:VLVLY), Cisco (CSCO), Schneider Electric (OTCPK:SBGSY), and Accenture (ACN).

Venture Capital

Recently, Helium has been rebranded as Nova Labs to distinguish between the parent company and the community-owned network itself. Nova Labs just received a $200 million Series D equity round (valuation of $1.2 billion) and they plan to further invest in the Helium ecosystem. The company is already backed by numerous VCs, including Tiger Global Management and Andreessen Horowitz (a16z), Khosla Ventures, GV (GOOGL), Liberty Global (VOD and TEF), Deutsche Telekom (OTCQX:DTEGY), MunichRe Ventures (OTCPK:MURGY), NGP Capital (NOK), and Goodyear Ventures (GT). Ali Yahya, general partner at Andreessen Horowitz, told the CoinDesk magazine: “Helium represents an entirely new business model for deploying wireless networks at scale at a fraction of the cost.”

Competition

There are some minor competitors in this space, but I hesitate to list them here as all of them seem to piggyback on the success of Helium and just try to sell their overpriced hotspots. None of them has a comparable slate of backers, a meaningful network size, or a strong community; most of these projects seem to be questionable at best. Although Helium is a different kind of animal compared to the traditional telco industry, some might compare it with the big 4G/5G network operators like Vodafone (VOD), T-Mobile (TMUS), AT&T (T), Verizon (VZ), etc. Based on a recent S&P Global research report about 5G commercial services, “the U.S. surpassed 100,000 5G base stations by mid-2021,” while Helium CEO Amir Haleem recently told Bloomberg that “there are currently 20,000 Hotspots that use 5G to provide cellular roaming services using the Helium network.”

Investment Risks

Investors need to consider that Helium is still very early stage, and crypto-asset-related investments in general should be looked at with extra caution. Adam Nasli, head analyst at international broker BrokerChooser, said to CoinDesk in a statement regarding the price of Helium that “this high correlation [with Bitcoin] makes it unpredictable, affecting its value.”

There are chip-shortage-related supply chain issues that might remain as we head into 2023, effectively delaying hotspot production and slowing network growth. Even the network itself has experienced technical disruptions, which is not unusual at this stage and mainly caused by its unprecedented growth. But there are also ongoing issues with cheaters and the consensus mechanism itself. Additionally, Helium is facing regulatory hurdles that might slow adoption as Sean Farrell, vice president of digital asset strategy at Fundstrat Global Advisors, said to CoinDesk (linked to above): “It’s possible that [HNT] would be considered a security by the SEC and therefore is not listed on any domestic [U.S.] exchanges.”

In this context, it seems reasonable that Coinbase (COIN) has not listed HNT since they added the token as “asset under review” back in July 2020. Currently, trading pairs for HNT are only available on Binance, FTX, Crypto.com, and some minor exchanges.

Valuation

In November 2021, according to CoinGecko the price of HNT-USD reached an all-time high at $52.99, but since then has lost roughly 50% of its value. HNT is currently trading at around $23 (as of April 6, 2022), which still is more than a 20,000% gain since its early trading days began back in 2020 when its value was just about $0.11. With a current market cap of $2.3 billion and a ranking at No. 59 of all cryptocurrencies, the project seems well positioned in the Top 100.

HNT All-Time High $55.99 (CoinGecko.com)

Tokenomics

HNT has a fixed maximum supply of 223 million tokens with a current issuance rate of 2.5 million tokens per month, which are distributed among the hotspot owners and other beneficiaries of the network. A halving event occurs every two years, effectively cutting the issuance rate by 50% each half, with the next halving taking place in August 2023. While the tokenomics of Helium are little more complex than those of Bitcoin, the HNT token comes with a comparable deflationary economic model in its DNA.

Conclusion

The biggest hurdle to start a global network is the typical chicken or the egg problem. It’s hard to acquire new users when there is no network, and there will be no network when it’s not economical to build it. The Helium community has already proven that it can successfully bootstrap a huge global network in a very amount of short time, and I think the demand to join the platform will grow as well.

I believe Helium is a stock with significant upside, and that it can reach a market cap of $25 billion (~10x from here) in the next three years if competition keeps lacking and the overall crypto sentiment is bullish. However, as with any startup, the risks are high, and the strong correlation to Bitcoin might add to that risk. That said, I do suggest to first dip your toes in now and spread your investment out over several tranches in the months ahead.

Be the first to comment