Justin Sullivan

Thesis

We highlighted in our pre-earnings article that Advanced Micro Devices, Inc. (NASDAQ:AMD) stock was likely at a near-term bottom, given the rapid panic selling move that the market forced against weak holders.

Therefore, AMD’s Q3 earnings release did not cause more mayhem, as the market had already contemplated its tepid performance. Furthermore, management suggested it guided conservatively for Q4, as it modeled for further weakness in its PC segment.

We believe AMD is at a critical juncture as buyers attempt to regain its medium-term bullish bias. AMD is also consolidating near its long-term moving averages, suggesting that we could still see some near-term upside.

Analysts remain confident that AMD could outperform the S&P 500 semi industry in 2023, with management confident that it could continue gaining share in its PC and enterprise/cloud business. Hence, despite the battering from its November 2021 highs, AMD remains priced at a premium against its industry and peers represented in the Semiconductor ETF (SOXX).

We discuss why AMD could potentially form a bottom from here if it could execute well through the significant inventory digestion in its PC business in 2023. Notwithstanding, we explain why we continue to stay on the sidelines, given the potential for further downstream macro weakness and slower enterprise/cloud spending over the horizon.

Coupled with significant technical damage in AMD’s price action, we lean more on the conservative side as we await more clarity from the market on its medium-term directional bias, given AMD’s growth premium.

Maintain Hold for now.

AMD: PC Segment’s Underperformance Is Expected To Continue Through H1’23

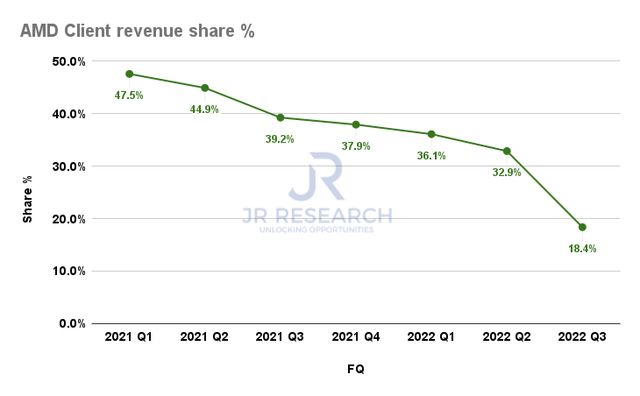

AMD Client revenue share % (Company filings)

Given the inventory mayhem seen by its downstream PC customers, AMD’s Client segment posted a revenue share of just 18.4% in FQ3, down significantly from last year’s 39.2%.

Therefore, despite the continued strength in its data center segment, the market has gotten its positioning on AMD spot on. Despite gaining share against Intel (INTC), the company wasn’t immune to the PC headwinds, as consumers pulled back further, worsened by much tougher comps. With worsening macroeconomic headwinds, the PC hit has been significant.

AMD’s Q4 guidance suggests that it didn’t expect an improvement in the near term, with inventory digestion still ongoing. In addition, supply chain checks indicate that PC vendors continue to embark on aggressive discounting to clear inventory and didn’t expect Q4 to show improvement.

Hence, we believe the critical question for AMD investors is whether the market has priced in significant weakness in its PC business against its valuation.

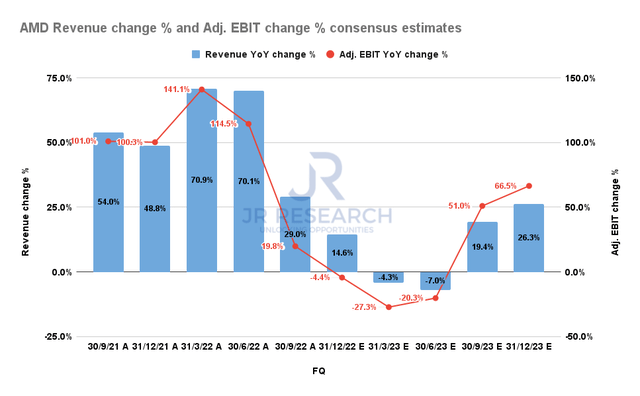

AMD Revenue change % and Adj. EBIT change % consensus estimates (S&P Cap IQ)

Accordingly, AMD’s Q4 guidance suggests revenue growth of about 14% YoY (midpoint). The revised consensus estimates (bullish) indicate revenue growth of 14.6%, with its adjusted EBIT falling by 4.4%.

Moreover, the Street’s modeling suggests that AMD could recover from its malaise in H2’23, with the PC segment’s inventory digestion likely resolved to a large extent.

We think the recovery slope is generally credible based on AMD’s strategy of under-shipping in the near term to aid its downstream customers in clearing their inventory levels. However, the critical question is whether the demand recovery is robust enough to help AMD recover from the steep decline in its PC business by FQ3’23.

IC Insights suggests that the consumer segment could grow at a CAGR of 4.6% from FY21-26. However, with the significant outperformance in FY21, forward performance could be relatively muted as growth normalizes. Therefore, we postulate that the Street’s projections suggesting AMD could recover its FQ2’22 revenue of $6.55B by FQ3’23 (est: $6.65B) could be overly optimistic.

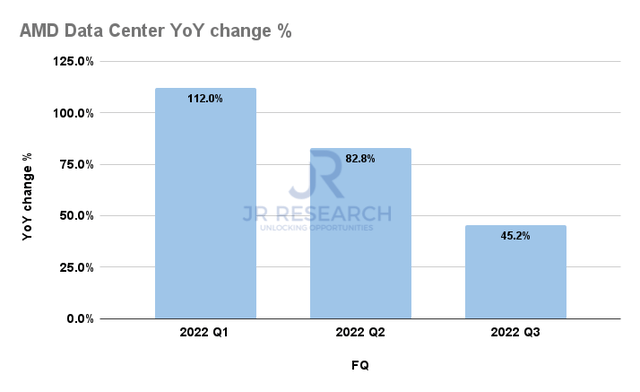

AMD Data Center Revenue change % (Company filings)

Note that AMD highlighted enterprise was relatively weaker in Q3, even though cloud revenue “more than doubled.“

Hence, it’s incumbent on AMD’s cloud segment to continue demonstrating significant growth through FQ3’23, even though signs of weakness have recently emerged from enterprise Cloud SaaS companies’ forward guidance.

Hence, we believe the possibility for further cuts in data center growth momentum is likely, which could impact the current consensus projections suggesting a complete turnaround by FQ3’23.

Is AMD Stock A Buy, Sell, Or Hold?

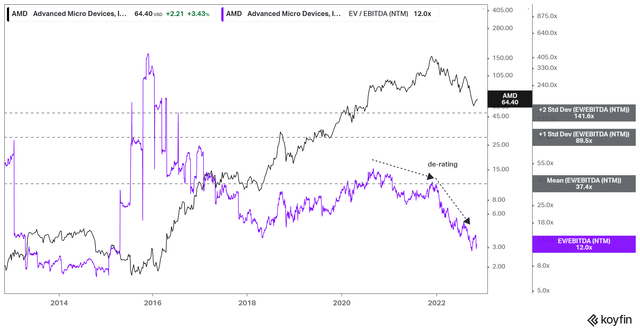

AMD NTM EBITDA multiples valuation trend (koyfin)

As seen above, the market had astutely de-rated AMD from its valuation highs in 2020, even though it continued to make new price highs through November 2021.

The market has again proved its prescience, which we should have considered more seriously. AMD last traded at an NTM EBITDA multiple of 12x, well above its peers’ median of 8.9x (according to S&P Cap IQ data).

Its NTM normalized P/E of 19.9x is also well ahead of SOXX’s forward P/E of 14.1x. In addition, it’s also significantly ahead of the S&P 500’s semi industry forward P/E of 15.3x.

Hence, while AMD seems inexpensive relative to its historical averages, the company needs to deliver significantly higher growth performance to justify its premium valuation.

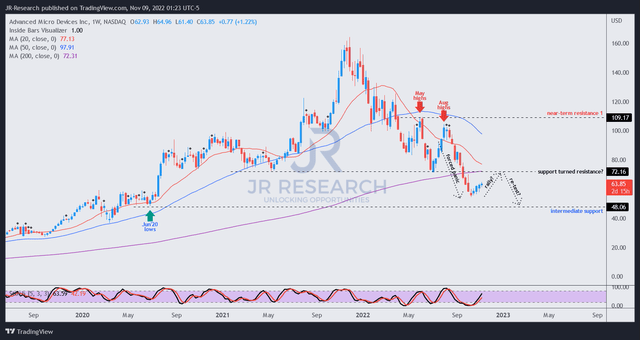

AMD price chart (weekly) (TradingView)

As we highlighted in our previous article, AMD looks to have bottomed out at its recent October lows.

However, the market had already anticipated a much weaker Q3, as it rejected the steep recovery from its summer rally and forced a rapid panic sell-off from its August highs.

We postulate that AMD needs to regain control of its 200-week moving average (purple line) or 200-week MA to potentially retake its medium-term bullish initiative.

Hence, we are leaning more conservatively and suggest investors bide their time and let the market demonstrate its directional bias before pulling the trigger.

A failure to retake its 200-week MA decisively could see it re-test its intermediate support before consolidating.

Maintain Hold for now.

Be the first to comment