eyewave

The Costamare E Series Preferreds (NYSE:CMRE.PE) are ones that we covered some years ago. Technically they did overperform since then, but we think that the preferreds trading below par now is a little unnecessary as it gives substantial margin over the rising reference rates. Given the state of the business, although seeing some mean reversion, CMRE.PE remains pretty attractive from a valuation and implied credit risk perspective. We won’t play in commodity exposed markets for the time being, but still highlight the potential in this stock.

Q2 Update

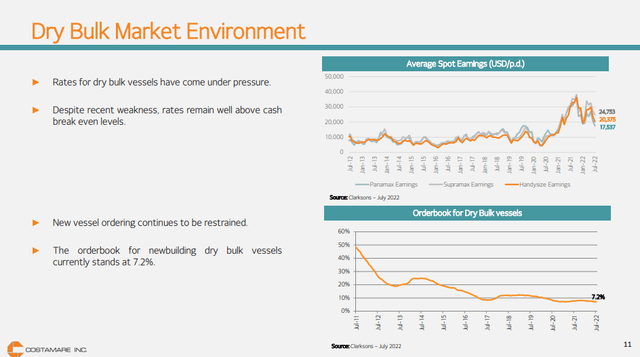

Let’s run quickly through some of the updates in Q2. The first thing to notice is that pressure is higher in dry bulk, which is more exposed to the commodity trends that have since reversed. While some commodities are still very valuable, especially as the Russian invasion has tightened supply dynamics, weakened demand from China for things like steel and iron ore, but also other construction commodities, has put pressure on some key commodities. The dynamics causing this to happen have taken their toll on the market for renting these ships.

Dry Bulk (Q2 2022 Pres)

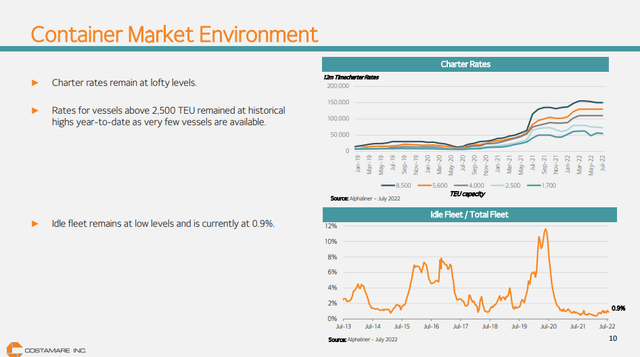

While tightening liquidity conditions and demand side pressures are harassing the dry bulk charter rate due to exposure to heavier more cyclical industry, the containership charter rates remain plateauing at peak levels, and this is the majority of CMRE’s fleet. In general we have seen performance in the demand for consumer staples and goods as the handover from supply chain pressures to demand side pressures takes place. We highlight pressure in some markets that matter for containerships like electronics, where stocks are rising now not falling and point towards another semiconductor glut coming. Also, slowdowns in consumer durables are starting now that higher rates are putting pressure on car purchases, and this will matter for the transport of car parts, a major containership cargo. In general, the velocity of consumer goods purchasing will be taking a hit, not least to the COVID-19 related recovery in the service industry, but also because of recessionary pressures from higher cost of living.

Containership Charter Rates (Q2 2022 Pres)

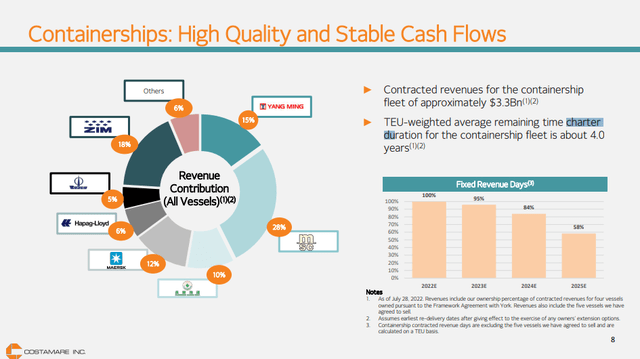

Net income is still on the rise, up 37% YoY, but also because comps are still a bit easier, and liquidity is rising with net debt falling very slightly due to some added financing. Part of this financing is for a pretty aggressive share repurchase program. About 30% of preferreds are getting repurchased, which will substantially reduce the dividend burden of the company, and about 4% of common stock are in the process of repurchase, also reducing the general dividend burden to equity holders, although preferreds have a senior dividend over the equity dividend.

Remarks

The reducing preferred and common stock burden is effectively a type of deleveraging, and the credit profile, especially because more preferreds are being retired compared to common stocks, should reflect this as an improvement.

Additionally, the charter duration rates remain high at 4 years, and any rollovers happening are still happening at very high charter rates for containership, and substantially above breakeven for the dry bulk ships. Idle rates have some inertia at these low levels.

Charter Duration (Q2 2022 Pres)

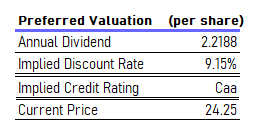

Using the current dividend yield on the E Series preferreds as the discount rate, we can connect the premium over the risk free rate, which we see as being at 5%, in order to find the implied credit rating.

CMRE.PE Implied Credit Rating (VTS)

Caa puts it at the top of the C category, but on the bottom half of what are already speculative grade investments. About 50% of the assets at market value are claimed upon by debt. In a recovery and liquidation scenario that could be a lot more. Then next 15% is for the preferreds, with the Series E being the least senior. That leaves another 35% discount in the asset values from current market values before recovery becomes a problem for the preferreds. It’s a good margin given that liquidation is unlikely, but it does reflect that leverage for CMRE is pretty high.

The key thing is that liquidation remains unlikely. If we’re at the end of the current cycle, then there’s 4 years of high rate charters to skate on. Things will incrementally decline but the preferreds will be late to lose their dividends.

We do note interest rate risks however. Rates have come up about 300 bps in the current phase of the rate hiking cycle. That puts about $18 million in net income pressure on the bottom line, which is about 20% of 2019 net income, and less than 5% of 2021 net income. We could see another 300 bps in increase in the worst case scenario. That would be a 40% hit to 2019 levels of net income, which maybe would better reflect a recessionary environment on top of sustained general demand for stockpiling reasons of products and commodities. Also the recession we’re gearing up for is likely to be relatively garden variety.

Overall, a rock bottom rating seems unreasonable for CMRE, despite macro pressures and IR risk on the bottom line from existing debt. Nonetheless, things could get more volatile in markets generally. While a 9% yield keeps you ahead of inflation erosion and rate erosion, we’d not like to own those assets when serious declines come in.

Be the first to comment