Matteo Colombo/DigitalVision via Getty Images

Investment thesis

In my previous article on BlackRock’s iShares MSCI Singapore ETF (NYSEARCA:EWS) I compared it against their ETF for Hong Kong (EWH) as these are two well-developed business hubs in Asia which many investors compare against each other as to where they want to invest.

At that time, I chose Singapore over Hong Kong, but with a caveat that EWS was a “Hold” at that time.

It has come down 12.2% over the last six months, although the trend tried to reverse in the middle of March it has since started to go down again.

EWS price development – six months (SA)

Let us examine some of the fundamentals of this ETF and its largest holdings. Those top ten companies account for as much as 73% of the fund.

Update on EWS

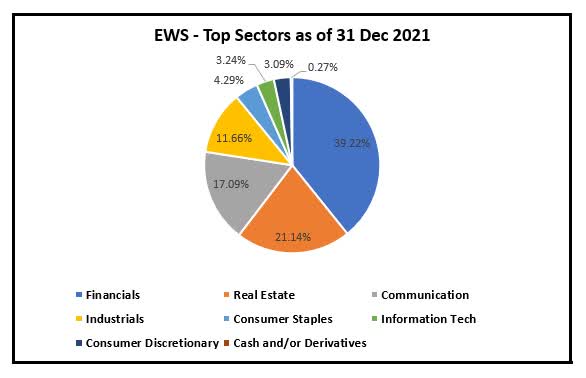

This ETF uses MSCI Singapore 25/50 index as its benchmark. Hence, it holds a relatively concentrated portfolio with just 20 positions. They are heavily invested in financials and real estate.

EWS – Top sectors as of 31 Dec 2021 (Data from BlackRock. Graph by author)

This large portion of financials and real estate is incidentally also quite similar to how my own portfolio is structured.

EWS’s one-year performance for 2021 was up 5.22%. This underperformance against MSCI World is very large as that index produced a hefty gain of 21.82% and the (SPY) was up as much as 28%.

It is perhaps a topic for discussion some other time, but MSCI World is largely weighted towards the U.S. stock market. Even within the S&P 500 index, it is heavily tilted toward the FAANGs. Fellow author Wolf Report questioned the reason for investing in the MSCI World for that particular reason. It was a valid question.

I have to assume that the reason you are interested in something like EWS is that you want to put a portion of your portfolio in an investment other than the main portion of your portfolio. It is not because you are trying to beat all other indexes.

BlackRock (BLK) charges their usual 0.50% management fee, which is acceptable.

It is interesting to note that the net assets in the fund at the end of 2021 were USD 539.7 million but have since grown by 18.7% to USD 640.8 million, as of 7 April 2022.

Top 10 holdings in EWS and their performance last year

Let us look at how well and how large the ten biggest investments are in this ETF.

1. DBS Group Holdings (OTCPK:DBSDF) – 18.76%

DBS Logo (DBS home page)

Southeast Asia’s largest bank broke yet another record in net profit last year earning SGD 6.8 billion. I have up-to-date coverage here and I am long DBS Group.

2. Sea ADS (SE) – 12.64%

Sea Ltd. Logo (Sea home page)

Going from DBS which makes billions of dollars, year in and year out, we move on to Sea Limited, which is in the “growth” category. They made a net loss of USD 2 billion.

Nevertheless, their share price went up 38% in 2021, but if we look at its performance when all tech stocks started to dive, it peaked at USD 365 in October last year and has since fallen 68% to USD 116.5

Sea Ltd. – six months share price (YCharts)

It is the ADS that is trading on the Singapore stock exchange which is held by EWS. I have no position here, and no plan to buy it.

3. Oversea-Chinese Banking Corp. (OTCPK:OVCHF) – 11.58%

OCBC Logo (OCBC home page)

OCBC is a fine bank. Their net profit increased 35% y-o-y to SGD 4.8 billion. With it, their ROE went up from 7.6% to 9.6% last year. Like the rest of the banks here, it also has a strong capital position with a Common Equity Tier 1 capital adequacy ratio of 15.5%. They pay dividends through one interim and one final dividend which works out to a yield of 4.36%.

4. United Overseas Bank (OTCPK:UOVEY) – 4.7%

UOB Logo (UOB Home page)

The third Singapore bank in the portfolio is UOB. They also had a good year in 2021 with a net profit up 40% y-o-y to SGD 4.1 billion. EPS was SGD 2.38 which gives it a P/E of 13.12.

ROE in 2021 was 10.2% and their CET1 ratio was 13.5%

The dividend for the year was SGD 1.2 which is a payout ratio of 49%. The yield based on the present price of SGD 31.22 per share is 3.84%

NAV per share is SGD 24.08

5. Ascendas REIT (OTCPK:ACDSF) – 4.69%

Ascendas Reit logo (Ascendas home page)

Ascendas REIT is the largest Real Estate Investment Trust in Singapore in what they define as business space. This covers science parks, suburban offices, and industrial properties located across Singapore, Australia, the United States, and the United Kingdom/Europe. In total, this is 217 properties valued at SGD 16.3 billion.

It is managed by Capitaland Investment. They have managed to grow the DPU to Singapore cents 15.258 which is a CAGR of 3.6% since their inception in 2003. Based on a price of SGD 2.89 it leaves investors with a yield of 5.29%.

6. Singapore Telecom (OTCPK:SNGNF) – 4.45%

SingTel Logo (SingTel home page)

SingTel has 740 million mobile customers in 21 countries. As much as 71% of their net operating profits come from outside of Singapore. Their two largest markets are Singapore and Australia.

In addition to their main business of mobile phones and broadband internet, they are dabbling in the same thing that every other digital player is doing.

That means cloud storage solutions, data centers, and fintech. Last year SingTel, in a joint venture with Grab (GRAB) was awarded a digital full bank license from the Monetary Authority of Singapore. It will start operating this year. Let us see how much money they can earn from it. It is a very competitive environment with banks such as DBS also doing the same thing.

Their accounting period ends 31st March of each year, so the latest financial figures we have is from their 3rd Quarter 2021 report which ended 31st of December 2021. Net underlying profit for the first 9 months was SGD 1,456 million which was an improvement of 10.8% y-o-y. Management has over many years had a generous dividend policy of distributing between 60 to 80% of earnings.

Out of seven bank analysts that cover SingTel here, all have a buy recommendation with a price target ranging between SGD 2.86 and SGD 3.10.

The present price is SGD 2.63 which should yield around 4.5% a year.

I am also long SingTel.

7. Wilmar International (OTCPK:WLMIF) – 4.29%

Wilmar Logo (Wilmar Home page)

Wilmar is Asia’s leading agribusiness group with palm oil and sugar being their main business.

On the back of firmer commodity prices, Wilmar was able to deliver a net profit in 2021 of USD 1.89 billion, which is the highest it has been since it was listed in 2006. EPS was USD 0.299 and they will pay a total dividend for FY2021 of SGD 0.155 per share which is the highest cash dividend they have paid so far. This works out to a yield of 3.37%.

In addition to the dividend, Wilmar also bought back about SGD 130 million of their own shares through 2021, and they plan to continue to do so as long as they see value in doing so.

8. Keppel Corporation (OTCPK:KPELY) – 4.19%

Keppel Corp. Logo (Keppel Corp. home page)

2021 was a turnaround year for Keppel Corporation. It turned a negative cash flow of SGD 75 million in 2020 to a cash inflow of SGD 1.75 billion which was mostly done through asset monetization.

The company is transforming itself from an offshore & marine shipyard company to a diversified group with interests in power production and distribution, property, infrastructure, and environmental solutions. The two large shipyard groups of Keppel and Sembawang, both controlled by Temasek, are planned to merge this year and will gradually move to a new mega-site at Tuas.

Keppel delivered a net profit of SGD 1 billion in 2021, and as a result management increased the dividend from just SGD 0.10 to SGD 0.33 per share. Based on the current price of SGD 6.50 per share it yields 5.1% which is quite satisfactory. Unfortunately, the dividend is not stable.

ROE was greatly improved from a negative 4.6% in 2020 to a positive 9.1% last year. Their gearing has also been improved to 0.68x.

9. Singapore Exchange (OTCPK:SPXCF) – 4.18%

SGX Logo (SGX home page)

Singapore Exchange made a net profit of SGD 445 million last year on revenue of SGD 1,056 million. EPS was SGD 0.416 which was down 6% y-o-y.

ROE was also down from 40% to 34%.

Despite lower earnings, their dividend was up 5% to SGD 0.32 per share. At a price of SGD 9.88 per share, which is where it is trading now, we get a yield of 3.24%

10. Singapore Airlines (OTCPK:SINGY) – 3.92%

Singapore Airlines Logo (Singapore Airlines home page)

All airlines in the world have been, and are still to some extent, going through an extremely difficult time. To survive, they have had to get help from shareholders, lenders, and often governments too.

Singapore Airlines has actually made money in the past, which in itself is quite an achievement. In 2018/19 they made a profit of 683 million.

This turned into a loss of SGD 4.27 billion in their last financial results of 2020/21.

I will not go into details. This is one industry that I will not invest in. It will never find its way into my own portfolio and herein lies one problem with indexing because ETFs do not choose what to buy. If the ETF tracks an index which are picking the shares with the highest market capitalization – you get some “bad” with the “good”.

Singapore’s economy

The whole world is grappling with inflation right now. Inflation in the U.S. has reached 7.9%.

Economists’ textbooks for curing this in the past have been to increase interest rates. If that is the right solution, it does seem to me that the Fed has been doing “too little” and “too late”.

Singapore is not sheltered from this either. Much of what we buy here is imported, such as energy fuel, food, and many consumer goods. In February of 2022, it recorded an inflation of 4.3% y-o-y which was the highest it has been in nine years. FocusEconomics Consensus Forecast panelists expect inflation to average 3.4% in 2022.

However, the Monetary Authority of Singapore takes a different approach to try to fight inflation than most central banks. Instead of using the interest rate, they try to manage inflation and growth through their currency against those of their major trading partners.

The focus is on the level of the SGD nominal effective exchange rate, often referred to as S$NEER, which is moving within a set policy band. Put differently, by allowing the currency to trade at a higher band towards the basket of currencies it has specified, the goal is to strengthen the SGD. This should lower prices in the SGD for imported goods.

The government had communicated for a long time that they were going to increase the Goods & Services Tax, which currently is 7%. It will increase it from 7% to 9% in two stages – one percentage point each time on Jan 1, 2023 and on Jan 1, 2024.

Increasing the GST will also add to the inflation.

In March, Singapore’s factory activity dipped with the PMI falling 0.1 points to 50.1. This is the third month of decline. Bear in mind that the PMI had actually been in expansionary territory for 21 months, since July of 2020.

Conclusion

Singapore, as a country, is still economically sound. Apart from it, there are only 10 other countries in the world that have AAA ratings for their debt by the three rating agencies.

As a matter of fact, Singapore Government does not need to borrow money, as their existing policy is to maintain a fiscal balance over the cycle of the government’s five-year term. This is something they have been able to do, except in 2020 and 2021 during the height of the pandemic. During these two last years, they did run a budget deficit which was financed through what they have in reserves. The government mainly issued debt to develop the local bond market, create savings instruments for residents and facilitate investment by the Central Provident Fund as part of the pension system mechanism. Consistent with this approach, the budget deficits in FY20 and FY21 will not lead to a rise in government debt, as the government is tapping into past reserves.

I maintain my stance on EWS as I believe it is a good proxy for investing in Asia.

You get exposure to a vibrant and still growing region through companies that are based in Singapore where corporate governance and international law apply. English is the Government’s official language.

To predict the price of EWS in the short term is a “fool’s errand”.

What matters most is the valuations for the companies in the ETF. They are not as attractive as it was before. EWS has a P/E of 20.35 and a Price to book value of 1.47.

Hopefully, it will be available at a more attractive level in the near future.

For that reason, it is still a Hold.

Be the first to comment