Funtay

Alpine High is a large natural gas and liquid discovery made by APA Corporation (NASDAQ:APA) in West Texas in 2016. It is estimated that Alpine High “AH” contains 3 billion barrels of oil and 75 trillion cubic feet of natural gas “NG”, and natural gas liquid “NGL”. APA invested heavily in infrastructure development in AH for processing and transport of the hydrocarbon products out of AH since the discovery. The wells drilled so far yielded mostly NG and NGL. Since the discovery and up until 2020, prices of NG and NGL were low. Because of lack of sufficient transport of NG out of the Permian Basin, the basis at the Waha hub caused NG prices to go negative at times. The complex geology in AH also caused some issues in drilling and completion productivity improvement. In February 2020, APA wrote down its investment in AH and turned its focus to its oil-rich fields and to investment in Block 58 offshore Suriname. However, the picture for NG prices has completely changed and with improvement of transport in the Permian, I believe AH has become a valuable asset. However, APA does not have a stated strategy to realize the value of this asset. In this article, I will highlight the value of AH in light of the current NG supply demand backdrop and some thoughts on how to realize the value of AH for APA owners.

APA is undervalued based on its current operation with a free option on Alpine High and Block 58 offshore Suriname

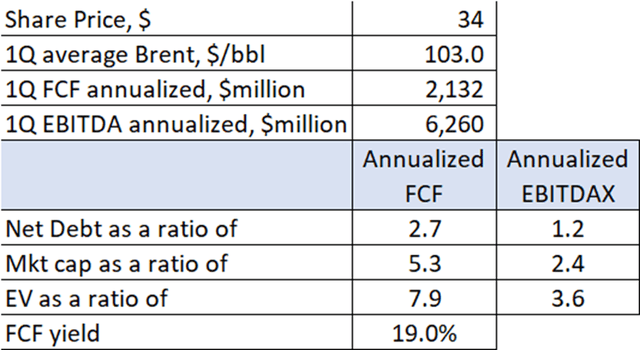

I have written a previous article on APA. The thesis of that article was that APA was trading at an attractive valuation, even without taking into account of its potential in offshore Suriname. I wrote that article when WTI was around $75. Currently, WTI is around $97. APA’s share price was around $27 at that time. It is currently at around $34. Using APA’s 1Q results, where WTI averaged $96, I updated the estimation of APA’s valuation multiples. It is shown in Figure 1. Figure 1 used 1Q2022 results, but the share count is based on the latest the company reported as of July 15, 2022.

Figure 1: APA valuation multiples showing gross undervaluation. (Author’s model based on company data.)

Figure 1 shows that even though APA’s share price has increased since my previous article, the substantial increase in 1Q results has made APA’s shares even more attractive. When APA reports 2Q results shortly, the undervaluation will further be amplified as the average WTI price in 2Q was $111 compared to $97 in 1Q. The more important point is that this undervaluation does not take into account the potential for the asset in Block 58 offshore Suriname and in AH. With NG prices well above $8 per MMBtu, the asset at AH has become valuable.

Alpine High is a valuable asset if natural gas price trend holds

Alpine High was estimated to contain 3 billion barrels of oil and 75 trillion cubic feet of NG. Let us just focus on the NG part of the resource for now. To put that in perspective, in 2019, the USGS estimated that there were 214 trillion cubic feet of NG in the Marcellus and Utica shales, two of the more prolific NG shales in the US. Even if only part of AH’s 75 trillion cubic feet of NG is recoverable, AH is still a very valuable asset. As part of the deal to monetize part of APA’s holding in Kinetik (KNTK) after the merger between Altus Midstream and EagleClaw Midstream to form KNTK, APA has agreed to invest at least $100 million in AH to maintain the volume feeding into the KNTK infrastructure. As part of the $100 million investment, APA will move one rig to AH in the second half of this year. Again, to put things in perspective, according to Baker Hughes’ (BKR) rig count report, there are currently 49 rigs working in the Marcellus and Utica shale. Basically, APA’s strategy is one where it is hardly investing in AH, even under today’s NG price environment.

When APA abandoned further investment in AH in early 2020, the company cited a list of issues. At the time, NG price at the Waha hub was very low. At times, the price went negative due to lack of transport. There was a lack of infrastructure within the AH play, prolonging the period to test full development. Furthermore, the AH play extends over 366,000 acres, making the cost of development much higher than APA could afford. The limited pad and pattern development APA did prior to 2020 did not result in productivity improvement, probably due to a more complex geology in the play. All these issues translated to a cost of development that APA was not able to undertake, given the price of NG and NGL at that time.

In the last several years, APA has adopted a maintenance mode in its capex strategy, using the resultant substantial FCF to pay down debt and returning capital to shareholders. As a shareholder in APA, I will not want the company to change its capital allocation strategy. Hence, the value of the asset at AH will not be realized unless APA changes its strategy regarding AH. I believe that given the NG supply demand backdrop and the resulting price trend in NG, a very different strategy to realize the value of AH is needed.

The NG supply demand dynamics have changed dramatically in the last year, resulting in a dramatic increase in NG prices. This is shown in Figure 2.

Figure 2: Nymex natural gas futures historical chart. Price is in $/MMBtu. (tradingeconomics.com)

Figure 2 shows that NG prices have been going up in the last year. This is driven by several factors that constrained supply growth. There is a more disciplined capital investment strategy by the E&P companies, focusing on capital return rather than growth. There is a lack of growth in the transport facilities in general due to active campaigns by environmental groups to stop the construction of new pipelines, further limiting growth. Some of the plays such as the Eagle Ford and Woodford have plateaued while some others such as the Barnett and Fayetteville are in decline. On the demand side, the steady growth in LNG export due to the growth in Asia has increased demand. Recently, the war in Ukraine has highlighted energy security as an issue in the EU. As a result, the EU’s pivot from Russian gas to American, Middle East and African gas has significantly increased the demand for American LNG.

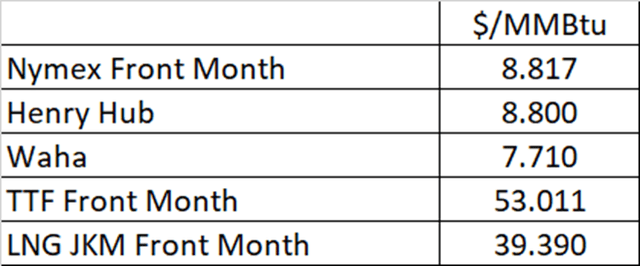

American gas prices have been low for years because there is relatively low LNG and pipeline export capacity out of the US. Cheap domestic gas is trapped in the US. Hence, the American gas price is significantly below that of the rest of the world. This is shown in Figure 3.

Figure 3: Gas price differential between US, EU and Asia. (CME and Texas Alliance of energy Producers.)

As more LNG processing and transport facilities are built, I expect that the price differential will continue to close. This means that the asset in AH is getting more and more valuable. In fact, given the current Nymex stripe, AH wells are very competitive in terms of its ROI, according to management.

A new strategy is proposed to realize the full value of Alpine High

Due to the lack of infrastructure in AH, the capex that is needed to develop the full potential is substantial. As a shareholder in APA, the dilemma is how to realize the value of AH without sacrificing the capital discipline and the capital return scheme. Hence, a change in the strategy is needed.

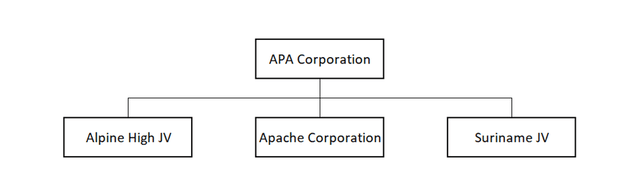

There are many ways to realize the value of AH. I will give one example below. In this example, APA sells a portion of AH to a JV partner, with an upfront cash payment from the JV partner and a guarantee of a defined stream of capex investment to build the necessary infrastructure and transport and to develop the resources. APA’s contribution to the JV is the AH asset. The JV partners will agree to share in the cash flow from this JV in some predefined formula. Further, the JV defines a roadmap based on the maturity of development of the AH play when the JV will go public by selling part of the JV to the public while APA spins out its portion of the JV to its shareholders. The initial APA organization structure of this strategy is represented in Figure 4.

Figure 4: Prospective corporate structure with the proposed Alpine High JV scheme. (Author)

This is just one of many potential strategies to monetize the value of AH for the shareholders. I am sure that there are many other different strategies. I do hope that management and its bankers are already brainstorming and implementing a new strategy. The AH asset is just too valuable to sit idle in today’s NG price environment and especially in the likely scenario of further closing of the gap between US and foreign NG price differential. If management does not act, I am sure the gross undervaluation of APA’s asset base and cash flow will attract an activist or an acquirer. As a shareholder, I do hope that management will delineate its strategy for AH and implement it soon before someone else does it for them. I expect that when a new strategy for AH is announced and implemented, it will be a catalyst to propel APA shares higher.

Risks

The premise of a new strategy for AH is based on the closing of the price differential of NG prices between the US and the rest of the world. Should the US E&P ramp up their capex in response to the increase in gas prices, this gap closing may not happen. Should the geopolitical issues resolve themselves, the EU’s demand for American LNG may not grow as quickly as expected. The closing of the price differential requires substantial investment in LNG facilities both in the US and the EU, and it will take time. Hence, we will not see the closing of the price differential overnight. Middle-eastern, African and Asian-Pacific NG suppliers are also getting into the LNG market, which may affect future price increase potential for US NG. There is not much production history in AH and its surrounding area. The lack of proven production data may cause a conservative pricing from a potential JV partner, thereby reducing the potential realized value of the AH asset.

Takeaway

The NG supply and demand dynamics have changed, resulting in rapid increase in US NG prices. APA’s AH asset is potentially a large NG play with potentially compelling value. However, it requires substantial investment to realize its potential. Given APA’s current capital discipline and its strategy regarding AH development, AH’s value may not be realized for a long time. A change in strategy is needed to realize AH’s potential. One such strategy is proposed. Should NG price trend continue and APA shares continue its undervaluation, APA management has to implement a compelling strategy for AH or someone else will do it for them.

Be the first to comment