Picturesque Japan/iStock via Getty Images

Investment Thesis

In my previous article on Nathan’s Famous Inc. (NASDAQ:NATH), I came to the conclusion that the stock was undervalued. You can read about it here. Since then, NATH lost ~6.5% vs a loss of ~11.6% for the S&P 500 and has outperformed the market. After the recent results, I continue to believe that NATH offers a good risk-reward investment. On top of that, the company has a robust business model and is likely to do better than its peers in case of a recession. That said, investors shouldn’t discard the risks associated with this investment. While attractively priced, it is impossible to say if NATH is near the bottom. In my opinion, further selling is highly probable if the market heads lower.

Recent Developments

In my last article on NATH, I discussed the company’s resilient business model and some of the potential catalysts. I came to the conclusion that the stock was fairly valued for an 8-10% annual return.

On June 10th, 2022, the company reported full-year results for FY22. Overall, the results were solid and in line with my expectations. Sales reached ~$114.9 million in the last year, which represents a ~51.6% YoY increase. NATH generated $46.1 million in gross profit during the last twelve months, compared to ~$42 million in FY21.

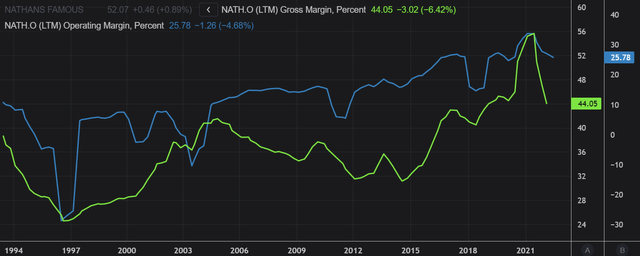

Profitability remains close to an all-time high, despite mounting inflation and an industry-wide rise in inputs costs. However, I think it’s important for investors not to forget that the cyclical nature of business cycles impacts profitability, which means that a period of high margins could be followed by a period with modest profit margins. NATH has a first-hand experience in that regard. The company’s margins took a hit back in 1996-1997 and during the GFC. I personally believe that margins have peaked in 2021 and future quarters could bear some disappointing profitability metrics. This trend seems to be on its way as shown in the chart below.

Investors are generally trying to assess whether or not they are getting a good deal before purchasing stocks. In order to quantify that, one of the best and simplest metrics to use is the price-to-sales ratio. On the good side, we are now far from the 2021 peak of 4x sales. However, NATH is still trading meaningfully above its lowest point over the last decade, which means there might be more downside risk ahead for investors.

NATH raised its dividend by 29% back in February 2022, which sent a strong signal to the market that the company is in a good shape. As a result of the recent hike and stock price decline, NATH’s dividend yield is now near its highest level in recent years. NATH has a TTM dividend yield of ~3.5%, which is competitive relative to how much market participants would get by investing in the S&P 500.

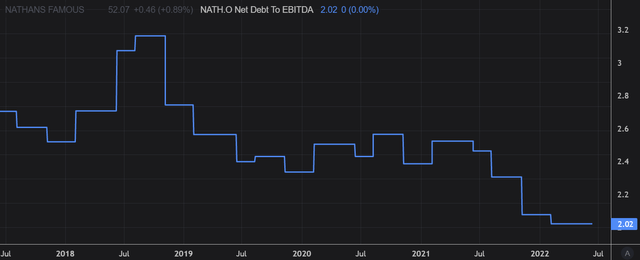

In my previous article, readers expressed some concerns about the company’s level of leverage, and how that would ultimately impact NATH going forward. NATH doesn’t face any major credit risk at a moment in my opinion. In fact, management has lowered the level of total debt in the last quarter and the firm now has a net debt-to-EBITDA ratio of ~2.

I believe my assessment is shared in the credit market, where we can find no immediate signs of distress or panic. While yields are now generally higher across the board, I am pleased to see they haven’t spiked as much and as fast as in the case of some other companies. Having said that, it is fair to remind investors that NATH is rated B by S&P, which is considered junk.

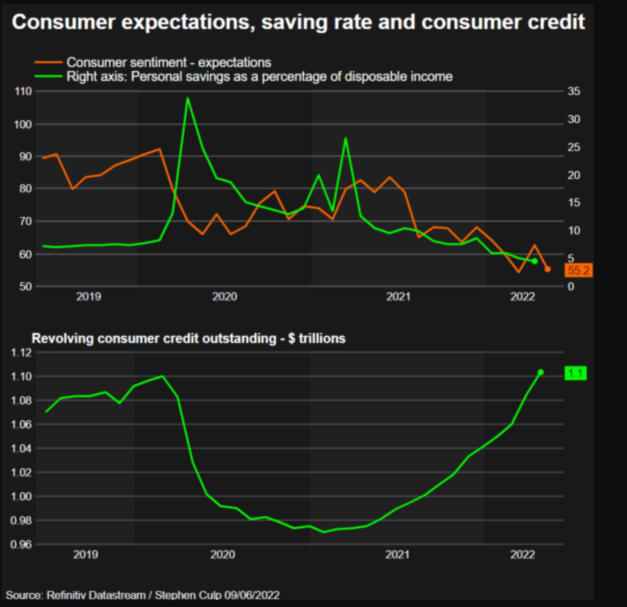

Going forward, I think investors shouldn’t be caught off guard if we see more selling in this stock. The market is adjusting the company’s price to reflect gloomy economic data. For instance, consumer sentiment in the US is reaching new lows at a fast pace and I believe many consumers will now dial back on discretionary spending if they haven’t already. I personally don’t see how that could be avoided given how fast personal savings are evaporating. However, I believe NATH has a resilient business model, which will prove much more robust than some of its peers. The company did relatively well compared to the market back in 2008-2009 and I expect some of this strength to re-emerge if things turn south in equity markets.

Refinitiv Datastream

Valuation

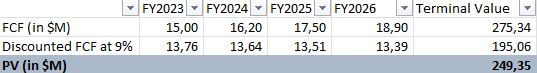

In my previous article on NATH, I have come up with an intrinsic value of $72 per share. We are now below my previous estimate since NATH trades at $51 per share. Based on 4.12 million shares outstanding, the company has a market cap of approximately $210 million. In this part, I have updated my DCF model to reflect some of my latest assumptions:

- Estimated free cash flow for FY23 of $15 million – revised upward by $1 million.

- A growth rate of 8% until FY26 – unchanged.

- A 2% terminal growth rate – unchanged.

- A 9% discount rate – 100 basis points higher than in my previous article, to account for higher yields.

Author’s DCF Model

Based on my updated model, the fair value of the stock is around $60.5 per share, which is ~16% lower than my previous estimate. I personally feel comfortable with this updated valuation as I believe it provides a higher margin of safety.

Key Takeaways

I continue to be bullish on NATH. The company has a robust business model and is in good shape to weather this treacherous environment. That said, I believe the market isn’t done selling, which means that downside pressure will persist over the next couple of months. In order to account for higher rates and to increase my margin of safety, I have lowered my price target on NATH from $72 to $60.5.

Be the first to comment