Noah Berger/Getty Images Entertainment

Amazon (NASDAQ:AMZN) has become a tale of two companies. The retail side of the business is struggling due to multifaceted economic challenges. The cloud computing side is gearing up for battle against Microsoft (MSFT) Azure and Alphabet’s (GOOG)(GOOGL) Google Cloud.

Both areas of the business demand and deserve laser-focused attention to enhance value for shareholders.

Since I last pined for an AWS spinoff, macroeconomic conditions on the retail side have deteriorated, and the case has been significantly strengthened.

The dynamics of a spin-off

A company can spin off part of its business for many reasons, which will be discussed below. Investopedia also has a terrific explanation here. The critical thing to know is that a spinoff creates independent entities, and existing shareholders will receive ownership interest (shares) in both companies upon completion.

What segments does Amazon operate?

Amazon currently operates in three segments: North America, International, and AWS (Amazon Web Services).

The North America and International segments encompass online and physical store sales, third-party seller services, advertising sales, and subscription services like Amazon Prime. For the sake of this article I discuss these in tandem. They would stay together in this spinoff scenario.

The AWS segment is the global leader in cloud infrastructure and platform services.

AWS has grown over the last decade-plus from an intriguing foray into cloud computing to a fast-growing and highly-profitable juggernaut over the years. If the segment were valued conservatively, at ten times sales, it would command a market cap of over $800 billion based on 2022 projections. Amazon’s current total market cap is $1.2 trillion. Microsoft, another profitable company in the cloud space, currently trades at 9.6 times sales. However, Microsoft as a whole isn’t growing as fast as AWS.

Why do companies perform spinoffs?

There are many reasons companies perform spinoffs, which can benefit shareholders.

Superior Management

The top brass at any company must know the core business inside and out to make the best decisions, properly allocate capital, set strategy, and a host of other functions. When a company pursues vastly different areas, this can become difficult.

Amazon’s North America and International operations fit together into a cohesive system. But AWS is fundamentally different. From competitors to employees to infrastructure, it has different requirements from the rest altogether. If the other operations fit together like peas and carrots, AWS is the strawberry.

CEO Andy Jassy has been with the company since 1997. He joined the company as a marketing manager but spent 15 years before becoming CEO growing Amazon Web Services (AWS) into the massively successful business it is today. Since taking over as CEO, AWS has continued to grow and become more profitable, but the rest of the company has not. Yes, much of this is macroeconomically related; however, an executive team with divided attention is less than ideal.

Competing priorities

When one portion of a conglomerate is exceeding expectations, and the other is lagging, it creates competing priorities which can cause strategic blunders. For instance, should the company invest the fruits from one side to prop up the lagging division, or should it focus on building the winner and reducing the footprint of the other? The allocation of resources becomes confused, and the more far-reaching the company, the more difficult crafting an effective strategy can become.

A spinoff can also make the new companies more agile and better equipped to deal with quickly changing market situations. This is critical for Amazon’s businesses at this challenging time.

Two examples that come to mind are the split of PayPal (PYPL) and eBay (EBAY) in 2015 and the upcoming division of General Electric (GE) which will separate its aviation, healthcare, and energy sector operations.

Increasing shareholder value

Management is ultimately responsible for unlocking value for shareholders – the company’s owners. In many cases, both the parent and spinoff companies outperform the market. This is especially true when each side of the spinoff is a well-established entity, as with Amazon, and when the spinoff is carefully planned and not done under duress. It also offers investors superior choices.

Amazon has the additional headache of antitrust scrutiny. Separating AWS from the advertising and online retail business may not solve this issue completely; however, it should alleviate some of the near-term scrutiny.

At the end of the day, management should be asking a simple question: “what is in the best interest of our shareholders?”

Why is Amazon’s stock falling?

The company is heading in different directions

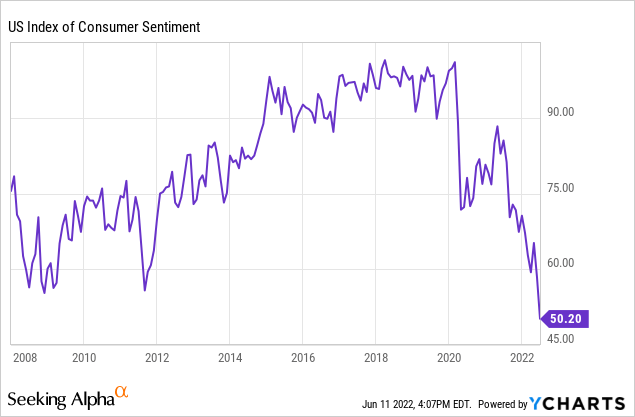

The economy is struggling to deal with persistent inflation. This has increased costs for consumers and businesses and threatens to send the country into a recession. It is a difficult time for retail. Target’s (TGT) disappointing earnings rightfully spooked many investors. In addition, consumer sentiment has cratered, as shown below.

Consumer sentiment is generally seen as a terrific indicator of consumer spending. It now stands below even the lows of the Great Recession. The sentiment gauge is perception-based; however, this figure is incredibly concerning.

In recent quarters, the tight labor market and logistical challenges have added billions of dollars in costs to Amazon’s bottom line. The company has not shied away from swallowing these expenses – which is good. These aren’t headwinds that the company can cut its way out of. It has rightly invested heavily in hiring and logistics. The headwinds will simply require time to dissipate.

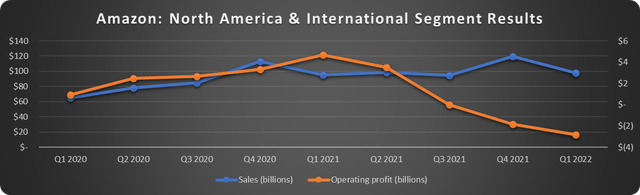

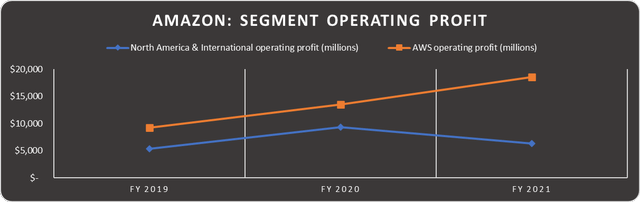

Because of this, Amazon’s North America and International segments have swung to combined net operating losses even as sales have remained strong, as shown below. The orange line represents operating profits which have fallen due to the increased costs.

Data source: Amazon. Chart by author.

The retail business also faces mounting challenges from competitors like Walmart (WMT), Target, and numerous others pursuing omnichannel growth strategies.

Walmart and Target are investing heavily in digital sales and have some inherent advantages that Amazon must combat. Walmart has a vast customer base and unparalleled leverage with its suppliers. The company reported a 38% increase in eCommerce sales on a two-year stack at its last release. Target leverages its existing physical stores to provide logistics for its digital sales. Target’s digital sales have grown 250% since Q1 2019.

It will take a massive effort to fend off these challengers. A nimble, streamlined, and focused Amazon is likely in the best interest of shareholders.

On the AWS side

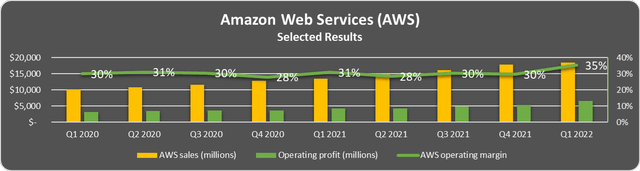

Meanwhile, AWS has only gotten stronger. As shown below, sales have skyrocketed, and the operating margin reached a downright gaudy 35% in Q1 2022.

Data source: Amazon. Chart by author.

AWS sales have increased 80% since Q1 2020, and the operating profits have more than doubled.

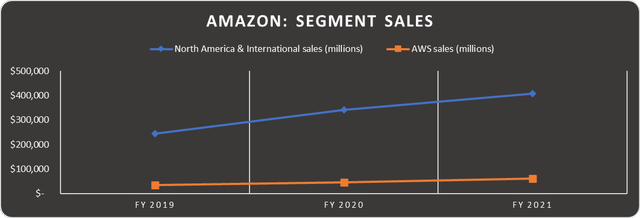

To put it another way, AWS accounts for just a tiny percentage of total sales, just 13% in 2021. But it accounts for much more operating income. The charts below illustrate this. The top graph shows total sales by segment, and the following shows operating profits.

Data source: Amazon. Chart by author. Data source: Amazon. Chart by author.

You may have heard of “work smarter, not harder,” which is a good summation of the central issue. The company is generating massive sales outside of AWS but not generating enough return on this investment. This must change.

However, this does not mean it will be smooth sailing for AWS. Amazon is currently the market share leader in cloud infrastructure, but Microsoft Azure and the Google Cloud are competing hard.

In its previous earnings release, Microsoft reported server products and cloud services sales growth of 29%, propelled by 46% gains in Azure and other cloud services revenue. Google Cloud revenue reached $5.8 billion in Q1 2022 on 44% sales growth year-over-year. The cloud computing space is highly coveted because it is expanding fast and very profitable. Market share gained now will pay off in spades down the road. Because of this, it is likely in shareholders’ interest to have a streamlined AWS that can make strategic moves independently.

Now is not the time for AWS to rest on its laurels. The battle for cloud supremacy will be fierce, and an independent AWS could be the key to enhancing long-term wealth for stockholders.

Should Amazon Spin-Off AWS?

Some might argue that Amazon’s legacy business segments need AWS to survive. However, I believe this logic is flawed. If the core business needs AWS to prop it up long-term, the battle is already lost. But I believe the retail, advertising, and Prime side of the company can do better.

And let’s not forget to focus on what is best for the company’s shareholders. Should the owners of a company continue to prop up a complex, resource-intensive, and largely unprofitable segment? Not if they want to maximize returns.

On the other side, the legacy business deserves to be treated as more than a nuisance and still has tremendous long-term potential. If the company can weather the macroeconomic storm, continue to drive advertising sales, and leverage Amazon Prime, it can generate profits and be successful without AWS.

Both sides of Amazon’s business are at significant inflection points. Both need strongly dedicated and highly-specialized leadership. As competition heats up and the macroeconomic storm strengthens, the time has come to do what is in the best interest of shareholders. It is time to spin off AWS.

Be the first to comment