ronstik/iStock via Getty Images

Investment Thesis

Amylyx Pharmaceuticals (NASDAQ:AMLX) joined the Nasdaq in January this year, raising ~$190m via an Initial Public Offering (“IPO”) at $19 per share, meaning that, just over six months later, its stock price is down only 7.5%. Not bad, considering the prevailing biotech bear market.

That only tells a small part of the Amylyx story, however. The biotech, founded in 2013 by Josh Cohen and Justin Klee, who graduated from Brown University with BSc’s in Biomedical Engineering and Neuroscience respectively, has only one drug in development – AMX0035 – described in the company’s Q122 10-Q submission to the SEC as:

a dual UPR-Bax apoptosis inhibitor composed of sodium phenylbutyrate, or PB, and TURSO (also known as tauroursodeoxycholic acid, or TUDCA)” in Amylyx’s Q122 10-Q submission to the SEC.

The 10-Q goes on to say:

Through the resolution of the unfolded protein response, or UPR, and by inhibiting translocation of the Bcl-2 Associated X-protein, or Bax, to the outer mitochondrial membrane, we have shown in multiple models that AMX0035 can keep neurons alive under a variety of different conditions and stresses, including in in vitro models of neurodegeneration, endoplasmic reticulum stress, mitochondrial dysfunction, oxidative stress and disease-specific models of a variety of other conditions, as well as in vivo models of Alzheimer’s Disease, or AD, and multiple sclerosis.

We are pursuing ALS as our first indication as it is a disease of rapid and profound neurodegeneration, and we are focused on the development and potential commercialization of AMX0035 for ALS globally.

ALS is most certainly an area of high unmet need, which the FDA has described as follows:

ALS is a rapidly progressive and fatal neurodegenerative disease that primarily affects motor neurons in the cerebral motor cortex, brainstem, and spinal cord, leading to loss of voluntary movement and the development of difficulty in swallowing, speaking, and breathing, ultimately leading to death of most patients within 3 to 5 years from the onset of symptoms.

ALS is a devastating disease with an incidence of two per 100,000 per year – and approximately 6,000 new cases per year in the U.S. There is no cure, and only two drugs approved by the FDA, summarized by the agency as follows:

Riluzole, which was shown to prolong survival by about three months and extend the time before ventilatory support is needed; and Edaravone, which demonstrated a 33% smaller functional decline over 24 weeks of treatment, compared to placebo, in patients who were within 2 years of ALS diagnosis.

The FDA concedes that “there is a continued need for new treatments for patients living with ALS,” and with AMX-0035 and its novel mechanism of action, disrupting the key pathways of cellular death using a combination of PB – a drug more commonly known as Buphenyl and used to treat urea cycle disorders – and TUDCA, a naturally-occurring bile acid that has been used for centuries in Asian medicine – Amylyx believes it can meet that need.

If that sounds a little far-fetched, Amylyx believes it has the data – from its 137-patient Phase 2 CENTAUR study – to prove its case. In this post I will break down the data, back story, approval in Canada, NDA submissions to the FDA and European Marketing Authority, and reasons why waiting for data from a planned Phase 3 pivotal trial before granting marketing authorisation may be the most sensible option, that I suspect the FDA and EMA will take.

That will likely disappoint investors, and drive the share price down, but it will equally give Amylyx the opportunity to double down on its thesis and even look to push on with trials in AD and MS – which would more than justify the delay.

The CENTAUR Study and Fast Track Discussions

In this study, the primary endpoint was rate of decline in total Amyotrophic Lateral Sclerosis Functional Rating Scale (ALSFRS-R) – a 5-minute questionnaire using an ordinal rating scale of 0-4, covering 12 functional activities relevant to ALS across four functional domains. ALSFRS-R is considered the gold standard for evaluating ALS therapies.

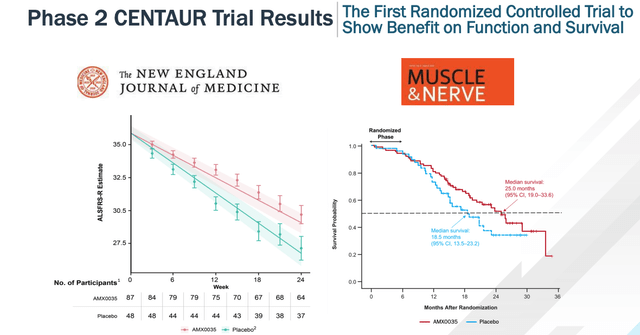

The headline results of this study, as shown below, reveal AMX-0035 had a statistically significant slowing of ALS disease progression as measured by the ALS Functional Rating Scale-Revised (ALSFRS-R) compared to placebo (p<0.05), whilst also achieving a higher median duration of survival of 25 months, compared to 18.5 months in the placebo arm. The results have since been published in the New England Journal of Medicine (“NEJM”).

Headline results from CENTAUR AMX-0035 in ALS study (Corporate Presentation)

Although the trial results were first announced in December 2019, and Amylyx went straight to the FDA with the data, hoping to obtain a Fast Track approval, given the scale of unmet needs in ALS, the FDA initially insisted that Amylyx conduct a further, Phase 3 placebo-controlled trial.

Amylyx has duly obliged, designing its Phoenix Global Phase 3 study designed “to provide additional safety and efficacy data on AMX0035 to further support our global regulatory efforts,” although in Q421, the FDA accepted Amylyx’s New Drug Application (“NDA”) application, promising a priority review, with a Prescription Drug User Fee Act (“PDUFA”) date scheduled for June 29 – when the FDA would rule on whether to approve the drug for commercial use.

It’s not unusual for the FDA to approve a drug based on Phase 2 data alone when the unmet need is high, requesting that the drug developer carry out post-marketing studies to ensure long-term efficacy and safety are established, but before making its decision, the agency arranged for AMX-0035 and its trial data to be reviewed by its Advisory Committee (“AdComm”).

AdComm Verdict

The AdComm was scheduled for late March, and briefing documents were released by the FDA on March 28, before the verdict was announced March 30, as follows:

On the question, “Do the data from the single randomized, controlled trial and the open-label extension study [Phase 2 CENTAUR trial] establish a conclusion that sodium phenylbutyrate/taurursodiol [AMX0035] is effective in the treatment of patients with amyotrophic lateral sclerosis (ALS)?,” the PCNSDAC voted 4 (yes) and 6 (no).

The negative verdict was perhaps not surprising in light of the briefing documents put forward by the FDA, which questioned several aspects of the Centaur trial, calling the statistical evidence – a treatment difference of 2.32 on the ALSFRS-R scale (p = 0.034) “not highly persuasive,” questioning the “linearity of ALSFRS-R over time assumption” used to prove statistical significance, highlighting missing data – 17% on placebo/18% on drug were alive but missing ALSFRS-R Total Score values at Week 24 – noting that patients were also using the approved therapies edaravone or riluzole during the trial, which could lead to biased results, and also pointing to a “randomisation implementation problem” which saw the first 18 patients in the trial assigned to the drug arm.

These and other criticisms – such as the study’s failure to meet any of its secondary endpoints, including Accurate Test of Limb Isometric Strength (“ATLIS”), Levels of plasma Neurofilament heavy chain (“pNF-H”), or Slow Vital Capacity (“SVC”), a key measurement of pulmonary capacity, likely counted against Amylyx and persuaded the AdComm not to back the drug.

In response, Amylyx said it “remained confident” in its data, was “motivated by the hundreds of people impacted by this devastating disease who shared their personal testimonies,” and concluded:

Our application is under review by the FDA, and we remain committed to pursuing its approval given the pressing need for new treatments for ALS.

Approval in Canada Sends Share Price Soaring

After the AdComm’s decision was announced, Amylyx stock fell from a value of $25 per share to <$7 by the end of May. The FDA’s discussion of the CENTAUR results was possibly more damning than expected, and in that context it doesn’t seem overly surprising that the agency announced at the beginning of June that it would be extending its review period of AMX-0035, moving the PDUFA date back to Sept. 29, saying it needed more time to review the data.

By this stage, the outlook did not look promising for Amylyx, with the likelihood being that the FDA – with no new data to review from the trial – would reach the same conclusion as its AdComm and reject the NDA for AMX-0035.

In a surprising move, however, this week Health Canada announced that it had decided to approve AMX0035, under its brand name ALBRIOZA, based on the CENTAUR data. The news sparked a revival in Amylyx’s share price, which is now up 97% across the past month, trading at a price of $16.7.

The approval is a conditional one, meaning Amylyx will need to supply data from its Phase 3 Phoenix trial, which will not read out data until 2024, but nevertheless, Amylyx says it will be ready to start rolling out ALBRIOZA in Canada in as little as six weeks.

According to Reuters, ~3,000 people in Canada have ALS, so if, as seems likely, Amylyx sets a list price of ~$170k, matching, e.g., Radicava, Mitsubishi Tanabe Pharma’s therapy that was only approved in oral form by the FDA last month, having been first approved in 2019 – there would be a ~$500m market in play in the country. In truth, ALBRIOZA’s sales may do very well to come in >$100m per annum factoring in market dynamics such as price and competition. Amylyx itself has yet to comment on its pricing strategy.

In addition to Canada, Amylyx has had a Marketing Authorization Application, (“MAA”) accepted in Europe – a 30k patient market, the company’s research suggests. An approval in Europe would certainly be another significant win for Amylyx, although there’s no guarantee that will happen, and even if it were to happen, pricing discrepancies between the US and Europe have created problems for breakthrough drugs in the past. bluebird bio (BLUE), for example, withdrew its approved gene therapy Zynteglo from the Europen market, calling the market “untenable”.

Looking Ahead – Tough To Look Beyond Necessity For A Further Pivotal Trial

In less than a decade, Amylyx has developed an ALS drug with a differentiated mechanism of action, inhibiting neuronal cell death, and guided it through a major Phase 2 trial, which met its primary endpoint – an achievement that the company and its co-founders can be justifiably proud of.

The approval in Canada is another major achievement, given the paucity of treatment options available to treat ALS, but in order to achieve its ultimate goal of securing approval in the US, Amylyx looks like it will have to conduct further trials.

There are some concerning echoes of the FDA’s disastrous approval of Biogen’s Alzheimer’s therapy Aduhelm in the latest developments in the Amylyx story, although it should be noted that, when approving Aduhelm, the FDA ignored an 11-0 vote against approval, and decided to let Biogen market and sell its drug.

The backlash against that decision was so strong that, even though the vote in relation to AMX-0035 was much closer, it seems doubtful if the FDA will ignore its own CNS AdComm once again, particularly since its own analysis of the CENTAUR trial appears to have been broadly negative.

The Aduhelm debacle also suggests that, even if the FDA were to approve ALBRIOZA, physicians may not be willing to prescribe the drug, and health insurers, and the Centers For Medicare and Medicaid (“CMS”), may not be willing to provide reimbursement for the drug, making it almost impossible to market and sell, as has proven to be the case with Aduhelm.

AMX-0035 does not present the same safety concerns as Aduhelm did, with regular brain scans part of the dosing regime for the latter. Although a reasonably high number of patient withdrawals were reported during the CENTAUR trial – 19% – serious adverse safety events were more frequent in the placebo arm of the trial than the treatment arm.

Additionally, AMX-0035 actually met its primary endpoint in its trial, unlike Aduhelm which failed a futility test midway through its Phase 3 trials. With that said, however, it seems concerning that none of the secondary endpoints were met, and in that context, arguably the sensible decision to take would be for the FDA to insist on seeing Phase 3 trial data before making an approval decision, as the agency initially wanted to do.

That will put some pressure on Amylyx’s finances – its co-founders have successfully raised large sums of money from ALS patient advocacy groups and raised nearly $200m via an IPO, but the company did report a net loss of $48m in Q122, and a cash position of $255m, and with a 600-patient Phase 3 trial to fund, it looks as though fresh funding will need to be sought sooner rather than later, which could be tricky if the share price falls again, for example on an FDA / EMA rejection.

Conclusion – Outlook More Bearish Than Bullish At This Time

Amylyx deserves much praise for developing AMX-0035 and bringing it close to approval in the US and getting over the line in Canada, but for my money, I think the likelihood is that the FDA will not approve the drug in September when the delayed PDUFA arrives.

While it’s true the FDA recently approved an oral form of edaravone, in Radicava, this drug has nearly 10 years’ worth of clinical studies behind it, having been approved as an intravenous drug two years before, and in its pivotal trial, proved 33% more effective than placebo, which appears to be superior to the AMX-0035 CENTAUR trial.

The FDA’s review of the CENTAUR data raised some important questions, and given that AMX-0035 is not a miracle drug, that will transform patients’ conditions overnight, investing time in a further clinical trial would seem to be a sensible option, given that it may help to allay the fears of physicians, insurers, and the public, helping the drug reach a wider patient population if the pivotal trial data does support approval.

It will likely be a close decision either way, and subject to some feverish speculation, but after witnessing the failure of Biogen’s Aduhelm, frankly, an early approval is worth nothing if physicians, scientists and patients do not fully support the drug and if its efficacy has not been established beyond reasonable doubt.

Be the first to comment