JimVallee/iStock via Getty Images

Investment Thesis

Despite our previous bullish analysis of Amazon (NASDAQ:AMZN) and the recent stock split, it is apparent that the market has its own ideas. The stock had lost easily 45% of its value since its 52-weeks high of $188.65, especially worsened by the 14% plunge post FQ1’22 earnings call on 28 April 2022. The Fed also decided to hike the benchmark interest rate to a range between 1.5% and 1.75% on 16 June 2022, potentially ending the year at 3.4%, and another hike to 3.8% in 2023, indicating the highest and fastest rate increase in the past 28 years.

As a result, consumer spending could be impacted in the near and intermediate-term, once the rising interest rates and goods prices impact their spending power. Consequently, we may expect harsher-than-expected temporary headwinds for AMZN in the next few quarters.

Inflation And Recession Are Coming For Amazon’s Hyper-Growth

Fed’s Interest Rate Hikes In 2022

The Balance

Despite the Fed’s continuous increase in interest rates in the past few months, it is apparent that consumer spending has continued to rise. Based on data from the Federal Reserve, more consumers are relying on debt and credit cards for bigger expenses, as revolving credit rose by 20% in April 2022 to $1.103T, while total household debt increased by 1.7% to a record high of $15.84T for Q1’22. The Federal Open Market Committee released a statement:

Overall economic activity appears to have picked up after edging down in the first quarter. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures. (CNBC)

In May 2022, the consumer price index also rose to a record high of 8.6% YoY, while core inflation excluding food and energy rose 6%. Rising fuel oil remains a massive problem as well, since it is up 106.7% YoY due to the ongoing Ukraine war. In addition, China’s Zero Covid Policy is not helping the surging inflation, since the global supply chain remains unbalanced and unpredictable. On the other hand, average hourly wages were down 3% YoY, thereby triggering drastic measures from the Feds to slow down growth and bring down prices.

However, these measures could kill the hyper-growth enjoyed by AMZN during the COVID-19 pandemic, given the potential reduction in consumer spending moving forward. The company had reported revenue growth at a CAGR of 29.41% in the past two years, which is expected to plunge to a CAGR of 14.16% by FY2023 based on mean consensus estimates, or worse at 11.3% assuming lower consensus estimates. The situation is also further worsened by AMZN’s lower profitability in FQ1’22, which had incurred $6B of incremental costs for its operational expenses, due to the multiple issues:

- $2B – Inflated transportation costs, China’s Zero Covid Policy, and the ongoing Ukraine war.

- $2B – Excess labor force post-Omicron variant wave.

- $2B – Overcapacity in its in-house fulfillment and transportation network.

As a result, it is finally apparent to us that the time of maximum pain is not here yet and that AMZN investors may, unfortunately, experience much volatility for the next few quarters.

AMZN’s Profitability Could Decline By -90% In FY2022

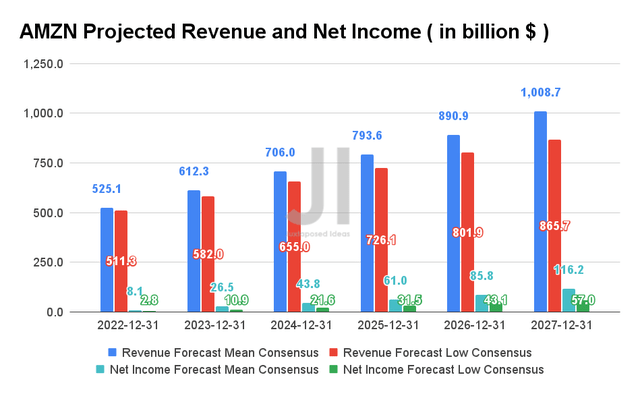

AMZN Projected Revenue and Net Income

Therefore, given the continued interest rate hikes, we could be looking at a drastic downwards re-rating of AMZN’s projected revenue and net income moving forward. In fact, since our previous analysis in May 2022, its mean revenue growth has been revised downwards by -4.1% and net income by -9.2%. In addition, if we were to refer to the consensus estimate’s lower range projection, it is evident that AMZN could very well deliver revenues of $511.3B and net income of $2.8B against the mean projection of $525.1B and $8.1B, respectively. It is rather alarming, given that the lower projection indicates a 91.6% decline in net income profitability from $33.36B in FY2021 to $2.8B in FY2022, despite the 8.8% YoY growth in revenue. Assuming that it really happens, we could not imagine the shocking plunge in AMZN’s stock price and consequently, the tsunami of stock selloff then.

Though no one could predict for sure if and when the recession could happen, it could be prudent for investors to refrain from making major changes to their portfolios now. There are currently too many risks, including the rising gas prices, the Fed’s forecast for higher unemployment, reduced consumer spending, and eventually reduced projection for online retailers’ revenue moving forward. Kathy Bostjancic, the chief U.S. economist at Oxford Economics, said:

At least in the second quarter, consumers really had their purses wide open. We think eventually that’s going to have limits. Right now we’re all feeling pent-up and just need to travel. But come next year, it’s a different story. (NY Times)

Nonetheless, analysts could have also priced in the effect of the eventual slowdown in 2023, therefore, making long-term sideways price action likely as well. Only time will tell, though, given the higher retail access post-stock split, the AMZN stock could also move drastically depending on the market sentiment.

In the meantime, we encourage you to read our previous article on AMZN, which could help you better understand its position and market opportunities.

- Amazon: Let The Sky Fall And Crumble – The Bottom Is Near

- PayPal Vs. Amazon’s Buy With Prime: Which Will Emerge As The Winner?

- Amazon Stock: Why Is It Splitting And What It Means For Retail Investors And Option Traders

So, Is AMZN Stock A Buy, Sell, or Hold?

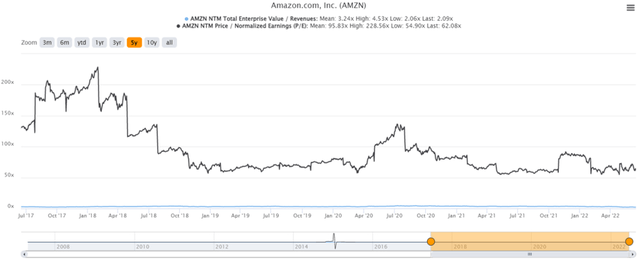

AMZN 5Y EV/Revenue and P/E Valuations

AMZN is currently trading at an EV/NTM Revenue of 2.09x and NTM P/E of 62.08x, lower than its 5Y mean of 3.24x and 95.83x, respectively. The stock has also remained mostly in line since our previous analysis, from $109.07 on 13 May 2022 to $103.64 on 16 June 2022, despite a brief rise to $125.51 pre-stock-split.

AMZN 5Y Stock Price

It is evident that the market is apprehensive about the Fed’s recent hike of the interest rates on 15 June 2022 and the resultant reduction in the US projected GDP gain from 2.8% to 1.7% for 2022. Combined with AMZN’s deceleration in retail sales from the hypergrowth during the COVID-19 pandemic, it appears that the stock is set for a double whammy correction soon. Major companies are already laying off staff in preparation for the event, with Tesla (TSLA) cutting 10% of its workforce due to a “super bad feeling” about the economy. Other giants such as Meta (META) and Netflix (NFLX) have also followed Amazon, on either their hiring freezes or staff cuts. In the event of a recession in H2’22 and FY2023, Amazon’s sales may miss consensus estimates as a result of reduced consumer spending.

Therefore, despite the consensus estimates’ strong buy rating on AMZN stock with a price target of $181.29, we are less optimistic now and expect a potential retracement in the next few quarters, starting from its next earnings calls in August 2022. Though the Federal Open Market Committee expects the situation to improve by the end of 2023, AMZN could suffer in the short term.

In the light of such uncertainties, we rate AMZN stock as a Hold for now.

Be the first to comment