serts/E+ via Getty Images

To many people, the word ‘technology’ might conjure up various consumer devices such as smartphones, gaming systems, computers, and more. But the fact of the matter is that the industrial markets have a significant demand for certain types of technology products as well. And one company that focuses on providing two types of these products is a firm called Acuity Brands (AYI). Financial performance for the company has been a bit lumpy in recent years. The overall trend for revenue growth has been more or less flat. Net profits have remained within a narrow range. But other profitability metrics like cash flow and EBITDA have generally trended higher. Overall, shares of the company do look to be priced at levels that would be considered either fairly valued or slightly beneath that. Given the company’s steady growth, the former is most likely.

A play on industrial technology

Acuity Brands describes itself as an industrial technology company. Today, it provides its services through two key segments that warrant investor attention. The first, and by far the largest, of these is the Acuity Brands Lighting and Lighting Controls, or what management calls the ABL segment. Through this segment, the company sells a portfolio of lighting solutions that include commercial, architectural, and specialty lighting. It also sells lighting controls and components that can be used to create certain lighting systems. Many of its technologies use LED and they address both indoor and outdoor applications. The company’s portfolio includes a wide variety of brand names. Some of these include Lithonia Lighting, Holophane, Peerless, and Gotham. During the company’s 2021 fiscal year, this particular segment accounted for about 94.5% of the company’s revenue and 98% of its profits.

The other segment owned by the company is the Intelligent Spaces Group, or ISG segment. Based on the data provided, this segment sells products and services such as building management systems and location-aware applications. Its building management systems include products that are used for controlling heating, ventilation, and air conditioning. This is in addition to providing the ability to control lighting, shades, and even building access for their customers. They also have an intelligent building platform called Atrius that, among other things, automates labor-intensive tasks and focuses on certain cost reduction initiatives. In all, this segment represented just 5.5% of the company’s 2021 revenue. And it was responsible for just 2% of profits.

Another thing worth noting is the geographical breakdown of the company’s operations. In 2021, the business generated 86.2% of its revenue from its domestic market. This nearly matched the 86.7% of profits that came from here at home. However, 55% of the finished goods that are manufactured and purchased by the company came from Mexico last year. That compares to 24% from the US, 16% from Asia, and 5% from other miscellaneous markets.

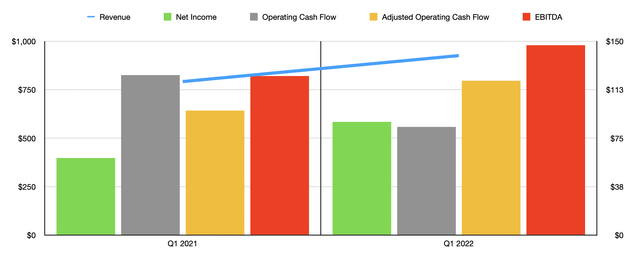

Over the past few years, management has succeeded in steadily growing the company’s revenue. Revenue has remained within a fairly narrow range of between $3.33 billion and $3.68 billion. In 2021, sales came in at $3.46 billion. Having said that, data covering the first three months of the company’s 2022 fiscal year does look encouraging. During that time, sales totaled $926.1 million. That represents a year-over-year increase of 16.9% compared to the $792 million generated in the first three months of 2021.

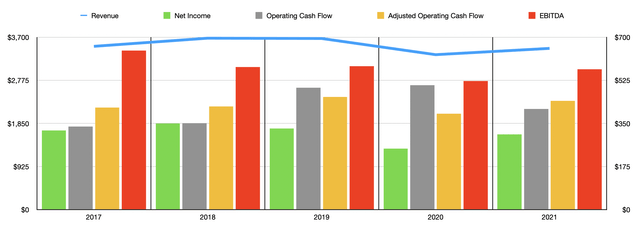

Just as has been the case with revenue, profits have been stuck in a fairly narrow range in recent years. Between 2017 and 2021, for instance, net income ranged from a low point of $248.3 million to a high point of $349.6 million. Last year, that figure came in at $306.3 million. That relationship does, however, break down some when we look at operating cash flow. Between 2017 and 2020, for instance, this metric grew from $336.6 million to $504.8 million. In 2021, it dropped to $408.7 million. But if we adjust for changes in working capital, then it would have risen from $413.7 million in 2017 to $458.1 million in 2019 before dropping to $390 million in 2020. Then, in 2021, it would have made a significant recovery to $442.1 million. A similar relationship can be seen when looking at EBITDA. After declining from $645.4 million in 2017 to $579 million in 2018, it increased to $582.2 million a year later before dropping to $522 million during the pandemic. Then, in 2021, it recovered most of that decrease, coming in at $569.5 million.

For the most part, financial performance for the company’s bottom line improved in the first three months of its 2022 fiscal year. Net profits increased, rising from $59.6 million to $87.6 million. Operating cash flow did decline, dropping from $123.9 million to $83.7 million. But if we adjust for changes in working capital, it would have risen from $96.3 million to $119.5 million. Meanwhile, EBITDA for the company increased from $123.1 million to $147 million.

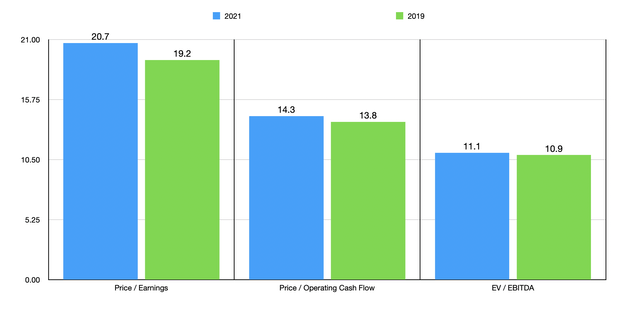

Taking the data from the company’s 2021 fiscal year and looking at the pre-pandemic year of 2019, we can effectively price the company. 2021 results give us a price to earnings multiple for the business of 20.7. That compares to the 19.2 that we get if we rely on 2019 figures. The price to adjusted operating cash flow multiple is 14.3, up from the 13.8 we get if we rely on 2019 data. And the EV to EBITDA multiple of 10.9 increases to 11.1 from 2019 to 2021. To put this all in perspective, I decided to compare the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 4.8 to a high of 30. Four of the five companies were cheaper than Acuity Brands. Using the price to operating cash flow approach, the range was from 6.2 to 20.7. Two of the five firms were cheaper than our prospect. And using the EV to EBITDA approach, the range was from 2.9 to 22.8. Once again, two of the five companies were cheaper than Acuity Brands.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Acuity Brands | 20.7 | 14.3 | 11.1 |

| Encore Wire Corporation (WIRE) | 4.8 | 6.2 | 2.9 |

| Emerson Electric (EMR) | 20.3 | 17.0 | 12.8 |

| Allied Motion Technologies (AMOT) | 18.2 | 17.3 | 13.6 |

| Regal Rexnord (RRX) | 30.0 | 20.7 | 22.8 |

| Atkore (ATKR) | 6.7 | 8.0 | 4.5 |

Takeaway

Based on the data provided, I can say that Acuity Brands is a solid company. But it’s not anything special. Shares are likely fairly valued more or less relative to other firms. And on an absolute basis, I would say that they generally look slightly underpriced. But when you consider that these low multiples come with a company that’s not really expanding at all that great a rate on the bottom line, and is not really expanding at all on the top line, I would say that if it is undervalued, it is only marginally so. More likely than not, I would say that the company is fairly priced at this time.

Be the first to comment