AllisonGinadaio/iStock Editorial via Getty Images

Objectively, 2022 has been an awful year for the stock market. All sectors are down by double digits YTD besides energy, which has risen by around 31%. After years of underperformance and contempt, energy stocks are now the market’s most resilient corner. Indeed, the underperformance in stocks is partly driven by the negative economic headwinds of skyrocketing energy prices. Thus, energy is the primary benefactor of today’s shifting economic environment.

The shortage of energy commodities is driven primarily by a continuing decline in global output following the 2020 shutdowns. On top of that, since most energy companies were struggling to make a profit from 2014 to 2020 (due to the shale-driven glut), most have held exploration and development spending at extreme lows for years. Even more, significant producers like Shell (SHEL) have stopped developing new energy assets due to ESG goals over recent years. It takes years to explore and develop new oil and gas projects. Even though energy prices are now much higher, most producers have no quick capability to dramatically increase production since they did not expect an energy bull market.

In my view, this factor will likely keep global energy prices high for years and may cause oil to rise to new all-time highs. Evidence suggests we may see some reprieve in the gasoline market due to demand destruction, and U.S. domestic natural gas prices may decline soon as LNG growth slows. Major energy stocks, such as those in the popular ETF (XLE), are a potential long-term investment. Still, I remain skeptical due to their elevated valuations and the potential for windfall profit taxes. Still, if we look closely at the energy market, some firms appear to be undervalued with strong long-term potential.

The Best Energy Bets Are In Neutral Countries

One energy company that stands out is Brazil’s Petrobras (NYSE:PBR). Petrobras is, by far, the largest oil and gas company in Brazil, effectively operating as a state-owned energy monopoly. The company operates the entire energy supply chain from upstream production to refining and distribution. Petrobras is also exporting around a quarter of its total oil products, being a significant supplier of energy to China.

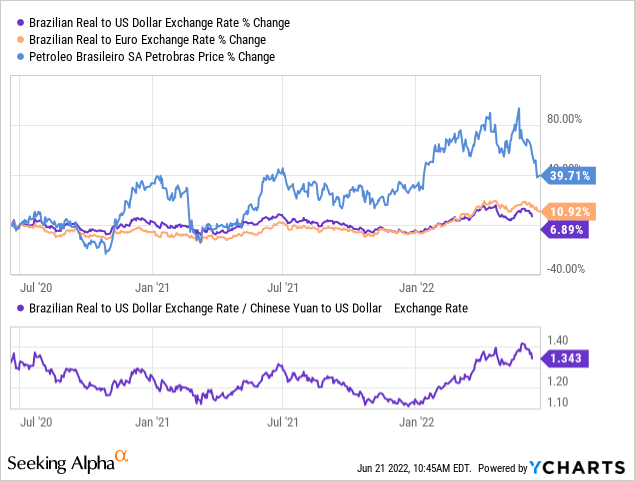

In my view, this is significant as Brazil, unlike most countries, tends to avoid developing strong geopolitical ties, being on relatively good terms with China, the U.S., Europe, and Russia. In a world increasingly caught up in geopolitical alliances and conflicts, I believe the few large remaining neutral countries will reap immense economic rewards. Most notably, when it comes to currency stability. Significantly, the U.S. price of Petrobras’s ADR PBR is closely correlated to the Brazilian Real’s exchange rate to the U.S. dollar and the Euro and Chinese Yuan. See below:

The ebbs and flows in PBR tend to track Brazil’s exchange rate. This factor partly stems from PBR’s listing price in U.S. dollars and will directly fluctuate with Brazil’s exchange rate. Even more, Petrobras’ export potential also rises and falls with Brazil’s currency. The Brazilian Real has gained in recent months despite the sharp rise in the U.S. dollar against most currencies. To me, that is a firm indication that Brazil’s relative neutrality mixed with its strong export capacity is strengthening its currency. Brazil does have a poor history with inflation-driven devaluation, but that era may be ending as today most developed countries have nearly identical inflation rates; the only difference is Brazil has a much stronger 13.25% base interest rate.

Since the 2000s, energy and emerging markets have generally been weak investments. However, as the economic tides shift, many underperforming bets are winning while outperformers (U.S. technology) are failing. Petrobras offers exposure to both the rebound in energy and developing markets and may see compounded gains if oil and the Brazilian Real continue to rise together. In this respect, PBR is not only a bet on energy, a strong inflation hedge itself, but also a hedge against geopolitical tension.

Petrobras’ Political Risks Similar To U.S. Peers

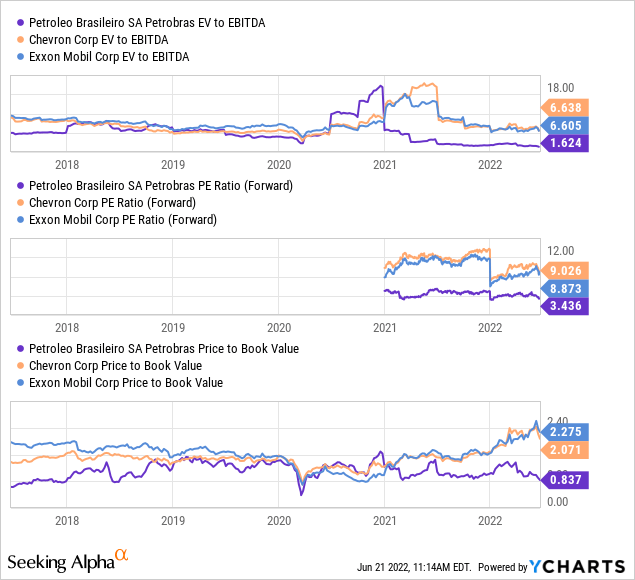

Petrobras trades at a significantly lower valuation than U.S. peers, with a forward “P/E” ratio of only 3.4X (3.15X TTM) and a substantial yield of 7.8%. The company also has significantly stronger margins than most U.S. producers due to its geographical advantage. See its comparative valuation data below:

Petrobras currently trades at a valuation around 60-75% below that of U.S. energy peers, depending on the statistic used. This factor is seen in the above data and others, including “price to cash flow,” TTM “P/E,” and more. Petrobras ranks first for a combined valuation, growth, and profitability metric for all integrated oil and gas stocks on Seeking Alpha. The company also has one of the highest dividend yields and profit margins 2-3X greater than its peers due to its abnormally low production costs.

By any objective measure, Petrobras is extremely undervalued compared to other energy companies. The undervaluation partly stems from it being a Brazilian company which, though I believe to be a major bullish factor, has been a contributor to underperformance in recent years due to the country’s inflation and domestic political issues. Again, today, it appears the U.S. and most other “developed” countries have equally significant, if not worse, inflation, economic, and domestic political issues.

Still, over half of the company is owned by the Brazilian government, creating issues wherein Brazil’s president Bolsonaro has asked the company to keep prices low. While many see the potential for government intervention as threatening, we must remember that Biden’s government has done the same and has proposed a 50% extra tax on recent oil earnings gains. Thus, the political risks facing U.S. energy producers and Brazil’s are roughly identical.

Petrobras’ CEO resigned recently following backlash due to the company’s fuel price increase. PBR has declined by around 25% over the past month due to the associated drama. Brazil’s current leader has taken action to investigate Petrobras to determine the efficacy of its pricing policy. Brazil also has an election this fall, and it appears that, similar to the trend in most Latin American countries, Brazil is likely to elect a left-wing leader – likely former President Luiz Lula. Lula aims to change Petrobras’ fuel pricing policy in a manner that would likely limit Petrobras’ earnings growth.

Of course, with oil inventories falling around the world, such direct price caps may be unworkable as demand must eventually fall if output fails to rise. Even more, the situation in Brazil is not entirely different than that of the U.S., both having leading political parties losing support due to high gasoline prices, encouraging them to try to intervene to lower consumer costs. In my view, the potential earnings impact of the U.S. leadership’s windfall tax ideas (or related) is likely similar to that of Brazil’s. At least in Brazil, we know where the government stands more clearly. Even more, Petrobras is more than sufficiently discounted as its valuation would still be low even if its earnings were cut in half.

The Bottom Line

Petrobras has exposure to the entire energy market and is likely to see strong earnings for years. I expect oil prices to remain elevated indefinitely due to chronic underinvestment and ESG-focused divestment across the global energy market. As such, even if Brazil’s government attempts to limit Petrobras’ gains, the stock’s extreme valuation discount would make up for it. Even more, Brazil’s government earns a fair amount of revenue from Petrobras’ dividends, so I doubt its legislators would impair the company to the same extent many U.S. legislators wish to impair U.S. oil companies.

Aside from PBR’s strong earnings and positioning, the stock is a solid hedge against growing volatility in most developed-market currencies. The Japanese Yen and the Euro are crashing at rapid rates. For now, the U.S. dollar has held up, but personally, I would much rather own the Brazilian Real with its 13% yield than the U.S. dollar with its 1.5% yield, given Brazil’s inflation is no worse than in most developed countries today. Even more, Brazil is on decent terms with both “Western” and “Eastern” countries, making companies like Petrobras potentially universal exporters to countries locked up in trade (and live) conflicts.

Overall, I am very bullish on Petrobras’ stock as a long-term investment. Oil has been volatile recently, potentially driving PBR lower in the short run. The ongoing spat between Petrobras and Brazil’s leadership may also create volatility for the stock. That said, I believe any further declines in PBR will make for solid discount buying opportunities.

Be the first to comment