monkeybusinessimages/iStock via Getty Images

Clipper Realty (NYSE:CLPR) is a small-cap REIT trading at a $351 million market cap. It trades at a forward FFO (funds from operations) of 21x, yields 4.58%, and focuses on New York multi-family homes. Updating my views on Clipper for this article, I came across a recent Politico article commenting on U.S. real estate trends since the pandemic (emphasis mine):

As the Covid-19 pandemic hit New York City in the spring of 2020, a subsequent exodus of residents ushered in a seemingly new era for the city’s ever-turbulent rental housing market.

Landlords offered months of free rent in some of the priciest neighborhoods, amid grim predictions of long-term damage to the city.

It did not last.

-Politico

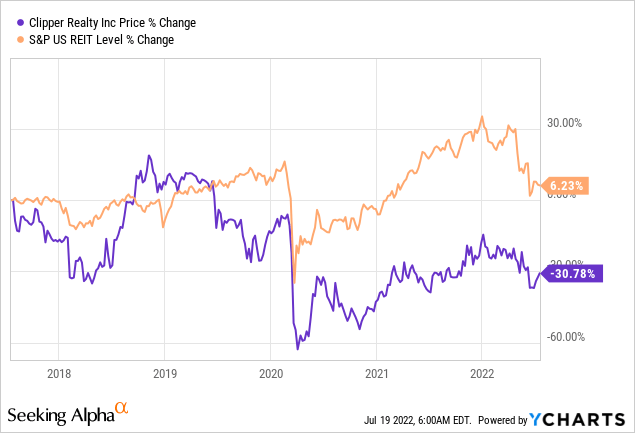

New York residential suffered during COVID, but there’s been a tremendous resurgence. That resurgence occurred nationwide, as an index like the S&P US REIT shows. Clipper Realty has been lagging in this recovery.

Two narratives have been hurting NY residential:

- Everyone would be moving away from the city because of “work from home” trends and COVID.

- New York City taxes are uncompetitive with other places in the U.S.

I’m convinced major cities that have existed for some time (I admit New York city isn’t exactly the oldest city on earth) are incredibly resilient places. Perhaps the most striking examples of urban resiliency are Hiroshima and Nagasaki. Two Japanese cities were deliberately made to be an example of the destructiveness of the atomic bomb in 1945. This was done with the hope of swiftly ending World War II. Today, these cities are thriving which is remarkable to me.

New York residential has also been recovering, but curiously, Clipper Realty’s share price has not recovered towards its pre-2020 level. I’ll get to what I view as the biggest risk here later, but first, I’ll go over the business and valuation.

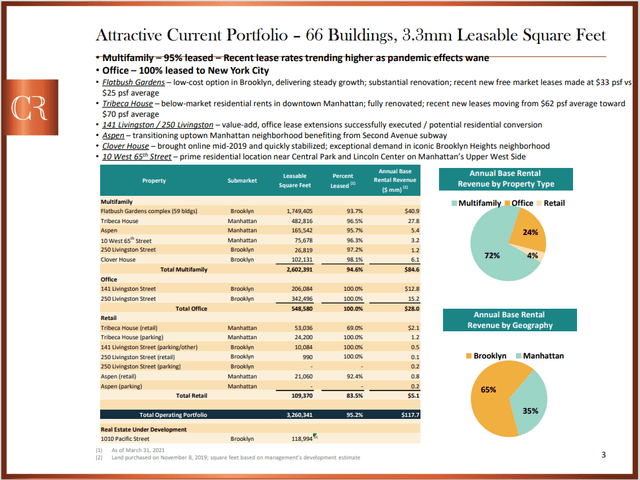

The company owns 66 buildings and 3.3mm leasable square feet. It is adding another 119,000 sq. ft. Flatbush Gardens (Brooklyn) and Tribeca House (Manhattan) are its most important properties. Its two office properties on Livingston Street, taken together, generate about as much revenue as Tribeca House. Other properties represent much smaller slices of the overall pie.

Clipper Realty Portfolio (Clipper Realty)

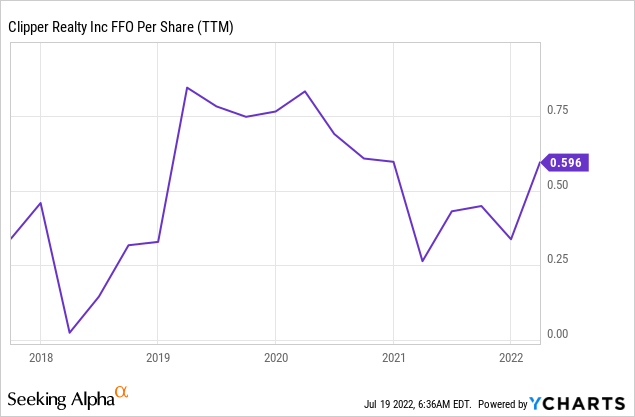

Funds from operation per share are still down from the highs pre-2020.

However, on the recent earnings call, it was pointed out that rents are rising rapidly to recover from the 2020’s reductions (emphasis mine):

We are experiencing strong rental demand at our Tribeca House property. Year-on-year lease occupancy has increased to 99% — from 89% in December last year with an average occupancy of 98% over the 12 months. As occupancy increased last year, we achieved higher rent per square foot levels, which now have reached in excess of $83 in April ‘22, a 35% increase over prior rents on the same units. As a result, average rent per square foot of the whole property have increased to nearly $65 in March, $66 per square foot last week. We expect rent per square foot to continue to grow steadily higher as our one and two-year leases turnover.

Revenue at Flatbush Gardens Complex in Brooklyn held up well in the first quarter increased from the fourth quarter based on new leases. Throughout the pandemic, property maintained leased occupancy between 92% and 93%, which we increased to 95% leased at the end of March and hope to go higher. Throughout we have maintained steady rent per square foot at $25 per square foot and near-record level and began trending up again in the first quarter based on new leases generally in excess of $30 per foot.

It looks very realistic to me that CLPR will surpass pre-2020 AFFO per share (above $0.70 per share) for these reasons:

- Rents dropped a lot in 2020 but have been recovering with rent renewals as 1-year and 2-year contracts roll off.

- Before the end of 2022, the development at 1010 Pacific Street is likely completed. This could be contributing to AFFO by 2023.

- The New York City Rent Guidelines Board just approved rent increases on rent-controlled apartments (applies to Flatbush and some selected parts of the portfolio).

- Short-term rent outlook is strong (will get into more detail later).

- Inflation looks to remain well above the 2% Fed target for a while.

- Management smartly bought back 1.5 million shares early ’21.

- Debt is almost entirely fixed (3.76%) and has an average duration of 7.4 years.

I pulled up the REITs Seeking Alpha suggested as peers for Clipper Realty to get an idea of REIT valuations. I’ve compared this set on a forward P/FFO basis. Price to FFO is a highly relevant REIT metric that Seeking Alpha makes available. Note that the comparison is on forward numbers.

However, I’d argue the Clipper P/FFO number is merely extrapolating the run-rate quarterly number to the future. It implies $0.40 in FFO per annum, which I believe understates the likely FFO improvements over the next few years by quite a large margin (think $0.70+).

Here’s the data on Clipper:

CLPR FFO data (Seeking Alpha)

BRT Apartments (BRT) is a company focused on the Southeastern U.S. and Texas. 18.7x FFO and 4.12% yield.

BRT FFO stats (Seeking Alpha)

UMH Properties (UMH) has been described as “rust-belt mobile homes with some baggage” by a fellow contributor. Trades at 21.5x FFO anyway. Yields 4.04%.

UMH FFO stats (SeekingAlpha.com)

Centerspace (CSR) is focused on multi-family in Minneapolis and trades at 18x and 3.63% dividend yield.

CSR FFO stats (SeekingAlpha.com)

The NexPoint Residential Trust (NXRT) focuses on Sunbelt apartments and trades at FFO multiple of 19.66x and yields 2.5%.

NXTR FFO stats (SeekingAlpha.com)

REITs tend to pay out a large part of their earnings, which qualifies them as a REIT. That makes dividend yield a slightly more interesting statistic than it otherwise would be.

I’m not intimately familiar with these various small-cap REITs, but Clipper jumps out at me from this set for three reasons:

- New York is an area (Manhattan is literally an Island) where it is very hard to bring on new supply. Safer real estate (less susceptible in most downturns should trade at a substantial higher FFO-multiple.

- Clipper has very solid FFO growth ahead of it as rents are increased back up etc.

- The yield is one of the highest while it is developing one property and actually investing a bunch in a few others.

I was put on to this idea a few months ago, through a Value Investors Club write-up and a YetAnotherValuePodcast episode. The latter featured NY real estate expert Bill Chen as a guest.

I wanted to highlight a quote from the aforementioned VIC article that gives a taste of what valuations look like if you’d take an approach based on a square foot level valuation (emphasis mine):

As a portfolio, Clipper Realty trades at roughly $420 per square foot and investors get the air rights of Flatbush Garden and West 65th Street and 1010 Pacific Ave construction in progress for free. Let that sink in for a minute. The minimum cost to build new supply is $500/sqft for the affordable units plus the time value of money and the developer’s profit. Clipper Realty owns some buildings where replacement cost is as high as $1,500 per square foot. Investors get to buy the portfolio at $420 per square foot today for something that cost $500 to $1,500 to recreate. More importantly, the equity is about $108 per square foot with the mortgages accounting for about $314 per square. Thus, there is significantly upside to the equity.

Risk

So why is this thing trading relatively cheap? The two things I can come up with besides investors neglecting a small cap REIT after a COVID resurgence is Fed policy and the debt load. Perhaps a combination of the two.

The Fed is aggressively raising rates. This is probably not a surprise to anyone. I expect this will continue (read more here). To be frank, I’m not dying to add real estate to my portfolio, given the Fed backdrop, either.

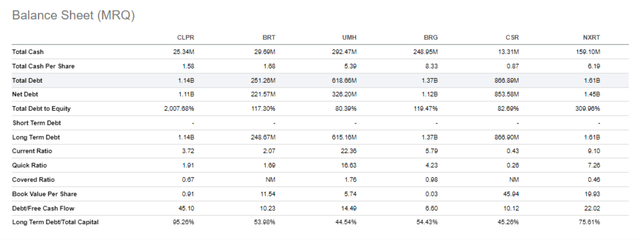

All these interest rate hikes are especially bad if you have a lot of debt on the books and you suddenly need to refinance it. Looking at the peers selected by Seeking Alpha, you’ll notice CLPR really jumps out at you as it has a lot more debt compared to peers.

CLPR debt (Seeking Alpha)

The debt is non-recourse to CLPR and, for the most part, only collateralized by individual buildings. What makes me a lot more comfortable is the debt being almost entirely fixed rate and with quite a bit of duration. In my view, the company is undervalued. Therefore, it makes sense it doesn’t score well on a debt-to-market cap basis. Part of this problem would cure itself if the company started trading at a higher (IMHO more appropriate) valuation.

I do think the Fed will remain aggressive as long as inflation is high. But as long as inflation is high, CLPR should be able to push through rent increases. A significant fixed debt load doesn’t necessarily work out too badly. What would start to hurt CLPR is if the 10-year yield continues to rise dramatically. Secondary it would hurt if the market starts to price in yields remaining elevated for an extended period of time.

Currently, the market is giving the Fed some credit it will succeed in getting inflation back down (albeit risking a recession). If the company will have to refinance at much higher interest rates, that would press FFO back down. There could be scenarios where rent increases can’t keep pace with interest rate increases (even after a lag), and these are environments in REITs that won’t do well. This company won’t be an exception.

The debt is non-recourse to CLPR and, for the most part, only collateralized by individual buildings. What makes me a lot more comfortable is the debt being almost entirely fixed rate and with quite a bit of duration. In my view, the company is undervalued. Therefore, it makes sense it doesn’t score well on a debt-to-market cap basis. Part of this problem would cure itself if the company started trading at a higher (in my humble opinion, more appropriate) valuation.

I do think the Fed will remain aggressive as long as inflation is high. But as long as inflation is high, CLPR should be able to push through rent increases. A significant fixed debt load doesn’t necessarily work out too badly. What would start to hurt CLPR is if the 10-year yield continues to rise dramatically. Secondly, it would hurt if the market starts to price in yields remaining elevated for an extended period of time.

Currently, the market is giving the Fed some credit it will succeed in getting inflation back down (albeit risking a recession). If the company will have to refinance at much higher interest rates, that would press FFO back down. There could be scenarios where rent increases can’t keep pace with interest rate increases (even after a lag), and these are environments in REITs that won’t do well. This company won’t be an exception.

Real estate outlook

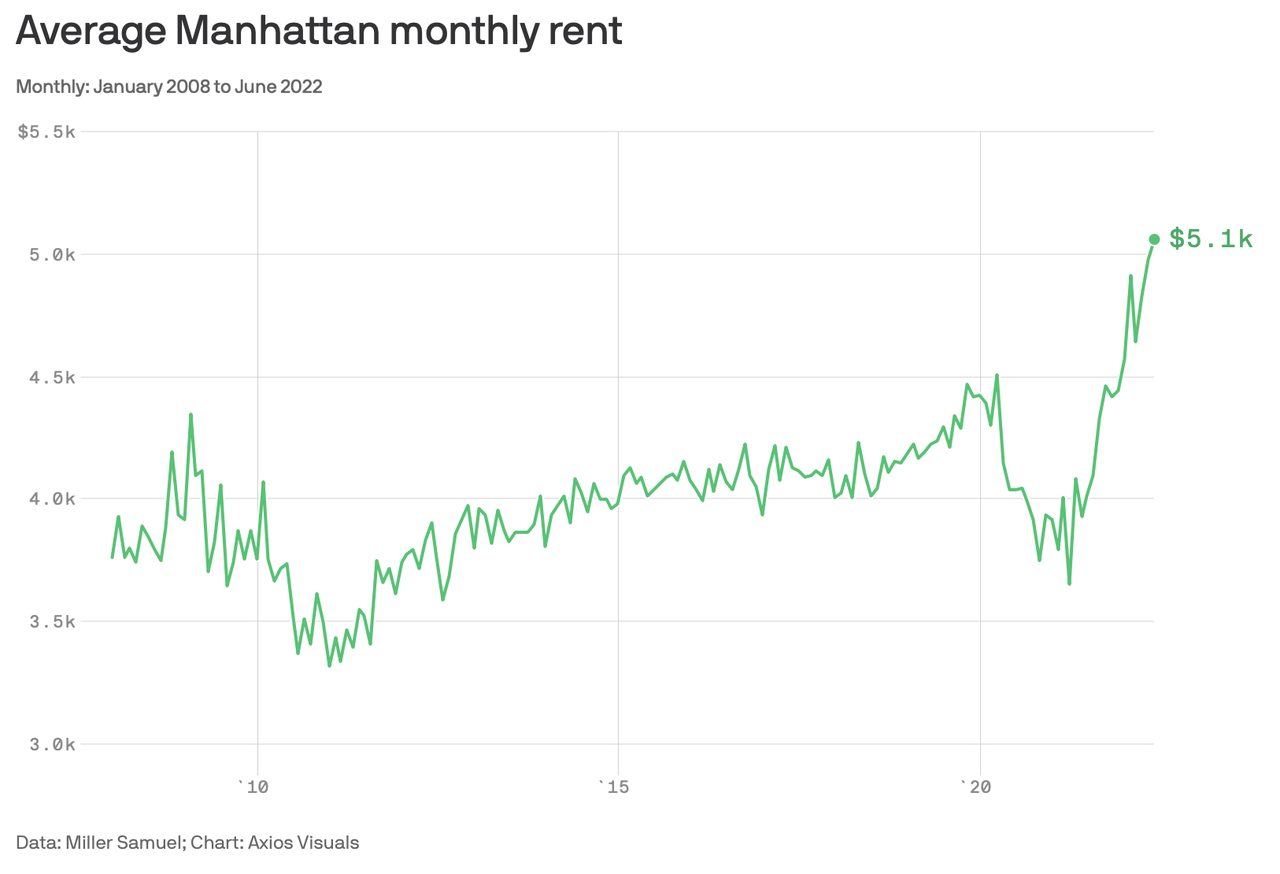

Currently, the NY real estate rental market rates remain really hot despite (or due to) mortgage rates increasing sharply. I found this perspective by Jonathan Miller superbly informative. It includes a lot of sub-segment data points and lots of graphs for the more visually minded. Average rents for Manhattan apartments hit a record $5,000. Vacancy rates are still under 2%. Landlord concessions fell to a new low. Non-doorman net effective median rent hit record highs for the third straight month. The luxury segment appears especially hot. But Jonathan Miller expects the overall market will stay hot (emphasis mine):

Because mortgage underwriting hasn’t normalized, remaining tighter than normal since the great financial crisis, would-be home buyers priced out of the market are being pushed into the already tight rental market, making it even tighter. On top of that, New York City leasing season doesn’t peak until August, so we anticipate more demand in the coming months, pushing rents up further.

I’ll include one of the many excellent graphs from the Miller-Samuel note:

Manhattan rent increases (Miller Samuel)

Conclusion

Overall, Clipper Realty seems a decent addition to my portfolio as a long-term (think three years+) hold. I believe FFO has solid growth ahead in the next few years. The near-term outlook for real estate rents remains strong for now.

In addition, Clipper Realty seems to be valued at a modest premium to other small-cap REITs while owning significantly safer assets due to their location.

The debt load is high when merely eyeballing current statistics. If you take into account AFFO growth and/or the fact the company should trade at a bit higher valuation, the debt load isn’t quite as concerning. Until the company is re-rated by the market, I’m picking up a 4%+ yield that seems easily sustained.

Be the first to comment