ismagilov

I’m sure you’ve heard the saying “History doesn’t repeat itself, but it does rhyme.” It’s often credited to Mark Twain (1835-1910), but there’s simply no evidence that he ever said it.

Kudos to whoever did say it first, though. It’s a very wise word, which is why I wanted to start this article out with it…

Because I’m beginning to see some interesting trends in the real estate investment trust (‘REIT’) sector.

In fact, what I saw in 2009, 2013, and now in 2022 is extremely interesting.

These recurring short cycles aren’t quite exact. But they are highly correlated. And when you consider them more closely, they may help you become a more intelligent REIT investor.

About Short Selling REITs (or Anything Else)

Don’t you find it interesting that some of the wealthiest REIT investors – in other words, hedge funds – claim to have a vast knowledge and understanding about their complex strategies…

Yet their overall performance is oftentimes poor?

We know that hedge funds by nature are opportunistic. They’re designed to pool people’s money to invest in a diverse range of assets.

They’re also lightly regulated and not sold to retail investors. Plus, they typically buy riskier positions and often even employ short selling and leveraging.

All understood. Yet I remain baffled as to why so many hedge fund managers attempt to short REITs.

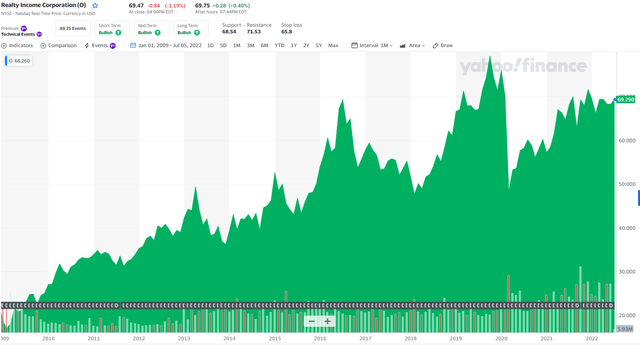

For example, in 2009 Pershing Square – led by Bill Ackman – waged a battle against Realty Income (O). His thesis was that the “monthly dividend company” had poor credit quality.

True story.

Ackman argued that Realty Income was suffering from mispriced risk since it was paying about a 7.5% dividend while private market cap-rate values were closer to 10.5%… making for a 40% premium.

He believed Realty Income’s fundamentals couldn’t support its dividend and that a cut was imminent.

But boy, was he wrong!

(Yahoo Finance)

Think about it like this: a short sale is basically the opposite of a regular buy transaction. Yet the mechanics behind it result in extremely volatile risks.

It’s somewhat like the law of gravity. Except that the law of investing is inflation, which means that betting against the upward momentum is inherently risky.

And when you bet against momentum and keep a short position for a long period of time… your odds get worse.

More About Short Selling REITs (or Anything Else)

Also, when you short sell, you don’t enjoy the same infinite returns long buyers do. A short sale loses when the stock price rises, whereas a stock isn’t theoretically limited in how high it can go.

In other words, you can lose more than you initially invest when you short sell. But the best you can earn is a 100% gain if the stock loses its entire value.

Finally – and most concerningly – risk is leverage or margin trading.

When short selling, you open a margin account. That allows you to borrow money from the brokerage firm using your investment as security.

And just as when you go long on margin, it’s easy for losses to get out of hand since you must meet the minimum maintenance requirement of 25%.

If your account slips below this, you’ll be subject to a margin call. And then you’ll be forced to either put in more cash or liquidate your position.

For all of these reasons, I’m not willing to risk hard-earned capital to short a REIT.

Plain and simple, it’s just way too risky. I believe that by patiently taking advantage of the margin of safety, my portfolio will hold more winners than losers.

Clearly though, some people disagree with my assessment. Because short sellers haven’t stopped betting against REITs.

Not that I completely object. After all, when that feeding frenzy becomes a catalyst, the “squeeze” ensues. As more and more of them buy shares to cover their positions, share prices skyrocket.

And real shareholders make more money.

For Example in 2013…

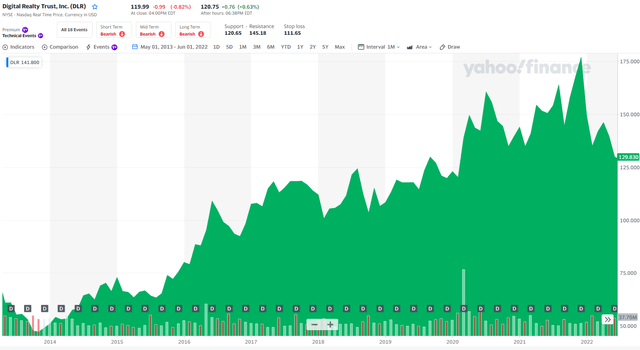

In May 2013, Highfields Capital decided to short shares of Digital Realty (DLR). Once again, the idea basically was that shares were too expensive and should be trading for around $20.00 each.

Last week, at the 18th Ira Sohn Investment Conference, CEO Jonathon Jacobson stated that “pricing is going lower, competition is increasing, and [Digital Realty] is tapping into capital markets as aggressively as” it can.

At the time, Digital was trading at $65.50 with a total capitalization of around $14 billion.

(Yahoo Finance)

As the time, Highfields claimed that Digital’s fundamentals were deteriorating. Moreover, it alleged, the REIT was a commodity business with no barriers to entry.

Simply put, Highfields was speculating that the stock would fall – without any true catalyst supporting the short other than the attempt to manipulate prices for personal gain.

Over the years, I’ve continued accumulating shares in Digital Realty with great results. So I’m not concerned now in 2022 where another fancy-dancy short seller is knocking on its front door.

Another Misinformed Short

As I explained to iREIT on Alpha members earlier this month:

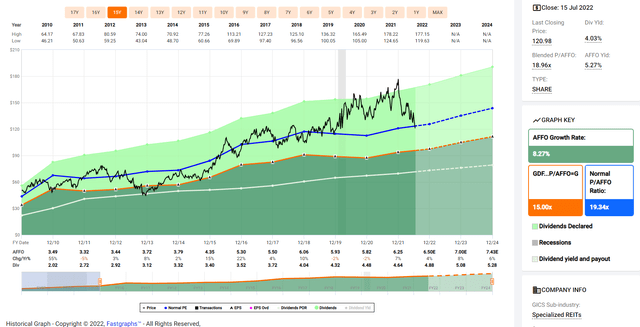

“Another uninformed investor is trying to short REITs… this time, it’s Jim Chanos, president and founder of Kynikos Associates, a New York City registered investment advisor focused on short selling. His thesis is… that the hyperscales are becoming competitors of the operators – like Digital Realty (DLR) and Equinix (EQIX).”

He thinks “hyperscales” are going to start relying on themselves instead of outside sources. That’s hardly a new idea.

But it’s as bad now as it was before.

In Q1-22, Digital Realty had record leasing. Again. Its bookings were up 43% year-over-year to $166 million, including $10.9 million of interconnection.

Sixty-seven percent of that was in the Americas, with 80.8% of the region’s development pipeline pre-leased. In fact, as I wrote:

“Leasing could not be any better for this blue-chip REIT, and hyperscales have increased the pace and size of leases in recent quarters. As such, the leasing strength is pushing down vacancy rates and improving the pricing backdrop.”

Chanos tweeted that data center operators are trading at 70x-90x price-to-earnings… but nobody who’s informed uses P/E for REITs.

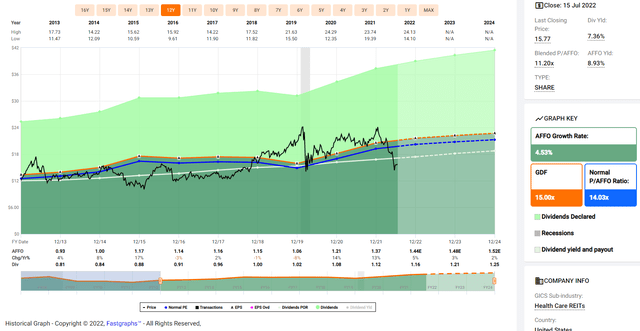

They use something like adjusted funds from operations (P/AFFO), which shows both DLR and EQIX trading attractively.:

- DLR: 18.9x

- EQIX: 21.1x

- Iron Mountain🙁IRM): 13.6x.

The first two are below their one-, three-, and five-year averages.

Incidentally, Chanos is also betting against Blackstone (BX) and KKR (KKR) – private equity firms that have been gobbling up data centers such as QTS Realty, CyrusOne, and Switch (DBRG). And let’s also not forget American Tower‘s (AMT) acquisition of CoreSite.

We continue to add to our data-center REIT holdings for their defensive and secular growth characteristics. Personally, I’m happy to square up against Chanos…

Which means I’m buying more on the drop.

(FAST Graphs)

Don’t Drink the Muddy Water

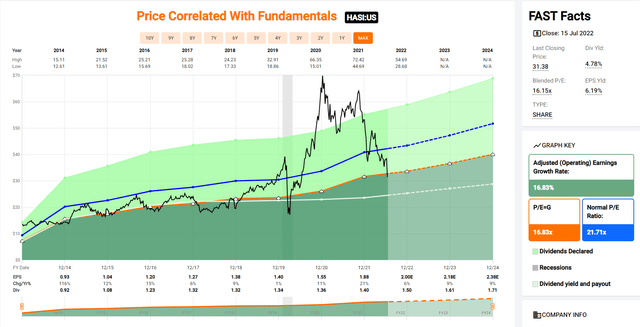

Last week, Austin-based Muddy Waters released a 27-page short thesis targeted at Hannon Armstrong (HASI).

Similar to Digital Realty, Hannon was already getting cheap as a result of the broader inflation-inspired REIT pullback. And then Muddy Waters focused on cash flow projections, triggering a 20% selloff.

As I explained to iREIT members, though, “The short sellers focused on three items related to Hannon Armstrong’s cash flow projections:

- “Non-cash HLBV, which is the equity method of accounting under hypothetical liquidation at book value to determine investee share of earnings and losses common to many renewable energy projects,

- “Non-cash gains on securitization, which is the pooling or reorganizing of financial instruments that may alter their market value…

- “Paid-in-kind (‘PIK’) interest they believe is either worthless or worth less than Hannon Armstrong is stating.”

Muddy Waters claims that various accounting methods and decisions are unethical and/or misleading, but not illegal. An example would be including non-cash income into a non-GAAP measure like funds from operations (FFO) in a way that investors wouldn’t anticipate.

If disclosed properly, it wouldn’t likely break any law.

Naturally, I have to reserve my detailed analysis of the situation for iREIT members. But I’ll tell you that I took advantage of the situation by adding exposure last week.

Shares were up over 4% on Monday, July 18.

(FAST Graphs)

The Death of Hospitals? Not So Fast…

A few days ago, I wrote on Medical Properties Trust (MPW), explaining that the pure-play hospital REIT:

“… has been accused of issuing several loans to Steward Healthcare and overpaying for lease-backed properties in order to help pay off its Cerberus Capital Management loans.”

Additionally:

“As for us, we believe there’s no proof of anything criminal here. We see nothing in the current documentation to suggest otherwise or, at worst, that overpaying was a widespread practice.

“There are, after all, many misconceptions made by so-called investigative journalists regarding REITs.

“Consider the accusation – also against MPW – of making risky mergers and acquisitions with unstable tenants because executive compensation was linked to M&A volume.”

What the complaint missed is that MPW owns mission critical hospitals – typically to the tune of around $100 million – and these properties are centered around the town. Most often, hospital are its area’s largest employer, with value created alongside adjoining:

- Medical office buildings (MOBs)

- Surgery centers

- Residential communities

- Retail.

Do hospitals fail? Occasionally, yes. But the odds of a hospital chain like Steward going under is slim, no matter what is being said.

That’s the shorth thesis in a nutshell: that the “big boogey man is the Steward exposure.”

For my part, I’ll take the other side of that bet all day long.

Besides, MPW’s leases ensure immediate control of properties in the rare event of parent-level distress. In 2021, property-level earnings before interest, depreciation, amortization, rent, and management fees (EBITDARM) rent coverage was 2.8x… demonstrating the properties are profitable.

In other words, if the facilities are covered in a bankruptcy scenario, it would be guaranteed the rent would be paid.

Knowing that and how these are mission critical assets, we’ll continue to ignore Mr. Market. Rest assured, we’re not losing any sleep whatsoever.

(FAST Graphs)

A Default in the Cannabis Sector

We knew it would eventually happen.

Last week, cannabis REIT Innovative Industrial Properties (IIPR) filed an 8-K stating that one of its operators – Kings Garden Inc. – had defaulted on six properties it owns. The filing expressed:

“On July 13, 2022, tenant defaulted on its obligations to pay base rent and property management fees for the month of July under each of the leases, and defaulted on its obligations to reimburse landlord for certain insurance premiums at the properties incurred by landlord that are payable by tenant as operating expenses under the leases.

“Tenant’s monetary default under all of the leases was approximately $2.2 million in the aggregate, consisting of approximately $1.8 million of base rent and property management fees for the month of July and approximately $382,000 of insurance premiums, but excluding applicable late charges and default interest.”

The company went on to explain that it’s “continuing discussions with tenant regarding the leases and has commenced discussions with other operators regarding potential re-leasing of certain of such properties.”

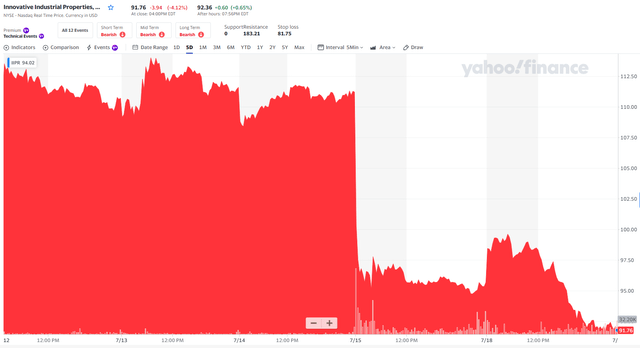

(Yahoo Finance)

The above image shows the five-day chart. The image below shows YTD:

(Yahoo Finance)

So the question on everyone’s mind is, “will IIPR ever get back to $200?” In which case, here’s what I will tell you…

Innovative Industrial Properties Continued

IIPR’s properties are valuable. Make no mistake of it. I’ve visited a few of them and can see the upfit costs related to drywall, HVAC, electrical, plumbing, security, etc.

It’s really a matter then of whether or not IIPR has pricing power… or its tenant does.

I guess we’re going to find out, sooner or later.

All eyes are on IIPR’s management team to see how quickly it can get rents cranking again. That and whether or not the rent will be the same, more, or less…

One thing is certain, though. Inflation has driven up the cost of construction. So, for an operator to start from scratch in this environment? It will cost significantly more to improve the space and obtain a license.

Last week, I interviewed the management team at Chicago Atlantic (REFI). That new cannabis mortgage REIT (mREIT) is now yielding a whopping 12.8%.

(iREIT has introduced coverage of it, and I now own shares in my new high-yield account. To see exactly why, join iREIT on Alpha to view the entire video.)

I asked REFI’s C-suite about the IIPR tenant default… and their response reinforced my Buy recommendation for IIPR.

There’s little doubt in my mind that IIPR has turned into a deep-value play. While some may consider it a value trap, I believe that – like the other shorted stocks referenced here – a coil spring will release, and shares will find fair value…

Whatever that value means.

(FAST Graphs)

This Ain’t My First Rodeo

As I explain in my book, The Intelligent REIT Investor Guide:

“REIT management teams must utilize costs of capital and economies of scale in the process to create shareholder value. Without those all-important additions, REITs are likely to underperform, and their investors will be disappointed.”

And I added:

“We must ask ourselves whether a REIT might be at a competitive disadvantage if it can’t afford to hire the highest-caliber employees or obtain the very best market information concerning supply and demand for properties in its market area. That lacking could affect its acquisitions, property management, financial reporting, budgeting, and forecasting.”

When I ponder the above-referenced REIT shorted stocks – Digital Realty, Hannon Armstrong, Medical Properties Trust, and Innovative Industrial – I’m reminded that, for the most part, they’re all consolidators in their respective industries:

- Data centers

- Sustainable energy

- Hospitals

- Cannabis.

Our team has spent time researching these areas and meeting with all four REITs’ management teams. While certain sectors are exposed to outside risks – such as the lack of federalization in cannabis or labor issues with hospitals – the business models and, we believe, earnings are sustainable.

To quote my book again:

“… there are certain efficiencies that come more easily with substantial size, including greater bargaining power with suppliers and even tenants. Again, cost of capital is the name of the game, and better-paid leadership is often better prepared to capture that potential.”

Warren Buffett said in a 1999 Fortune interview:

“The key to investing is… determining the competitive advantage of any given company and, above all, the durability of that advantage. The products or services that have wide, sustainable moats around them are the ones that deliver rewards to investors…

“Competition is fierce everywhere. But well-run organizations can often operate at lower costs and frequently enjoy more bargaining power because of their costs of capital and scale advantages…

“It can’t be overstated that these elements give them significant competitive edges more often than not. REITs that have both will almost assuredly attract and retain the strongest tenants because they can provide the best-in-class services to them.”

In Conclusion…

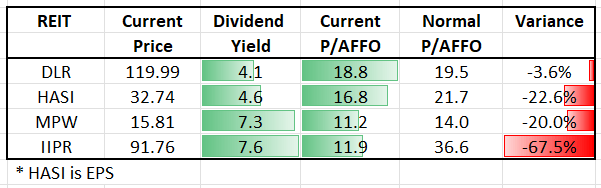

As shown below, all four REITs are trading at discounts to their historical valuation multiples.

(iREIT)

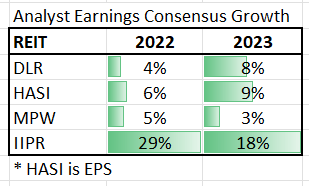

Yet all four REITs are still growing:

(iREIT)

Our job as analysts is not to completely ignore the hedge funds shorting REITs that we recommend. We want to dig deeper into any risks we may have missed.

A few weeks ago, I interviewed Kyle Bass, CEO of Hayman Capital Management. He was successful with shorting a REIT called United Development Funding (formerly UDF).

During the discussion, he told me:

“Make sure you have a big four auditor… Just stick with the ones that have the big four auditors. Don’t go to some second-, third-, fourth-tier auditor. Because you remember, Madoff had an auditor right around the corner that basically was in his back pocket that was not a big-four auditor. This company (‘UDF’) didn’t have a big-four auditor. Just stick with real auditors.

“Now can those auditors be fooled sometimes? Yes, but it’s rare. Right? The Enrons and the WorldComs are rare. In REIT-land, stick with big auditors, stick with companies that are publicly listed, and stick with management teams that aren’t marking their own assets.”

But when it comes to shorting quality REITs? I’ve seen it play out time and time again, which is why I always remind myself…

“History doesn’t repeat itself, but it does rhyme.”

Be the first to comment