Andrea Kessler/iStock via Getty Images

Hell is truth seen too late.”― Thomas Hobbes, Leviathan

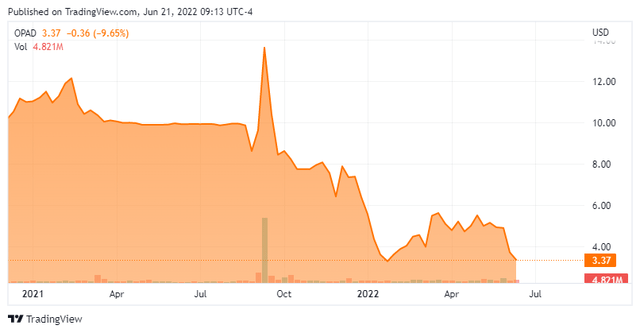

Today, we take our first look at Offerpad Solutions Inc. (NYSE:OPAD). The company went public via special-purpose acquisition company Supernova Partners back in the first half of 2021. It was the brainchild of Zillow (Z) and Hotwire co-founder Spencer Rascoff. Like most SPAC debuts of this ‘vintage‘, the stock is now in ‘Busted IPO‘ territory. The company has an interesting business model, but one that might turn out to be of poor timing given the recent spike in mortgage rates and those impacts on the housing market. An analysis and first take on this small cap concern follow below.

Company Overview

Offerpad Solutions Inc. is based just outside of Phoenix. The company buys, sells, rents, and renovates properties to homeowners in the United States. Offerpad provides and operates iBuying, a real estate solutions platform for on-demand customer. This allows clients to sell and buy homes online with streamlined access to ancillary services, such as mortgage and title insurance services.

May Company Presentation

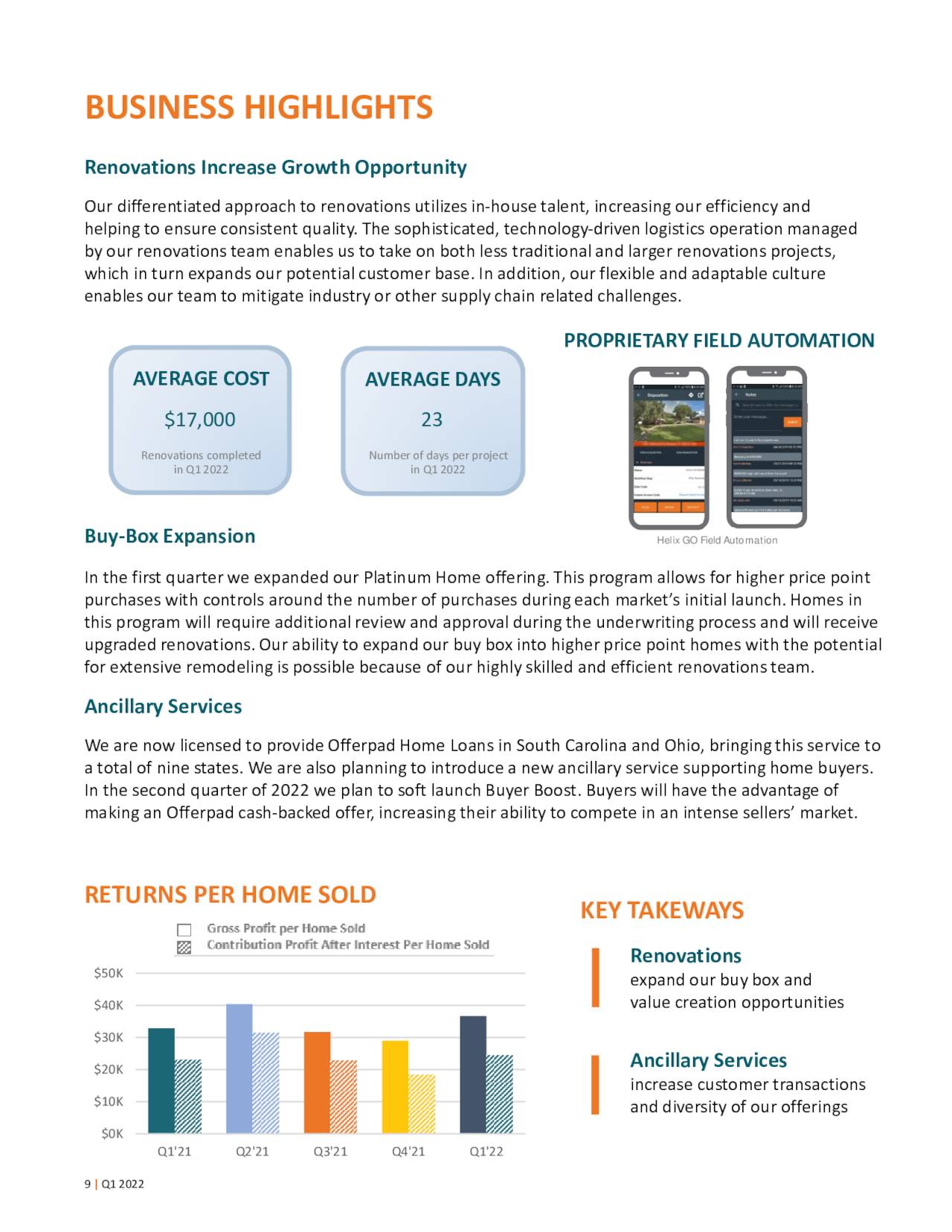

The company continues to expand and plans to be in approximately 30 different markets in the U.S. by year end. Offerpad is different than most concerns in this space such as mortgage companies like Rocket Companies (RKT). Instead of offering referrals to companies or individuals, customers can use to complete each part of their transaction such as agents, renovation companies, mortgage companies, moving companies, etc… Offerpad can take of the entire buying and selling process.

May Company Presentation

This includes Offerpad’s renovations team in each market that can quickly do renovations to increase the value of the listing while the home is going through the sales process. The company offers multiple and customizable solutions to homeowners and this has resulted in higher gross profit being made per sale.

May Company Presentation

The stock currently trades near $3.50 a share and sports an approximate $825 million market capitalization.

First Quarter Results

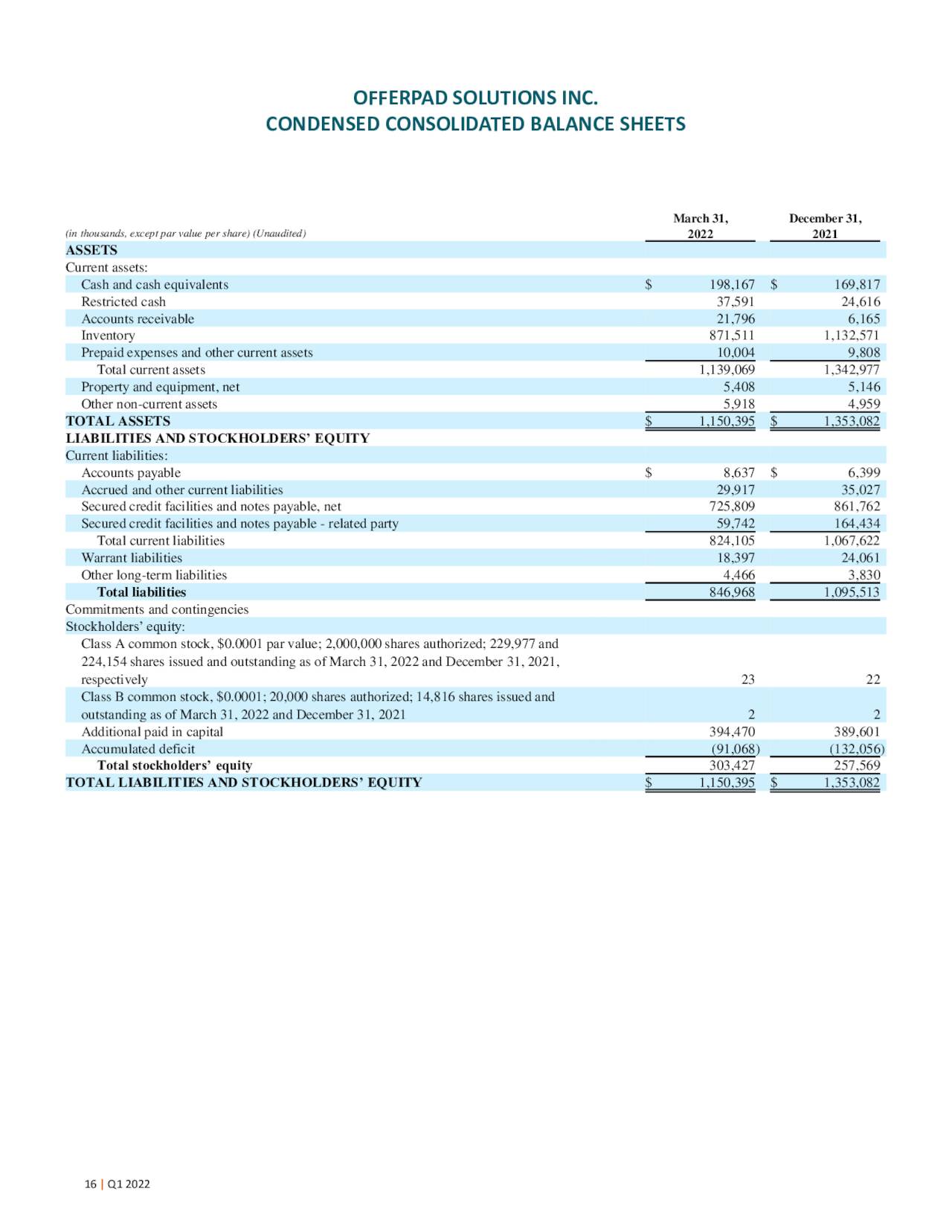

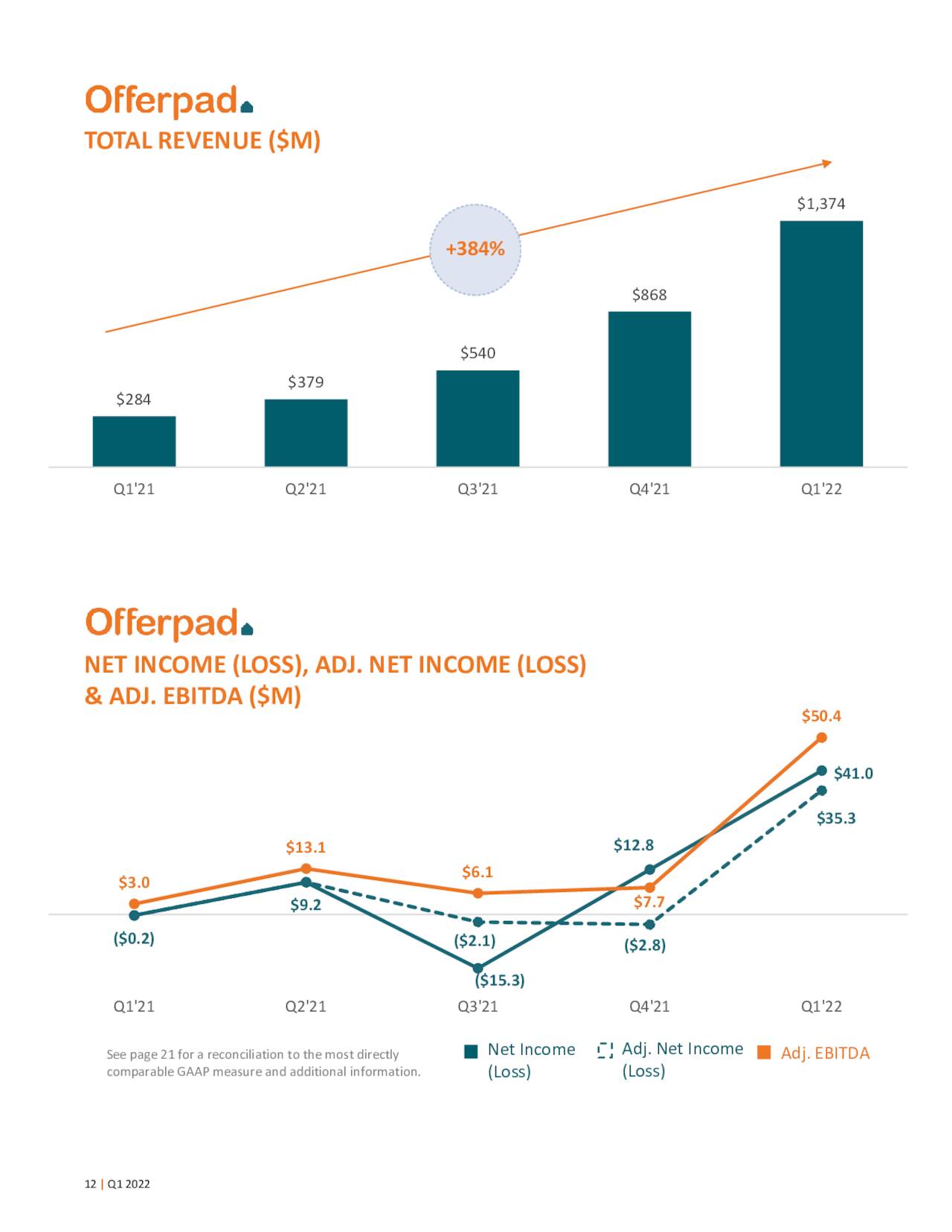

On May 4th, the company posted first quarter numbers. Offerpad delivered 16 cents a share of GAAP profit as revenues rose over 380% on a year-over-year basis to $1.37 billion. Both top and bottom line results easily beat the analyst consensus.

Q1 2022 Financial Highlights

|

Q1 2022 |

Q1 2021 |

Percentage Change |

|||||||

|

Homes acquired |

2,856 |

1,196 |

139% |

||||||

|

Homes sold |

3,602 |

1,018 |

254% |

||||||

|

Revenue |

$1.37B |

$284.0M |

384% |

||||||

|

Gross profit |

$132.1M |

$33.5M |

294% |

||||||

|

Net income/(loss) (reported)1 |

$41.0M |

($0.2M) |

n/a |

||||||

|

Adjusted net income/(loss) |

$35.3M |

($0.2M) |

n/a |

||||||

|

Adjusted EBITDA |

$50.4M |

$3.0M |

1,562% |

||||||

|

Contribution profit after interest per home sold |

$24,400 |

$23,100 |

6% |

As can be seen above, it was an impressive quarter. Gross profit and Adjusted EBITDA both soared as homes sold increased by over 250% from the same period a year ago, and profit per home also rose six percent. The days between home acquisition and sale was less than 100 days. The company expanded into 600 new zip codes (a 15% increase). The company also expanded its Offerpad Home Loans mortgage service to nine states.

For the second quarter, the company offered up the following guidance.

|

Q2 2022 Outlook |

|||

|

Homes Sold |

2,900 – 3,100 |

||

|

Revenue |

$1.1B – $1.15B |

||

|

Adjusted EBITDA1 |

$27M – $37M |

Analyst Commentary & Balance Sheet

The company has seen five Buy recommendations and three Hold ratings from analyst firms so far in 2022. Over the past month, Jefferies reiterated its Hold rating with $5.00 price target while both JMP Securities ($8.50 price target) and Compass Point ($5.50 price target) have initiated the shares as a new Buy over the past two weeks.

May Company Presentation

Approximately eight percent of the overall float of this stock is currently held short. In mid-March, two company directors purchased just over $140,000 of new stock. Those are the only insider transactions in these shares so far in 2022. The company ended the first quarter with approximately $200 million in cash and marketable securities on its balance sheet.

Verdict

The current analyst consensus has the company earning 25 cents a share on almost $5.2 billion worth of revenue in FY2022. They project profit will fall to 20 cents a share on $7 billion in revenue in FY2023. It is important to point out there is wide range of possible profit outcomes (a net loss of 14 cents a share to a profit of 36 cents a share) from analysts for next fiscal given the uncertainty in the housing market.

May Company Presentation

The company has done a great job growing revenue, adjusted EBITDA and net income during its time as a public company. However, this was largely in a market seeing the average home price rising in the mid-teens annually. Until this year, it was also a market environment with a robust economy and with 30 year mortgage rates hovering around three percent. The average 30-year mortgage ended the week of June 10th at 5.65%.

Higher interest rates mean lower asking prices and falling home sales. While the company’s business model is more robust than Zillow in this area, remember that company had to exit its home buying business late last year. In addition, it looks like the country is heading into at least a mild recession as the Fed continues to hike rates to cool inflation, which is running at its highest levels since the early 80s.

The company has not navigated through this sort of economic environment before, so I am passing on any investment recommendation even though I do find the firm’s business model intriguing. If Offerpad makes it through this downturn in the housing market, this is the name I would probably look hard at accumulating towards the end of any recession as the central bank ends its monetary tightening stance after the inflation genie is put back into her bottle.

It’s always about timing. If it’s too soon, no one understands. If it’s too late, everyone’s forgotten.” ― Anna Wintour

Be the first to comment