Olemedia

The Amplify Lithium & Battery Technology ETF (NYSEARCA:BATT) is designed to generate returns by investing in companies that produce, develop, and use lithium-ion batteries. These are EV companies, battery metals & associated materials producers, and companies that provide battery storage solutions, for instance. The ETF has a rather stiff 0.59% expense ratio but does give investors diversified exposure to this fast-growing technology sub-sector. For investors who allocate some capital to thematic and relatively high risk/reward opportunities, the lithium battery and tangentially related companies may be just the ticket.

Investment Thesis

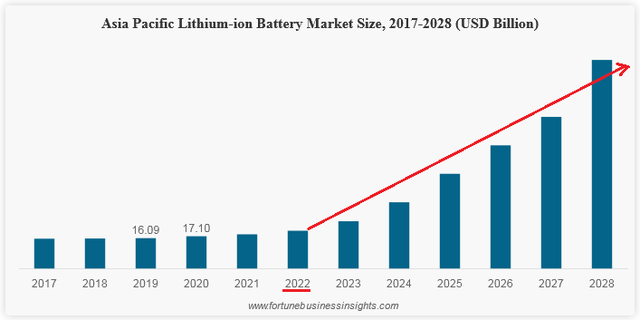

According to Fortune Business Insights:

The global lithium-ion battery market is projected to grow from $44.49 billion in 2021 to $193.13 billion by 2028, exhibiting a CAGR of 23.3%.

Source: Lithium-Ion Battery Market Size, Share & Growth Report, 2028

Today, key battery packs, battery components, and materials come mainly from the Asia Pacific region, and – in particular – China. However, there is significant global interest in the industry and it is certainly not too late for investors to jump onto the lithium-ion battery bandwagon. I say that because the industry is still in its infancy, and today – in 2022 – we are on the cusp of a boom in lithium-ion battery demand as more and more companies begin to offer attractive EV models to consumers:

[NOTE]: Red lines added by the author.

This already bullish set-up in the Asia-Pac region can now be combined with the fact that the United States has finally entered the fray. I say that because with President Biden signing the recent IRA clean-energy legislation (which includes $369 billion in spending on climate and energy policies in an effort to reduce U.S. carbon emissions by an estimated 40% by 2030), North America has now a bullish catalyst for its commitment to grow the domestic battery industry.

That being the case, today I will take a look at the BATT ETF to see how it has positioned investors for success going forward.

Top-10 Holdings

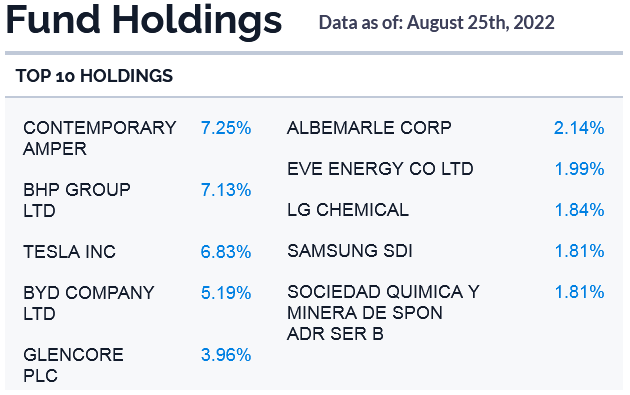

The top-10 holdings in the BATT ETF are shown below and equate to what I consider to be a relatively diversified 40% of the total portfolio of 85 companies:

Amplify ETFs BATT Webpage

The #1 holding in the BATT ETF is Contemporary Amper, better known in the industry as “CATL”. CATL has a 7.3% weight that is well-supported by the fact that the China-based company is generally considered to be the global leader in lithium-ion battery production for EVs. Note CATL is rumored to be looking for a new $5 billion factory site in North America. In my opinion, this is a validation of the recent IRA act signed into law by President Biden and shows that China has definitely taken notice.

BHP Group (BHP) is the #2 holding with a 7.1% weight. BHP is an Australia-based international miner of materials & metals, some of which are critical to lithium-ion battery production (nickle and copper, for instance). Earlier this month, BHP announced record full-year results, including the generation of $24.3 billion in free cash flow. Despite the impressive results, BHP is down 9% over the past year as rising input costs and concerns about a global recession (and thus lower raw material demand) have weighed on the shares.

Tesla (TSLA) has a 6.8% weight in the BATT ETF and is the #3 holding. The company began trading today (Thursday, Aug. 25th) post the 3-1 stock split. Despite what I consider to be a most unnecessary distraction with Musk’s battle with Twitter, Tesla shares are up 25% over the past year as it continues to impressively execute on its plan to increase production in new plants in Austin, TX and Germany.

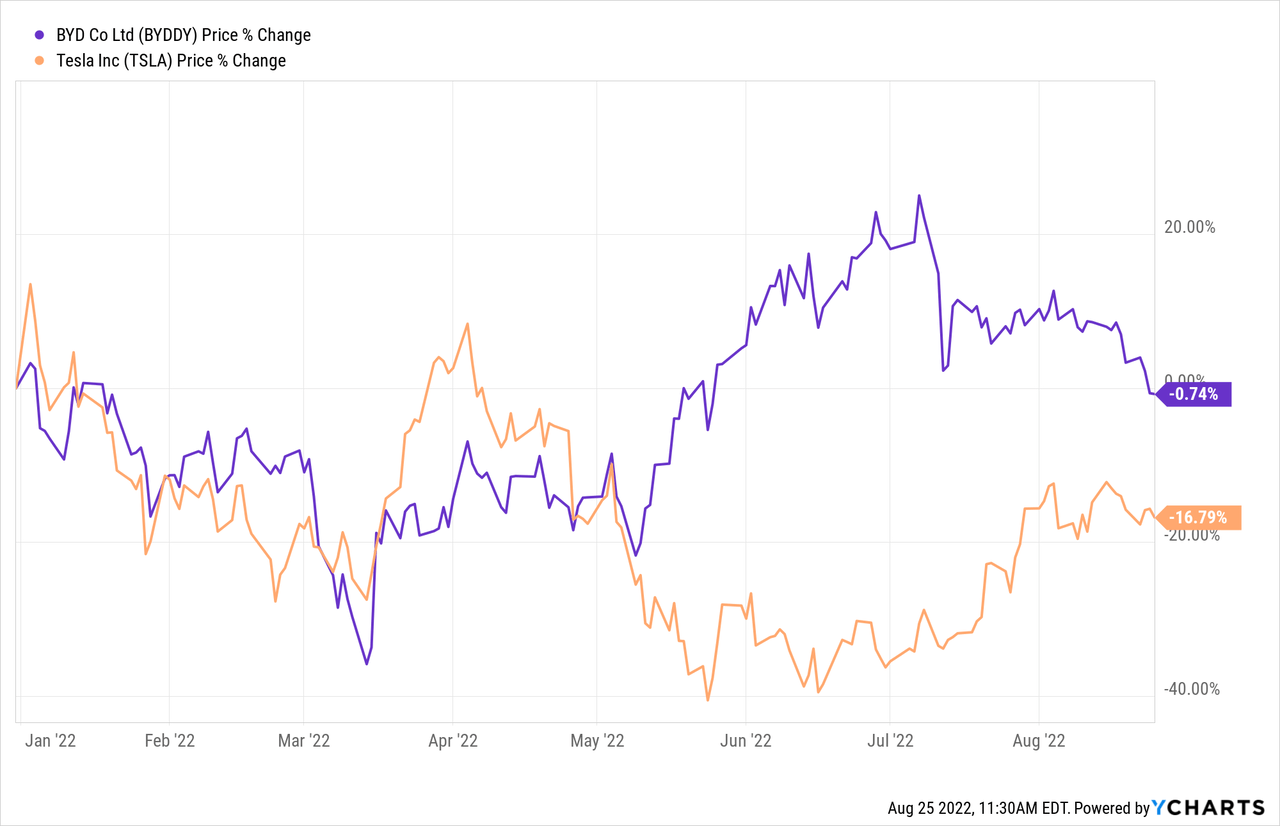

As I pointed out in my last Seeking Alpha article on BYD (OTCPK:BYDDY) (OTCPK:BYDDF), the #4 holding with a 5.2% weight is now arguably the leading EV producer on the planet (see BYD: Outselling & Outperforming Tesla). BYD recently announced plans to launch an e-SUV in India. India, the world’s second largest country, has severe urban pollution issues that desperately needs to move away from gasoline & diesel cars & trucks and embrace EVs. Clearly, BYD wants to be the leading EV supplier to the world’s two biggest countries: China & India.

Note that BYD has significantly outperformed TSLA during the 2020 bear market:

The #6 holding is Albemarle (ALB), a major lithium producer based in North Carolina. ALB is up 24% over the past year and, as a domestic company, is generally considered to be a leading beneficiary of the recent IRA clean-energy legislation pushed through Congress by the Biden administration. At pixel-time, Albemarle is currently trading more than 1% higher in sympathy with a Goldman Sachs upgrade on lithium miner Freyr (FREY).

Samsung (OTCPK:SSNLF) (OTCPK:SSNNF) (OTCPK:SSDIY) is the #9 holding with a 1.8% weight. The Korea-based company is a diversified electronics manufacturer that also makes lithium-ion batteries for consumer electronics as well as batteries for PHEV and EVs.

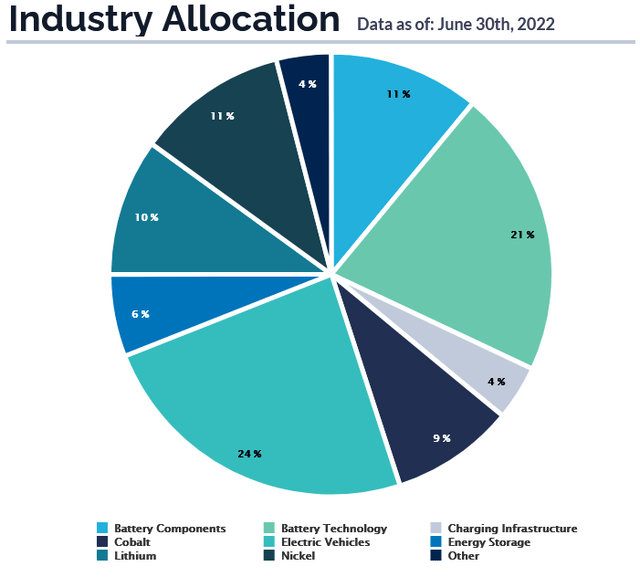

From an overall portfolio perspective, the BATT ETF is relatively diversified across the industry with 45% of the portfolio invested in EVs and battery technology and the rest generally allocated to battery components and the supply of critical raw materials like lithium, cobalt, and nickle:

Performance

The long-term performance of the BATT ETF is shown below and is quite poor:

I say poor because, since inception in June of 2018, the fund has an average annual return of -5.2%. That said, note the more recent 3-year returns (during both the bull market and the bear market of this year) is 12.9%. Not bad. But it is hard to look past the -16.3% return this year – especially in light of the performance of companies like Tesla, BYD, and the passage of the significant U.S. clean-energy legislation.

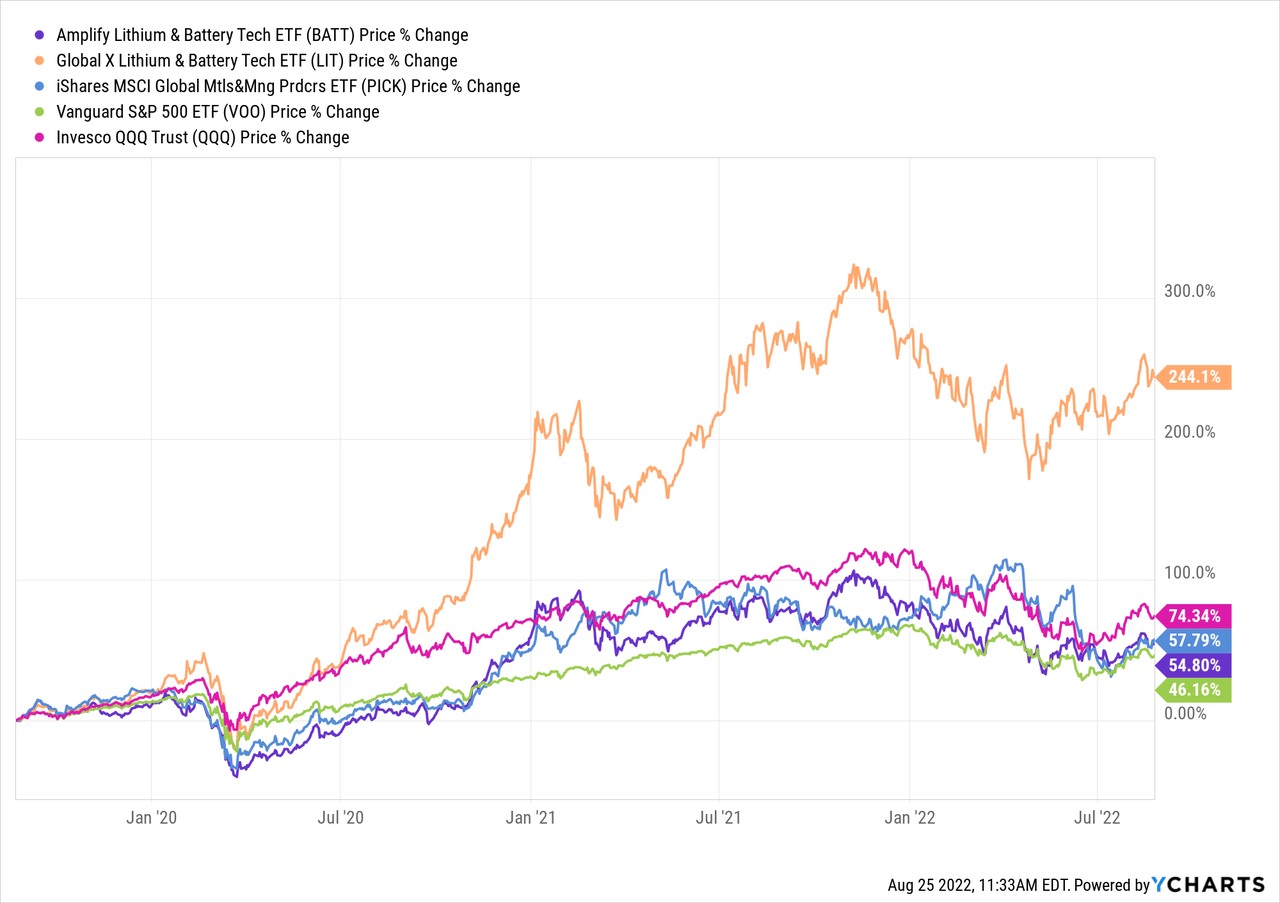

The graphic below compares the three-year performance of the BATT ETF with competing ETFs like the Global X Lithium & Battery ETF (LIT), the iShares MSCI Global Metals & Mining ETF (PICK), and the broad market indexes as represented by the (VOO) and (QQQ) ETFs:

The LIT ETF has clearly been the outperforming ETF in the lithium-ion battery space.

Risks

The BATT ETF is not immune to the current macro-environment: Covid-19 related shutdowns and supply chain disruptions, high inflation, expectations for rising interest rates, and the massive geopolitical uncertainty as a result of Putin’s horrific war-of-choice in Ukraine and the resulting economic sanctions put on Russia by the U.S. and its Democratic NATO allies. Any or all of these factors could have a negative impact on the global economy and could push it into recession, which could slow the transition to EVs and a resulting contraction in demand for lithium-ion batteries.

The BATT ETF has 38% of the portfolio invested in China. Although China is (currently) where most of the action is with respect to lithium-ion battery production and raw materials availability, it is certainly conceivable that the CCP could take governmental control over all EV related supply chains and your guess is as good as mine as to what effect that would have on the China-based companies within the BATT ETF.

Upside risks include relatively high gasoline prices and a plethora of new EV models being introduced from a number of global high-quality auto manufacturers. The combination could accelerate the transition to EVs. For instance, where I live it currently costs ~$12 to recharge an EV with a 300-mile range. That compares to ~$54 to refill an ICE-based vehicle that gets 20 mpg.

Summary & Conclusion

Investors have some options with respect to the lithium-ion battery market. They can make specific company bets (like Tesla, BYD, Albemarle, etc) or they can go to the diversified approach via an ETF. If the latter, I would go with the LIT ETF which has clearly demonstrated superior returns not only as compared with the BATT ETF, but has stomped the S&P500 and the Nasdaq-100 as well. That being the case, I have a HOLD rating on the BATT ETF and a BUY rating on LIT and suggest holders of BATT swap into LIT.

Be the first to comment