David Tran

Adobe Inc. (NASDAQ:ADBE) has agreed to acquire Figma, the online whiteboard and design tool, for about $20 billion in cash and stock. In response to the news, Adobe fell some ~12%. Adobe is a leader in publishing and content creation through its creative cloud subscription model. It sports a $152 billion market cap. The company has about $5 billion in cash on the balance sheet. Net of debt, there is about $500 million in cash. Adobe generates $6.66 billion in EBITDA, and its free cash flow is in a similar ballpark.

The 10% drop in Adobe seems overdone. I’ve speculatively acquired some shares. My reasoning is that there are a few possible reasons the market doesn’t like the deal: 1) it is partly in stock, implying Adobe management believes the stock is valued too high. 2) it could be viewed as a killer acquisition. Where the point is to take out a competitor preemptively. Shareholders don’t like these because your R&D expenses may be low, but if you have to shell out $20 billion every year to buy another start-up, maybe your competitive position isn’t as unassailable as once believed. 3) It could also be regarded as Adobe overpaying by acquiring this firm at 200x or 100x revenue. The deal isn’t accretive for years 1 and 2, according to Adobe, which is something the market doesn’t like.

Here are my thoughts on these issues:

The financing

Adobe is paying half cash and half stock. Adobe thinks it can pay with cash on hand and, if necessary, a term loan. I have very little doubt Adobe can scrounge together the $5 billion it’s missing. The companies expect the deal to close in 2023, so just free cash flow gets it about halfway there, depending on when the deal closes in 2023.

Killer acquisition

Adobe tends to acquire firms that it can fit into its own ecosystem of products and cross-sell very effectively. Adobe is also dominating its field, and that’s partly because all young people are getting trained using its software at educational institutions worldwide. One sentence that jumped out at me from the PR was the following:

Figma has attracted a new generation of millions of designers and developers and a loyal student following.

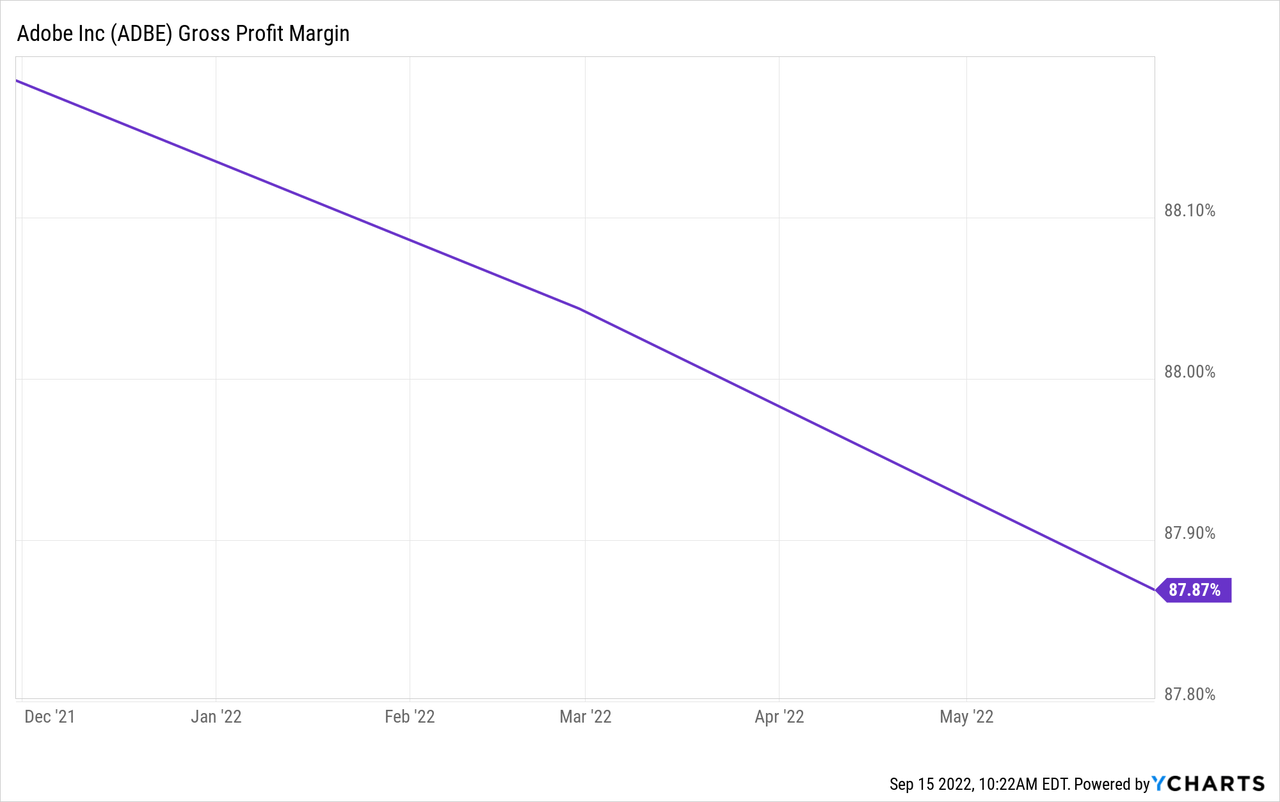

Regulators frown upon killer acquisitions (read more here), but shareholders sometimes do as well. It is all great when you are achieving 87% gross margins:

But if you then have to go out and acquire startup after startup for $20 some billion, shareholders will start to question the reality of these margins. You could argue this is outsourcing R&D or CapEx. Or you could argue the competitive position simply isn’t as unassailable as previously, though, and marketing expenses are artificially low.

In my view, Adobe tends to make smart acquisitions (although this is on the larger side) and they really fit within their ecosystem. In the current M&A climate, I can see regulators in the U.S. and/or Europe taking a pretty hard look at this deal, but from Adobe’s shareholders’ perspective that could be viewed as a positive. Since the stock is plummeting on the deal, the stock should rebound if the deal gets into regulators’ cross-hairs. Lately, I don’t see a lot of larger deals where a tech company buys a competitor or a product it can integrate very well. The big deals are more like Microsoft (MSFT) buying Activision (ATVI) where there is a strong argument the companies are competing in different markets, and it is not immediately obvious how it will strengthen Microsoft’s moat.

Adobe is overpaying

Adobe is paying in the neighborhood of 100x 2022 revenue and 200x 2021 revenue for Figma. Although I don’t love these multiples, they can make sense. First of all, these suggest a 100% annual revenue growth rate. The PR also says the company has very high retention rates (which is valued highly in SaaS business models) and it’s achieving 90% margins. If Adobe can implement Figma’s best tools within its own suite, it is conceivable it could supercharge growth. Where the firm’s tools are overlapping, Adobe can choose and pick to offer the best alternative. It is conceivable this protects Adobe’s own growth rate. In my experience, deals that aren’t accretive close at slightly lower rates. Although the stock and cash structure of the deal could be intended to avoid a shareholder vote.

In conclusion, I don’t believe the announcement of this deal should immediately make Adobe worth ~$15 billion less. Adobe has a pretty solid track record in terms of doing sensible “tuck-in” deals. There are two paths to recovery for the stock here: 1) the market could realize the deal may not be so terrible; or 2) the deal could still fail in various ways, getting blocked by an activist or regulator, for example. Finally, I have some general market hedges on, which makes me less worried I’ll go down with the market owning Adobe.

Be the first to comment