JonGorr

Earnings of Ames National Corporation (NASDAQ:ATLO) will likely remain flattish next year as provision normalization will counter margin expansion and loan growth. Overall, I’m expecting Ames National to report earnings of $2.16 per share for 2022 and $2.22 per share for 2023. Compared to my last report on the company, I haven’t changed my earnings estimate for 2023. However, I’ve increased my estimate for 2022 because I’ve reduced my provisioning estimate following the third quarter’s performance. Next year’s target price suggests a small downside from the current market price. On the other hand, Ames National is offering a high dividend yield for a bank holding company. Based on the total expected return, I’m downgrading Ames National to a hold rating.

Regional Factors to Sustain Loan Growth

Ames National’s loan growth shot up in the third quarter after a disappointing first half of the year, according to details given in the 10-Q Filing. The portfolio grew by 3.0% during the quarter, taking the nine-month growth to 2.7%, or 3.6% annualized. Going forward, economic factors will likely keep loan growth afloat.

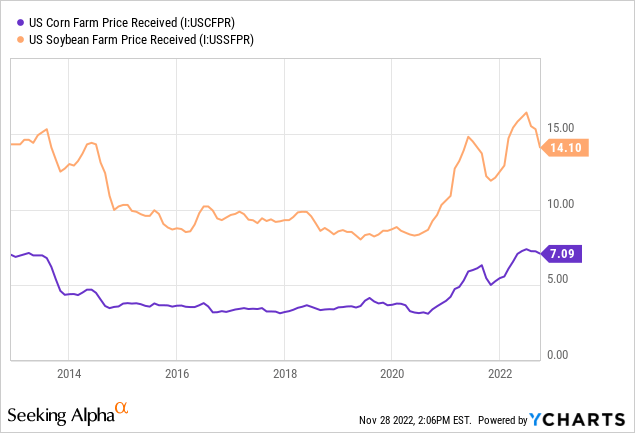

Ames National is the parent of several banks that operate mostly in Iowa. The consolidated loan portfolio of the subsidiary banks is concentrated in residential, agriculture, and commercial real estate loans. Iowa’s main agricultural products are corn and soybeans; therefore, the prices of these two commodities are an important indicator of credit demand in Ames National’s markets. As shown below, despite the decline in recent months, commodity prices are still quite high.

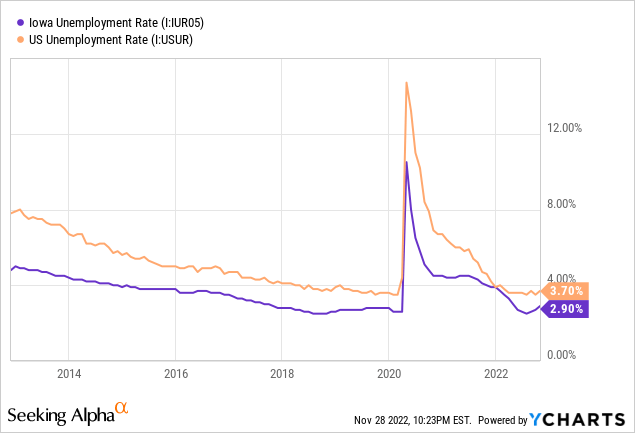

Moreover, other regional economic factors also bode well for Ames National. Iowa’s unemployment rate is very low compared to other states as well as Iowa’s history.

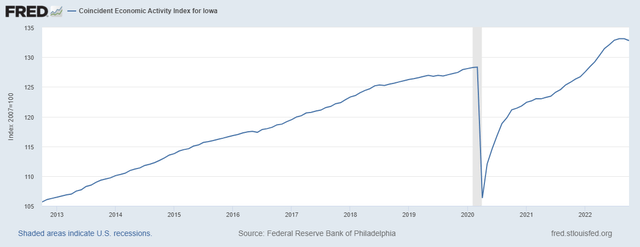

Further, the economic activity index paints a satisfactory picture of the condition of the regional economy.

The Federal Reserve Bank of Philadelphia

Considering these factors, I’m expecting the loan portfolio to grow by 1.0% in the last quarter of 2022, taking full-year loan growth to 3.7%. For 2023, I’m expecting the loan portfolio to grow by 4.1%.

Large Securities Portfolio Bodes Ill for Equity, Margin

Ames National’s biggest weakness in the current environment is its large available-for-sale securities portfolio, which makes up 39% of total earning assets. As interest rates have risen, the market value of these securities has fallen leading to unrealized losses. As they’re unrealized, these losses do not appear in the income statement. Instead, they flow through other comprehensive income into the equity book value account. Ames National’s equity book value has already plunged by a hefty 34% in the first nine months of 2022.

Further equity book value erosion is likely in the fourth quarter because of the 75 basis points hike in the fed funds rate in early November. Moreover, I’m expecting an additional 75 basis points hike till the mid of 2023. Consequently, I’m expecting equity book value to decline by a further $20 million, or 15%, by March 2023. Compared to my last report on Ames National, I’ve significantly reduced my equity book value estimate because the book value has already declined by more than I expected. The following table shows my balance sheet estimates.

| Financial Position | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E |

| Net Loans | 890 | 1,048 | 1,130 | 1,144 | 1,187 | 1,235 |

| Growth of Net Loans | 15.4% | 17.7% | 7.8% | 1.3% | 3.7% | 4.1% |

| Other Earning Assets | 489 | 595 | 768 | 921 | 818 | 852 |

| Deposits | 1,221 | 1,493 | 1,716 | 1,878 | 1,892 | 1,969 |

| Borrowings and Sub-Debt | 55 | 47 | 40 | 43 | 69 | 72 |

| Common equity | 173 | 188 | 209 | 208 | 129 | 129 |

| Book Value Per Share ($) | 18.6 | 20.3 | 22.9 | 22.8 | 14.4 | 14.4 |

| Tangible BVPS ($) | 17.2 | 18.6 | 21.2 | 21.2 | 12.8 | 12.8 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) | ||||||

Another reason why the large securities portfolio is a weakness is that it will hold back average earning assets yield as deposit costs rise during this up-rate cycle. Most securities are based on fixed rates, so only a small part of the portfolio can be expected to re-price.

The margin will also suffer from the recent deterioration of the deposit mix. Non-interest-bearing deposits have declined to 20.3% of total deposits by September 2022 from 21.9% at the end of December 2021.

Considering these factors, I’m expecting the margin to be mostly unchanged during the fourth quarter of 2022 and early 2023. However, once the up-rate cycle is over (probably by the middle of 2023), the margin will expand because deposit repricing will end quickly while asset repricing will continue. As fixed-rate loans and securities mature, they will be rolled into higher-yielding loans and securities which will lift the average earning asset yield. Overall, I’m expecting the margin to grow by 16 basis points in 2023.

Expecting Earnings to Remain Flattish Next Year

Ames National surprised me by reporting net provision reversals for the third quarter of 2022. Going forward, I believe Ames National will stop releasing such a high amount of reserves because of the threats of a recession. All in all, I’m expecting provisioning to rise to the historical average in future quarters. I’m expecting the net provision expense to make up 0.13% of total loans in 2023, which is the same as the average from 2017 to 2019. In my last report on Ames National, I estimated a net provision expense of $0.6 million for 2022. I’m now expecting net provision reversals of $0.3 million for the full year because of the third quarter’s surprise.

In contrast to the provision normalization, the anticipated margin expansion and loan growth will lift earnings next year. Overall, I’m expecting Ames National to report earnings of $2.16 per share for 2022, down 18% year-over-year. For 2023, I’m expecting earnings to grow by 2.6% to $2.22 per share. The following table shows my income statement estimates.

| Income Statement | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E |

| Net interest income | 42 | 45 | 55 | 56 | 54 | 57 |

| Provision for loan losses | 1 | 1 | 6 | (1) | (0) | 2 |

| Non-interest income | 8 | 9 | 11 | 11 | 10 | 9 |

| Non-interest expense | 28 | 32 | 37 | 37 | 38 | 39 |

| Net income – Common Sh. | 17 | 17 | 19 | 24 | 19 | 20 |

| EPS – Diluted ($) | 1.83 | 1.86 | 2.06 | 2.62 | 2.16 | 2.22 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) | ||||||

In my last report on Ames National, I estimated earnings of $2.04 per share for 2022 and $2.26 per share for 2023. I’ve tweaked upwards my earnings estimate for 2022 because I’ve changed my provision estimate for this year. I haven’t significantly changed my earnings estimate for 2023.

My estimates are based on certain macroeconomic assumptions that may not come to pass. Therefore, actual earnings can differ materially from my estimates.

Price Downside Counters High Dividend Yield

Ames National has increased its dividend every year since 2010. Given the earnings outlook, it’s likely that the company will maintain the dividend trend next year. Therefore, I’m expecting the company to increase its dividend by $0.01 per share to $0.28 per share in the first quarter of 2023. The earnings and dividend estimates suggest a payout ratio of 50.5% for 2023, which is close to the five-year average of 52.2%. Therefore, the dividend appears secure.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Ames National. The stock has traded at an average P/TB ratio of 1.32 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 17.2 | 18.6 | 21.2 | 21.2 | ||

| Average Market Price ($) | 28.6 | 27.1 | 21.2 | 24.3 | ||

| Historical P/TB | 1.66x | 1.46x | 1.00x | 1.15x | 1.32x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $12.8 gives a target price of $16.8 for the end of 2023. This price target implies a 25.8% downside from the November 28 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.12x | 1.22x | 1.32x | 1.42x | 1.52x |

| TBVPS – Dec 2023 ($) | 12.8 | 12.8 | 12.8 | 12.8 | 12.8 |

| Target Price ($) | 14.3 | 15.5 | 16.8 | 18.1 | 19.4 |

| Market Price ($) | 22.7 | 22.7 | 22.7 | 22.7 | 22.7 |

| Upside/(Downside) | (37.0)% | (31.4)% | (25.8)% | (20.1)% | (14.5)% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 12.4x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 1.83 | 1.86 | 2.06 | 2.62 | ||

| Average Market Price ($) | 28.6 | 27.1 | 21.2 | 24.3 | ||

| Historical P/E | 15.6x | 14.6x | 10.3x | 9.3x | 12.4x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $2.22 gives a target price of $27.6 for the end of 2023. This price target implies a 21.9% upside from the November 28 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 10.4x | 11.4x | 12.4x | 13.4x | 14.4x |

| EPS 2023 ($) | 2.22 | 2.22 | 2.22 | 2.22 | 2.22 |

| Target Price ($) | 23.2 | 25.4 | 27.6 | 29.8 | 32.0 |

| Market Price ($) | 22.7 | 22.7 | 22.7 | 22.7 | 22.7 |

| Upside/(Downside) | 2.3% | 12.1% | 21.9% | 31.7% | 41.5% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $22.2, which implies a 1.9% downside from the current market price. Adding the forward dividend yield gives a total expected return of 3.0%.

In my last report on Ames National, I adopted a buy rating and a target price of $23.4 per share for December 2022. My target price for December 2023 is lower than the previous target price I gave for December 2022 because I previously underestimated the effect of mark-to-market losses on the equity book value. Based on the updated total expected return, I’m downgrading Ames National Corporation to a hold rating.

Be the first to comment