Nina Shatirishvili/iStock via Getty Images

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on November 19th, 2022.

A few months ago, we highlighted three trades where we had written puts that all expired worthless. One of those trades was with VICI Properties (NYSE:VICI). We are once again today highlighting we have another trade expiring worthless. We’ve locked in some more option premium and are looking for potential next moves.

We entered this latest trade on October 13th, 2022, at a $27.50 strike price and collected $0.45. That works out to a potential annualized return of 16.59%. We took this opportunity as the overall market was relatively lower at that time. Here was the main point of writing puts on VICI, as I highlighted it in the trade alert:

I’ve continued to watch VICI as an attractive REIT that is worth investing in. Today, with the markets continuing to tank, I’m taking the opportunity to write puts. This will either see the trade expire worthless and collect the premium, or the name will be added to my portfolio. After which, if it is added, I plan to utilize the options wheel strategy of turning around and writing covered calls.

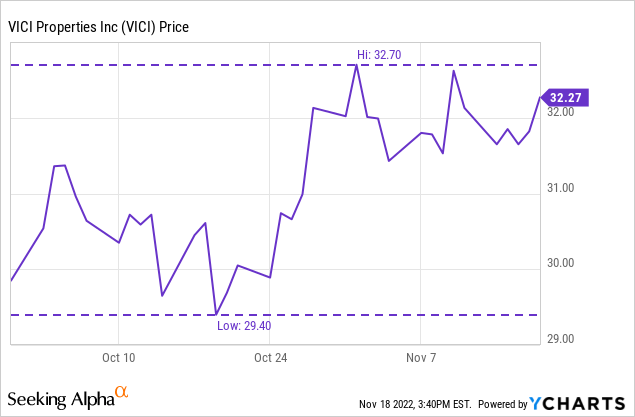

We now know that shares rallied higher, and the trade expired worthless. For the most part, since the trade was entered, the shares basically weren’t at risk of breaching the strike price. That was even after they announced a secondary offering of shares on November 3rd.

Secondary offerings generally are a good time to sell puts because there is often a temporary decline in the price in an overreaction. It then tends to raise back higher afterward. We can see exactly that play out in the price chart below. Since we were already in a position of selling puts, I chose not to sell more.

Ycharts

All said, we netted the entire premium and have the cash (for those that had the trade cash-secured) to now move on to another trade. Whether that is in VICI again or not will depend on how the market treats VICI next week.

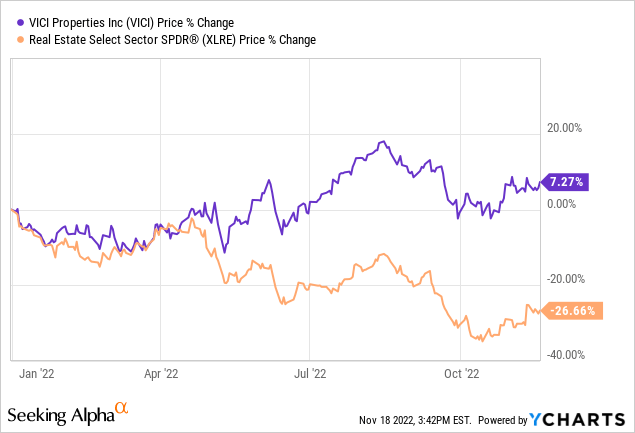

REITs have been incredibly beaten up in 2022. Yet, VICI has been doing the opposite as the rest of the sector. Instead, we see that the share price has risen YTD – not counting the returns from the attractive dividend.

Ycharts

As a specialized REIT in the hospitality, gaming and entertainment sector, it could be argued they’re a prime candidate for a pullback into a recession. With less money circulating and potential job losses, it could mean less spending at these hospitality and leisure establishments.

However, that hasn’t seemed to dent demand for these particularly large tenants that they have exposure to. Apparently, money never stops flowing into the Vegas Strip.

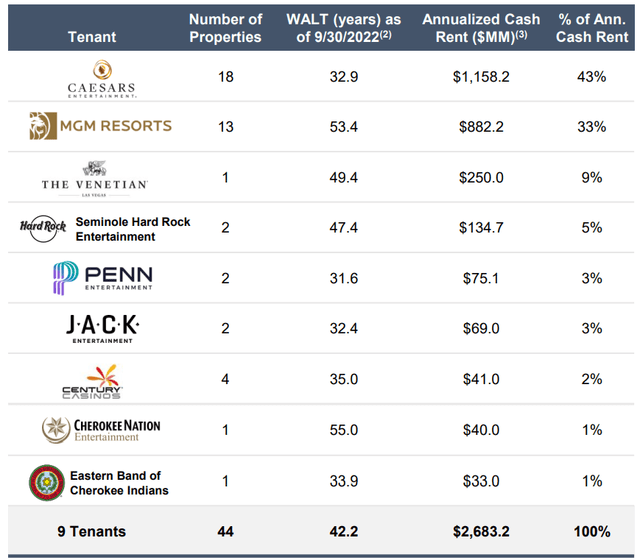

Though, note that they have a very concentrated group of tenants.

VICI Tenants (VICI Presentation)

It includes only 44 properties spanning 15 states, with an overemphasis on Nevada – particularly Las Vegas, at 45% of the rent roll. That being said, they do try to mention that it is at least diversified within the “experiential” category. Meaning that the properties are spread out amongst hotel rooms, gaming space, meeting & convention space, F&B outlets, entertainment venues and retail outlets.

They also note that it’s incredibly expensive to compete against their properties. That means a “favorable supply/demand balance.” Not only the costs to try to build these properties but the regulatory hurdles to establishing gaming properties are a benefit for VICI. That’s the sort of highlights that provide for the 100% occupancy rate. They are also benefiting from the pent-up demand that still seems to be surging after the COVID lockdowns.

Finally, they have an uncapped CPI lease escalation with a sizeable 47% portion of their portfolio. 96% of their leases are CPI-linked in total but are restricted with a cap generally around 2.5 to 3%. With inflation elevated, this will benefit them, as noted in their conference call.

AFFO for the year ended December 31, 2022 is expected to be between $1.682 billion and $1.692 billion or between $1.91 and $1.92 per diluted common share. Our updated guidance reflects the uncapped CPI lease escalation of 8.1% that VICI will receive under our Las Vegas master lease and regional master lease with Caesars, effective for the lease year beginning on November 1, 2022.

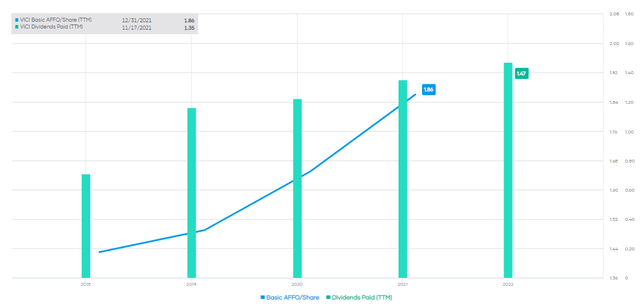

Put it all together, and VICI has had a lot of success in a relatively short time after being spun off from Caesars Entertainment in 2017. AFFO has been growing, and that has meant a growing dividend too.

VICI Annual Dividend And AFFO (Portfolio Insight)

Earnings estimates for 2023 are $2.36. Based on the latest $0.39 paid out for the quarter, we are looking at a payout ratio of 66%. That leaves them with plenty of room to continue raising their dividend. Not to mention that Wall Street has an average price target of $37.19 and is currently rated a “Strong Buy.”

With that, writing more puts and potentially taking a long position in this name is quite a strong proposition.

What’s Next For VICI?

As always, it will really depend on where shares open up next week to give better clarity on the next move. With shares finishing up quite strongly on Friday’s close, waiting for a red day could lead to better results. Being what appears to be a strong candidate based on the fundamentals, an investor that wants to go long anyway can afford to be a bit more aggressive here.

- December 16th, 2022, expiration at a $30 strike could net investors a premium of $0.25 (last bid.) That works out to a PAR of 12.17%. This would be lower than my ~15% arbitrary target—still, not a bad choice for investors who want some downside protection. If shares are weaker next week, that will push the potential premium collected up too.

- For those more aggressive investors, they could consider the same December 16th, 2022, expiration at a $32.50 strike. That would mean it is in-the-money. However, after collecting $0.97 (last bid), the breakeven would come to $31.53. Still meaningfully below the last closing price of $32.30. In that case, the PAR jumps dramatically to 43.58%. Of course, the chances of taking assignment is then significantly higher.

We’ve successfully traded around with VICI in the past too, where we played out the options wheel strategy. We took the assignment of shares through writing puts, then turned around and sold covered calls. We collected premiums on both ways and collected a dividend in that time too. That’s ultimately what we would be looking to do again here if assigned or remain long. Either way, with VICI, it would seem a win-win. We win when we collect premium, and we win if we end up long!

Be the first to comment