Joe Raedle

Introduction

It has been more than six months since I first discussed Riley Exploration Permian (NYSE:REPX) and the share price has been hit hard by the decreasing oil price in the past few weeks. I am flabbergasted given the strong financial performance of Riley Exploration, its strong reserve base and the dividend yield has now increased to about 7.5%.

This article will focus on how Riley will perform during a period of lower oil prices.

A quick look at the 9M 2022 results tells you what REPX will make at $70 oil

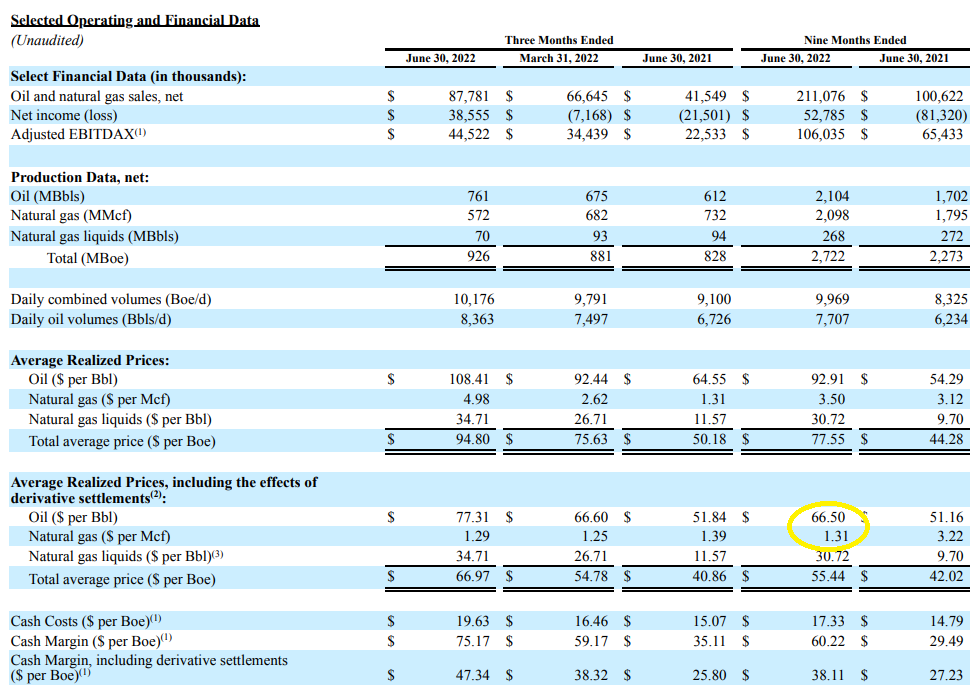

It’s actually pretty easy to figure out how Riley will perform at a lower oil price as the company is still honoring some low-priced hedges. A substantial portion of the oil production was hedged at a price in the mid-$50s, which means the average realized price of Riley’s oil output was substantially lower than the market price. As you can see below, the average WTI price in the June quarter was just over $108 per barrel, but Riley’s average realized price was just $77.31 per barrel. We see a similar gap in the 9M 2022 results, the average oil price was almost $93/barrel in the nine months ending in June while Riley Exploration reported a realized oil price of $66.50.

REPX Investor Relations

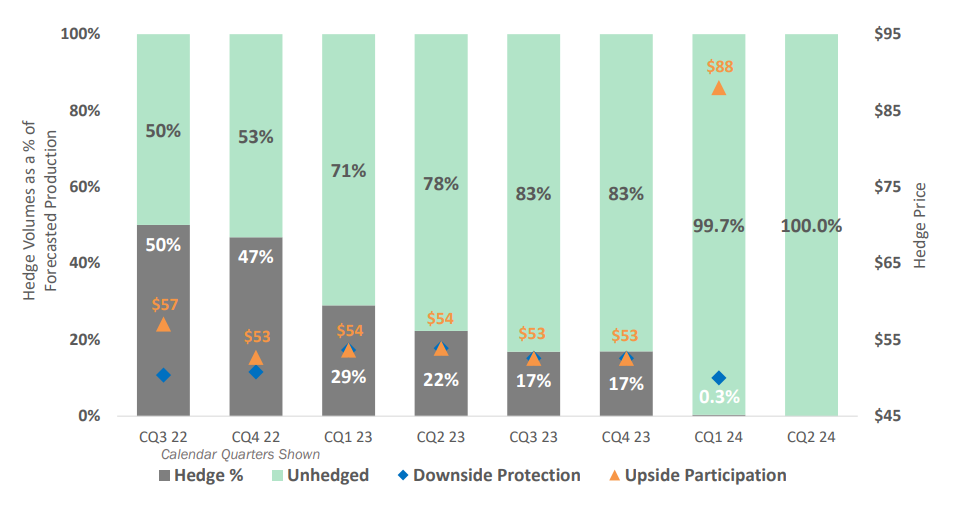

The massive difference in market prices and realized prices could easily be explained by the hedge book. When the oil market was much weaker, Riley entered into hedging contracts, essentially selling a substantial portion of its anticipated production at a fixed price in the mid-$50 range. The residual hedge book can be found below.

REPX Investor Relations

So for the current quarter (ending in a few days) about 50% of the anticipated oil production has been hedged at an average price of $57 per barrel. This essentially means that if the market price for the quarter is $90 and the hedged price is $57, the average realized price will be approximately $73.5/barrel.

As you can see, the total percentage of hedged production continues to move down. In Q1 calendar year 2023, only 29% of the oil production has been hedged, at an average price of $54/barrel. If the market oil price is $80/barrel during that quarter, Riley will report a realized price of $72.46/barrel. The trend is clear: as the total percentage of production that has been hedged will be continuously decreasing from here on, the realized price will likely stagnate, even if the oil price remains at the current level.

Keeping this in mind, I think looking at the 9M 2022 results provided by Riley offer an excellent insight into how the company would perform at an oil price that’s about 15% below the current price. As shown earlier in this article, the average realized oil price in the first nine months of the year was just $66.50 per barrel.

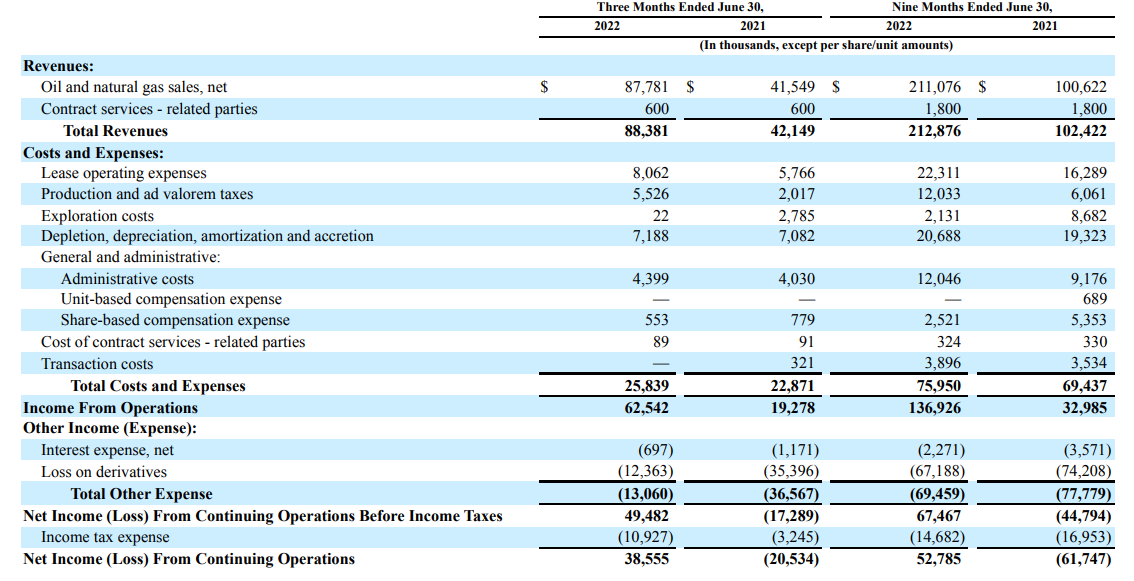

REPX Investor Relations

The total revenue in the first nine months of the year exceeded $210M and Riley reported a net income of approximately $53M for an EPS of approximately $2.70. Keep in mind this also included approximately $7M in unrealized losses on the hedge book, so the normalized net income would be even higher (closer to $3/share). Also, keep in mind this includes a $14.7M tax allowance although Riley didn’t have to pay corporate taxes – yet. This will change in the near future, so for now, I will keep the normalized tax payments in the equation. But at $66.50 oil, Riley was pretty much on its way to generate about $4/share in annualized earnings.

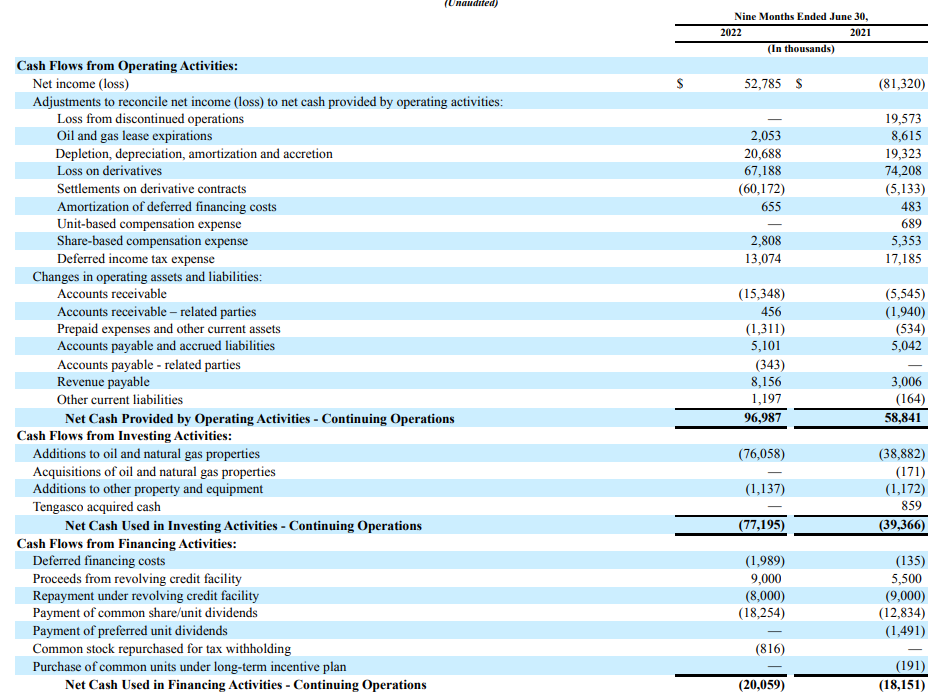

Looking at the reported cash flows, we see a similar result. The company reported an operating cash flow of $97M and after adjusting this for the working capital changes and after deducting the $13M in taxes due based on the 9M 2022 result, the adjusted operating cash flow was $87M and that’s approximately $120M on an annual basis.

REPX Investor Relations

Although the total capex exceeded $76M, it’s important to understand a large portion of this capex was related to growth. In February, I estimated the sustaining capex was approximately $36-40M and if I would increase this to $50M or even 60% to also account for the higher production profile, Riley would still be making approximately $60-70M in free cash flow per year, excluding investments in further growth. And a sustaining free cash flow result of $60M equals in excess of $3/share.

Investment Thesis

At an average oil price of $66.5 and a production rate of just under 10,000 boe/day, Riley is generating roughly $3/share in free cash flow. While that is already strong, there are two elements why one should perhaps expect the free cash flow to come in even higher. First of all, the growth investments will start to deliver. The company was guiding for a Q4 production rate of 11,100-11,600 boe/day, and the midpoint of that range is about 13% higher than the 9M 2022 production rate. The logical consequence is that – keeping all other parameters equal – the operating cash flow will be higher as well.

Secondly, the average realized natural gas price will increase as a gas processing facility expansion has been completed. During the Q3 conference call, REPX management disclosed the revenue from natural gas could double or triple.

Combine this with a strong balance sheet (the net debt is lower than $50M), a generous dividend policy of $0.31 per share per quarter and a PV10 value of $680M for the proved reserves (1P reserves) using $57.6 oil, and it is remarkable to see Riley trading at the current share price.

I have a long position, and I am adding more shares.

Be the first to comment