viper-zero

In a previous report, I had a look at which low-cost carriers might be worthy of investment. In that analysis I paid attention to various key metrics and parts of strategies that appeal to me as an investor. Next to that, I also explained why low-cost carriers might be positioned well in case the average traveler turns more cost conscious and other cost components for airlines remain inflated. In this report, I will have a look at which mainline airlines look attractive in my book.

Airline Bookings Are Under Pressure, Concerns On Global Economy

In a recent news item by Seeking Alpha it was highlighted that weekly data showed that airline bookings had come under pressure in August being 23.6% lower compared to 2019 and pricing was 0.1% lower. It’s not an immediately reason for concern as in 2019 there might have been a bump in bookings due to an approaching hurricane. That means that if there’s a suitable way to normalize for this, data could have shown that more moderate declines and at the same time in the comparable week in 2019 pricing might have been elevated due to the increase in travel demand for that week. So, while it’s hardly possible to make an apples-to-apples comparison because of the evolving nature and complexity of travel patterns and airlines operations, you could say that without a hurricane bookings and pricing would have been softer.

Airline Bookings Are Under Pressure, Concerns On Global Economy

However, I do believe that airline investing is not for the faint hearted. Surely, there are profits to be made but airlines are navigating an extremely tough environment at present. On the operations side, training and staffing has resulted in capacity recovery being somewhat slower than airlines initially desired. This sent fares up significantly as travel restrictions have started easing globally. This in turn was offset or partially offset by higher energy prices. So, there’s an extremely challenging environment with a web of interdependencies.

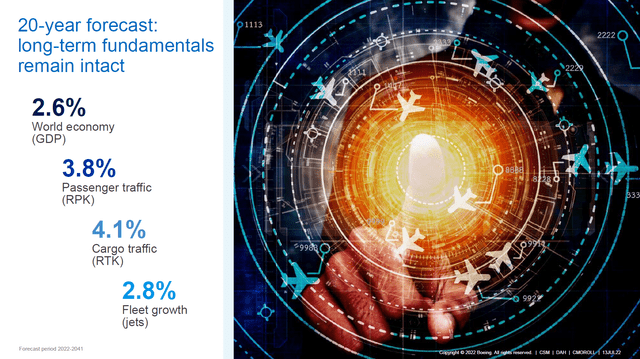

GDP growth and passenger traffic growth (The Boeing Company)

Next to that we have to watch the state of the global economy as well. The slide above is from Boeing’s 20-year forecast on GDP and traffic and fleet growth. Obviously a 20-year forecast figure does not tell you much about the near term. However, one thing to keep in mind is that at 2.6% annual GDP growth, the expectations for GDP growth have come down from forecasts of up to 3% in previous years. However, more interesting is the coupling between traffic growth and GDP growth. In previous years we saw that for each percent in GDP growth traffic would grow by 1.65%. Applying that to the 2.6% annual growth rate, we would see around 4.2% in traffic growth. The traffic growth has often been around 4.5% to 5% and so the current GDP outlooks really seems to be putting a damper on traffic growth, and for every percent in GDP growth, traffic is now only growing by 1.46%.

So, it’s that coupling that has weakened and could be a cause for concern. Obviously in the GDP numbers a lot of elements are packed. Think about supply chain issues, economic damages from lockdowns, inflation, and the current energy prices. That brings us to some elements that will cause doubt on financial performance for airlines.

First, as inflation has skyrocketed to more than 8% and there are inflationary cost pressures on staff and items like airport handling. That means higher costs for airlines, and with interest rates going up to battle that inflation, interest expenses also will grow for debt financing, a non-operational cost item for airlines. Then we have high oil prices, which are expected to account for 24% of the costs. This is similar to previous years but at a higher cost basis for fuel. So, overall costs have grown.

That brings us to the consumer side. Over the course of the pandemic, consumers had the possibility to save money. The government was actively supporting companies so employees could keep getting paid and money was stacking up since there was simply nothing open to spend the money on apart from online shops, which saw logistical challenges. So, as travel markets reopened everybody wanted to travel and since they stacked money for basically the past one or two years paying elevated prices to recommence traveling was the norm. So, the airline cost growth was captured by the premium that the traveler paid, and one can wonder whether that will remain the case. What we are seeing is that inflation is still very high and that also hurts the consumer. Whereas they might already have spent their money on more expensive trip, they are now confronted with day-to-day life having become more expensive. Prices at the gas station are still high and energy bills in Europe are skyrocketing. There are plenty of cases where the energy bill has doubled, and consumers can expect another levy at the end of the year that would triple the energy bill. What this means is that savings evaporate or the ability to save up declines and willingness to commit to those more expensive airfares might be on the decline.

I’m not saying that airlines are going to go belly up tomorrow, but changes in savings and for consumers might be providing less support to bookings and airfares in the future.

The opportunity for mainline airline stocks

Airbus A330 Delta Air Lines (Delta Air Lines)

Evolving ancillary products and low costs in the DNA of low-cost carriers is what makes them appealing in my view as consumers grow more cost sensitive. However, that does not mean that mainline carriers should fall out of grace. Mainline carriers had the opportunity during the pandemic to transform fleets and terminate the most fuel inefficient ones and some airlines did that better than others.

Additionally, mainline carriers still offer a level of service that low-cost carriers cannot match. That holds for the cabin comfort as well as the network. Mainline carriers offer the long-haul flights, which have yet to see most of the recovery materialize. So, there are opportunities there as well.

The list of US mainline carriers that part of this analysis are:

- Alaska Airlines (NYSE:ALK)

- American Airlines (AAL)

- Delta Air Lines (NYSE:DAL)

- Hawaiian Airlines (HA)

- United Airlines (UAL)

Which Airline Stock Has The Best Papers?

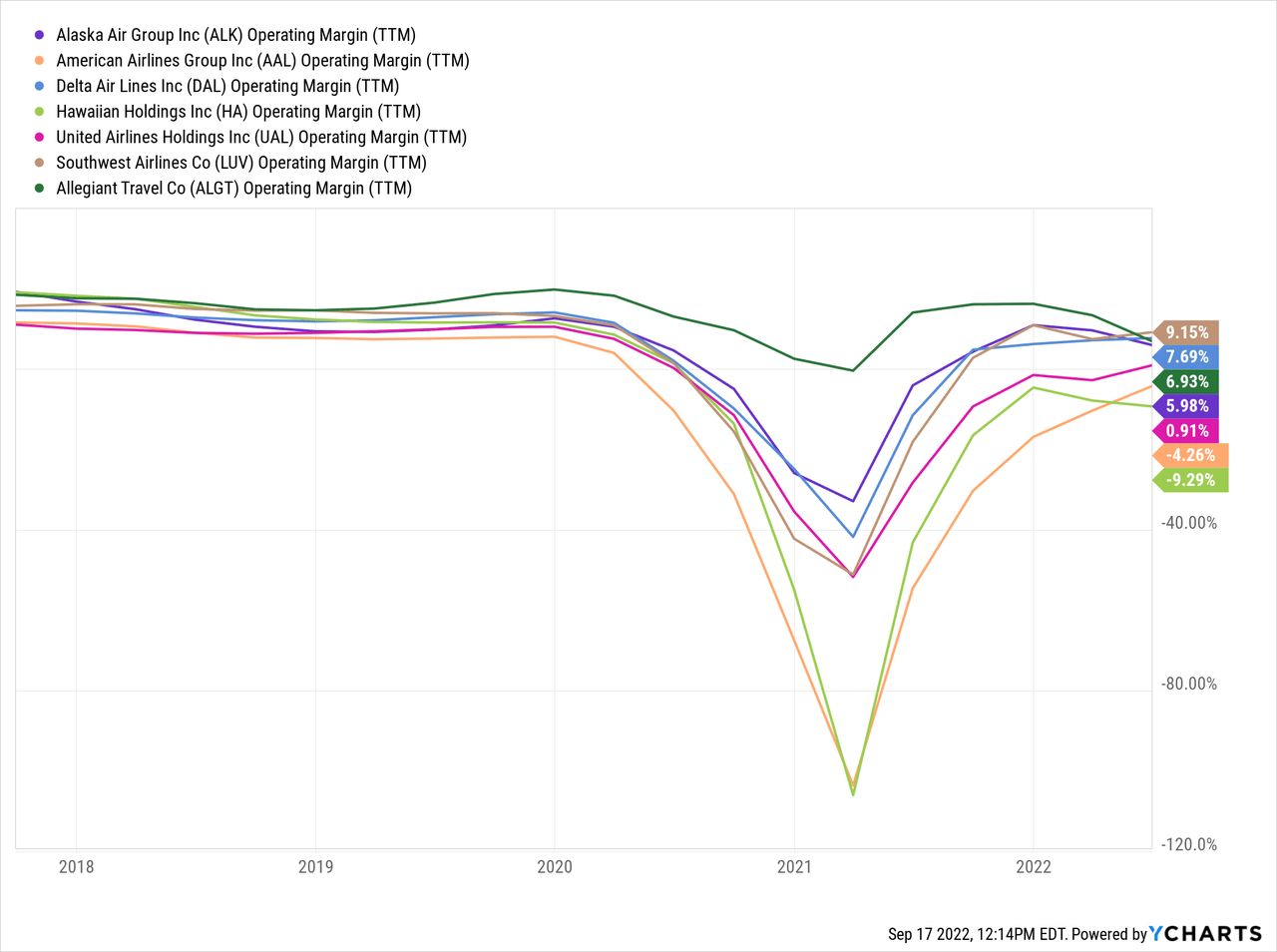

So, we are going to assess five mainline airlines on various metrics. The first of those metrics are the operating margins. It gives us insight in how profitable the airlines are now with past quarters experiencing unprecedented demand as well as pre-pandemic performance. Additionally, I will also be adding the two low-cost carriers from my previous analysis for comparison purposes.

Margins pretty much show the V-shaped recovery that we have heard much about during the pandemic, and this was most visible with Hawaiian Airlines and American Airlines. Prior to the pandemic the top three legacy carriers in terms of margins were as follows:

- Delta Air Lines

- Alaska Airlines

- Hawaiian Airlines

Interesting to note is that the low-cost carriers would rank #1 and #3 if we would include them in the overview. Does this say something about the strength of low-cost carriers or the strength of mainline carriers? While the Allegiant Air profit margins are simply phenomenal, I think this goes to say something about mainline carriers not doing quite as badly as one would think given that low-cost carriers have cost control as a business DNA. However, there is no denying that while mainline carriers do well with their margins it seems like low-cost carriers are able to squeeze out more of the lemon.

In the recovery phase, things look as follows:

- Delta Air Lines

- Alaska Airlines

- United Airlines

So, we see Delta Air Lines and Alaska Airlines leading the way once again. The company that is not in top 3 in the recovery phase is Hawaiian Airlines. This can be attributed to Hawaiian Airlines being a destination carrier and it highly depends on tourists from for instance Japan, which had a daily cap on inbound travellers. That is also affecting the airline’s ability to benefit from high demand to the same extent other carriers have been able to. Keeping the low-cost carriers in mind, they would occupy rank #1 and #3 once again. When it comes to operating margins, the low-cost carriers are superior, but mainline carriers such as Delta Air Lines and Alaska Airlines are really not far behind.

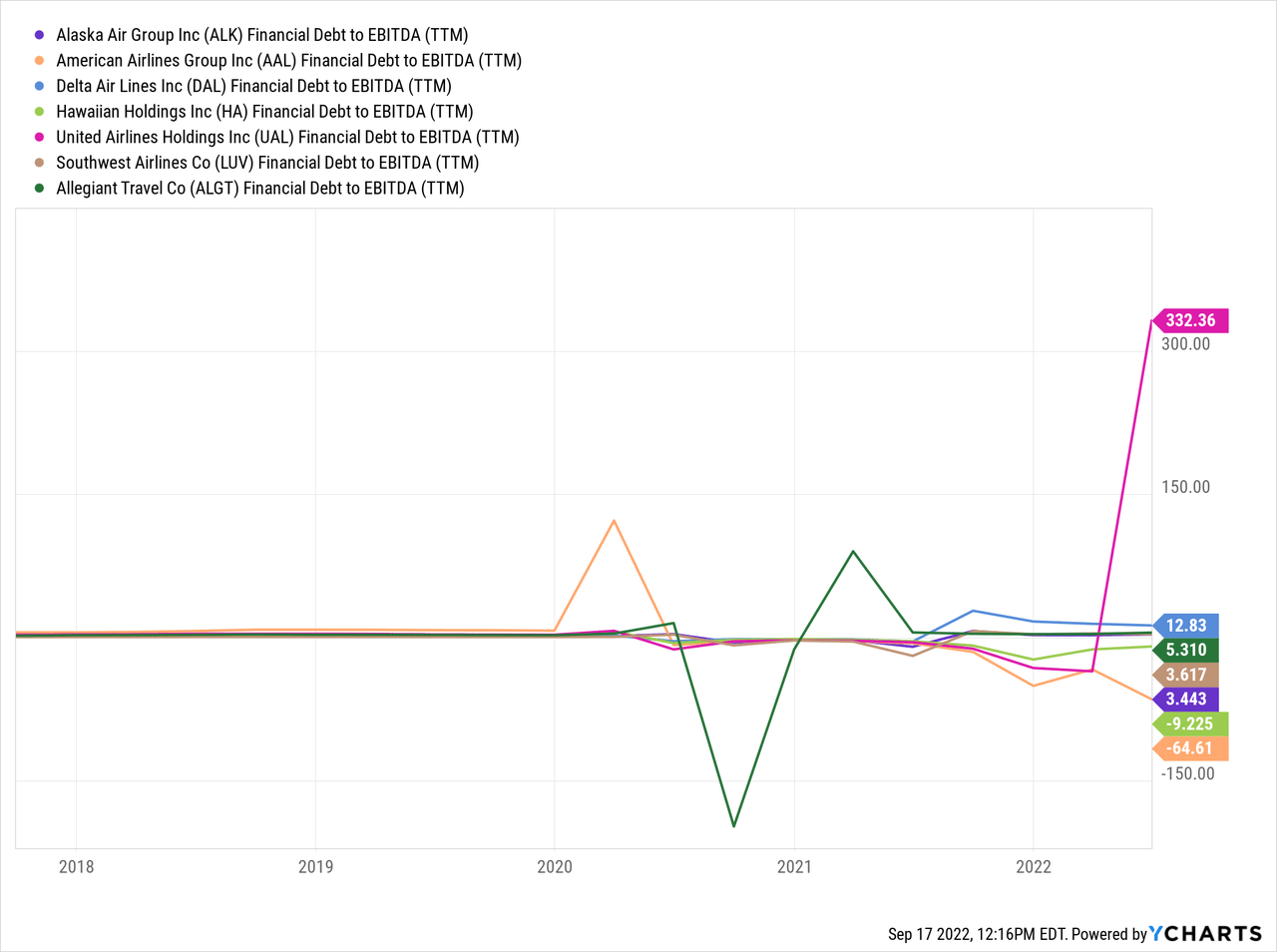

The next metric I find useful to look at is the debt-to-EBITDA. You could look at just the total debt levels, but that doesn’t take into account the scale of the airline. The debt-to-EBITDA tells us in an inverse way how much profit a company generates per unit debt or for the non-inversed metric how much debt a company has per unit earnings.

The five-year chart shows United Airlines stretching the y-axis driven by their low twelve-month trailing profits. In the pre-pandemic era, the top 3 of airlines (ranked from best to worse) are as follows:

- Alaska Airlines

- Delta Air Lines

- Hawaiian Airlines

Southwest Airlines would occupy rank #1 when low-cost carriers are included while Allegiant Travel Company would rank on spot 5. The airlines that would meet my debt-to-EBITDA multiple of up to 2x are Southwest Airlines (low-cost), Alaska Airlines, Delta Airlines and Hawaiian Airlines.

In the recovery phase things look as follows:

- Alaska Airlines

- Delta Air Lines

- United Airlines

In the recovery phase, unsurprisingly no airline makes the cut when it comes to a maximum debt-to-EBITDA of 2x and preferably <1. More importantly, American Airlines and Hawaiian Airlines have negative ratios and low-cost carriers would occupy rank #2 and #3.

The next thing I want to have a look at is the credit rating:

|

Airline |

Fitch rating |

|

Delta Air Lines |

BB+ (Negative) |

|

United Airlines |

B+ (Negative) |

|

American Airlines |

B- (Stable) |

|

Hawaiian Airlines |

B- (Stable) |

|

Southwest Airlines |

BBB+ (Negative) |

|

Allegiant Travel Company |

BB- (Stable) |

None of the mainline carriers in the list have an investment grade rating at present and Southwest Airlines is the only carrier in the list with an investment grade rating. With a BB+ rating, Delta Air Lines has the best rating of the mainline carriers.

If we consider the metrics, there are two airlines that consistently make it to the list. Those airlines are Delta Air Lines and Alaska Airlines. That might not be extremely surprising as these two airlines were managed well prior to the pandemic and Delta Air Lines is coined the template airline when it comes to strategy and brand loyalty even by its competitors.

A Winning Airline Strategy Or Not?

Alaska Airlines Boeing 737 (Alaska Airlines)

So, Delta Air Lines and Alaska Airlines come out on top in the comparisons made but I would also like to address the opportunities, strengths, and weaknesses of the airlines.

When I still had appetite for investing in airline names, which is roughly five years ago already, Delta Air Lines was one of the airlines I really liked. The company has a phenomenal fleet strategy where it doesn’t just buy the newest aircraft but looks at which aircraft fits them from cost perspectives and opens up opportunities in other areas such as maintenance. The recent purchase of the Boeing 737 MAX 10 is just one out of many examples on how the airline is strengthening its business in a cost-efficient manner.

Alaska Airlines is another airline that I quite like also because of its fleet strategy. During the summer Alaska Airlines lost some credit with its travelers as pilot shortages resulted in a schedule meltdown, but overall Alaska Airlines has a strong brand and is insulated from any travel restriction on the other end of the oceans.

United Airlines is a relative odd company I would say. When demand picked up, the company blasted a pitch for investment in airline stocks rather than highlighting any points in which they truly excel. The company has a significant number of single aisle jets on order, but also needs to make some steps on its wide body fleet and as a result the company could lower fuel costs but also might have increase debt to finance those planes. So, United Airlines is not an airline I favor given the decisions ahead and their already stretched financials.

American Airlines is mostly known as a debt-laden company and that is also why you don’t see it in the top three a single time. However, that does not do just to the way the company has been transforming its business and the company has attracted debt to renew its fleet, which means that unlike United Airlines the company is not in a position where it should pile up even more debt in the coming years. Instead, the company is aiming to reduce its debt to $15 billion by 2025.

Hawaiian Airlines is I mention a couple of times before highly depends on bringing in tourists, but I don’t see any strategic strength itself. The company has a geographical advantage that it capitalizes on.

Conclusion: A Lot To Like, A Lot To Fear For Airline Stocks

While I highlighted low-cost carrier strengths in a previous report. I also see opportunities for mainline carriers, the primary reason for that is the long-haul recovery that has yet to materialize. Delta Air Lines is one of the companies that consistently makes it to the top of the lists, and I am very much impressed with their management style for years. The other airline that makes it to the top of the lists is Alaska Airlines. That airline has no long-haul exposure. Depending on how you view it, you might consider it a safe bet on North American travel demand or an airline stock lacking the upside unlocked by long-haul demand.

Either way, Delta Air Lines has around 55% upside according to Wall Street analysts while Alaska Airlines has at least 45% upside. In comparison, Wall Street has put price targets for Southwest Airlines 48% higher than today’s price and 65% for Allegiant Travel Company. So, the current ratings do not prefer one over the other and that is understandable given that each airline or airline type comes with its different pressures and opportunities.

United Airlines is a company that seemed to be focused on the wrong thing, stock prices instead of laying out a path to sustained profits and debt reduction. Debt reduction is an area where American Airlines actually did excel. Wall Street analysts only see 27% upside for the company with a hold rating while Seeking Alpha contributors are a lot more upbeat with a Buy rating on the name. American Airlines did not make it to the top of the list, but I would give this one an honorable mention as a highly speculative buy on their debt reduction effort.

Investors, however, should also be aware that while some airlines have superior financial metrics and strategies, the current inflationary landscape does provide some risk to the translation of winning strategies into shareholder value.

Be the first to comment