Bet_Noire

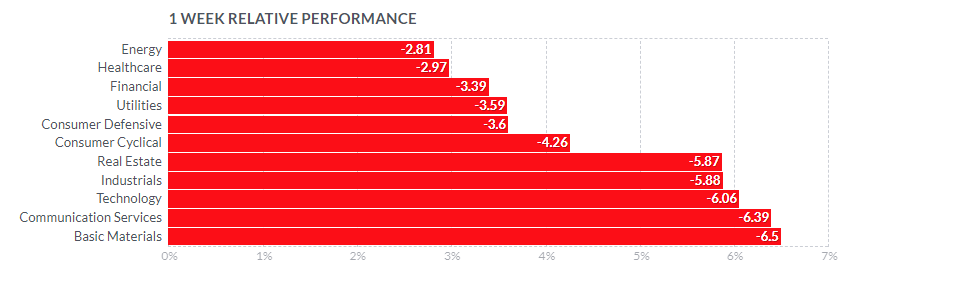

Stocks suffered one of their worst weekly performances since June, following a Consumer Price Index report that raised doubts for the consensus about whether the rate of inflation has peaked. A better-than-expected report for producer prices did nothing to assuage this concern. As a result, 2-year Treasury yields rose to a new high on the year of 3.85%, while the 10-year is closing in on its June peak of 3.5%.

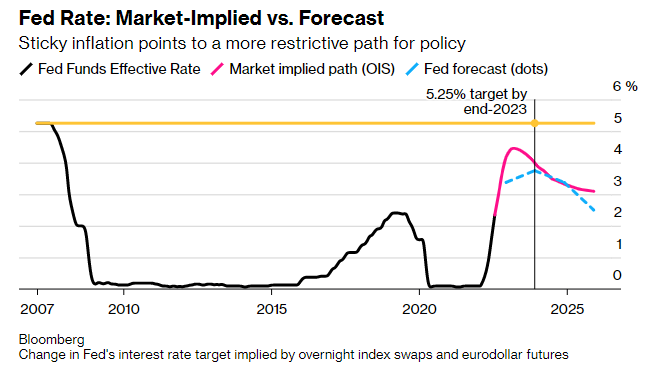

The bond market is anticipating a more aggressive monetary policy response from the Federal Reserve to bring down the rate of inflation, which is also reviving recession fears. A disappointing earnings preannouncement from FedEx (FDX) on Friday further fueled the flames of pessimism after the company withdrew guidance for the remainder of the year, due to slowing global growth. Another 75-basis-point rate increase is a given on Wednesday when the Fed concludes its policy meeting, but market performance will be dictated by the revised guidance for future rate increases and what Chairman Powell says during his press conference that follows.

Finviz

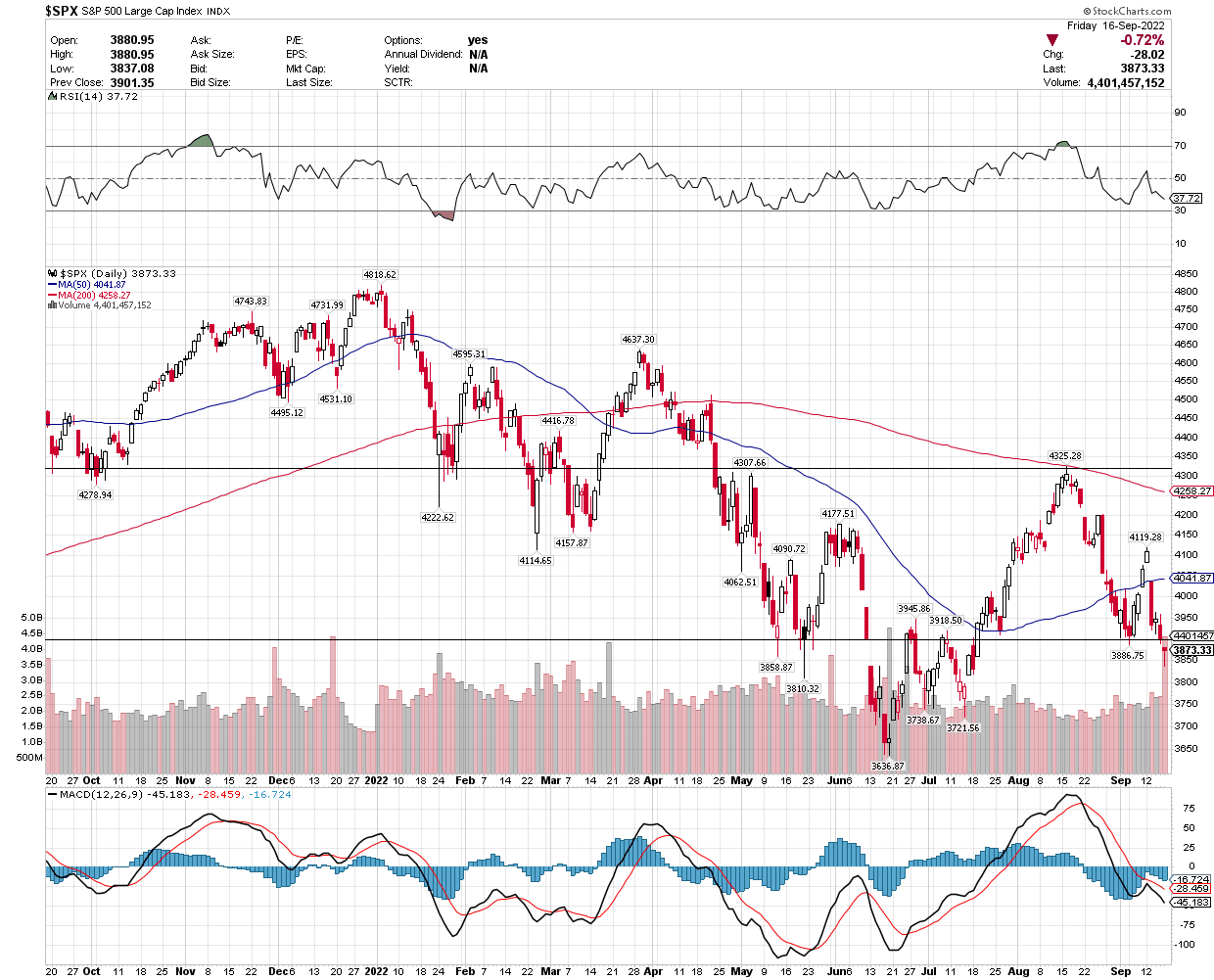

Last week’s sharp increase in interest rates weighed heavily on stock prices, resulting in the S&P 500 breaking below its near-term support level of 3,900. That opens the technical door for a retest of the June low at 3,666, as investors now see the Fed increasing short-term rates as high as 4.5% in 2023, with some outside wagers speculating that it could peak as high as 5%. This is well above the Fed’s current forecast, so the revised guidance will be key. The market’s recent performance has not changed my view that peak rate of inflation is behind us, and it will fall rapidly over the coming 12 months. As such, I still think the Fed will end its rate-hike campaign before year end and well ahead of consensus expectations. This should provide support to the S&P 500 above its June low.

Bloomberg

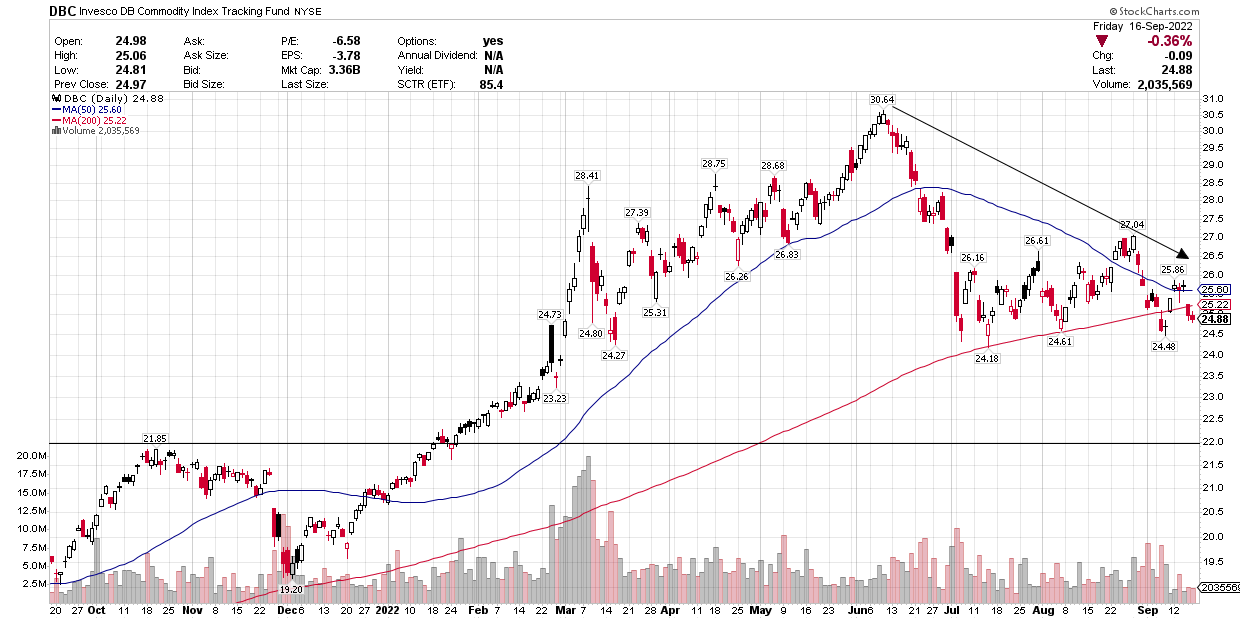

In my view, investors have been making forward-looking investment decisions by selling risk assets based on the most backward looking of indicators, which is the rate of inflation. Yes, the current rate is near a 40-year high on a year-over-year basis, but when we annualize the 3-month and 6-month rates, it is falling. Soon the year-over-year rate will be falling, just as the basket of commodity prices (Invesco DB Commodity Index) has been falling in price since June and nearing a price point where the annualized rate of increase will be zero.

Stockcharts

Additionally, the housing market is slowing rapidly, with mortgage applications collapsing to pandemic-low levels, while home price appreciation has abruptly stalled. This is the result of the doubling of mortgage rates to 6%. Rents may still be rising, but they trail the change in home prices by approximately one year, so we know the rate of increase will slow substantially by next summer.

Chairman Powell is no fool. He is well aware that the price declines building in the pipeline will take several months to start showing up in the annualized rate of inflation. He also knows that outside of the housing market his rate increases to date have yet to work their way through the economy. Lastly, he has won the war on inflation expectations, as they are collapsing over multiple time frames to his 2% target. His hawkish rhetoric is designed to keep expectations anchored and limit any enthusiasm for risk assets that may fuel a wealth effect, while tighter financial conditions slow growth and tame inflation. I think a Fed funds rate of 3% this week is sufficient to accomplish that goal, but Powell may want an additional 50 basis points in November as an insurance policy that the Fed’s goal will be met in 2023.

Bloomberg

For these reasons, I expect he will be more balanced in his assessment of the economy, inflation, and forward guidance on Wednesday. The steep pullback in stock prices leading up to this week’s meeting increases those odds. During the fourth quarter there should be more convincing evidence that the rate of economic growth has slowed and inflation is falling, which should reverse the inversion of short-term and long-term interest rates, as well as reduce rate hike expectations.

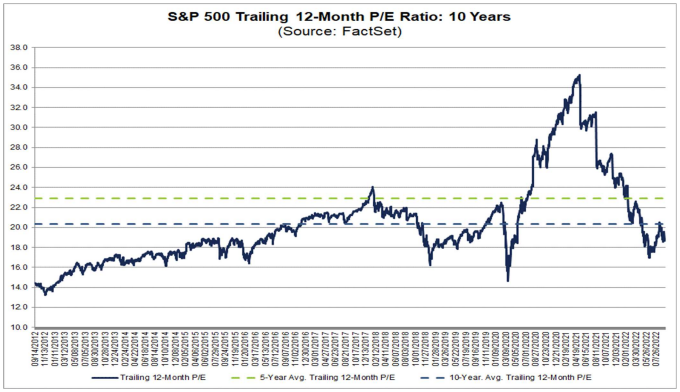

Still, the stock market is likely to remain volatile leading up to the mid-term election on November 8, as September is the worst performing month of the year on a historical basis. October will bring third-quarter earnings, which will be scrutinized for any weaknesses in profit margins and earnings growth. Valuations have fallen below their 5- and 10-year averages, but questions remain about the reliability of guidance so long as the rate of inflation remains elevated and the Fed is tightening monetary policy.

FactSet

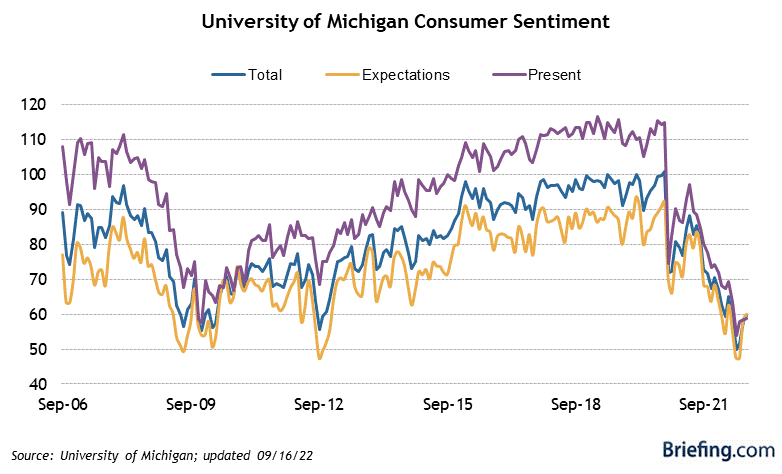

While the bears may have the stage in the short term, so long as the market’s momentum is to the downside, consumer and investor sentiment remain at abysmal levels, which is far more consistent with a bottoming process for the stock market than a top.

Briefing.com

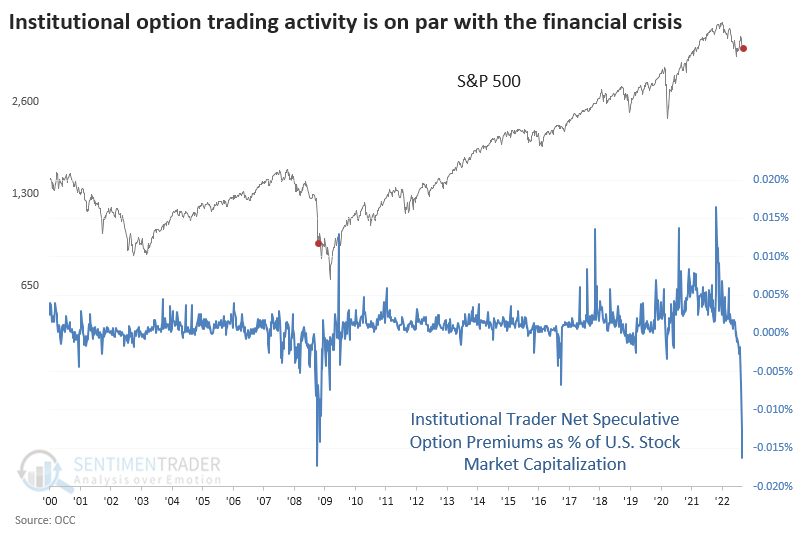

While Wall Street strategists are climbing over one another to make bearish predictions, investor positioning is also more consistent with a bottoming process than a top.

Yahoo Finance

The current economic cycle is unlike any we have seen before in that it has absorbed the impact of a pandemic, followed by a war, leading to an unprecedented combination of monetary and fiscal stimulus. This combination of headwinds and tailwinds has distorted the incoming economic data for months. As the impacts of the pandemic, the war in Ukraine, and the fiscal stimulus that followed wane, the rate of inflation should fall as fast as it rose. Monetary policy is normalizing at the same time. Provided the Fed does not overreact today in the same manner that it underreacted 18 months ago, the expansion should continue and market prices should stabilize. A lot rests on Chairman Powell’s leadership moving forward.

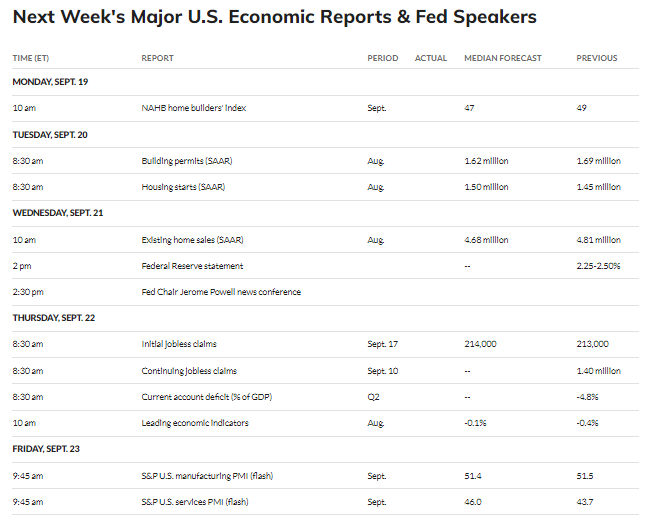

Economic Data

We have a lot of housing data this week, which will not be pretty, but that should give the Fed pause in its outlook for rates. Wednesday’s rate decision and Chairman Powell’s press conference that follows will be the event of the week. I will also be looking closely at S&P Global’s flash PMIs for September on Friday.

MarketWatch

Technical Picture

I thought the S&P 500 would hold support at 3,900, but it did not. That puts the June low in play, unless it is able to retake the 3,900 level. Everything in the short term depends on Wednesday’s Fed meeting.

Stockcharts

Be the first to comment