mbonaparte/iStock via Getty Images

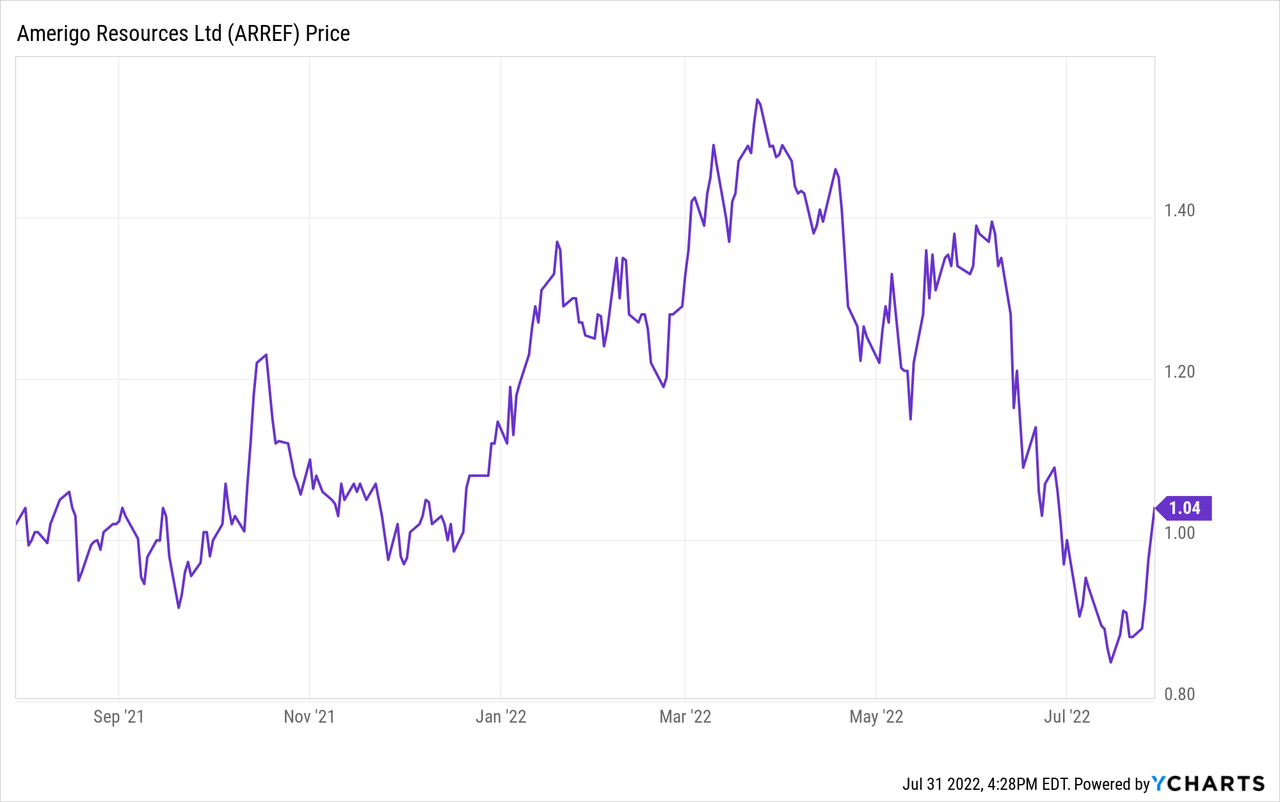

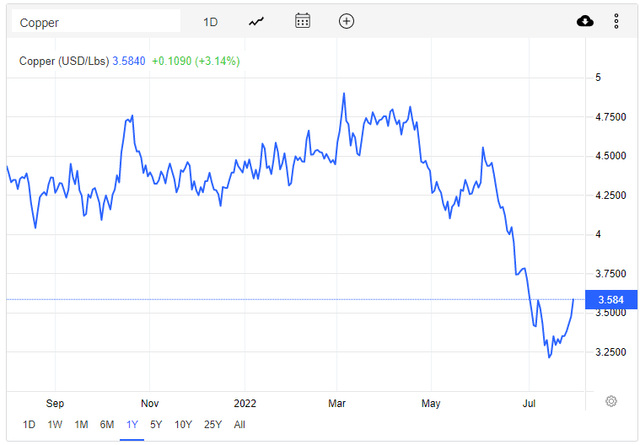

Amerigo Resources (ARG:CA, OTCQX:ARREF), the Canadian company that produces copper from Codelco’s tailings in Chile, was not immune to the selloff that engulfed copper stocks in recent months. Even though the lower copper price will mechanically reduce earnings for Q3, and possibly the rest of 2022, I see no change to Amerigo’s favorable long-term prospects.

I view the company, whose strategy has pivoted towards shareholder returns in the past few quarters, as an income stock. The regular quarterly dividend of C$0.03 represents a yield of 9%, at the current share price of C$1.30 on the TSX or US$1.04 OTC in the US. While a sizable special dividend at year-end is looking increasingly unlikely, I expect the regular dividend to be maintained in the coming quarters.

Of course, there’s a caveat: there’s no such thing as a safe dividend in the field of natural resources. But one thing is for sure, management is committed to return as much as possible to shareholders, and, if one shares a bullish view of copper in the coming years, Amerigo is certainly a good stock to own.

Copper Price And Share Price Under Pressure

The price action in Amerigo was not pretty in June and July, despite a bounce in the past week. Unsurprisingly, the stock moved in tandem with the price of copper, which felt the impact of recession fears:

Steady Operational Performance

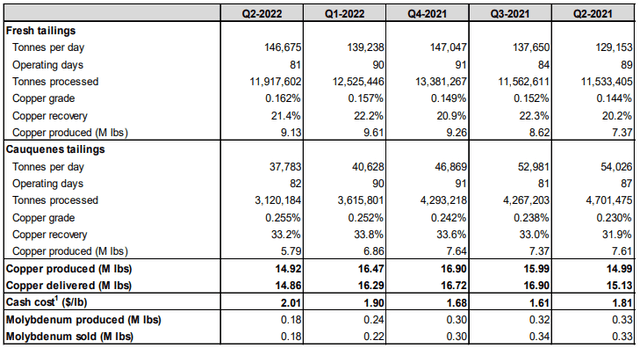

There is nothing wrong with the parameters that the company can control. Production volumes in Q2 were lower than in previous quarters, but this was due to the scheduled annual maintenance shutdown. In fact, Amerigo raised its annual production guidance for copper by 3%.

Source: Amerigo Resources Q2-2022 production press release

At $2.01/lb, the unit cash cost in Q2 is seen to be higher than normal, but this is just the consequence of lower production volumes. According to the press release, cash cost should remain on target for the full year.

Importantly, the company’s quarterly copper price in Q2 was $4.10/lb, compared to $4.64/lb in Q1. This will have a material impact on the quarterly results that will be release on August 3rd (which will also include a downward adjustment to Q1 revenue). Let us now see in more detail what this means for Amerigo’s ability to cover its dividend.

Amerigo’s Dividend Coverage: Regular Dividend Covered For Now, Special Dividend At Risk

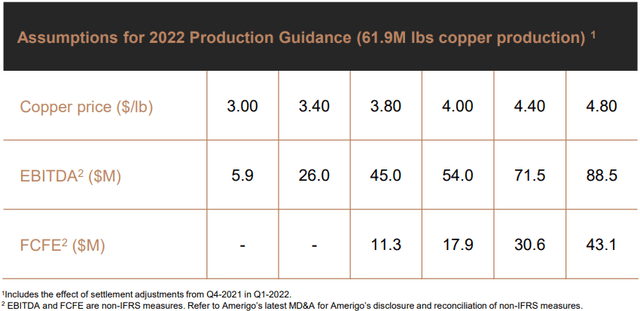

To get a better idea of the impact of the copper price on Amerigo’s financial performance, let’s consider the sensitivity analysis below, provided by the company in its corporate presentation:

Source: Amerigo Resources corporate presentation

First, it’s clear that the company has a high leverage to the copper price, even though the sliding scale royalty agreement with Coldelco puts some limits on the downside and upside.

Then, it’s important to note that the amount of FCFE (Free Cash Flow To Equity, that is, the FCF that’s available for shareholders returns after debt repayments) needed to cover the current dividend rate is $16M per year. Based on the table above, a price of $4/lb is required to sustain this level of distribution.

While this is true in the long run, Amerigo’s balance sheet is now strong enough to maintain the dividend for several quarters without putting debt repayments at risk. For the remainder of 2022, there’s no risk in my opinion: the free cash flow generated in Q1 ’22 alone ($17.9M) is enough to cover the yearly distributions.

However, it is increasingly likely that there won’t be a juicy special dividend later this year. This “Performance Dividend” has been mentioned by management and it looked in the cards at copper prices in excess of $4.2/lb. I now expect a more cautious approach in this respect – let’s see what management has to say about this during the Q2 earnings call on August 4th.

Longer-term, the $4/lb copper price required by Amerigo to sustain the C$0.12/year (C$0.03/quarter) distributions looks realistic, if one believes, like this author, in the macro trends underpinning the copper market. A recent article from Mining.com shows why a copper crunch is likely, and should support higher prices in the coming years, even if headwinds such as a recession can have a short-term impact.

To conclude on this section, let’s mention management’s approach to the dividend, which to me looks like a commitment to the C$0.03 quarterly distribution:

We continue to see strong market fundamentals supporting copper prices and have a robust balance sheet designed to weather market volatility while protecting the regular quarterly dividend of Cdn$0.03 per share. We are monitoring market conditions to determine the optimum time to trigger additional performance dividends as part of our return of capital to shareholders.”

Source: company’s Q1-2022 earnings call

Chilean Politics

Finally, a word on Chilean politics. Back in December, I dedicated an article to this topic and the potential impacts on Amerigo: Little To Fear From Chile’s New Government.

At this juncture, everything points to a business as usual future for the company. A new constitution has been prepared, and it will go to referendum on September 4th for approval or rejection. Even if it is approved, which is far from certain based on local sentiment, there is nothing of concern to Amerigo. Radical provisions regarding the nationalization of mining companies were removed – in fact, only a few environmental restrictions were included. This is an area where Amerigo has little to fear given the nature of its operations:

Regarding the redrafting of the Chilean constitution, we do not have mining concessions, but rather receive tailings from Codelco. Codelco is Chile’s national copper company. We are providing Chile with additional copper production, which would otherwise be lost, while at the same time, providing local jobs and repositioning environmental liabilities. And with regards to nationalization of copper assets in Chile, this also poses no threat to Amerigo.

Source: company’s Q1-2022 earnings call

Takeaway

Again, natural resource stocks have limitations as regular dividend payers, but I am confident that Amerigo will keep rewarding shareholders handsomely over the coming years. The regular dividend, and potential performance dividends and share buybacks (Amerigo has recently completed one such buyback program) should be in the cards if copper trades where the fundamentals suggest it should.

Be the first to comment