MarioGuti

Investment Thesis

First Solar, Inc. (NASDAQ:FSLR) is negatively affected by the global headwinds of inflation and the armed conflict in Ukraine that disrupt supply chains and accentuate an already rising global inflation.

In the long run, it is expected to benefit massively from the headwind brought about by rising global demands for clean and renewal energy sources like Solar Energy. As these headwinds are supported by government initiatives, they are likely to persist for a long time.

In spite of FSLR being a beneficiary of these headwinds due to the demand for renewable energy, the company’s larger competitors are expected to benefit as well, making these competitors more favorable as investment options compared to FSLR.

Moreover, a specific part of the “Inflation Reduction Act” that FSLR is widely expected to benefit from may not even be implemented into law eventually given the common occurrence of gridlock in the U.S. government.

As such, investors should adopt a wait-and-see approach to observe whether FSLY will benefit more from these tailwinds compared to its larger competitors.

Company Overview

According to the latest annual report 2021, FSLR provides photovoltaic (“PV”) solar energy solutions in the international markets of the U.S., India, Europe, and Japan. The company designs, manufactures, and sells cadmium telluride solar modules to harness sunlight into electricity.

It faces competitors from other bigger players like Enphase Energy, Inc. (ENPH), and SolarEdge Technologies, Inc. (SEDG) by market capitalization.

Quarterly Earnings Summary

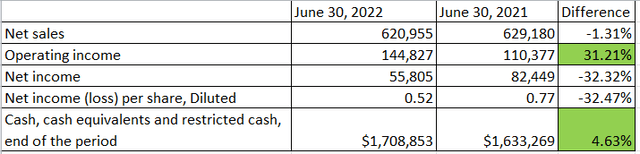

These are some of the key financial results from the company’s latest quarterly report:

Q2 Quarterly Results 2022 (Company 10Q)

From the figures tabulated:

- The headwind of inflation, supply chain disruptions, and geopolitical conflict has affected the company’s financial profile. Most of the top and bottom line items have clearly taken a beating significantly compared to one year ago.

- The operating income increased significantly due to “increased module sales volume” and the sale of some of the Company’s assets.

- The sale of the Japan project development platform has benefitted the company’s cash profile on its balance sheet.

Short-Term Headwinds

The macroeconomic headwinds of inflation and supply chain have affected almost all industries, including the green “Solar Energy” market. FSLR is one of those companies significantly affected.

The rising cost of components, labor, and shipping due to the global recovery from the pandemic has put a strain on FSLR’s margins.

The cost of renewable energy like Solar has declined over the last decade, which causes a huge surge in demand benefitting solar companies like FSLR. As this article pointed out:

” In 2010, the price of one megawatt hour (MWh) – a weighted average cost of electricity – of solar electricity was $378, which fell to $68/MWh in 2019 – a more than five-fold decrease in the cost of solar energy. “

But the recent pandemic and Ukraine conflict has threatened to reverse these cost declines:

“These kinds of market disruptions during the COVID-19 pandemic have worsened since the Russian invasion of Ukraine, reversing a decade of cost declines for the renewable energy sector.”

With the anticipation that inflation might have peaked, there are reasons to believe that the light at the end of the tunnel of these market headwinds appears to be visible for the company now.

Long-term Tailwinds

FSLR is a benefactor in the long-term global movement for clean energy sources and the adoption of renewable energy. This global movement is not new and started even before the advent of rising inflation and the conflict in Ukraine.

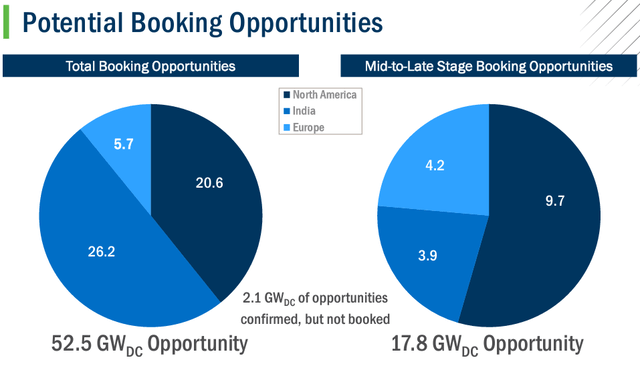

As a result of rising oil prices, the European Union proposes new legislation to adopt renewable energy sources for 40% of its power needs by 2030. The United States also has a political interest to reduce the reliance on authoritarian states including Russian oil and natural gases. In Q1 2022, India already increased its installation of rooftop solar panels by 21 percent.

From the latest 2022 Q1 earnings call presentation, we understand that FSLR’s total booking opportunities for solar capacity installations are dominated by the U.S., Europe, and the Indian market. As mentioned, these regions enjoy government support in implementing renewable energy solutions like Solar.

Potential Booking Opportunities (2022 Q1 earnings call presentation)

This suggests the company will be able to benefit greatly from these global long-term tailwinds. Indeed, FSLR is widely speculated to be one of the biggest beneficiaries of the Inflation Reduction Act.

According to this article, the management is already planning to take advantage of the anticipated tax credits allocated by the bill:

“Separately, CEO Mark Widmar said on First Solar’s earnings conference call that the company would consider expanding its manufacturing operations in the U.S. if the proposed legislation becomes law.”

Financial Comparison With Peers

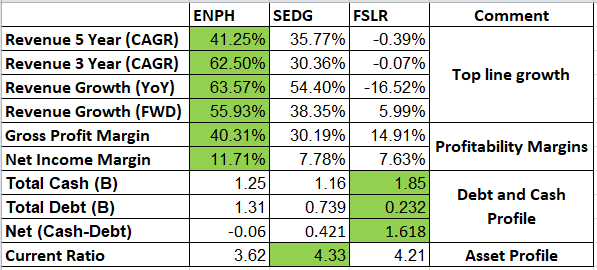

We indicated in the Company Overview section that FSLR competes with larger players like ENPH and SEDG. Let’s take a look at how the company’s financial profile fares with respect to these peer companies using figures taken from Seeking Alpha.

Key Financial Figures (Seeking Alpha)

From this table, we can observe that:

- FSLR’s top-line revenue is largely stagnant or even declining slightly in a long-term perspective over the last 3 and 5 years.

- As we drill down to the bottom line items of gross and net income margins, it is positive but significantly lower than its other 2 peers in the comparison list.

- One silver lining is that FSLR is operating in a net cash position of 1.6B, which is the highest in the comparison list. This is a positive contrast to the largest player of ENPH which is operating with a net debt financial position.

- Looking at the current ratio, the company appears to have a respectable amount of assets which is comparable to the 2nd largest player of SEDG, but still lower than the largest player of ENPH.

Overall, in my opinion, FSLR appears to be an underdog in the industry that is nimble in cash management but has not risen above its competitors in growth.

Valuation

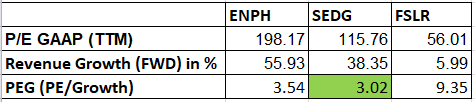

We will compare the valuations of FSLR with respect to its other peers in the industry using data from Seeking Alpha cited earlier.

Valuation Figures (Seeking Alpha)

I consider a PEG greater than 1.5 to be overvalued. From this understanding, all 3 peers in the comparison list are generally overvalued. However, FSLR is observed to be very overvalued compared to its peers.

Investment Risks

From a source cited earlier, the stock price of FSLR “soars 36% in three-day rally as ‘biggest beneficiary’ of climate bill,” referring to the new “Inflation Reduction Act” being proposed. This bill is not currently written in law yet and may face some significant resistance from opposing Republican lawmakers as noted by this article:

“While Republicans are expected to line up en masse against the proposal, the bill has gained the support of former Treasury Secretary Larry Summers, who notably predicted the Biden administration’s post-pandemic stimulus efforts would stoke inflation.”

As political gridlock is common in the United States, government, investors should be mindful that there is a significant chance that this favorable law for FSLR might not materialize eventually.

Conclusion And Key Takeaway

Financially, I perceived FSLR to be an underdog by revenue and income, but it has the advantage of being asset-rich and nimble in cash management compared to its larger peers.

It is expected to benefit from the Inflation Reduction Act only if the proposed legislation becomes law eventually. Assuming the proposed legislation fails to be finalized in law, the current status quo of FSLR’s competitive profile suggests investors are more likely to benefit from investing in ENPH or SEDG.

FSLR is also very overvalued with respect to its peers. In my opinion, even if the Inflation Reduction Act is successfully implemented by the U.S. government, the larger peers of ENPH and SEDG are likely to benefit as well.

Investors should observe closely whether FSLR is able to reap the anticipated benefits more than its larger peers and make an informed investment decision based on this outcome.

Be the first to comment