wellesenterprises/iStock Editorial via Getty Images

American Express Company (NYSE:AXP) faces macroeconomic headwinds and expensive competition. But it remains on solid footing with stable revenues and margins. Its popularity, franchising opportunities, and adherence to digital transformation help it navigate the market landscape. Even better, it has adequate cash levels, although borrowings spiked amidst interest rate hikes. Overall, AXP has sound fundamentals, allowing it to cover borrowings and dividends. Yields are still reasonable but lower than the S&P 500 (SP500) average. Meanwhile, the stock price is consistent with its fundamentals. Despite market pessimism, it remains an enticing and secure stock.

Company Performance

In the face of elevated prices, interests, and mortgages, American Express Company has to be more careful today. Near-term performance may see more macroeconomic headwinds. Even so, it appears prepared for these massive changes as it remains stable. In recent months, customer engagement and brand loyalty have risen, with an overall spending increase of 21%. Consumer spending has bounced back to pre-pandemic levels for the first time.

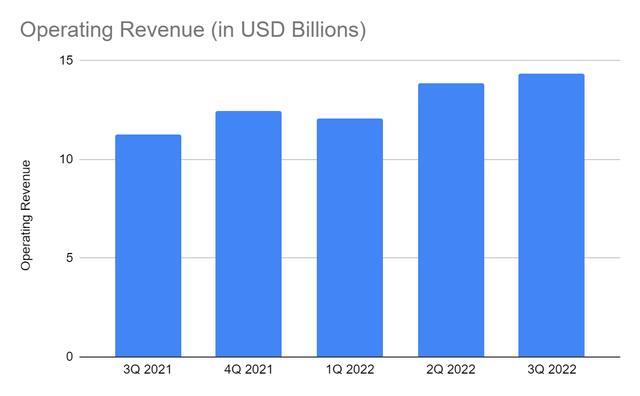

Its most recent operating revenue amounted to $14.35 billion, a 28% year-over-year growth. Both its non-interest and interest segments showed a notable increase. Discount revenue from its merchant fees remained its primary growth driver, up by 24%. Thanks to the solid growth across its business segments, especially travel and entertainment spending. Revenge travel has exceeded expectations, despite restrictions and skyrocketing fuel costs. Also in this segment, there was a 57% year-over-year spending increase in international markets.

Likewise, its interest segment showed an impeccable 47% growth rate. Interest rate hikes played a significant role, raising returns on loans and deposits. Even more important is the idea that consumer demand remained robust. It can be attributed to the weaker purchasing power, making credit cards a staple despite higher costs. Inflation continues to impact spending and budgeting. So credit cards are essential to make ends meet, especially during emergencies. We must also understand that inflation is more of a demand-pull than a cost-push. The unemployment rate is still far from 9.5% during the Great Recession. As such, we can say it is part of the economic rebound due to pent-up demand in the last year. Nevertheless, AXP must watch out for the potential recession to stabilize its core operations.

Operating Revenue (MarketWatch)

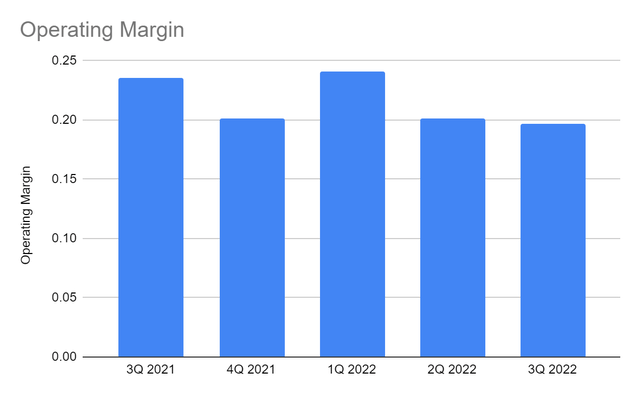

On the other hand, the operating expenses appear overwhelming at $11.54 billion, a 34% year-over-year increase. It can be attributed to higher costs of customer engagement, technology, and servicing. Raw materials for producing cards and compensation are also affected. Operating expenses had a higher increase, offsetting revenue growth. So, the operating margin dropped from 24% to 20%. Despite this, the fact that it remains viable in a larger capacity amidst macroeconomic pressures indicates stability and sustainability. It continues to generate returns as it expands its operations despite higher prices.

Operating Margin (MarketWatch)

Its increased demand is testament to a solid customer base. With a 1.2 million uptrend in new cards acquired, AXP can cater to more customers and work with merchants. This quarter, I expect its performance to be almost the same as in 3Q 2022. Leisure travel and food spending may be affected by Winter and holidays.

Risks, Opportunities, and Core Competencies

To weigh AXP’s potential performance in the following years, we have to assess risks and opportunities. We must also account for its core competencies and if it can withstand disruptions. Despite the solid performance, American Express Company must not be complacent. Increased spending may also be attributed to inflation cooling down to 7.7% recently. However, it remains way higher than pre-pandemic levels. Interest rates may keep increasing to 4.5-5% to stabilize the economy. Given the nature of its business, it is more vulnerable to risks associated with economic volatility. Its operations require high levels of capital that may lead to more borrowings. Also, it faces tight competition as cheaper alternatives flock to the market. Its peers may emulate its business strategy if they will be brave enough to incur higher expenses.

Nevertheless, there are more opportunities that can sustain its potential. The demand for travel this season remains high. A recent survey shows that 82% of Millennials and Gen Zs face strained budgets due to inflation. Yet, they will only change their itineraries as travel remains part of their holiday plans. Another survey shows 47% of Americans plan to travel during holidays despite rising prices. This Christmas, about 30% of Americans will travel, up from 27% in 2021. Likewise, there is an increase in New Year travel plans to 14% compared to 12% in 2021. Overall, American existing trip plans have already exceeded 2021 levels. These figures mean higher charges for travelers using credit cards. In turn, AXP may generate more returns this quarter.

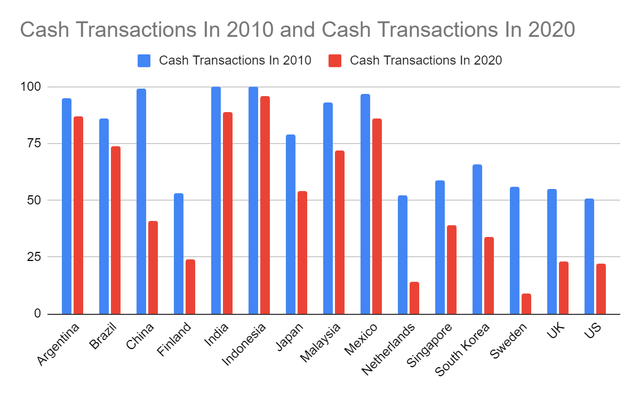

Moreover, the pandemic has changed the consumer spending landscape globally. Both in emerging and mature economies, people shifted to cashless transactions in 2020. In the U.S., cash transactions dropped to 22% in 2020. It opened more avenues for mobile wallets and credit cards to sustain their growth. Although it has already started in 2015-2018, the frequency of cashless transactions continues to increase.

Cash Transactions 2010 And 2020 (The Straits Times)

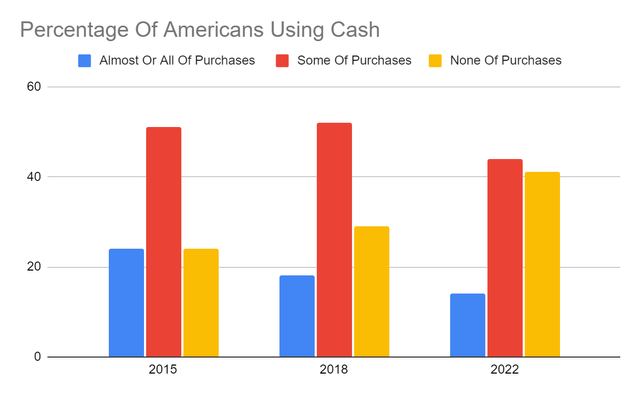

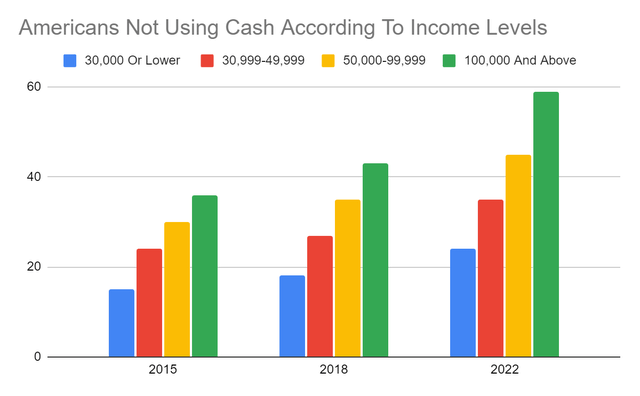

This year, 41% of Americans do not use cash in their purchases anymore. The majority of cash usage is divided between no purchases and some purchases. Moreover, the percentage of cash purchases has an inverse relationship with income levels. Over 50% of Americans with an income of $100,000 and above do not use cash for their transactions. But overall, the percentage of cash purchases have become lower across all income brackets.

Percentage Of Americans Using Cash (Pew Research Center)

Americans Not Using Cash According To Income Levels (Pew Research Center)

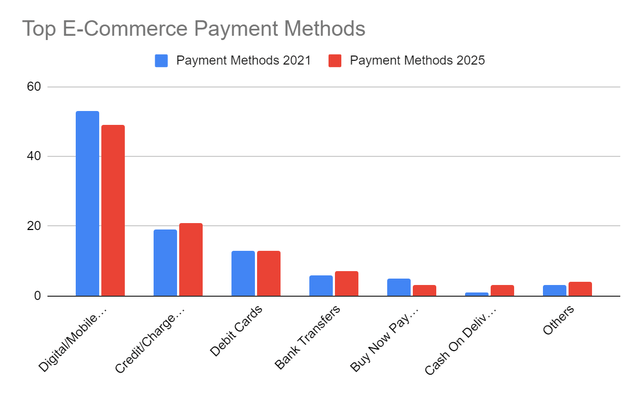

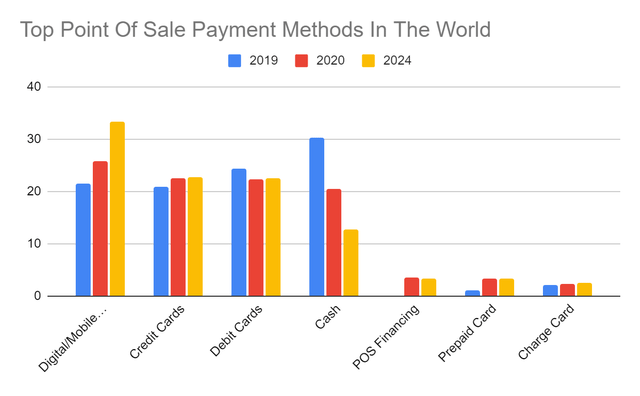

The rise in e-commerce is another growth catalyst for mobile wallets and cardholders. The U.S. ranks second in e-commerce, with over $800 billion in sales. As more and more businesses go online, mobile payments and credit cards become more of a staple. As of 2021, credit cards are the second most used e-commerce payment method, with 19%. Projections show it may increase to 21% in 2025. Note that more businesses speed up their digitalization of their financial transactions. One of its manifestations is the increased preference for cashless payments. Credit cards are the second most preferred point of sale payment method with 22.4% and may increase further in 2024.

Top E-Commerce Payment Methods (Statista)

Top POS Payment Methods Across The Globe (Statista)

After weighing risks and opportunities, we must assess how AXP can sustain its operating capacity. Clearly, AXP is still geared toward growth and expansion. What makes it a solid company is its capacity to withstand disruptions. Amidst the tight competition, AXP has a more solid customer base. It leverages its popularity and brand loyalty through rewards and partnerships. Competitors may emulate its business model. But what sets AXP apart is its capacity to incur higher costs. It has already proved its profitability despite higher costs, as shown by its stable margins.

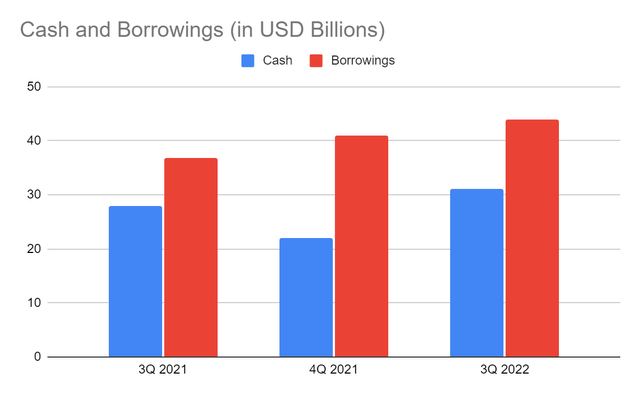

Another attribute to appreciate about is its stellar balance sheet. It has stable and increasing cash levels. Although borrowings are high amidst interest rate hikes, liquidity remains solid. Cash alone can cover all its accounts payable and short-term borrowings. Its percentage to total borrowings remains stable at over 70%. Even more, its Net Debt/EBITDA Ratio is only 1.5x.

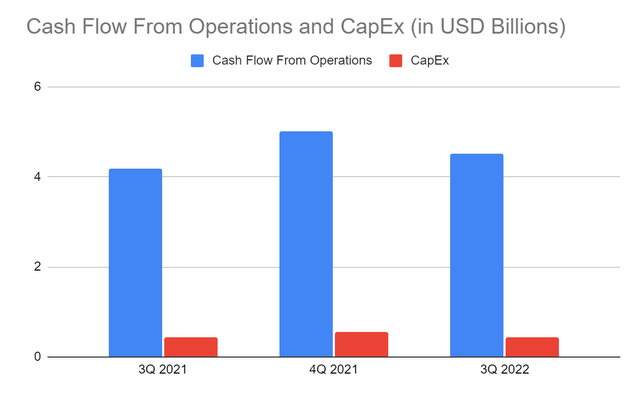

So, AXP generates enough income to cover borrowings. This is excellent for a capital-intensive business like American Express Company. It is proven by its cash inflows from operations that can cover CapEx, leading to impressive FCF. Its FCF/Sales Ratio is high at 28%, showing its capacity to turn revenues into cash. Hence, it has adequate means to cover outstanding borrowings, dividends, and sustain expansion.

Cash And Cash Equivalents And Borrowings (MarketWatch)

Cash Flow From Operations And CapEx (MarketWatch)

Stock Price Assessment

The stock price of American Express Company shows a recent uptrend following a continued decrease. It adheres to fundamental uptrends, although it has not regained the 2022 highs yet. At $156.8, AXP is still 5% lower than the 2022 starting price. It is trading at an earnings multiple of 16x. Its Price/Cash Flow adheres to the optimistic view.

With regards to dividends, payments have been consistent. It is one of the often overlooked dividend-paying stocks that promises secure returns, although it comes with a price. Also, it is still well-covered with a dividend payout ratio of 21%, so the risk of dividend cuts is very low. However, the dividend yield of 1.35% is lower than the S&P 500 (SP500) average of 1.82%.

FCFF $4,144,000,000

Cash $31,180,000,000

Borrowings $1,520,000,000

Perpetual Growth Rate 5%

WACC 9.2%

Common Shares Outstanding 747,232,696

Stock Price $166.8

Derived Value $171.74

The derived value confirms our supposition that the stock price is reasonable. There may be a 3-5% increase in the next 18 months. Yet, again, investors may consider cheaper alternatives if we look at the price metrics.

Bottom Line

American Express Company is a solid company as it maintains stable revenues and margins amidst inflationary headwinds. It has sound fundamentals that allow it to sustain its operating capacity. It is generating enough income to cover its financial leverage and dividends. Also, its stock price remains reasonable, although the upside potential appears low. The recommendation after assessing the risks and opportunities is that American Express Company is still a buy.

Be the first to comment