Tashatuvango/iStock via Getty Images

Investment Thesis

Devon Energy (NYSE:DVN) has subtly changed its shareholder strategy from a balanced dividend and share repurchase program to a company that is much more aggressively focused on a dividend payout strategy.

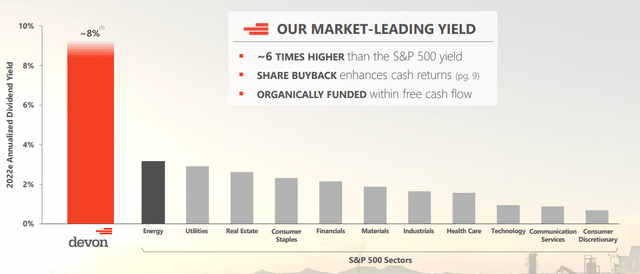

For my part, I believe that is the right focus. I believe that in the current environment, getting anything at a 6% yield or higher is extremely compelling. And close to an 8% yield is just wonderful.

As we look ahead to 2023, I continue to believe that too many investors are pricing in the negative consideration of the energy market. And insufficiently focused on global oil demand.

So, with all that in mind, let’s get to it.

There’s A Lot of Uncertainty

There’s a confluence of cross-currents facing the oil markets right now. The big worry facing investors is that there’s going to be a global economic recession that’s going to weigh down energy markets.

To that, I push back by stating that throughout the bulk of 2022, the oil market remained robust, even though China was largely in lockdown. With China now slowly reopening, there’s going to be a dramatic jump in demand.

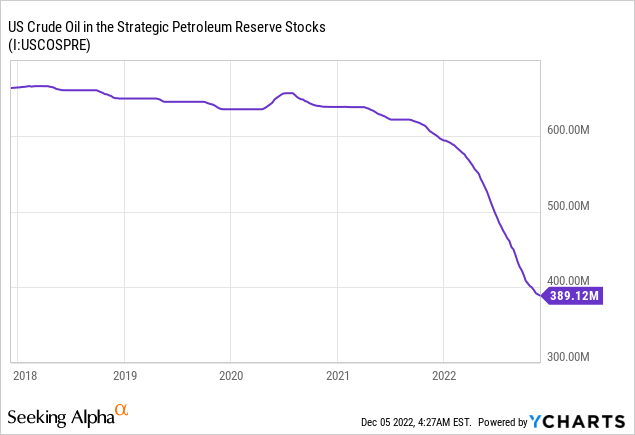

What’s more, keep in mind that even now, the US is still emptying its Strategic Petroleum Reserve. So, once that’s fully empty, that’s gone.

Meanwhile, with the Russian oil embargo also in play, there are even further inefficiencies that will lead to higher oil prices in 2023 in my view.

Altogether, I believe that the setup into 2023 is demonstrably stable. And perhaps even more positive than in 2022.

Capital Allocation? Favoring Dividends, 7.9% Yield

There are two kinds of attractive oil companies. Those that are favoring dividends and those that are seeking to return capital via buybacks. Anyone that’s interested in empire-building, is getting swiped left, and onto the next company.

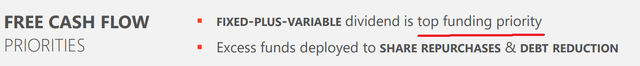

Accordingly, Devon leaves no ambiguity on what its top priorities are.

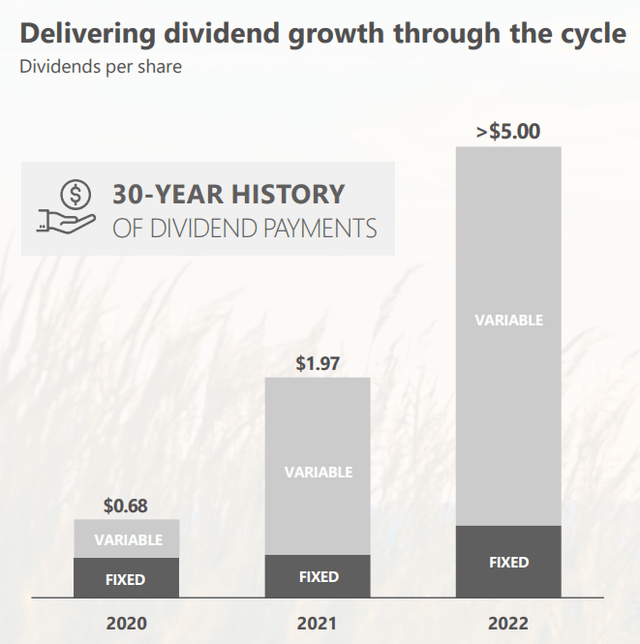

Devon is returning to shareholders the equivalent of $5.40 annualized. That translates into a 7.9% yield.

As you can see above, even though Devon’s variable dividends are not set in stone, over the last few years these variable dividends have been increasing. Even when things were particularly challenging. Namely, in 2020.

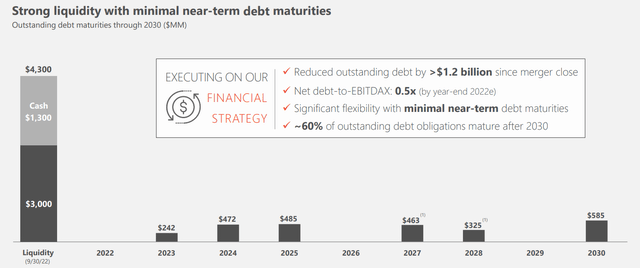

What’s more, as is the case with many other oil and gas companies, given the bombastic 2022 performance from a cash flow generation perspective, Devon has been left with a very strong balance sheet

Furthermore, the credit ratings have recognized Devon as investment grade, with Fitch actually recognizing Devon as BBB+, which is the high end of lower medium grade. For an oil company, that’s strong praise.

That’s mostly because Devon’s debt stacks are very well spread out with no significant near-term debt maturities.

From another perspective, it’s interesting to see that Devon’s share buybacks went from approximately $336 million in Q2 to $127 million in Q3. A drop of approximately 62% sequentially.

For investors that have any doubt over what Devon’s priority is, this clearly reflects its imperatives.

Next, we’ll turn our focus to discussing Devon’s hedged portfolio.

A Hedge Book Aimed at Upside Potential

In Devon’s Q3 2022 10-Q we can see that Devon has ”approximately 25% and 15% of our anticipated 2023 oil and gas production hedged”.

I believe that’s a great setup for investors that are bullish on energy prices. It leaves investors nearly fully exposed to high oil and gas prices.

But with some level of downward pricing protection, with 25% of its oil volumes hedged.

Energy Companies With High Returns on Capital?

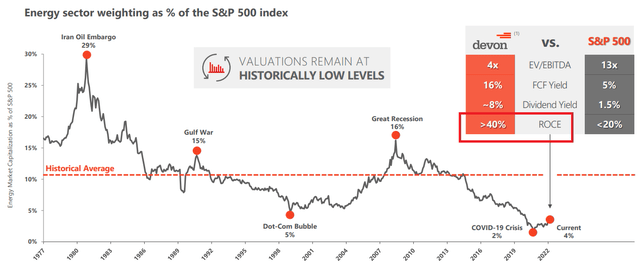

The graphic that follows reiterates much of what I’ve been arguing for a while. We see two things illustrated.

In the first instance, you see that energy stocks are still under-owned relative to historical averages compared with the S&P500 (SPY).

The second, and least appreciated element, is that Devon has very high returns on invested capital. So many investors love tech companies because there’s the perceived illusion of a high return on invested capital.

Whereas in reality, right now, energy companies have a lot higher ROI figures.

The Bottom Line

Want my whole investment thesis summarized into one chart? See below.

Devon is fully focused on having a leading dividend yield. And has a balance sheet that supports this strategy.

Be the first to comment