Justin Sullivan

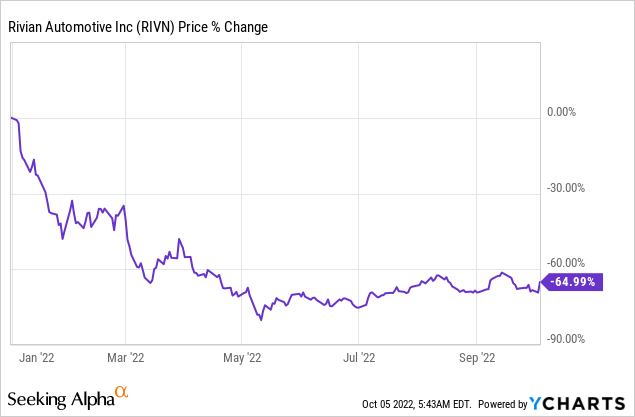

Rivian Automotive (NASDAQ:RIVN) announced a significant production and delivery ramp in the third quarter and the electric vehicle maker also confirmed its full-year production forecast of approximately 25 thousand EVs again. Rivian’s shares surged 14% after the company made the release. However, I believe that the market unduly rewards Rivian for confirming its production target which should have been expected. The production ramp is fully priced into Rivian’s valuation here, I believe, and the risk profile remains skewed to the downside!

Production and delivery update

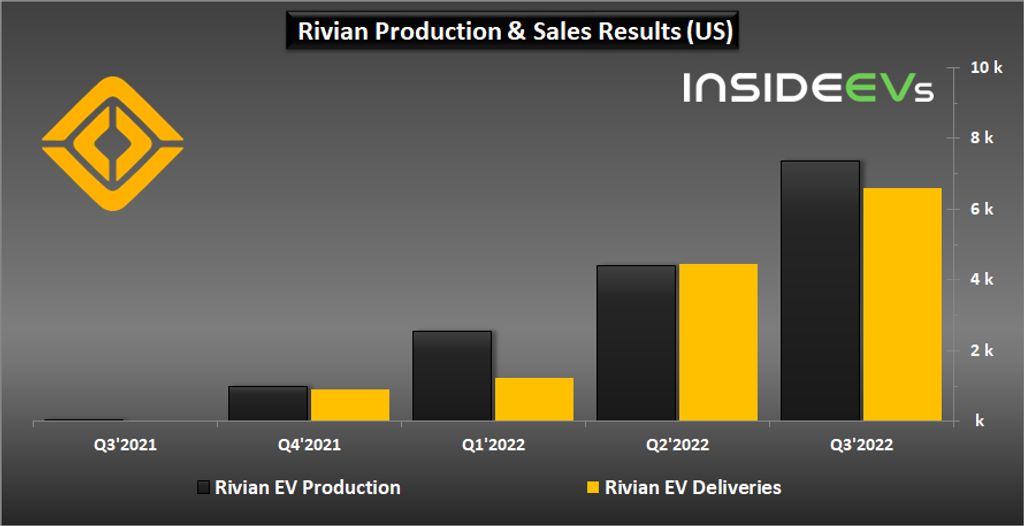

In the second quarter, electric vehicle startup Rivian Automotive produced 4,401 electric vehicles at its manufacturing plant in Illinois. The electric vehicle company delivered approximately the same amount of vehicles — 4,467 — to customers in the second quarter after production of the R1T and the R1S finally ramped up after years of development and investments in manufacturing capacity. Rivian’s production saw 72% quarter over quarter growth in the second quarter.

Rivian made another leap regarding production and delivery growth in the third quarter. In Q3’22, Rivian’s manufacturing output rose 67% compared to the second quarter and the company saw a record 7,363 vehicles roll off of its factory belts. Rivian also delivered 6,584 electric vehicles in the third quarter which translates to 89% of the company’s third quarter factory output. Going forward, deliveries are going to ramp up nicely as the electric vehicle maker is working through a massive backlog: Rivian said that it had 98 thousand pre-orders from the US and Canada on its books as of the first week of August.

InsideEVs: Rivian Production/Deliveries Q3’22

While the ramp in Rivian’s production is a sign that the electric vehicle maker is making progress growing its factory output, the ramp should have been widely expected and did not really exceed any expectations. Rivian has stated a production goal of 25,000 electric vehicles in FY 2022 which the company confirmed again. Rivian last confirmed its FY 2022 production goal when it released Q2’22 earnings in August.

Year to date, Rivian has produced 14,317 electric vehicles — 2,553 in Q1’22, 4,401 in Q2’22, and 7,363 in Q3’22 — meaning the company must produce approximately 10,683 electric vehicles in Q4’22 to meet its manufacturing target of 25 thousand EVs. The FY 2022 production target implies 45% quarter over quarter output growth and I believe Rivian will achieve this.

Rivian’s recent deal with Mercedes

In September, Rivian signed a Memorandum of Understanding with Mercedes-Benz (OTCPK:MBGAF, OTCPK:MBGYY) for a strategic partnership and joint production of commercial vans in Europe. Mercedes-Benz will provide a manufacturing facility which will produce vans for Mercedes-Benz as well as Rivian. The joint venture clearly seems to be an attempt to scale commercial van production more rapidly outside of the US while both companies are looking for operational synergies. Rivian didn’t disclose any financial details about the joint venture yet, but may give the market more details when it releases earnings for the third quarter next month.

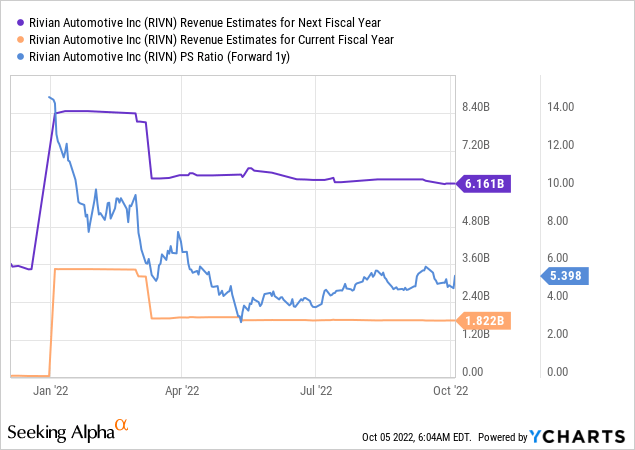

Rivian’s valuation is too ambitious

I believe Rivian’s production ramp is already fully priced into the company’s valuation. Rivian currently has a market cap of $33B and since expectations for next year imply about $6.2B in revenues, the stock is trading already at a lofty price-to-revenue ratio of 5.4 X… which is only slightly below the valuation multiplier factor that Tesla gets (6.5 X), despite Tesla producing a significantly larger amount of vehicles — over 365,000 vehicles in Q3’22 — and generating billions of dollars in profits and free cash flow.

Risks with Rivian

Electric vehicle startups have two major risks: (1) Their liquidity runway and (2) their production timeline. For Rivian, the first factor is not really a risk since Rivian has the best-funded EV operations in the entire electric vehicle industry with nearly $15B in available cash at the end of the second quarter. What Rivian does have, however, is production risk. The company may be on track to achieve its production target in FY 2022, but supply chain risks, inflation, and a possible drop-off in consumer spending as a result of decelerating economic growth are all factors that could weigh on Rivian’s valuation going forward.

Final thoughts

Rivian again confirmed its FY 2022 production goal of 25 thousand electric vehicles … which was sort of expected and should not have resulted in a 14% stock rally. Additionally, because Rivian’s valuation is already high relative to the low current output level, I continue to believe that Rivian’s production ramp is already fully priced into the company’s valuation. Since inflation and supply chain risks continue to be an issue in the electric vehicle sector, I believe that Rivian continues to have an unattractive risk profile that is skewed to the downside!

Be the first to comment