Justin Sullivan/Getty Images News

Introduction

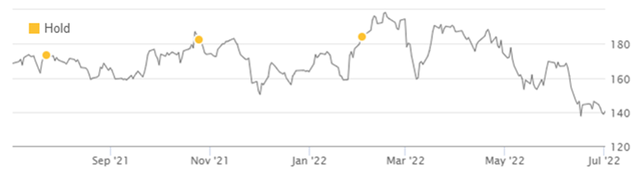

We review our Hold rating on American Express Company (NYSE:AXP) after shares have fallen 30% from their peak in February. Year-to-date, AXP’s share price has fallen 17%, underperforming both Visa (V) (down 10%) and Mastercard (MA) (down 14%), and is about 20% below the level where we had been reiterating our Hold rating in the past year:

|

Librarian Capital Rating History on AXP vs. Share Price  Source: Seeking Alpha (03-Jul-22). |

Since we initiated our Neutral rating in March 2019, AXP shares have gained 32% (including dividends) in just over three years, roughly in line with Visa and approximately 8 ppt behind Mastercard (both Buy-rated since 2019).

We remain cautious on American Express shares. While volumes have continued to recover from COVID-19, expenses have risen far more. Management has set out ambitious targets that imply a significant acceleration in growth rates from pre-pandemic norms, even as marketing spend is slowed, and we are not convinced these will be achieved. Shares are trading at 5.1x Price/Book, 17x P/E and a 1.5% Dividend Yield, which are not particularly cheap. We believe AXP shares are to be avoided, and continue to prefer Visa and Mastercard.

American Express Cautious View Recap

Our holding rating on AXP has been based on what we see as structural weaknesses in its business model, including:

- Competition in credit cards is fierce, and AXP mainly attracts customers through rewards and co-brand partners, which competitors can match if they spend enough; this has led to escalating costs for AXP.

- AXP’s closed-loop network means it bears the full costs of competing with card-issuing banks, and finds it harder to collaborate with Fintech players, including in Buy Now Pay Later (“BNPL”).

- AXP’s increasing focus on loan growth means growth is necessarily more capital intensive, and it’s likely to have to retain a sizable portion of its earnings each year to maintain adequate capital ratios.

- AXP is more exposed to a future U.S. economic downturn, since the U.S. is more than 70% of its Pre-Tax Income, and its lending activities would be vulnerable to the eventual normalization in loan losses.

COVID-19 was a significant negative for AXP earnings as pandemic restrictions significantly disrupted Travel & Entertainment (“T&E”), which were 72% of AXP Billed Business in 2019.

Volume Continuing To Recover from COVID

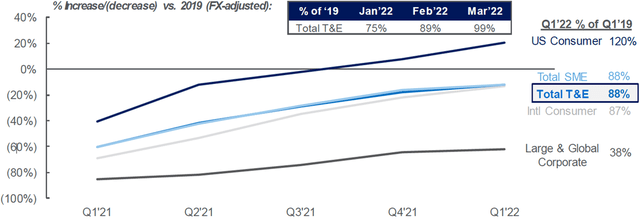

AXP volumes have continued to recover from COVID-19. As of Q1 2022, total Billed Business was approximately 18% higher than in 2019 (excluding a small change in definition), led by growth in Goods & Services (“G&S”). T&E Billed Business was still only 88% of 2019 levels in Q1 2022, but had reached virtual parity (99%) as of March:

|

AXP T&E Billed Business vs. 2019 (Ex-Currency) (Since 2021)  Source: AXP results presentation (Q1 2022). |

AXP’s volume trends have continued to be strong after Q1 2022, as CFO Jeff Campbell commented at an investor conference in mid June:

“We had a very strong first quarter that we talked about in April and you all would have seen the trends that we talked about at that time. And as we sit here today on June 15th, all of those trends remain really solidly in place. So billings continue to be really strong.”

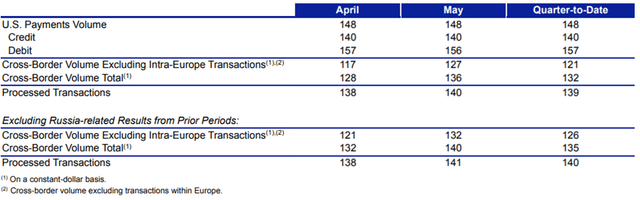

Volume data published by Visa at the start of June provided quantitative evidence of the same strong trends, with total U.S. Payments Volume at 48% above 2019 levels in April-May and Cross-Border Volume Excluding Intra-Europe Transactions at 26% above 2019 levels in the same period (excluding Russia):

|

Visa Volume Indexed to 2019 (ex-Currency)  Source: Visa 8-K filing (01-Jun-22). |

The continuing recovery means that AXP volume are likely to continue improving sequentially through 2022.

Expense Grown Far More Than Revenues

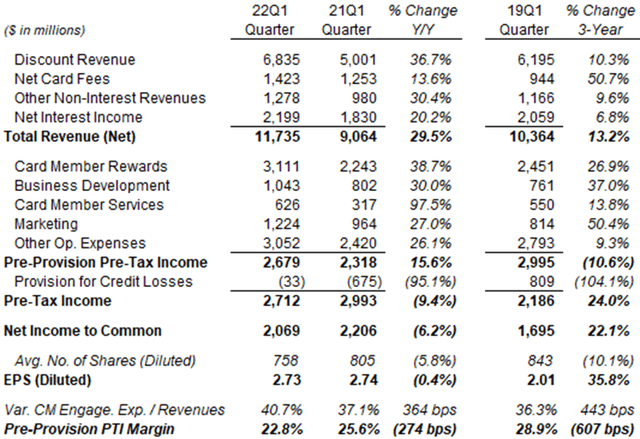

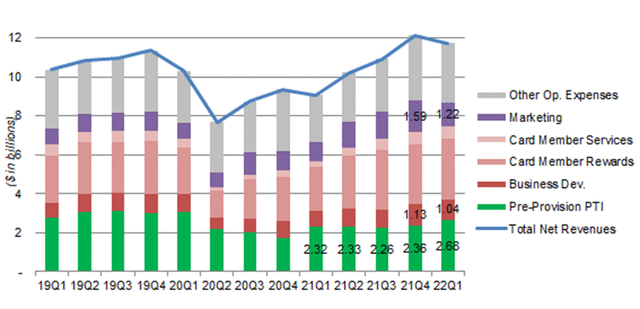

AXP’s earnings have recovered far less than its volume, as expenses have grown far more than revenues.

As of Q1 2022, AXP’s Pre-Provision Pre-Tax Income (“PPPTI”) remained 10.6% below the corresponding quarter in 2019, despite revenues having grown to 13.2% above. Card Member Rewards, Business Development, Card Member Services and Marketing expenses have all grown faster than revenues. Variable Card Member Engagement Expenses, as these four expense lines are collectively known, have risen from 36.3% of revenues in Q1 2019 to 40.7% in Q1 2022, and is guided to be approximately 42% of revenues for the full year:

|

AXP P&L (Q1 2022 vs. Prior Periods)  Source: AXP results supplement (Q1 2022). |

(PPPTI is the most meaningful measure of structural profitability, as Provision for Losses includes volatile one-off credit reserve builds or releases, which means Pre-Tax Income and Net Income are also volatile.)

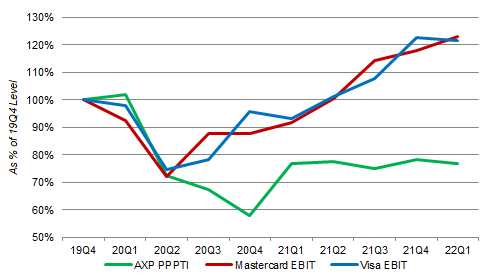

The weakness in AXP earnings stands at sharp contrast to the strength at Mastercard and Visa, which have seen their EBIT grown substantially in the past few years, even as compared to the seasonally-strong level at Q4 CY19:

|

Card Networks’ Operating Income, Indexed to Q4 2019  Source: Company filings. NB. Mastercard and Visa EBIT figures are non-GAAP. |

Compared to Q1 CY19, Mastercard’s EBIT was 34% higher and Visa’s EBIT was 35% higher as of Q1 2022. While Mastercard and Visa’s revenues have each grown by more than 30%, due to their lower exposure to T&E, their strong EBIT growth also is helped by expenses having grown less than revenues (by 2 ppt and 7 ppt respectively).

AXP’s PPPTI had stagnated in a narrow $2.3-2.4bn range through each quarter in 2021, despite rising revenues, as Variable Card Member Engagement Expenses continued rising. PPPTI did rise to $2.68bn in Q1 2022, largely due to reductions in Marketing and Business Development expenses:

|

AXP Revenues, Expenses & Pre-Provision PTI (Since 2019)  Source: AXP company filings. |

What AXP’s growth would look like with a lower level of Marketing and Business Development expenses is a key question for any investment case, and we’re cautious because of strong competition in the card sector.

Long-Term Targets May Be Too Ambitious

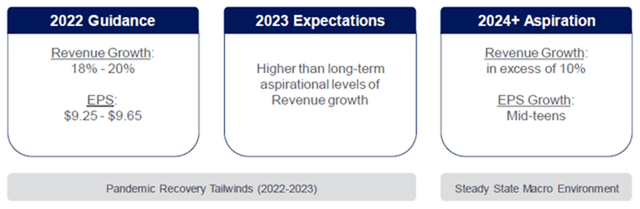

Management has set out ambitious mid-term targets at Q4 2021 results, including revenue growth in excess of 10% and EPS growth in the mid-teens for 2024 and beyond. Revenue growth is expected to be 18%-20% in 2022 and higher than long-term targets in 2023, thanks to pandemic recovery tailwinds:

|

AXP Mid-Term Targets  Source: AXP results presentation (Q4 2021). |

Management expects a long-term Return on Equity of approximately 30%, in line with the level in 2019, and will target a CET1 Ratio of 10-11% (compared to 10.4% at Q1 2022).

As management acknowledged, the 2024-plus targets imply a level of growth significantly higher than what AXP achieved in the past. AXP’s revenue growth was below 10% in both 2018 and 2019 (at 9.4% and 8.0% respectively), and had a CAGR of just 5.0% in the five years before COVID-19 (2014-19).

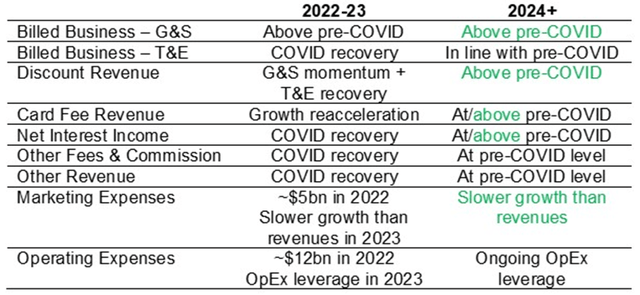

The underlying assumptions behind the mid-term targets were disclosed at AXP’s investor day in March:

Source: Librarian Capital.

Most importantly, AXP expects to do better than before the pandemic in G&S Billed Business growth and thus overall Discount Revenues, and to grow Marketing Expenses less than revenues. It also expects to potentially grow Card Fee Revenue and Net Interest Income at rates above pre-COVID growth rates.

While some of this higher growth is expected to come from sector-wide trends (an accelerated shift to electronic payments and more people taking up premium fee-based cards), others will require AXP to gain market share (especially in G&S and lending). As discussed in previous articles, we’re cautious about AXP’s chances in the latter as it’s often competing against larger competitors such as JPMorgan Chase (JPM) which can subsidize their card products with non-card revenues and target much lower return on equity. We also believe that technological advances and consolidation among payment processors has been eroding AXP’s data and cost advantages as a closed-loop network.

We’re not convinced AXP will achieve its long-term targets.

Impact of Younger New Cardmembers

The proportion of Millennials and Gen Z in AXP’s new cardmembers and spend growth has continued to rise, and this may have an unexpected impact on financials during an economic downturn.

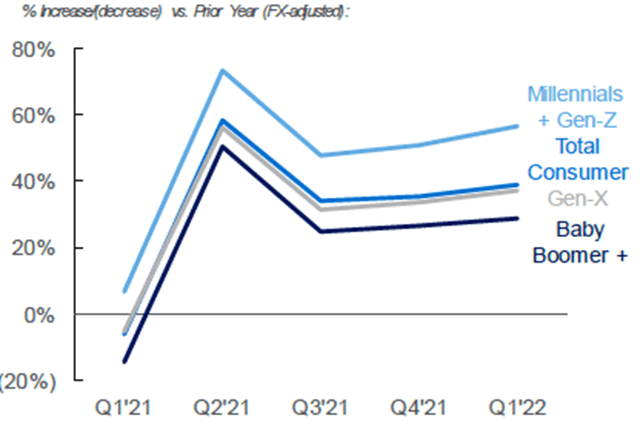

The percentage of New Accounts Acquired in AXP’s US Consumer business from Millennials and Gen Z has risen from approximately 40% in 2016 to approximately 60% in 2021, and these groups have much higher billed business growth than other age cohorts in recent quarters:

|

AXP Billed Business by Age Cohort (Since 2021)  Source: AXP results presentation (Q1 2022). |

AXP new Millennial and Gen Z cardmembers have slightly lower FICO scores (averaging approximately 750, vs. other age cohorts’ approximately 775) than other age cohorts, though the average is still in the super prime category (above 720).

Management believes the rising proportion of Millennial and Gen Z to be a positive, as these cardmembers can potentially have longer lifetimes and higher spend growth, and therefore higher Life Time Values (“LTV”). (We suspect the higher LTV may have justified higher Marketing and reward spend in the eyes of management.) However, after the easy credit conditions and boom in tech jobs in the past few years, a major economic downturn may have an unexpected impact on these age cohorts and therefore on AXP financials.

American Express Valuation

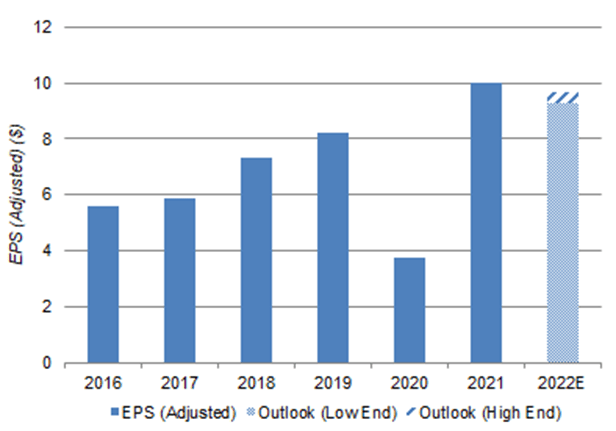

AXP’s EPS has been volatile due to one-off credit reserve changes, with earnings being reduced by $4.73bn in Provision for Credit Losses in 2020 but being increased by a $1.42bn benefit in 2021:

|

AXP Adjusted EPS (2016-22E)  Source: AXP company filings. |

At $140.40, relative to pre-COVID 2019 earnings, AXP stock is trading at 17.1x P/E. The stock also is trading at 5.1x Price/Book (with a book value of $27.56 at Q1 2021), which on a targeted Return on Equity of 30% also implies a P/E of approximately 17x. (The P/E multiple is 14.0x on 2021 EPS and 14.9x on the mid-point of 2022 guided EPS.)

Prior to COVID-19, AXP share price peaked at approximately $135 in February 2020, which also represented a Price/Book of 5.1x (with a book value of $26.51 at Q4 2019).

AXP stock pays a dividend of $0.52 per quarter ($2.08 annualized), implying a Dividend Yield of 1.5%. AXP continues to target a 20-25% Payout Ratio.

We do not believe AXP shares are particularly cheap at present.

Conclusion

AXP shares have fallen 30% from their peak in February and underperformed both Mastercard and Visa year-to-date.

AXP volume has continued to recover, but earnings are lower than in 2019 and lagged Mastercard’s and Visa’s, due to higher expenses.

Management mid-term targets see AXP growing revenues in excess of 10% and EPS at mid-teens from 2024, but we’re not convinced.

AXP expects growth to accelerate above pre-COVID levels even as Marketing spend is slowed, which is difficult with strong competition.

At $140.40, AXP shares have a Price/Book of 5.1x, a P/E of approximately 17x and a Dividend Yield of 1.5%, not particularly cheap. Avoid.

Be the first to comment