HT Ganzo

Investment Thesis

In my opinion, the prospect of an aluminum-producing company like Alcoa Corp (NYSE:AA) depends very much on the future demands for aluminum. While aluminum is still considered one of the raw materials required for the future green economy, it is not the most sought after compared to other raw materials like Lithium.

The price for aluminum is expected to stay low for the rest of the year. Although the demand is expected to pick up as with other commodity metals, in the long run, it may not be as highly sought after as other commodity metals.

Even when demand for aluminum picks up after the current short-term headwind, companies with a stronger financial profile than AA are expected to recover stronger.

Company Overview

AA is one of the largest aluminum mining companies in the world. It sells bauxite, alumina, and aluminum products in the United States, Spain, Australia, Iceland, Norway, Brazil, Canada, and internationally.

The company’s operations can be classified under three segments: Bauxite, Alumina, and Aluminum. It mines bauxite, processes it into alumina, and sells it to customers. The customers then process the bauxite further to turn it into industrial chemical products. AA is also involved in aluminum smelting and casting businesses.

Forward-Looking Demands Of Aluminum

Aluminum delivered the 4th largest returns on investment in 2021, after Coal, Crude Oil, and Gas. In my opinion, these are ‘lagging’ data that may not accurately predict the future returns of Aluminum. It is more useful to consider the commodity metals with the highest growth in demand in the ‘future’.

The Biden administration published a report of the findings from the “100-Day Reviews under Executive Order 14017”. This report outlines steps to strengthen the critical supply chains of America, the largest economy in the world.

We can use this report to understand the most important raw materials required in the ‘future’, primarily in the development of the Green Economy. If we infer from Visual Capitalist, the raw materials required to build a green economy include copper, silicon, aluminum, lithium, cobalt, rare earth, and silver. For each of the raw materials mentioned, I checked the number of times they are found in the report, and here are the findings:

- Copper – 29

- Silicon – 94

- Aluminum – 25

- Lithium – 315

- Cobalt – 166

- Rare Earth – 104

- Silver – 2

We can see that Aluminum is only mentioned 25 times. Comparatively, it is one of the least mentioned raw materials required to drive the green economy. This suggests the future returns of investing in Aluminum may not be as lucrative as other raw materials in the list that are mentioned more often.

Recovery Of Aluminum Prices Is Not Immediate

Companies producing commodity metals like aluminum have taken a beating due to macro headwinds like lock-downs in China and supply chain disruptions and fear of recession. With signs of Chinese authorities taking steps to end the 2-month-long lockdown of the largest city of Shanghai, and gradually opening up, the previously dampened demand for Aluminum could pick up, benefitting Aluminum producers like AA. However, according to Capital.com:

“But ultimately, SMM thinks that the aluminum market is in the process of marginal weakening throughout 2022, meaning that aluminum prices will remain in the downward trajectory with fluctuations,” said Shanghai Metals Market.”

It seems that at least in the short term towards the end of 2022, Aluminum prices will still be falling “marginally”. Investors who are holding stocks that are affected by Aluminum prices like AA should be aware of this short-term headwind that is likely to persist until the end of the year.

Financial Comparison With Peers

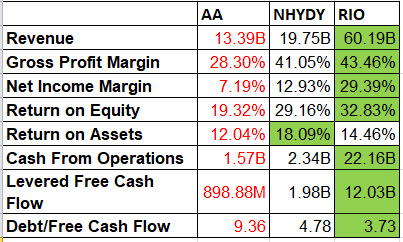

Norsk Hydro ASA (OTCQX:NHYDY) and Rio Tinto Group (RIO) are 2 US-listed Aluminum companies that compete with AA. We will compare the financials of AA with these 2 peers to understand how it fares comparatively.

Financial Comparison (Seeking Alpha)

From the table, we understand that:

- At one glance, we can see that AA has a financial profile that is inferior to its other 2 peers at all levels of its financial profile, from top line revenue to bottom line net margins.

- It is also having the least amount of operating and free cash flow.

- The proportion of debt with respect to free cash flow is the highest when compared with the other 2 peers in the comparison list.

As discussed in the earlier sections, the demand for aluminum is likely to pick up after the end of 2022. However, the players most likely to benefit from this recovery are likely to be those with a superior financial profile. Right now, it looks more likely that RIO is more like to recover stronger than AA and NHYDY.

Valuation

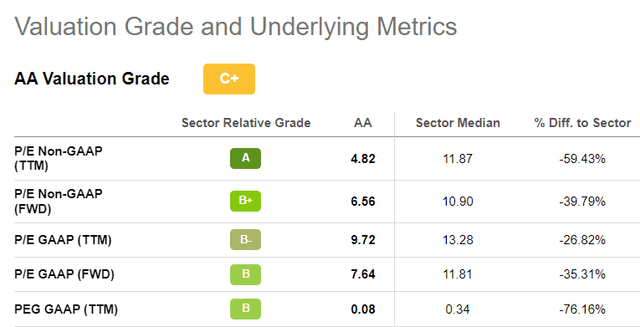

We infer from Seeking Alpha’s P/E and PEG values to understand the valuation of AA.

Valuation by PE and PEG (Seeking Alpha)

We can see that by P/E, the company is clearly undervalued compared to the sector medium. Even if we take the growth rate into consideration and look at the PEG with respect to the sector median, it is also undervalued.

Risk

As discussed in earlier sections, the forward-looking demands of commodity metals are likely to be driven by the Green Economy. According to reports released by lawmakers in the US, we understand that Lithium is expected to command the highest demand in the future. Aluminum is one of the metals that received the least coverage in the report. If investors are looking to invest in a company producing commodity metal that is expected to have the highest ‘growth’ in demand, in the long term, it appears to be other metals like lithium, not aluminum.

Conclusion

Aluminum is still one of the raw materials required to drive the future green economy. Generally, demand is expected to stay in the long run.

Comparatively, however, the demand may not ‘grow’ as fast as other commodity metals like Lithium.

The stock looks undervalued compared to the sector median which presents an opportunity only for investors looking for a ‘value play’ on AA.

‘Growth’ investors who intend to buy and hold AA within a long-term time frame may want to consider other companies producing commodity metals of higher comparative growth potential.

Be the first to comment