Douglas Rissing/iStock via Getty Images

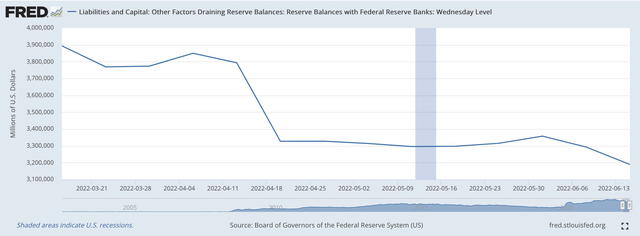

Since March 16, 2022, the commercial banking system has lost over $700.0 billion in reserve balances at the Federal Reserve.

March 16 is when the Fed raised the range for its policy rate of interest by 25 basis points, from a range of 0.00 percent to 0.25 percent to 0.25 percent to 0.50 percent.

The effective Federal Funds rate moved from 0.08 percent to 0.33 basis points.

The Fed began moving into a more restrictive stance on monetary policy.

The Fed made another move in the range in May and the effective Federal Funds rate moved to 0.83 percent.

On June 15, 2022, the Federal Reserve pushed up the policy rate of interest range by another 75 basis points.

The Fed has been overseeing the reduction in the reserve balances of commercial banks at Federal Reserve banks so as to support the rise in the policy rate of interest by making funds less available on bank balance sheets.

Here is a chart showing the changes taking place.

Reserve Balances with Federal Reserve Banks (Federal Reserve)

During this time from March 16, 2022, to June 15, 2022, the Federal Reserve’s outright holdings of securities increased, but by only $2.1 billion.

Starting this week, the Federal Reserve is supposed to begin to reduce the size of its holdings of securities.

This past Wednesday, June 15, 2022, the amount of securities held by the Federal Reserve, outright, amounted to $8,492.6 billion or $8.5 trillion.

The plan, for now, is for the Fed to oversee its portfolio decline by $47.5 billion for the time between now and the next meeting of the FOMC and then will oversee another decline in the portfolio by $47.5 billion through to the August FOMC meeting.

Note that the decline in the securities portfolio will take place entirely through securities maturing off of the Fed’s balance sheet. In these first two months, the runoff will amount to a $30.0 billion decline in U.S. Treasury securities on the Fed’s balance sheet, and a decline of $17.5 billion in mortgage-backed securities.

In September, the expected runoff will be $95.0 billion, made up of a $60.0 billion runoff in U.S. Treasury securities and a $35.0 billion runoff of mortgage-backed securities.

This reduction in the Fed’s securities portfolio is expected to go on into the middle of 2024.

My calculations show that if the Fed were to carry out this plan, the securities portfolio would be slightly lower than it is today by about $2,230.0. Thus, rather than having a securities portfolio worth around $8.5 trillion, the Fed’s portfolio would be reduced to around $6.3 trillion.

Results

No one really knows what Federal Reserve officials are thinking about what these plans will finally produce.

With the announcements coming out of the FOMC this week, the Federal Reserve released its economic projections for the next three years.

In terms of the Federal Funds rate, the Fed’s projections have the median level for the Federal Funds rate coming in at 3.4 percent for 2022. In 2023, the projections rise to 3.8 percent, while in 2024, the expectations drop back down to 3.4 percent rate again.

Given that the effective Federal Funds rate has been at 83 basis points, this can look like a substantial rise taking place in the funds rate over the next two and one-half years.

The 2023 figure is 300 basis points above the most recent level of the effective Federal Funds rate.

But, will that really be enough.

The talk now is that the rate of inflation is now around the level it was 20 years ago. At that time, the Federal Reserve had to take the Federal Funds rate up over 20.0 percent to reduce the rate of inflation.

I’m not saying that we will need to go have a Federal Funds rate in excess of 20.0 percent this time around.

I just wonder if having the “median” rate in 2023 of up to 3.8 percent will be sufficient if the rate of inflation is as high as 8.0 percent a year?

I am just worried that Federal Reserve officials are just too optimistic about how high they are going to have to raise the range for their policy rate of interest.

Furthermore, I wonder if the Fed’s program to reduce the size of its securities portfolio will be sufficient to achieve the policy rates of interest officials want?

A reduction of the portfolio by $2.2 trillion sounds like a lot of money, but in today’s market, will this amount really be enough to accomplish what Federal Reserve officials are aiming for.

To me, there are still major uncertainties about what this Federal Reserve program is really going to look like over the longer run. So, there are going to be a lot of questions around that may not be answered for a long time.

Stock Market

Then there is the stock market.

The stock market is in “bear” territory.

Stock prices can be expected to fall a lot further.

Next question. How far can Federal Reserve officials let the stock market fall before the pressure becomes so great on them that they have to back off from their restrictive policies?

My analysts aren’t sure that Federal Reserve chairman Jerome Powell will stick around too long. Mr. Powell has always seemed to want to err on the side of monetary ease in his tenure as the Fed chairman.

So, how much heat will he be willing to take as stock prices continue to tank?

We’ll see.

Going Forward

Well, we are in a period of monetary policy that is moving in a direction that many people didn’t really see this Fed going into.

We are also in a period of radical uncertainty.

In many respects, we really don’t know where we are going.

Keep loose and keep smiling.

Be the first to comment