jetcityimage/iStock Editorial via Getty Images

The following segment was excerpted from this fund letter.

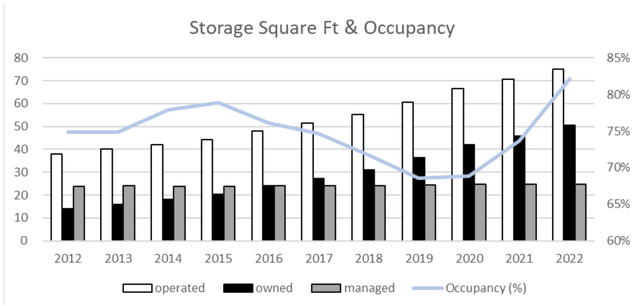

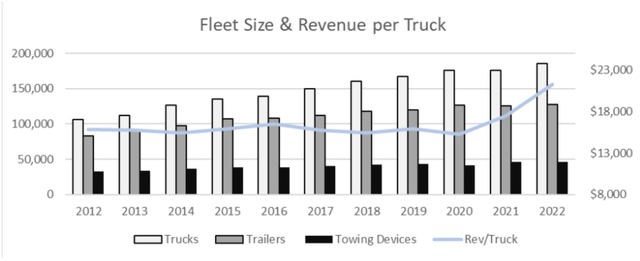

Amerco (NASDAQ:UHAL) is the fourth largest self-storage unit owner in the US, with ownership of just over 50 million square feet (4.65 million m2) of these properties, along with management of a further 23 million square feet. That’s a pretty robust starting asset, but when you combine it with a fleet of 186,000 trucks, 128,000 trailers and 46,000 towing devices under the “U-Haul” banner, you have an astonishing integrated, moated moving and storage business across the USA.

U-Haul has a storied history[1] having been established as a “one-way” rental company in 1945, and now having 23,000 locations across North America – 2,100 company owned and 21,100 independent franchise dealers. The company has a near monopoly in DIY inter-city moves having 10 times the number of locations as its nearest competitor Penske (PAG).

Whilst Penske employs a fleet 52% the size of U-Haul, a likely significant (yet undisclosed) portion of the Penske fleet is made of commercial rental vehicles (refrigerated units, semi-trailers etc.). Next largest is Avis Budget (CAR) who have a truck rental fleet a little under 6% of that of U-Haul.

Amerco is controlled by the Shoen family – Chairman Joe and family control 42.7% of the small float of only 19.6 million shares; at $478 a share, the equity pricing of the company is just under $9.4 billion. With an adjusted $3.4 billion in net debt, enterprise value is a very low $12.7 billion.

We can compare UHAL’s in-situ storage portfolio, which it has grown from around 15 million ft2 in nine years with five publicly listed large-scale peer REIT’s. We acknowledge this is a theoretical exercise in splitting the “real assets” (storage) from “the business” (trucks) since the Shoen’s are highly unlikely to ever securitise the properties because of the massive competitive advantage brought about by the combination. But it’s an exercise worth doing to get to the bottom of the magnitude of undervaluation UHAL stock.

By comparison with UHAL, REIT’s have an obvious tax advantage, but also benefit in investors’ eyes from transparency – if we ignore the fact that some have equity in highly geared unconsolidated JV’s or have management income streams, or significant minority ownerships in sub-trusts. These minority interests are especially difficult to cater for. We have made an attempt to deal with these inconveniences for the peers but must concede that our math has more than the usual caveats.

As a guide, the “average” facility in America has around 72,000 – 77,000 ft2 of available space at ~110ft2 per unit renting out at ~$18.75 per ft2pa. Valuations vary widely for obvious reasons. The table below shows the four largest public storage REITs by area, the smallest of which is a smaller size than Amerco, are valued by the equity market at an equivalent EV/ft2 of $273, which would value UHAL’s owned portfolio at $13.6 billion, against a current company EV of $12.7 billion. The comparison becomes even more ludicrous when including managed properties.

Even the second-lowest[2] rated of the five REIT peers (LSI: $153.64 psf) suggests the owned Amerco portfolio to be worth $7.7 billion on a standalone basis, leaving $4.9 billion of attributable value for the UHAL and insurance businesses.

|

Millions/$mn |

Cube Smart |

Extra Space |

Life Storage |

National Storage |

Public Storage |

Aggregate |

|

Ticker |

CUBE |

EXR |

LSI |

NSA |

PSA |

|

|

Issued shares |

224.4 |

134.3 |

84.3 |

91.5 |

175.2 |

|

|

Price (30 Jun 22) |

$42.72 |

$170.12 |

$111.66 |

$50.07 |

$312.67 |

|

|

Equity Capn. |

9,586 |

22,839 |

9,414 |

4,577 |

54,770 |

101,186 |

|

Net debt/prefs |

3,348 |

5,198 |

3,092 |

3,193 |

11,791 |

26,622 |

|

Assessed other assets |

(117) |

(500)† |

(215) |

(184) |

(2,569)†† |

(3,585) |

|

Enterprise value |

12,817 |

27,537 |

12,291 |

7,586 |

63,992 |

124,223 |

|

Owned ft2 (million) |

43.6 |

76 |

80 |

56 |

199 |

455 |

|

EV/ft2 |

$293.97 |

$360.55 |

$153.64 |

$136.19 |

$321.56 |

$273 |

|

Managed ft2 (million) |

6.5 |

88 |

95 |

|||

|

Owned & managed ft2 |

50.1 |

164 |

80 |

56 |

199 |

550 |

|

Adj. EV O&M |

12,817 |

28,037 |

124,723 |

|||

|

Adj EV/O&M ft2 |

$255.82 |

$170.00 |

$227 |

† management company valuation

†† includes publicly listed stocks PBS and SHUR.BR

Amerco owns two insurance businesses – a property casualty insurer (Repwest) which mainly does claims management for the U-Haul portfolio of vehicles and a life company, Oxford and its various subsidiaries. Both businesses are profitable and have combined equity bases of $736 million – not inconsequential. Over the past two years, the two companies combined have recorded average per annum pre-tax profits of $62 million.

Based on Deloitte analysis[3], the typical global life company has transacted in a willing buyer- seller deal at 1.15x BV in the past year; the equivalent in the P/C business has been a slightly higher 1.2x. As a consequence, this suggests the Amerco businesses might be worth a combined $860 million, equivalent to 13.9x average pre-tax earnings in 2021 and 2022.

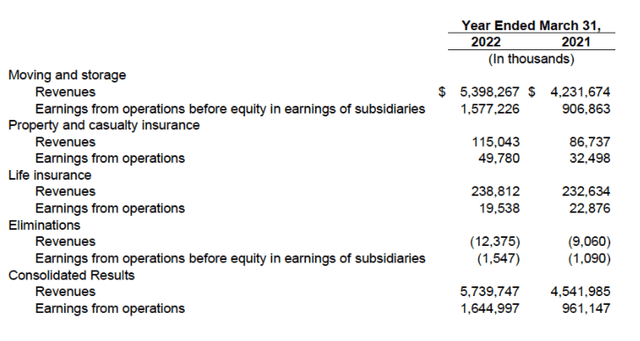

The key piece of opacity within Amerco which mitigates against transparent analysis is the binding together in the segmental accounts of “moving and storage”; in other words, the self-storage rental returns – which we are valuing above on an asset basis – are not broken out from the truck and trailer rentals.

Hence, the analysis which follows is our own work and not cross-checked with the company to establish what we believe the pure vehicle, trailer rental and parts sales might be valued at by the equity market. With that warning, the good news is that there is respectable consistency across the five large listed REIT peers in respect of costs and revenues per square foot.

The good news is that Amerco does disclose REVENUES from self-storage – which have compounded at just under 17% per annum over the past nine years, as the portfolio has continued to grow and occupancy has improved.

As an estimate, based on the cost structure of the peers, but where we expect Amerco to operate at a more parsimonious level; we believe operating cost of about $5 psf pa to be a reasonable and possibly conservative estimate.

Self-storage revenues only ($ million)

|

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

|

153 |

182 |

211 |

248 |

287 |

324 |

367 |

419 |

477 |

617 |

On that basis, across the owned portfolio, this would imply operating profit of ~$380 million in the year to 31 March 2022 from self-storage ownership on revenues of $617 million. Hence, our portfolio estimate valuation of $7.7 billion represents an earnings yield of ~4.95%, on an asset which management in its latest earnings call notes is “continuing to fill at historically high rates”.

It explains why Amerco is not retiring equity despite the apparent discount to value (below). They see further opportunities in the ownership component of the business given demographic change in the US, and shortage of available sites – for others – as well as zoning difficulties in urban environments.

With the self-storage “property” revenues backed out of the segmentals for “moving and storage”, we can hazard an estimate of the profitability of “moving”, encompassing vehicle and trailer rentals.

Based on the UHAL segmental profit analysis (reproduced below), this would suggest the remaining “moving and storage” operations to have burgeoned in the past two years with an operating profit of $1.68 billion EBITDA in 2022, up from an estimated $1.25 billion in 2021 – excluding profits on vehicle sales. Why so strong?

UHAL have been slowly expanding the truck fleet, adding 10,000 trucks between March 2020 and 2022; however, the key driver has been the average revenue per truck per annum, which has bounced from $15,700 in the 2020 year via $17,520 in 2021 to a hefty $21,872 in the latest year. That’s inflation for you! 18% compound growth in revenue per truck for the two years.

We are unsure how sustainable this growth over the past two years will prove to be, but managements insights from the latest earnings call is encouraging with their assessment that: “About half of the increase was coming from transactions and the other half was split between the number of miles driven by our customers and the rate that we were charging per mile.”

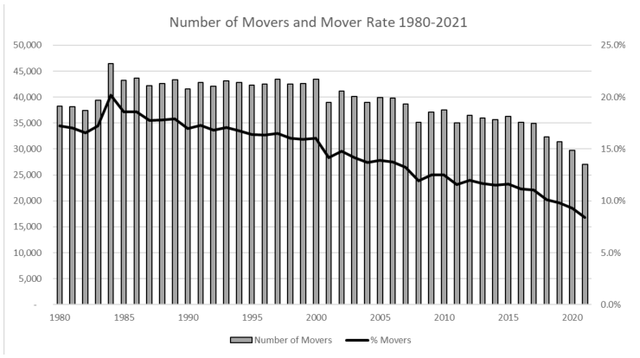

What is surprising, is that these results have emerged during a period when Americans have been (proportionally) their least mobile since data was tracked, in 1948, with, according to US Census Bureau statistics, only 9.8% of the population relocating!

In conclusion, we see Amerco as being able to post significant growth over the next 3-5 years. This will come at the expense of capital management – despite the gap between equity price and value (below) – with management undertaking ongoing expansion plans. Given the massive competitive advantage, this seems reasonable but does mean a lack of free cash flow to fund equity retirement. It also means that advancement in the share price will require the management growth “thesis” to play out; given their stockholding, they have plenty of incentive.

An idea of the gap between listed equity price and underlying value comes from our sum of the parts analysis. This suggests UHAL to be worth between $710 and $1016 per share in its present state, an uplift of 48 – 113% against prevailing 30 June 2022 levels:

|

$ million |

Low case |

High case |

|

Self-storage property (low LSI; high = average peers) |

$154/sq ft |

$273/sq.foot |

|

Implied self-storage value |

$7,682 |

$13,650 |

|

Insurers per notation above |

$860 |

$860 |

|

UHAL moving at 6x EBITDA (av 2021& 2022) |

$8,790 |

$8,790 |

|

Debt |

(3,380) |

(3,380) |

|

EQUITY VALUE |

13,952 |

19,920 |

|

Per share (19.6 million) |

$711 |

$1016 |

Reverse engineering, at the prevailing price of $478/share, and backing out the self-storage property at low values together with insurance, we believe we are paying around $4.2 billion for U-Haul, equivalent to less than 3x average EBITDA in the past two years, and very roughly 1x revenues in the year to 31 March 2022.

We believe investing in UHAL represents ownership of an entity with near monopoly attributes in one-way DIY moving; moreover, we view this monopoly as difficult to erode in a product which has little scope for future disruption. Against other comparatives with significant moats to their business, pricing power and a dominant position, we believe the calculated valuation metrics to be extremely low.

Footnotes

[1] The “storied” includes bankruptcy protection and sons forcing out their father from the board of Directors!

[2] NSA (the lowest) have various “affiliates”, significant minority interests and external management of their properties making equivalences difficult to compute.

[3] Deloitte 2021 Insurance M&A outlook (Deloitte)

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment