Investment Thesis

AAON, Inc. (NASDAQ:AAON) is experiencing strong demand from its end market which resulted in a healthy order backlog at the end of Q2 FY22. The strong demand, healthy order backlog, pricing actions taken in 1H FY22, and the acquisition of BasX in December 2021 should drive sales growth in the second half of FY22. The conversion of a higher price backlog in 2H FY22 and moderation in material costs should benefit the margins in 2H FY22. The integration of BasX with AAON’s business is allowing AAON to expand its footprint in other products and better serve its customers.

AAON Revenue Growth Prospects

AAON’s net sales in Q2 FY22 benefited from the increased unit volumes at its AAON Coil products segment, pricing actions, and the acquisition of BasX. The organic unit volumes in the AAON Coil products segment increased due to the addition of a new manufacturing facility at its Longview, Texas facility in early 2021 as well as the strong demand for the electric-powered split systems manufactured at this facility. The production capacity at this facility has nearly doubled and is used for both equipment and coil warehouse storage, reducing production time and improving overall efficiency. AAON improved its production rates to record levels for the second straight quarter. The demand remains strong as the company is booking orders slightly more than it is producing, leading to an increase in backlog levels which bodes well for 2H22 sales. The company is also doing a good job in terms of managing lead times which remained stable and below industry average last quarter. As of August, the company is still booking orders for shipment in late FY22, which shows that it is managing its leadtime well despite industry wide supply chain and labor constraints. To satisfy the demand levels, the company has also increased its production rate in August compared to July. The bookings in June and July were strong. Organic orders in the first half of FY22 were up 60% Y/Y. The total backlog was up sequentially, and the organic backlog was up 164% Y/Y.

On the inorganic side of the business, the company is seeing tremendous growth from its acquisition of BasX in December 2021. BasX designs and manufactures high-efficiency data center cooling solutions, cleanroom systems, custom HVAC systems, and modular solutions. The data center and cleanroom end markets, which make up a vast majority of BasX sales, are extremely strong. Additionally, the pipeline of projects extends over multiple years, giving them strong visibility for growth. From the end of FY21 to the end of Q2 FY22, the backlog of BasX has increased threefold. BasX won a $16.2 mn project award from a data center customer. This customer has been purchasing AAON for their ancillary areas but has never bought AAON for their core data hall. This acquisition gives AAON an opportunity to expand its footprint and gain new customers, as well as, better serve its existing clients. Given that the majority of the plants of this data center customer are in the Midwest and East, AAON plans to leverage its Longview facility to manufacture the product. From a pricing standpoint, this should benefit the company by leveraging its overhead costs at the facility. The costs associated with shipping the products from BasX’s Redmond, Oregon facility to the East Coast are quite expensive. A load of freight going from Redmond, Oregon to this project site is ~$8,400 versus $4000 going from Longview to this plant.

The product for this project is relatively simple and is a custom design, which fits better with the Longview manufacturing culture. The Redmond facility is much more suitable for complex equipment. Moving simple products from BasX’s Redmond facility to AAON plants gives BasX the capacity to build very complex units, such as Air units for a chip manufacturer like Intel. Intel has been BasX’s client for a long time. BasX is expected to contribute ~$100 mn in sales FY22 and has already generated $45.5 mn in 1H FY22.

Looking forward, I believe the strong order backlog at the end of 1H FY22 and the pricing actions taken in the first half should contribute to the revenue growth in the second half of FY22. Additionally, the Dodge Momentum Index, a 12-month leading indicator that measures the number of construction projects in the planning stages for non-residential construction, is at a 14-year high. Also, the Architectural Billing Index (ABI), a leading indicator of non-residential construction, remains above 50. The backlog among the architectural firms remains above seven months, which is extremely high from a historical perspective. The strong demand in the non-residential construction market should drive the order rates in 2H FY22.

Margins

The company’s gross margin in Q2 FY22 contracted due to the higher cost of materials. However, the gross margin improved sequentially throughout the quarter as the company started to see some of its higher-priced backlogs come into production. The difference between the pricing of the equipment and the cost of materials was the largest in the most recent quarter during this inflationary cycle. The company implemented an 8% price increase in January and a 7% price increase in March. The company is experiencing additional costs due to the supply chain disruption, which is leading to volatility in the cost of parts.

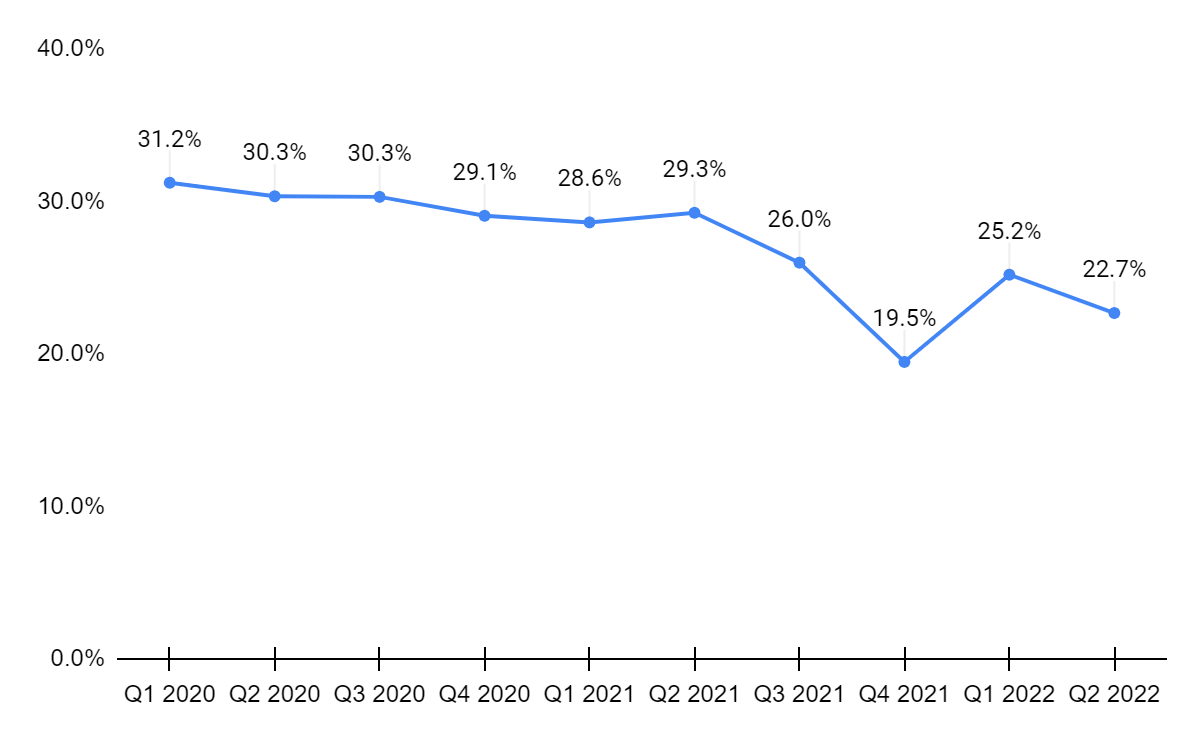

AAON’s gross margin (Company data, GS Analytics Research)

The pricing of orders in the backlog is much greater than the pricing of orders shipped in 1H FY22. Furthermore, raw material prices have turned down since peaking earlier in the year. This should lead to substantial margin expansion in 2H FY22. Even though the supply chain disruption is expected to continue in 2H FY22, the pricing actions taken by the company should offset these costs. Apart from this, AAON is growing its parts business, which generates a good gross margin for the company. Parts sales contributed 7% to the total sales in Q2 FY22. The company is targeting a 30% plus gross margin, which is expected to be achieved in Q4 FY22. The BasX business has a better gross margin than AAON as it directly deals with its customers, unlike AAON, which has a sales channel partner. Given the longer duration of projects, BasX can reprice its order backlog.

Valuation & Conclusion

AAON stock is currently trading at 23.97x FY23 consensus EPS estimates of $2.38, which is lower than its five-year average forward P/E of 41x. The company’s revenue should benefit from the strong demand in the end market, healthy order backlog, the addition of BasX, and pricing actions taken in 1H FY22. The margins should improve as the higher price backlog gets converted into revenue and with the stabilization in material costs. Given the reasonable valuations compared to historical levels, good execution and growth prospects, I believe the stock is a good buy.

monsitj

Be the first to comment