visualspace

Overview

Benson Hill (NYSE:BHIL) is currently undervalued. The multi-billion-dollar food industry is undergoing an evolution as you read this. In the next 10 years, your food will never be the same. As with every major evolution in human history, the future belongs to those who can recognize an attractive opportunity. BHIL presents an opportunity to ride on the secular trend in the food industry.

Business description

Benson Hill is an agri-food company that is revolutionizing the food industry. By combining data science and machine learning with biology and genetics, they have been able to unlock nature’s genetic codes within crops through the CropOs food innovation engine. Benson Hill is changing the world through its two business units: The Ingredients Segments and The Fresh Segment. The Ingredients segment is focused on trading in these areas: soy-based specialty vegetables, aquaculture and animal feeds, and ultra-high protein [UHP] ingredients. As for the Fresh Segment, a subsidiary firm, J&J Produce Inc., grows, packages, and sells fresh produce to retail and food service customers.

Secular trend in the food industry

There are eight billion mouths on the planet to feed. That’s eight billion directions in which food should go. The present supply chain was supposed to ensure everyone get their share of food. However, that has not really worked out well given that about 829 million people worldwide go to bed hungry each night.

Benson Hill has been able to design better foods and ingredients before they even leave the laboratory, thanks to changing consumer tastes and cutting-edge technology such as cloud computing, artificial intelligence, and gene sequencing. They have found that, by identifying and modifying the genetic sequences within plants, foods can increase in quantity and quality. Benson Hill has found a long-term solution to the growing food shortages that doesn’t involve rationing or the mass production of low-quality goods.

Benson Hill – Investor Day Management Presentations May 2022

Also, at no other time in history have consumers been so emphatic about a healthier lifestyle, especially when it comes to food intake. Obesity, cancer, and their band of merry men have convinced humanity of the need for a better feeding system. Food experts tell us that the healthiest kinds of food are those that have gone through the least amount of processing. This is because the more processing a food ingredient undergoes, the more nutrients it loses along the line. Benson Hill has found a way to minimize the level of food processing while enhancing taste and durability. This is where their amazing technology comes in.

Proprietary technology and process reduces cost of operation

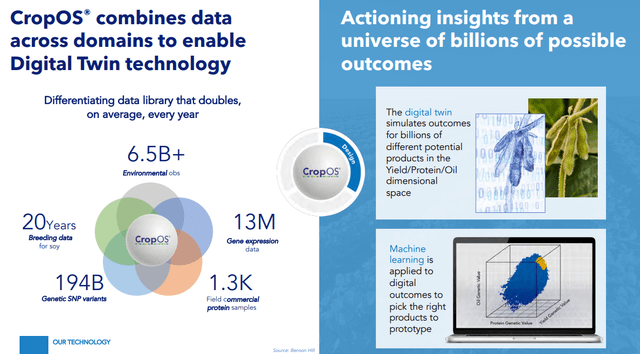

With a vast database of genotypic, phenotypic, and other intricate data on their crops, consumer feedback on the ingredients, and environmental data, Benson Hill is armed with everything it needs to overhaul the food industry. There is also a machine learning ability that uses the elements of the data library in the first step of the CropOs platform. This robust data collection system and an advanced simulation enable them to create more effective products. Their skill at managing data puts them ahead of the competition and lets them respond more quickly to customer needs and farmer requests.

Benson Hill – Investor Day Management Presentations May 2022

In the first step, which is the design stage, Benson Hill employs a wide array of simulations using the data available in the data library. Billions of data points in millions of configurations are analyzed in order to identify the best configurations. This prevents waste and allows copious amounts of products.

It is from this stage that they start building. At the build stage, crop genomes are modified. Lost or mutated genetic variation, which is important to the process, can be recovered through their knowledge of plant genes. By using the Crop Accelerator facility, the scientists can speed up the process. This facility also made testing go faster and helped them come up with new ways to combine products.

After a marketable product is created, the process enters the testing stage, where it is evaluated within a certain testing system. This testing system includes both internal and third-party sites, with hundreds of such testing sites. Most companies may not take the pains of testing after the initial product has been created. This is what marks Benson Hill as different. The extent they would go just to ensure the safety and satisfaction of their consumers is unparalleled.

Benson Hill – Investor Day Management Presentations May 2022

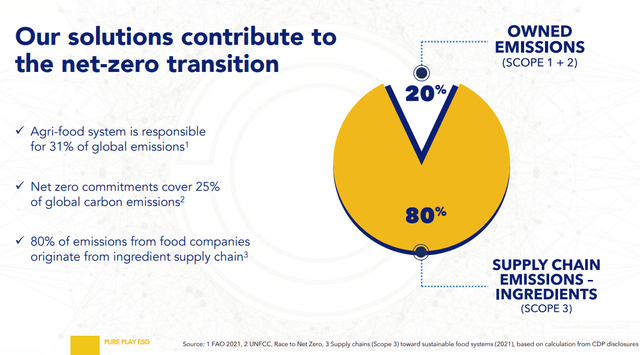

ESG-oriented strategies in place

Benson Hill’s ESG strategy is based on creating ingredients and products that meet the nutritional needs of consumers. The tools and technology used in this process are all top-notch. They believe in helping manufacturers increase demand and reduce environmental impacts. The goal is to make plant-based products available and affordable for all. They have cultivated a traceability system that will allow them to call upon and leverage opinions from third-party users. Benson Hill’s focus on ESG, among its long string of other qualities, is likely to attract investors and funds into the stock.

Benson Hill – Investor Day Management Presentations May 2022

Forecast

Based on my investment thesis, I expect BHIL to continue innovating and eventually achieve commercialization of its product at scale, given its promising proprietary technology and process.

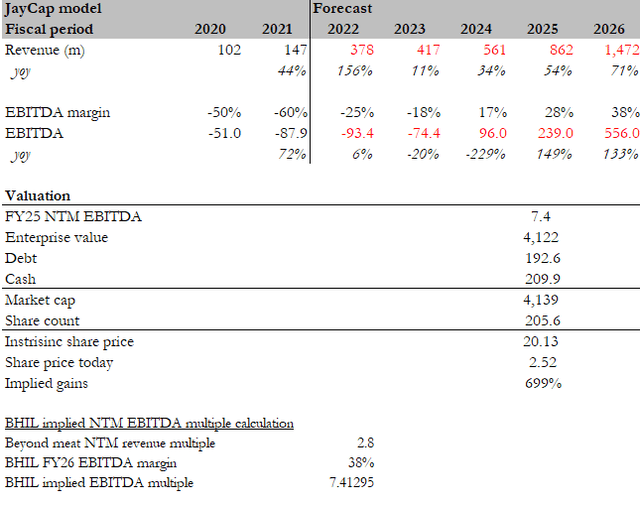

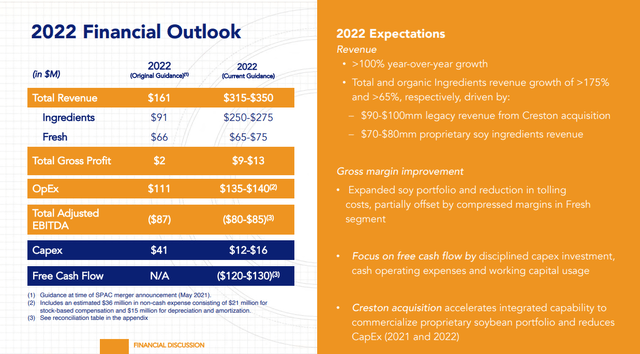

In the SPAC presentation, management guided to a long-term revenue target of $1.4 billion and EBITDA of $556 million in FY27. However, performance has been better than expected recently. Hence, I expect BHIL to be able to achieve guidance one year ahead of schedule (in FY26).

Given the scarcity of profitable comparable in the market, the question is at what multiple should BHIL trade at in FY26. In order to derive a figure, I used a very simple method, and that is to assume BHIL would have the same revenue multiple as Beyond Meat (BYND) today, which translates to 7.4 NTM EBITDA. BHIL’s valuation has been beaten down by a fair bit, from 5x forward revenue to 1.2x forward revenue. Hence, in a bullish market environment, investors could benefit from a valuation re-rating upwards.

Based on the above assumptions and an NTM EBITDA of 7.4x, I came up with an intrinsic value of $20. This is 7x the current share price of $2.52.

Author’s estimates Benson Hill – Investor Day Management Presentations May 2022

Red flags

Attractive market attracts many competitors

First, the market for plant-based products is a battlefield in its own right. Benson Hill faces fierce competition from both direct and indirect sources. If at any time they fail to innovate and improve, they could fall behind in the race.

Predicting food trends is not easy

You also have to recognize that predicting food trends is not an activity that can be done with your eyes closed while sipping cappuccinos on a sandy, steamy beach. It’s not easy to catch up with the ever-changing customer tastes.

Commercialization at scale may not happen as quickly as expected

For BHIL to be able to sell its products, it needs to be able to mass-produce high-quality items at low prices and accurately predict how much demand there will be for them. Neither of these things is guaranteed, though.

Conclusion

BHIL is undervalued at its current share price as of the date of this writing. The true value slowly dawns on you as you consider the high payout that accompany this investment if it works out. You can be part of this revolution as we move towards feeding the world. And what better way is there to serve people when you can make money by doing so?

Be the first to comment