MF3d

Advanced Micro Devices, Inc. (NASDAQ:AMD) is about to release its Q3 earnings results tomorrow, and they might disappoint its shareholders. The company’s preliminary results that were published earlier this month showed that the revenue for the period is already going to be below the previous forecasts, and now there’s a risk that due to the new export control restrictions along with the further downturn in PC spending the outlook could be worse than expected as well. Therefore, as the world enters a new geopolitical reality full of uncertainties, it appears that AMD’s stock has become less attractive of an investment than it once was.

Welcome To The New Reality

At the end of August, the Biden administration announced new export restrictions that target chips, which are used in AI and high-performance computing, in order to undermine China’s efforts in those fields. From what we know so far, the new regulations prevent Nvidia (NVDA) from exporting its A100 and H100 family GPUs, which Chinese companies such as NIO Inc. (NIO) and Alibaba (BABA, OTCPK:BABAF) use for their AI projects. They also restrict the exports of AMD’s Instinct MI250 Accelerator family that powers data centers and are used in high-performance computing and AI development.

Then, earlier this month, the U.S. Department of Commerce released a 100+ page document that imposes new export control rules, which target commercial chips as well due to them being constantly used by China’s military-industrial complex. The document without a doubt outlines one of the broadest export restrictions issued in decades, as it enforces stricter control on the export of advanced commercial chips, chip equipment, and supplementary tools.

In addition to that, the U.S. Department of Commerce has also added the need to obtain additional certification in order for companies to export chips to Chinese firms from the Unverified List, while at the same time it imposes harsher sanctions on Chinese businesses if the American inspectors are unable to do onsite verification of their facilities.

On top of that, after the publication of new regulations, news came out that the U.S. citizens that worked in China’s semiconductor industry began to resign en masse in order to not lose their American citizenship. Bloomberg recently reported that the Biden administration is exploring ways to impose additional restrictions on China.

All of this happened precisely before the beginning of the 20th National Congress of the CCP, in which Xi Jinping once again gave a grim outlook for the future of Sino-American relations. This, in the end, could lead to a further confrontation between the two biggest economies in the world in the future.

The Latest Casualty Of The Sino-American Confrontation

The new restrictions, along with the worsening of the Sino-American relations, are a big deal for AMD. The company risks losing royalties from its joint ventures in China and, at the same time, its overall business is significantly exposed to revenues generated on the mainland. Let’s not forget that back in 2019, the Bureau of Industry and Security of the U.S. Department of Commerce added two of its joint ventures in China to its Entity List, which makes the company apply for a license in order to export some of its chips to the mainland. While AMD has been saying in its latest 10-Q filing that it’s complying with the law, there’s a risk that with a further confrontation its operations in China could be put at risk. As the company itself stated:

In addition, we may not realize the anticipated benefits from our business initiatives. For example, we may not realize the expected benefits from the THATIC JV’s expected future performance, including the receipt of any future milestone payments and any royalties from certain licensed intellectual property.

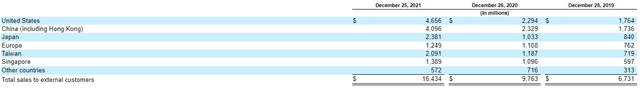

At the same time, AMD’s significant exposure to China is a company’s major downside in the current environment as well. Nvidia already stated that due to the new export rules, it could lose up to $400 million in sales this year. While so far AMD didn’t say much about the potential losses, it could shed more light on this issue tomorrow during its earnings conference call. However, considering that in 2021, China has been its second-biggest market that generated ~25% of the total revenues, any major restrictions are more than likely to negatively affect the whole business in the long run, especially if the U.S. and China begin a new trade war.

On top of all of this, AMD’s purchase of Xilinx earlier this year could also backfire in the foreseeable future. Xilinx’s latest report as an independent entity for Q4 and FY21 showed that 49% of its revenues at the end of 2021 came from the Asia Pacific region, its biggest single market. Considering that revenues from Japan are reported separately, it’s safe to assume that a significant portion of that 49% of revenues was generated in China.

The problem is that the publicly available reports show that the Chinese military relies, among others, on chips developed by AMD’s Xilinx, which could make it a perfect casualty of a further Sino-American confrontation. Therefore, it’s safe to assume that AMD could experience additional disruptions of its operations in the foreseeable future, as it becomes clear that the current U.S. administration is on a quest to undermine Beijing’s ability to realize its military ambitions in the AI and high-performance computing fields.

The Growth Is Slowing Down

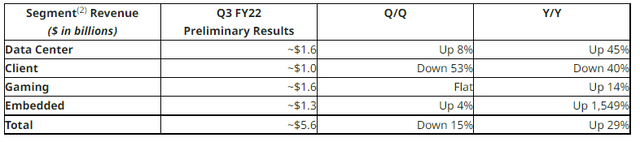

AMD is expected to release its full Q3 earnings results tomorrow, but earlier this month it has already disappointed its investors by releasing preliminary earnings results, in which the company stated that it expects its revenues for the period to be $5.6 billion, below the previous outlook of $6.7 billion. The potential decline in revenues is attributed to the underperformance in the client segment, which is forecasted to generate only $1 billion in revenues, down 53% Q/Q, and down 40% Y/Y.

AMD’s Preliminary Q3 Earnings Results (AMD)

This also suggests that so far AMD has not been significantly impacted by the initial export controls in Q3, which ended in September, as its data center and embedded businesses showed growth. However, after the publication of the 100+ page document by the Department of Commerce in October, there’s a risk that the real impact of those restrictions would be felt in Q4, which could prompt AMD’s management to disappoint its investors tomorrow again by releasing a downbeat outlook.

On top of that, there’s also a possibility that AMD’s client business would continue to underperform and drag down the rest of the business, as the downturn in PC spending could extend into the next year, further negatively affecting the sales of CPUs.

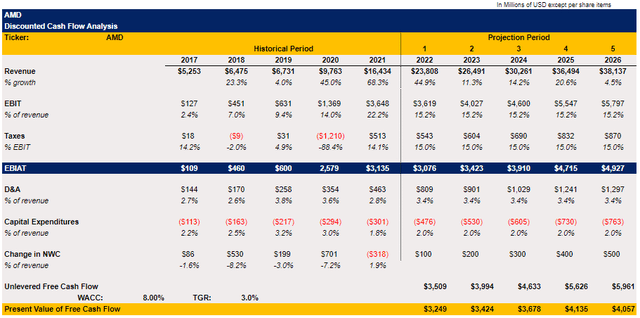

As a result, we could safely assume that, at least in the following periods, AMD’s growth rate would be lower in comparison to the last couple of years. That’s why, in my base case discounted cash flow (“DCF”) model, the revenue growth rate along with the earnings forecast are mostly in-line with the street estimates while all the other metrics in the following years are either averages of previous periods or are close to the latest reported period. The WACC in the model is 8%, while the terminal growth rate is 3%.

AMD’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

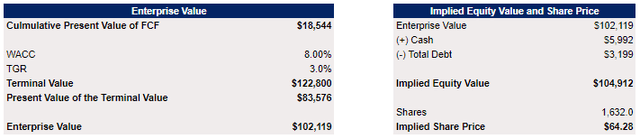

The model shows that AMD’s enterprise value is $102 billion, while its implied share price is $64.28 per share in the base scenario, which is close to the current market price. Therefore, it makes sense to give AMD a “HOLD” rating, which is the same rating that Seeking Alpha’s Quant algorithm gives to the company’s stock, as so far it appears that some portion of risks is already priced in after the latest depreciation of shares. At the same time, there are no foreseeable major catalysts that could’ve given reasons to value AMD higher in the current environment.

AMD’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

The Bottom Line

In the last decade, AMD, under the leadership of CEO Lisa Su, has been able to reinvent itself and become one of the dominant players in the global CPU market. Thanks to this, the company’s stock has experienced a major appreciation in recent years and has greatly rewarded its shareholders. However, times are changing and, with them, the need to reevaluate the company’s prospects in this changing geopolitical landscape full of uncertainties.

Considering that it’s more than likely that we would witness a further confrontation between China and the United States, it’s safe to assume that AMD’s exposure to China is no longer a major upside given the new reality, which makes purchasing its stock less attractive than before.

Be the first to comment