HAKINMHAN/iStock via Getty Images

What Is Decca Investment Limited?

Hong Kong, China-based Decca Investment Limited (DCCA) was founded to manufacture custom-made wooden furniture and related fixtures and fittings for office, hotel and retail clients.

Management is headed by Chief Executive Officer, Mr. Wong Man Hin, who has been with the firm since June 2021 and was previously self-employed in the corporate finance industry as a consultant on M&A, restructuring and business strategy.

The company’s customer base is located in Hong Kong, mainland China and to a lesser extent in the U.S. and Europe.

As of March 31, 2022, Decca Investment has booked a fair market value investment of $17.5 million as of March 31, 2022 from investors including Pioneer East Investment Development (Mr. Wong Man Hin and Tsang Yee Ling).

The firm seeks clients among property developers, hotel and restaurant owners and operators, retailers, airports and banking concerns.

The company also exports its furniture overseas ‘through an international network of offices and showrooms.’

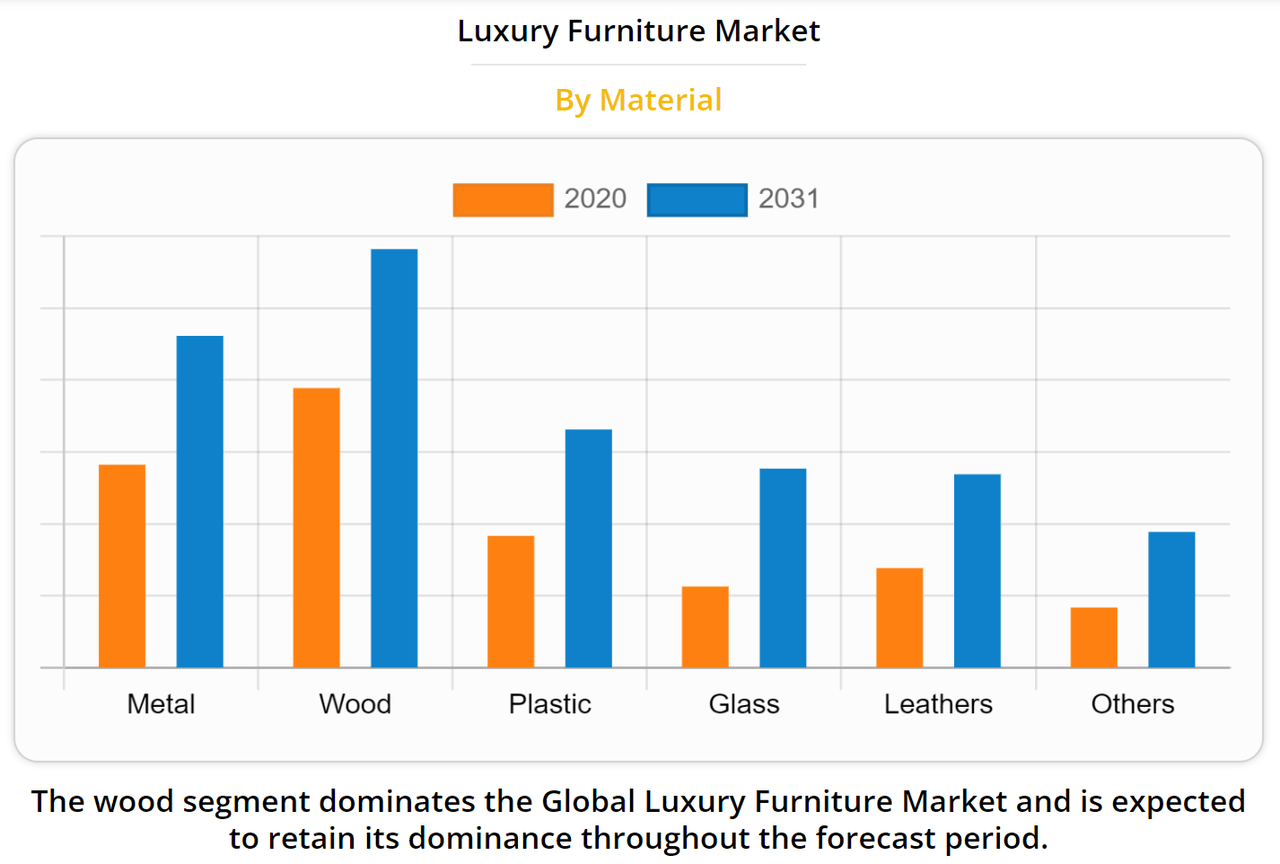

According to a 2021 market research report by Allied Market Research, the global luxury furniture market was an estimated $23.8 billion in 2020 and is forecast to reach $42.1 billion by 2031.

This represents a forecast CAGR of 5.5% from 2022 to 2031.

The main drivers for this expected growth are increasingly creative designs by manufacturers and a transition to environmentally-friendly product offerings to consumers concerned about sustainability.

Also, the wood segment of the luxury furniture market has been and is expected to continue to be the largest segment of the luxury market, as the chart shows below:

Global Luxury Furniture Market By Material (Allied Market Research)

Major competitive or other industry participants include:

-

Muebles Pico

-

Valderamobili

-

Giovanni Visentin

-

Scavolini

-

Laura Ashley Holding

-

iola Furniture

-

Nella Vetrina

-

Henredon Furniture Industries

-

Turri S.r.l.

-

Others

Decca Investment’s IPO Date & Details

The initial public offering date, or IPO, for Decca Investment has not yet been indicated by the company or the underwriter.

(Warning: Compared to stocks with more history, IPOs typically have less information for investors to review and analyze. For this reason, investors should use caution when thinking about investing in an IPO, or immediately post-IPO. Also, investors should keep in mind that many IPOs are heavily marketed, past company performance is not a guarantee of future results and potential risks may be understated.)

Decca Investment intends to raise $33 million in gross proceeds from an IPO of its ordinary shares, offering 6 million shares at a proposed midpoint price of $5.50 per share.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $187.9 million, excluding the effects of underwriter over-allotment options.

The float to outstanding shares ratio (excluding underwriter over-allotments) will be approximately 13.04%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

Management says it will use the net proceeds from the IPO as follows:

Approximately 20% for developing more sales channels for individual customers globally;

Approximately 20% for expanding more showrooms and distributors to increase the market share in North America and Europe;

Approximately 20% for developing more brands and designs on products;

Approximately 20% for spending on potential mergers and acquisitions, which would expand our manufacturing facilities; and

The balance to fund working capital and other general corporate purposes

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says the firm is not currently a party to any legal proceedings that would have a material adverse effect on its financial condition or operations.

The sole listed bookrunner of the IPO is Univest Securities.

How To Invest In The Company’s Stock: 7 Steps

Investors can buy shares of the stock in the same way they may buy stocks of other publicly traded companies, or as part of the pre-IPO allocation.

Note: This report is not a recommendation to purchase stock or any other security. For investors who are interested in pursuing a potential investment after the IPO is complete, the following steps for buying stocks will be helpful.

Step 1: Understand The Company’s Financial History

Although there is not much public financial information available about the company, investors can look at the company’s financial history on their form S-1 or F-1 SEC filing (Source).

Step 2: Assess The Company’s Financial Reports

The primary financial statements available for publicly-traded companies include the income statement, balance sheet, and statement of cash flows. These financial statements can help investors learn about a company’s cash capitalization structure, cash flow trends and financial position.

My summary of the firm’s recent financial results is below:

The firm’s financials have shown increasing topline revenue, higher gross profit and gross, growing operating profit but increased cash used in operations.

Free cash flow for the twelve months ended March 31, 2022 was negative ($6.7 million).

Selling and marketing expenses as a percentage of total revenue have dropped as revenue has increased; its selling and marketing efficiency multiple was 2.1x in the most fiscal year.

The firm currently plans to pay no dividends and to retain any future earnings to reinvest back into its growth initiatives.

Step 3: Evaluate The Company’s Potential Compared To Your Investment Horizon

When investors evaluate potential stocks to buy, it’s important to consider their time horizon and risk tolerance before buying shares. For example, a swing-trader may be interested in short-term growth potential, whereas a long-term investor may prioritize strong financials ahead of short-term price movements.

Step 4: Select A Brokerage

Investors who do not already have a trading account will begin with the selection of a brokerage firm. The account types commonly used for trading stocks include a standard brokerage account or a retirement account like an IRA.

Investors who prefer advice for a fee can open a trading account with a full-service broker or an independent investment advisor and those who want to manage their portfolio for a reduced cost may choose a discount brokerage company.

Step 5: Choose An Investment Size And Strategy

Investors who have decided to buy shares of company stock should consider how many shares to purchase and what investment strategy to adopt for their new position. The investment strategy will guide an investor’s holding period and exit strategy.

Many investors choose to buy and hold stocks for lengthy periods. Examples of basic investing strategies include swing trading, short-term trading or investing over a long-term holding period.

For investors wishing to gain a pre-IPO allocation of shares at the IPO price, they would ‘indicate interest’ with their broker in advance of the IPO. Indicating an interest is not a guarantee that the investor will receive an allocation of pre-IPO shares.

Step 6: Choose An Order Type

Investors have many choices for placing orders to purchase stocks, including market orders, limit orders and stop orders.

-

Market order: This is the most common type of order made by retail traders. A market order executes a trade immediately at the best available transaction price.

-

Limit order: When an investor places a buy limit order, they specify a maximum price to be paid for the shares.

-

Stop order: A buy-stop order is an order to buy at a specified price, known as the stop price, which will be higher than the current market price. In the case of buy-stop, the stop price will be lower than the current market price.

Step 7: Submit The Trade

After investors have funded their account with cash, they may decide on an investment size and order type, then submit the trade to place an order. If the trade is a market order, it will be filled immediately at the best available market price.

However, if investors submit a limit order or stop order, the investor may have to wait until the stock reaches their target price or stop-loss price for the trade to be completed.

The Bottom Line

DCCA is seeking U.S. public capital market investment to fund its general corporate growth and working capital requirements.

The market opportunity for luxury furniture is relatively large and expected to grow at a moderate rate of growth in the coming years.

Like other firms with Chinese operations seeking to tap U.S. markets, the firm operates within a WFOE structure or Wholly Foreign Owned Entity. U.S. investors would only have an interest in an offshore firm with interests in operating subsidiaries, some of which may be located in the PRC. Additionally, restrictions on the transfer of funds between subsidiaries within China may exist.

The recent Chinese government crackdown on IPO company candidates combined with added reporting and disclosure requirements from the U.S. has put a serious damper on Chinese or related IPOs resulting in generally poor post-IPO performance.

Also, a potential risk to the company’s outlook is the uncertain future status of Chinese company stocks in relation to the U.S. HFCA Act, which requires delisting if the firm’s auditors do not make their working papers available for audit by the PCAOB.

Prospective investors would be well advised to consider the potential implications of specific laws regarding earnings repatriation and changing or unpredictable Chinese regulatory rulings that may affect such companies and U.S. stock listings.

Additionally, post-IPO communications from management of smaller Chinese companies that have become public in the U.S. have been spotty and perfunctory, indicating a lack of interest in shareholder communication, only providing the bare minimum required by the SEC and a very different approach to keeping shareholders up-to-date about management’s priorities.

Univest Securities is the lead underwriter, and IPOs led by the firm over the last 12-month period have generated an average return of negative (52.7%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

As for valuation, management is asking investors to pay an Enterprise Value/Revenue multiple of approximately 2.0x, which is well above the 1.25x average for the U.S. publicly traded Furniture/Home Furnishings basket as of January 2022 compiled by noted valuation expert Dr. Aswath Damodaran.

While the firm has grown revenue and is profitable, it faces uncertain Chinese government regulatory risks and the IPO appears excessively valued.

So, I’m on Hold for the DCCA IPO.

Be the first to comment