sanfel

On April 26th, EastGroup Properties, Inc. (NYSE:EGP) reported stellar 1Q22 operating results. The metrics were truly astounding:

- Funds from Operations of $1.68 Per Share for First Quarter 2022 Compared to $1.45 Per Share for First Quarter 2021, an Increase of 15.9%

- Same Property Net Operating Income for the Same Property Pool Excluding Income from Lease Terminations Increased 8.5% on a Cash Basis and 7.4% on a Straight-Line Basis for First Quarter 2022 Compared to the Same Period in 2021

- Rental Rates on New and Renewal Leases Increased an Average of 33.5% on a Straight-Line Basis

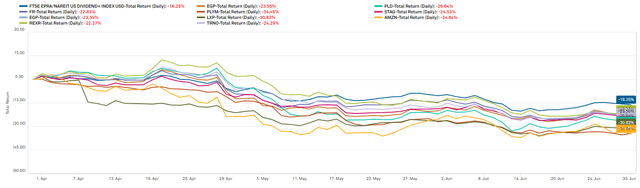

Somehow, though, EGP’s celebration of success was cut short less than 48 hours later when Amazon (AMZN) reported an unexpected loss of $7.56/share and implied they had leased/bought/built too much industrial/logistics/distribution space.

The Amazon fallout didn’t just affect EGP but hit the whole industrial REIT sector. Like EastGroup, Prologis (PLD), Terreno Realty (TRNO), First Industrial (FR), Rexford Industrial (REXR) and other industrial REITs reported record earnings and double digit rent roll-ups, but AMZN’s report/comments quickly knocked 25% off their share prices.

An Inappropriate Market Response

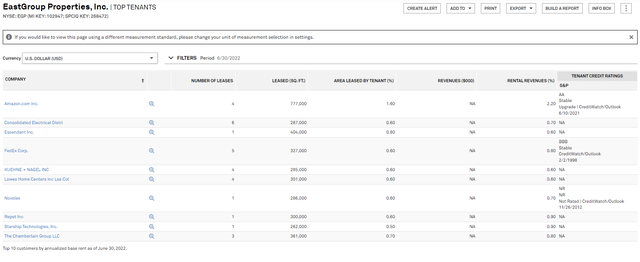

As it turns out, Amazon is EastGroup’s largest tenant, but even at 2.20% of EGP’s total rental revenues, an unlikely AMZN lease default would go unnoticed in EGP’s 98%+ leased, high demand portfolio. More to the point, Amazon’s revenues are growing, they are on the hook for all of their leases, and more than 90% of their leases with EGP expire after 2033!

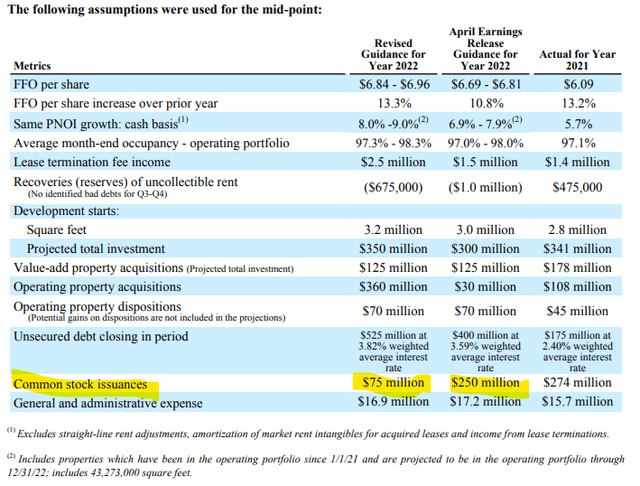

Even though Amazon’s prospects have no negative impact on EGP’s revenues, EastGroup management has been forced to address the AMZN fallout on many fronts. In negotiating a seller tax-advantaged OP Unit acquisition in the Bay Area, they successfully navigated their share price decline with a wary, but understanding, counterparty. Similarly, to capitalize their robust development pipeline, they pivoted from using their previously advantageous common share ATM and chose, instead, a series of fixed-rate debt offerings as opposed to issuing shares at dilutive prices.

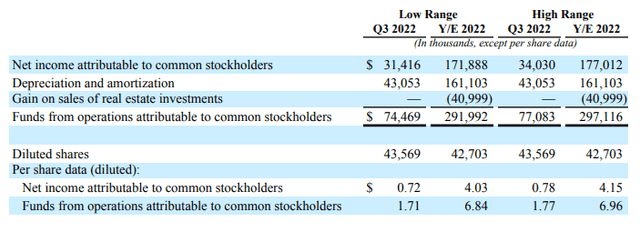

EGP’s July 27 2Q22 earnings release was again impressive:

*Funds from Operations of $1.72 Per Share for Second Quarter 2022 Compared to $1.47 Per Share for Second Quarter 2021, an Increase of 17.0%.

*Same Property Net Operating Income for the Same Property Pool Excluding Income from Lease Terminations Increased 9.5% on a Cash Basis and 7.7% on a Straight-Line Basis for Second Quarter 2022 Compared to the Same Period in 2021.

*Rental Rates on New and Renewal Leases Increased an Average of 37.2% on a Straight-Line Basis.

In the report, EGP also revised their 2022 earnings guidance higher, and the impact of the Amazon fallout was conspicuous in their modeling.

OUTLOOK FOR 2022

Amazon’s mea culpa report in April didn’t affect EGP’s cash flows or projections, but it did crush their stock price. The guidance below demonstrates a considerable discipline in management’s decision to not issue shares at dilutive, discounted prices, but instead to suffer a more temporary harm in issuance of slightly more debt at higher rates.

When the share price recovers, which it has already begun to do, they can go back to the ATM and secure more favorable capital.

It’s the Markets, Not the Economy

Amazon is the dominant player in e-commerce, cloud computing, and a growing number of other business lines. AMZN is only 1 of hundreds of businesses who compete for space in EastGroup’s operations-essential properties in the nation’s most vibrant MSAs.

2022’s anxious investment environment can extrapolate fear like a pernicious microbe. Amazon is fine, it’s not contagious; but it sent a chill through the industrial REIT sector.

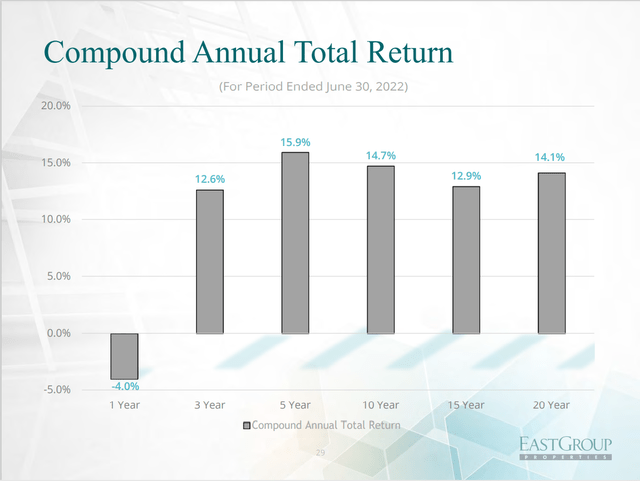

EGP remains the exceptional operator it has been for the last 20 years.

Its shares have just become opportunistically cheap.

Be the first to comment