LightFieldStudios/iStock via Getty Images

Introduction

British American Tobacco p.l.c. (NYSE:BTI) (referred here as “BAT”) released its H2 2022 pre-close update this morning (December 8). (U.K. companies release “pre-close updates” before the close of a reporting period.) BAT shares are down 2.8% in London as of 1 pm local time.

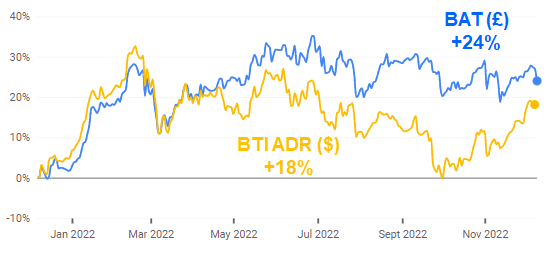

We originally upgraded our rating on BAT to Buy in March 2020. Since then, shares have gained 54% (including dividends) in pounds, and around 72% in U.S. dollars, though recent performance has been distorted by the pound strengthening 13% against the dollar since September 27:

|

BAT Share Price Performance (Last 1 Year)  Source: Google Finance (08-Dec-22). |

BAT’s operations appear to have remained stable. Full-year guidance of a 2-4% revenue growth and a mid-single-digit EPS growth (at constant currency) was reaffirmed. In cigarettes, downgrading in the U.S. has accelerated in H2, but volumes in Emerging Markets were better than expected. In New Categories, BAT is making good progress in Vapor but remains behind in Heated Tobacco and Oral Tobacco. There are pending regulatory and tax risks in California and the European Union. BAT shares are currently at 9x expected 2022 EPS and have a 6.6% Dividend Yield. Our return forecasts indicate a total return of 56% (17.9% annualized) by 2025 year-end. Buy.

British American Tobacco Buy Case Recap

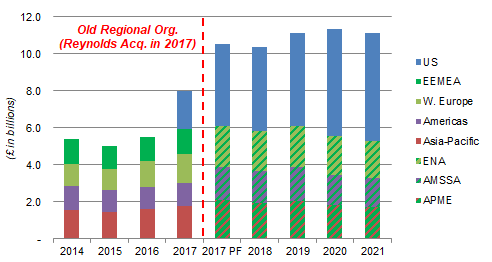

BAT is a global tobacco company, but relies on the U.S. market for half of its segmental Profit from Operations (“PfO”, equivalent to EBIT) and most of its PfO growth; non-U.S. PfO was roughly flat in 2017-19 and fell in 2020 and 2021:

|

BAT Profit from Operations by Region (2014-2021)  Source: BAT company filings. Key: EEMEA = Eastern Europe, Middle East & Africa; ENA = Europe & North Africa; AMSSA = Americas & Sub-Saharan Africa; APME = Asia-Pacific & Middle East. |

Our investment case on BAT is based on the following:

- A broadly stable U.S. cigarette business, where Vapor is the main threat but with only moderate growth (led by BAT)

- Mostly stable non-U.S. cigarette markets, with disruption by IQOS Heated Tobacco having only limited impact on group earnings

- A mid-single-digit ex-currency EPS CAGR over time, thanks to broadly stable cigarette revenues, expanding margins, and buybacks, but limited by BAT’s poor performance in New Categories in most markets

- A long-term P/E multiple of 10x, implying a Dividend Yield of 6.5%

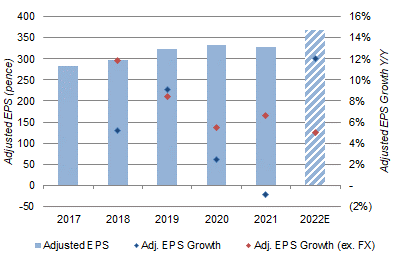

COVID-19 was an overall positive for BAT, as the boost to tobacco consumption in Developed Markets (approx. 75% of BAT revenues) more than offset the hit to that in Emerging Markets (approx. 25%). BAT achieve ex-currency Adjusted EPS growth of 5.5% in 2020 and 6.6% in 2021, and is guiding to one of mid-single digits in 2022:

|

BAT Adjusted EPS & EPS Growth (2017-22E)  Source: BAT company filings. |

Philip Morris International Inc. (PM) has recently entered the U.S. market through its acquisition of Swedish Match AB (publ) (OTCPK:SWMAY), though it will not regain the right to sell its IQOS Heated Tobacco product there until after April 2024, and will need time to obtain FDA marketing approval for its VEEV Vapor products (where a PMTA filing is planned for “early 2023”).

BAT’s H2 2022 update shows that its operations remain stable overall at present.

Full-Year 2022 Guidance Reiterated

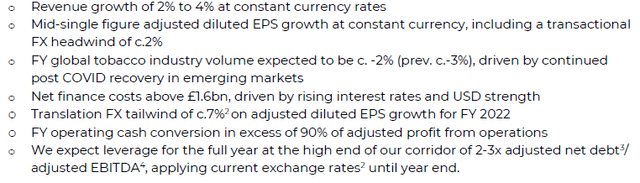

With only a few weeks left in 2022, BAT reiterated its full-year guidance, which includes a 2-4% revenue growth and a mid-single-digit EPS growth (at constant currency); EPS growth is after a 2% transactional currency headwind:

|

BAT 2022 Guidance  Source: BAT pre-close update (H2 2022). |

Management expects currency to be a translational tailwind of 7% for EPS, which means reported Adjusted EPS growth will likely be around 12% (in pounds).

Russia continues to be included in BAT results under IFRS accounting standards. BAT has disclosed that Russia and Ukraine together represented 3% of group revenues and “a slightly lower” percentage of Adjusted EBIT in 2021.

Industry Cigarette Volumes Broadly Stable

BAT expects global cigarette industry volume to fall by 2% in 2022, an improvement on the 3% previously expected. However, this is the combination of a worse-than-expected U.S. and better-than-expected Emerging Markets

In the U.S., BAT stated there were “early signs of accelerated downtrading in the industry” in H2. Specifically, while they were expecting year-on-year volume decline to be better in H2 due to an easier prior-year comparable, this improvement did not materialize. (BAT’s U.S. combustibles volume fell 13.4% year-on-year in H1 2022.)

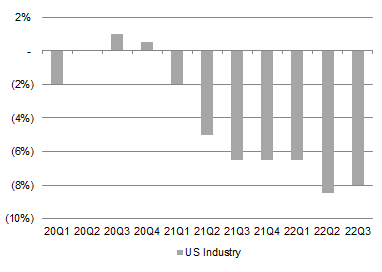

This is consistent with results reported by Altria Group, Inc. (MO), where Q3 2022 industry volume decline (adjusted for inventory, calendar differences, etc.) was only 0.5 ppt better than in Q2, despite a 1.5 ppt easier prior-year comparable:

|

U.S. Cigarette Industry Volume Decline By Quarter (Since 2020)  Source: Altria company filings. |

Similar to Altria, BAT attributed the pressure on U.S. cigarette volumes to “ongoing macro-economic factors and post-COVID normalization of consumption patterns,” and has “recently activated commercial plans” including more marketing and discounting. Management does not believe BAT’s long-term pricing power in the U.S. has changed but will be more selective in how it is applied.

Better-than-expected volumes in Emerging Markets were attributed to a “continued post-COVID recovery.”

Mixed Progress in New Category Products

In New Categories, BAT is making good progress in Vapor but remains behind in Heated Tobacco and Modern Oral Tobacco. Key September year-to-date category share figures for various BAT products are as follows:

|

New Category |

Market |

Category Position |

Category Share |

Compared to FY21 |

|

Vapor |

U.S. |

#1 |

39.3% (value) |

+6.8 ppt |

|

Vapor |

Top 5 Markets |

#1 |

35.7% (value) |

+2.2 ppt |

|

Heated Tobacco |

Japan |

#2 |

20.2% (volume) |

-1.0 ppt |

|

Heated Tobacco |

Europe ex. Russia |

#2 |

18.8% (volume) |

+4.8 ppt |

|

Heated Tobacco |

Top 9 Markets |

#2 |

19.5% (volume) |

+1.6 ppt |

|

Modern Oral |

U.S. |

#4 |

<10% (volume) |

n/a |

|

Modern Oral |

Top 5 Markets |

n/a |

30.6% (volume) |

-4.1 ppt |

(U.S. Modern Oral share is estimated from Swedish Match’s Q3 2022 results.)

In Vapor, BAT’s Vuse appears to be benefiting from moderate growth in the U.S. Vapor category as well as continuing problems at Juul, previously the #1 player there. Outside the U.S., growth in the Vapor category has been driven by the disposables segment, where BAT has recently launched its Vuse Go product. Vuse Go is now sold in 12 markets and has achieved a #2 value share in the disposable segments in the U.K. and France. More market launches are planned for Vuse Go.

In Heated Tobacco, BAT’s glo has a 19.5% volume share in the top 9 markets (including Russia), up 1.6 ppt from FY21. However, this overstates BAT’s position as it excluded markets that are smaller or where glo is not present. In Europe excluding Russia, glo has a volume share of 18.8%, up 4.8 ppt year-on-year. However, in Japan, glo’s volume share fell 1.0 ppt to 20.2%, “in a highly competitive market.” The new Hyper X2 device has been rolled out nationally in Japan in October and launched in 19 key markets globally, with more to follow by year-end.

In Modern Oral, BAT’s Vuse has a 30.6% volume share, down 4.1 ppt year-on-year, which BAT attributed to a decline in the U.S. market after its decision to instead prioritize Vapor there. We know from Swedish Match data that Velo’s last 6-month U.S. volume has more than halved year-on-year in a growing market (as of Q3 2022), and we expect competition from Swedish Match’s ZYN to intensify under Philip Morris ownership.

More positively, for the U.S. market, BAT has applied for a PMTA for “a superior Velo product” (likely drawn from its Nordic business), while Pakistan has become Velo’s third biggest Modern Oral market with a monthly volume of 40m pouches (compared to average monthly volumes of 230m in Europe and 30m in the U.S. in H1 2022).

New Categories overall remain loss-making but with expected “growing contribution across all New Categories and all Regions in 2022.”

Upcoming Regulatory & Tax Changes

There are pending regulatory and tax changes in California and the European Union which need to be monitored.

California will be implementing a ban on flavored tobacco products (including menthol) after it was upheld in a referendum in November 2022. Similar bans in Canada and the E.U. in the past saw BAT retain nearly all of its previous menthol cigarette volumes, including with the help of New Category products, and we expect the impact to be again very limited this time. However, California does have 11% of the U.S. population and, unlike previous menthol bans, will be banning menthol-flavored Vapor at the same time.

The European Commission is introducing a ban on flavored Heated Tobacco products. Including time for member states to translate the directive into law and the notice period, the ban will likely take effect in late 2023. As it does not affect Vapor, and BAT is behind in Heated Tobacco, the ban may be a positive for BAT.

The European Commission is also proposing a significant increase in tobacco taxes across the E.U., including an increase of the minimum cigarette duty from €1.80 to €3.60, a new 55% duty on Heated Tobacco products, and a new duty on Vapor products of at least 20% (and at least 40% for higher-nicotine products). The proposal will have to be agreed by all member states to become law, which means it is not certain to happen. However, the changes would make all nicotine products more expensive and would likely reduce consumption overall, so negative for BAT.

Valuation: BAT Dividend Yield is 6.2%

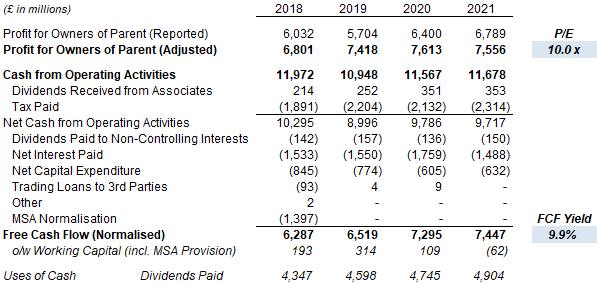

With shares at 3,316.0p in London as of 1 pm local time, relative to 2021 financials, BAT shares are trading at a 10.0x P/E and a 9.9% Free Cash Flow Yield:

|

BAT Net Income, Cashflow & Valuation (2018-21)  Source: BAT company filings. |

With guidance implying a 12% growth in Adjusted EPS in pounds, shares are at around 9x 2022 Adjusted EPS.

BAT shares pay an annual dividend of 217.8p (54.45p per quarter), implying a Dividend Yield of 6.6%. BAT still targets a 65% Payout Ratio, but now on a “medium to long term” basis, though its dividend policy is also “progressive” (i.e., growing the dividend every year).

BAT is on track to complete its £2bn buyback program, announced in February, by the end of 2022. The amount is equivalent to 2.7% of the current market capitalization.

Net Debt/EBITDA is expected to be at the “higher end” of the 2-3x targeted at 2022 year-end. Management expects to move back “towards the middle of this corridor over the medium term” to reflect higher interest rates and currency volatility, which will somewhat reduce buybacks in the interim.

British American Tobacco Stock Forecast

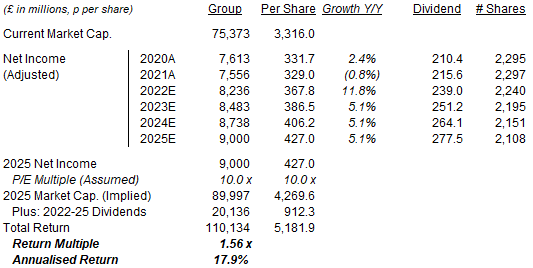

We raise our 2022 EPS forecasts slightly to reflect the higher currency tailwind (in GBP):

- 2022 Net Income growth of 9.0% (was 8.5%)

- From 2023, Net Income growth of 3.0% annually (unchanged)

- Share count to fall by 2.5% annually (unchanged)

- Dividends to grow with EPS on a Payout Ratio of 65% (unchanged)

- 2025 P/E at 10x P/E, representing a Dividend Yield of 6.5%

Our new 2025 EPS forecast is 427.0p, 0.5% higher than before (425.0p):

|

Illustrative BAT Return Forecasts  Source: Librarian Capital estimates. |

With shares at 3,316.0p, we expect a total return of 56% (17.9% annualized) by 2025 year-end, in just 3 years.

Is British American Tobacco A Buy? Conclusion

We reiterate our Buy rating on BAT but will monitor the business closely.

Be the first to comment