mihailomilovanovic

Qurate Retail (NASDAQ:QRTEA) provides video and online e-commerce through its subsidiaries, such as QVC, Inc, which includes HSN, Zulily, and Cornerstone brands. QVC sells a wide variety of consumer products through highly engaging, video-rich, interactive shopping experiences, distributed to over 216 million households through Broadcast networks and believed to be a global leader in video retailing operations based in the US, Germany, Japan, UK, and Italy.

The company quickly adapts its offerings in direct response to changes in customer purchasing patterns, providing the business with significant flexibility in operations.

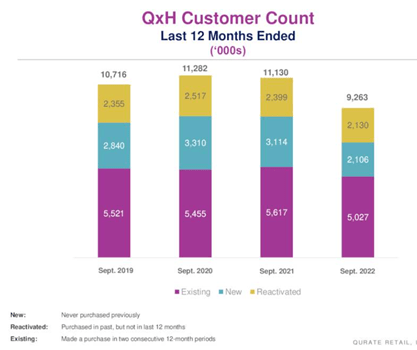

customer base (investors presentation )

It should be noted that the company enjoys considerable customer loyalty, and over 88% of the worldwide sales in 2021 came from repeat and reactivated customers, which provides the business with substantial stability.

In 2017, the company acquired the remaining 62% ownership in its previously owned brand HSN; and since then, management has been working extensively to strengthen its business operations.

Currently, due to volatile margins, the stock price has been dropping consistently. As a result, the stock has become substantially undervalued and from this price point, it provides a huge margin of safety. Therefore, I assign a buy rating to the stock.

Historical performance

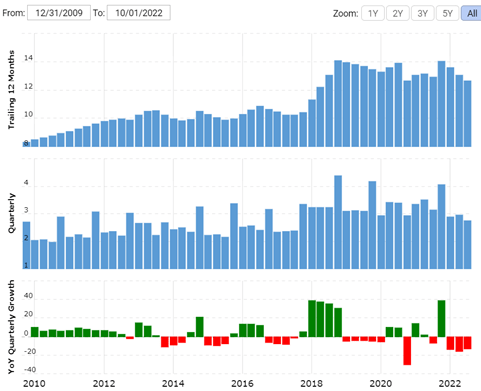

revenue growth (macrotrends.net )

I believe to analyze the actual earning power of the business, the investor must carefully analyze its historical performance. In the last ten years, revenue has increased from $9.8 billion in 2012 to about $14 billion by 2021. Considerable growth in revenue came in 2018, resulting from the acquisition of HSN, and from then onwards, it has been oscillating from the same levels. Also, over the period, net profits remained volatile and increased from $605 million in 2012 to about $823 million by 2018, but in the last three years, profit margins have fluctuated significantly. As a result, the company has produced net profits of $-456 million, $1.2 billion, and $340 million in 2019, 2020, and 2021, respectively. Also, fluctuations in the business performance over the last three-year period came from Zulily business which has produced over $1 billion and $469 million of impairment charges in 2019 and 2021, respectively, whereas the company’s two main businesses have been producing huge profits.

Note that, for the last few years, management has been focusing on share buybacks; as a result, the total outstanding share count has dropped from 610 million in 2016 to 381 million by now. Also, the management has been focusing on debt reduction, as a result, debt has reduced significantly to $5.6 billion from $7.5 billion in 2017. Currently, the company has a balance sheet of over $11 billion comprised of more than $7 billion in intangible assets and over $2.7 billion in inventory and receivables combined. Having such high goodwill combined with debt levels might put a business model at considerable risk of impairment and weakness in debt refinancing.

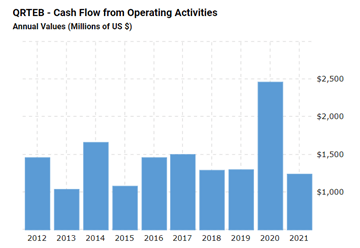

Due to significantly high depreciation charges along with high profits, the cash flow from operations has remained significantly higher for the business. Over the period, CFO remained more than $1 billion, and such a consistent and strong cash flow generating business model provides a significant margin of safety to the investors. Also, Management has invested the generated cash for CAPEX, debt reduction, share repurchase, and dividends, which has produced significant value for the shareholders.

From 2018 onwards, share prices have been dropping despite a consistent cash flow-generating business model; over the period, the stock has lost over 90% of its value, dropping from $28 per share in Feb 2018 to $2.34 per share by now. Such a substantial drop might be attributed to volatile business performance in the last three years. But the overall long-term outlook for the business seems attractive.

Strength in the business model

Strong customer loyalty

Over the period, management has invested a significant amount of money for brand development through various Marketing initiatives; also, by keeping its own margins at considerably low levels, the company provides huge value to its customers at competitive prices. As a result, the company has been enjoying strong customer loyalty, which has translated into repeat purchases and a consistent customer base, which provides significant advantage to the business.

Substantial cash flow

cash flow from operations (macrotends.net )

It should be noted that the company’s ability to generate cash flows has been very attractive and it has produced cash flows of over a billion in the last ten years; such a business model provides stability to the financial position.

Risk factors

The company operates in a business model where the product segment changes rapidly with changes in consumer preference. As a result, the company’s cost structure becomes highly variable relative to other retailers.

Also, in the next two years, significant payments are due, which can bring considerable risk to the business. Over $1.4 billion of long-term borrowing is going to mature in the upcoming years, and any weakness in the business performance might affect the refinancing process.

Recent development

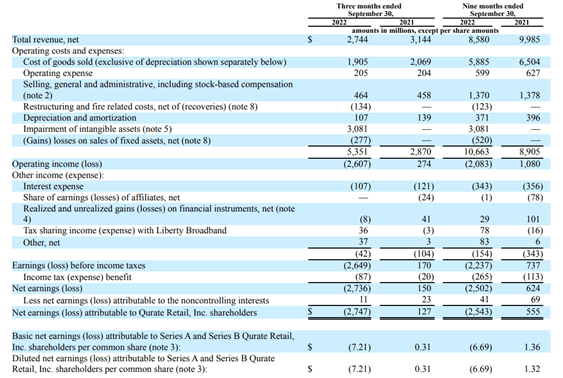

Quarterly results (Quarterly report )

In the recent quarter, revenue has dropped from $3.1 billion in the same quarter last year to $2.7 billion now. Also, as a result of a huge impairment loss of over $3 billion, the company has posted a net loss of $2.6 billion. Huge impairment loss attributed to impairments of over $2.5 billion and $899 million in QxH and Zulily business till last nine months.

Furthermore, net profits over the last nine-month period have been engulfed by a huge impairment loss in the recent quarter, partially offset by gains in asset sale. Also, due to low profit margins along with payments for account payables and other liabilities, the cash flow from operations has turned negative.

A significant backdrop that the company has been facing is attributed to general economic headwinds, loss from its second-largest facility due to fire and initiatives to reduce inventory and as a result, the gross margins have dropped significantly.

Furthermore, in the last nine months, the management has brought various experienced board members to drive profitability and has been focusing on turnaround, with its new initiative called Athens, by bringing high-quality customer experience along with strategic capital allocation; these initiatives might bring substantial improvements in the operating performance in the upcoming years.

Also, the number of active users on its streaming services QVC plus and HSN has been increasing consistently; as the management has been putting in significant efforts, it is expected to bring huge value to the business operations.

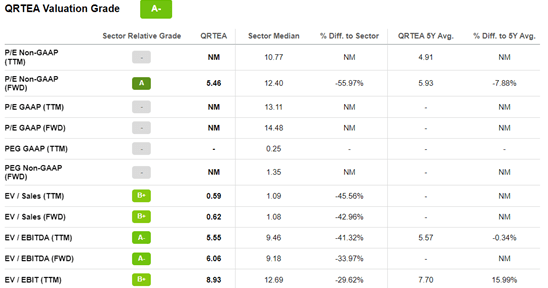

valuation (seeking alpha)

Currently, the company has been trading for $938 million, whereas it has produced over $ 340 million in net profits in the last year. Over the last ten years, CFO remained above $1 billion. But as the current inflationary environment, along with various issues mentioned above, the company has been producing huge losses. I believe the company has been trading for less than three times its last year’s earnings, and the management’s new efforts might bring profitability in the upcoming years. Therefore, I assign a buy rating to the stock.

Be the first to comment