KanawatTH

Thesis

Leading internally-managed business development company (BDC) Hercules Capital, Inc. (NYSE:HTGC) stock has recovered remarkably since our previous article urging investors to capitalize on the pessimism.

Accordingly, it surged more than 35% from its October lows and met our price target (PT) before pulling back recently. Relative to its 5Y and 10Y total return CAGR (including dividends reinvested) of 11.8% and 13%, respectively, we believe it has been a solid “buy the panic” opportunity for investors.

However, we also gleaned that the mean reversion rally was insufficient to reverse its downtrend bias decisively. Despite a robust Q3 earnings release as Hercules leveraged the Fed’s record rate hike cadence, we assess that investors could be assessing a slowdown in the Fed’s momentum.

Hence, we believe investors could turn their focus back to the underlying performance of Hercules’ portfolio companies in a worsening macro environment. With the growth tailwind of the Fed’s rate hike cadence normalizing, it could also moderate Hercules’ net investment income (NII) growth with less robust investment activity.

Notwithstanding, we believe HTGC’s valuation has already reflected significant macro headwinds, as calls for a looming recession have been getting more pronounced. However, the most-anticipated recession in recent years could also turn more positive than anticipated, as highlighted in a recent S&P 500 (SPX) (SP500) article.

Therefore, we deduce that the market’s positioning of HTGC is appropriate as we move into the Fed’s interest rate decision next week, preceded by the release of November’s CPI print.

With HTGC having met our PT and pulling back, we revise it to a Hold for now as we assess its near-term directional bias.

HTGC: Valuation Likely Reflected Significant Macro Challenges

Wall Street economists and strategists have turned increasingly pessimistic as they assess the fallout from the Fed’s record rate hikes in 2022. CEOs have also become even more cautious, as a recent report highlighted that 98% expect a recession over the next 12-18 months.

Furthermore, China’s COVID reopening moves could complicate the Fed’s top priority of combatting elevated inflation rates. Bloomberg Economics enunciated in a recent piece that China’s projected full reopening in 2023 would likely put the supply chain under pressure, with a further uplift in commodity prices. With the full reopening consensus by H1’23, “Bloomberg Economics estimates energy prices will increase by 20%, and the US consumer price index may jump to 5.7% by year-end,” from a projected moderation to 3.9% through H1’23.

Hence, we believe the potential for a further macroeconomic fallout from the Fed staying in the restrictive zone for an extended period to combat inflation has intensified. Therefore, ARK Invest (ARKK) (ARKG) CEO/CIO Cathie Wood’s call on the Fed to relent on its hawkish stance due to the steepest 10Y/2Y curve inversion in decades could fall on deaf ears.

With that in mind, we believe the risks of a significant recession have risen. However, the interest rate growth tailwind Hercules rode in 2022 could still moderate in 2023 as the Fed moves into a data dependency phase.

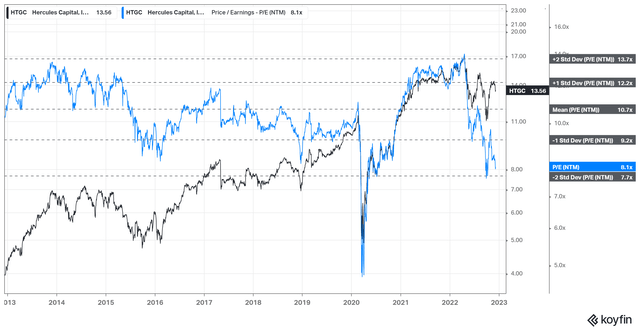

HTGC NTM NII/share multiples valuation trend (koyfin)

As such, we believe that HTGC’s NII per share multiple of 8.1x, close to the two standard deviation zone under its 10Y average, is appropriate to reflect significant recessionary risks.

We believe such a backdrop could be treacherous for BDCs, as their portfolio companies potentially suffer from the economic fallout. As such, it’s critical for investors to apply a considerable margin of safety, as investment activity and prepayment levels could fall further, lowering NII growth accretion.

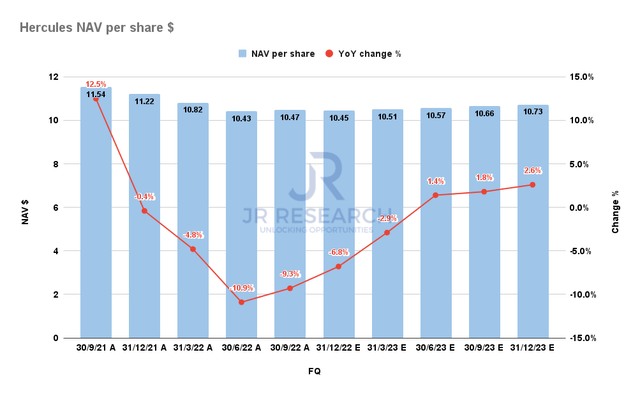

Hercules NAV per share consensus estimates (S&P Cap IQ)

Also, Hercules’ net asset value (NAV) per share estimates suggest an inflection from Q2’22 through FY23. Hence, analysts likely don’t expect a further battering in its portfolio companies through 2023. It’s also in line with the analysts’ projections of an improvement in the market’s earnings estimates for 2023, as discussed in our S&P 500 article.

Therefore, investors should not rule out further earnings compression risks that could have implications for the valuations of Hercules’ portfolio companies through 2023.

Is HTGC Stock A Buy, Sell, Or Hold?

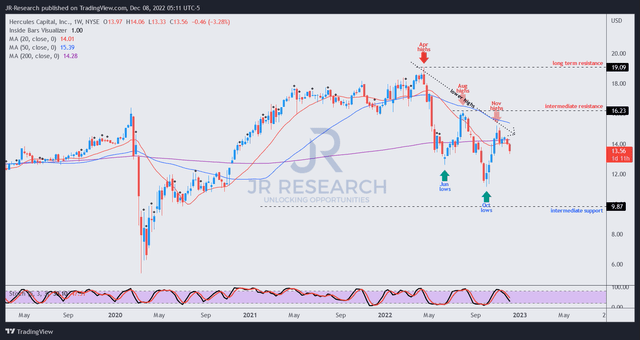

HTGC price chart (weekly) (TradingView)

It’s clear that HTGC remains in a medium-term downtrend, despite the recovery from its October lows.

The 50-week moving average (blue line) has continued to attract sellers to digest HTGC’s upward momentum. As such, we urge investors to watch for the subsequent consolidation of HTGC’s price action before deciding to add more to positions.

Revising from Buy to Hold for now.

Be the first to comment