Imgorthand

An all-equity portfolio can be a risky proposition for the retiree. Bear markets and/or recessions can derail the portfolio, and retirement plans. We can increase our chances of success by first creating a defensive portfolio. In essence we will use some ‘bond substitutes’. We will then hold types of stocks (sectors) that cover off all of the possible economic conditions. We are building the all-weather stock portfolio. Let’s have a look at the stocks for the retirement portfolio.

But first, get up to speed on the all-weather portfolio concept.

The portfolio models will be ready for most anything – with at least some assets that will perform no matter what the economic conditions of the day. We will be somewhat prepared for inflation and deflation that is then affected by the level of economic growth or contraction.

There’s always something working goes the theory for the all-weather portfolio models.

The ready for anything recap

From the first post in the series, here’s the types of stocks for economic conditions.

Assets for disinflationary growth

U.S stocks and international stocks (markets).

Telco’s, utilities and pipeline dividends

Most robust: Consumer discretionary, retailers, technology, healthcare and financials stocks

Assets for slow growth and low inflation

U.S. and international stock markets

Most robust: Technology, industrials, healthcare and energy stocks

Assets for deflation

Telco’s, utilities and pipeline dividends

Consumer staples, consumer discretionary, healthcare stocks

Assets for robust inflation and stagflation

Energy stocks

REITs

Other commodities stocks

In addition to being prepared for all economic conditions, the retiree has to be able to take on a bear market that often comes attached to a recession. We will start with a defensive stance – defence first.

Here’s another way of framing or simplifying the retirement portfolio challenge. The key is to give the retirement portfolio a defensive tilt.

Defensive bond substitute stocks – 60%

Utilities / Pipelines / Telecom / Consumer Staples / Healthcare / Canadian banks

Growth assets – 20%

Consumer discretionary, retailers, technology, healthcare, financials, industrials and energy stocks

Inflation protectors – 20%

REITs 10%

Oil and gas stocks 10%

Consider other commodities stocks

The retirement stocks – master list

Here are some stock ideas comprised of my own stocks that I hold, picks from Seeking Alpha authors that I follow, plus some of the top suggestions from the very successful Seeking Alpha Quant model. Dividend growth history is also a consideration. From a recent post on the Findependence Hub…

History suggests that stable, dividend-paying stocks offer an efficient alternative to bonds. Over long-periods of time, income-producing stocks have generated higher returns than their non-dividend-paying counterparts while suffering shallower losses in challenging periods. Over the past 20 years ending June 2022, the S&P 500 Dividend Aristocrats Index has produced a total return of 624.7% as compared to 468.6% for the S&P 500 Index.

Of course, do your own research. These ideas for consideration. But I will also put together a portfolio model, later in this post.

Defensive bond substitute stocks – 60%

Utilities

NextEra Energy (NEE), Duke Energy Corp (DUK), The Southern Co (SO), Dominion Energy (D), American Electric Power Group (OTCPK:APGI), Sempra Energy (SRE), Exelon (EXC), Xcel Energy (XEL), Consolidated Edison (ED), WEC Energy Group (WEC), CMS Energy (CMS), Atmos Energy (ATO), Alliant Energy (LNT), National Fuel and Gas (NFG), American States Water (AWR).

Pipelines

Enbridge (ENB), TC Energy (TRP), Pembina Pipelines (PBA), Enterprise Partners (EPD), Energy Transfer (ET), ONEOK (OKE), Kinder Morgan (KMI).

Telecom

AT&T (T), Verizon (VZ), Comcast (CMCSA), T-Mobile (TMUS), Bell Canada (BCE), Telus (TU).

Telco REITs – American Tower (AMT), Crown Castle (CCI).

Consumer Staples

Colgate-Palmolive (CL), Procter & Gamble (PG), Clorox (CLX), Walmart (WMT), Costco (COST), Pepsi (PEP), Coca-Cola (KO), General Mills (GM), Kimberly Clark (KMB), Kraft Heinz (KHC), Tyson Foods (TSN), Kellogg, (K), Kroger (KR), McCormick (MKC), Hormel Foods (HRL), Albertsons Companies (ACI).

Healthcare

Johnson & Johnson (JNJ), Abbott Labs (ABT), Medtronic (MDT), Stryker (SYK), CVS Health (CVS), McKesson Corporation (MCK), UnitedHealth (UNH), Pfizer (PFE), Eli Lilly (LLY), Merck (MRK), Bristol-Myers Squibb (BMY), Becton Dickinson (BDX), Cigna Corp (CI), Moderna (MRNA), Humana (HUM).

Canadian banks

RBC (RY), TD Bank (TD), Scotiabank (BNS), Bank of Montreal (BMO).

Growth assets – 20%

Consumer discretionary, retailers, technology, healthcare, financials, industrials and energy stocks.

Apple (AAPL), Microsoft (MSFT), Qualcomm (QCOM), Texas Instruments (TXN), Nike (NKE), BlackRock (BLK), OTIS (OTIS), Carrier (CARR), Alphabet (GOOG), Lowe’s (LOW), Home Depot (HD), Amazon (AMZN), Starbucks (SBUX), TJX Companies (TJX), McDonald’s (MCD), Tesla (TSLA), JPMorgan (JPM), Visa (V), Mastercard (MA), Union Pacific (UNP), S&P Global (SPGI), Lockheed Martin (LMT), Raytheon (RTX), General Dynamics (GD), Waste Management (WM), Berkshire Hathaway (BRK.A) (BRK.B), Sunoco (SUN), Broadcom (AVGO).

Inflation protectors – 20%

REITs 10%

Here are 5 top REIT picks for 2022 from Steven Cress at Seeking Alpha. That uses the very successful and proprietary quant evaluation system. Here’s the post – Top 5 REITs For 2022

And the REITs from Steven are…

Agree Realty Corporation(ADC), Essential Properties (EPRT), Alpine Income Property Trust (PINE), Regency Centers Corporation (REG), STAG Industrial (STAG).

Steven offers that American Tower Corporation is overvalued.

The most popular REIT author on Seeking Alpha is Brad Thomas.

I asked Brad for his 5 picks that would be suitable for the stock portfolio for retirees challenge. Brad first offered some commentary on fair value.

As you know, many REITs are closer to fair value… however, I like these 5 that are trading at a discount to iREIT’s FV:

1) Medical Properties Trust (MPW)

2) Highwood Properties (HIW)

3) Store Capital Corporation (STOR)

4) Digital Realty Trust (DLR)

5) Sachem Capital Corporation (SACH) (Yes, a little yield enhancer)

I (Dale) also like Tanger (SKT) for consideration. Global Self Storage (SELF) and EPR Properties (EPR) are also highly rated on Seeking Alpha.

You might also look at these REIT picks for 2022 and beyond from Kiplinger.

Oil and gas stocks 10%

Canadian Natural Resources (CNQ), Imperial Oil (IMO), Tourmaline (OTCPK:TRMLF), ConocoPhillips (COP), Exxon Mobil (XOM), Chevron (CVX), EOG Resources (EOG), Occidental Petroleum (OXY), Marathon (MRO), Xcel Energy (XEL), Vista Energy (VIST), Devon Energy (DVN).

Agricultural

Nutrien (NTR). The Mosaic Company (MOS).

Precious and other metals

Teck Resources (TECK), BHP Group (BHP), Rio Tinto (RIO).

I also like the idea of playing the green energy commodities supercycle.

The all-weather retirement stock portfolio

Here is a close approximation of the ready-for-retirement stock portfolio. I will add in the allocations for each sector.

Once again, this is an idea for consideration. Do your own additional research and consider valuation, taxation and your own greater financial plan. Keep in mind that for U.S. investors, any Canadian stocks are best held in certain registered retirement accounts.

The Canadian banks are included as they have been paying (and mostly increasing) dividends for 150 years or more. They operate in an oligopoly setting. These banks are also one of the best-performing (total returns) sub sectors in North American stock market history.

Defensive stocks

Utilities – 10%

NextEra Energy, Duke Energy Corp, The Southern Co, Dominion Energy, Alliant Energy, Oneok, WEC Energy.

Pipelines – 10%

Enbridge, TC Energy, Enterprise Partners, Energy Transfer, Oneok.

Telecom – 10%

AT&T, Verizon, Comcast, T-Mobile, Bell Canada, Telus.

Telco REITs – American Tower, Crown Castle.

Consumer Staples – 10%

Colgate-Palmolive, Procter & Gamble, Walmart, Pepsi, Kraft Heinz, Tyson Foods, Kellogg, Kroger, Hormel Foods, Albertsons Companies.

Healthcare – 10%

Johnson & Johnson, Abbott Labs, Medtronic, Stryker, CVS Health, McKesson Corporation, United Health, Merck, Becton Dickinson, Cigna Corp.

Canadian banks – 10%

RBC, TD Bank, Scotiabank, Bank of Montreal.

Growth assets – 20%

Consumer discretionary, retailers, technology, healthcare, financials, industrials and energy stocks.

Apple, Microsoft, Qualcomm, Texas Instruments, Nike, BlackRock, Alphabet, Lowe’s, Amazon, TJX Companies, McDonald’s, Tesla, Visa, Mastercard, Raytheon, Waste Management, Berkshire Hathaway, Broadcom.

Inflation protection – 20%

REITs 10%

Agree Realty Corporation, Realty Income, Essential Properties, Regency Centres Corporation, Stag Industrial, Medical Properties Trust, Store Capital Corporation, Global Self Storage and EPR Properties.

Oil and gas / commodities stocks 10%

Canadian Natural Resources, Imperial Oil, ConocoPhillips, Exxon Mobil, Chevron, EOG Resources, Occidental Petroleum, Devon Energy.

Agricultural

Nutrien, The Mosaic Company.

Precious and other metals

Tech Resources, BHP Group, Rio Tinto.

Why the all-weather stock portfolio?

We might all suffer from recency bias. All we have known, all we have invested through, is a disinflationary low growth environment. There have been brief bouts of deflation or inflation, but we’ve always quickly returned to the disinflation that we are too familiar with.

We are now in an economic transition period.

One can argue that we are currently in a stagflation environment. We should remember that stock markets don’t like unexpected inflation or stagflation.

Recently, only energy stocks have been banging out solid returns. Oil and gas stocks are currently the greatest source of free cashflow and dividend growth.

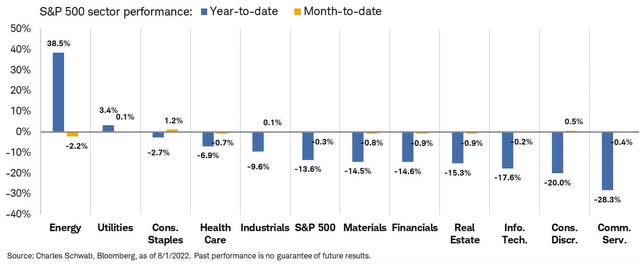

Sector Performance YTD to August 2022 (Charles Schwab / Bloomberg)

Utilities have been a pleasant surprise, though many investors have been moving to defensives. Utilities and pipelines can also inherently provide a source of inflation protection, at times.

Who’s ready for deflation?

As most investors are not prepared for an ongoing stagflation or high inflation regime, they’re not ready for deflation or ongoing recessions, or a depression. Yes, I used the “D” word. Anything can happen, right?

The defensive posture of the stock portfolio for retirees should help the cause in managing those risks. But of course, there are no guarantees of success. It’s possible that even a well-positioned retirement stock portfolio could hold up much better than the market, but still deliver negative real returns.

In my opinion it is still prudent to hold a modest amount of bonds (AGG) and cash – even with the ready-for-anything retirement stock portfolio.

On the other side of the risk coin, retirees might consider greatly de-risking the portfolio as they enter retirement or as they move into the retirement risk zone. Here’s more on retirees going heavy on cash and bonds and then using an equity glide path to ramp up equity exposure over time. The retiree essentially removes the sequence of returns risk.

The most reliable inflation protection

I’d suggest retirees go off the stock-script on the inflation front as well. There is no asset that is more reliable and explosive than a basket of commodities. You might consider a 5% weighting in commodities, working in tandem with the REITs and commodities stocks. Keep that total inflation protection in the 20% allocation area.

The hybrid approach might then include:

- 5% cash

- 5% bonds

- 5% commodities

- 85% retirement stocks

The final decision and allocation is up to you. You might also consider an allocation to gold. Gold performs well during stagflation, raging inflation and during market corrections.

I use that hybrid approach, and I build my retirement stock portfolio with the Canadian Wide Moat stocks and our dividend-growth-focused U.S stock portfolio.

Read. Decide. Invest.

Thanks for reading, we’ll see you in the comment section. What’s your take on stocks for retirement? Did I miss any must-hold stocks?

Dale

Be the first to comment