123ducu

When the facts change, I change my mind. What do you do sir? – John Maynard Keynes.

Written by Sam Kovacs

Introduction

A while ago, tobacco companies realized that in developed nations, adults were quitting cigarettes at an impressive rate.

This was a problem for their revenues.

The big question these firms had to ask was: how can we continue selling addictive nicotine products in a future in which we cannot sell cigarettes?

Let’s not encourage users to quit, but let’s encourage them to switch.

A variety of products have since been tried out by all major tobacco companies, from oral nicotine pouches, to e-cigarettes, to heated tobacco sticks.

E-cigs took off, and heated tobacco has a real shot at being the “next big thing” in tobacco.

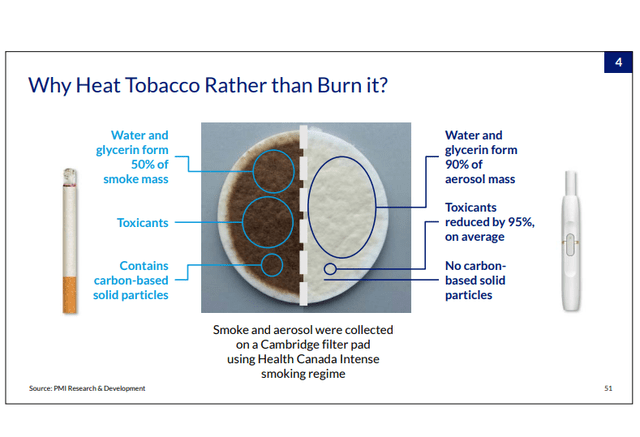

An oversimplification could suggest that new and younger nicotine consumers gravitate towards vapor based e-cigs, while existing tobacco users are more likely to switch to heated tobacco, as it still contains tobacco and mimics the experience of a combustible cigarette, with less risk as highlighted in the slide by Philip Morris (PM) below.

Philip Morris Investor Presentation

This has paid off for Philip Morris, as IQOS is now 12% of its volume, and smoke free in general contributes 30% of the company’s revenues.

British American Tobacco (NYSE:BTI), and Altria (NYSE:MO) are behind PM in this respect, with 14% and 10% of revenues coming from smokeless products, which is one reason why PM has been and remains my favorite tobacco stock.

In this article I’ll review BTI and MO, which both yield substantially more than PM, and pick a winner. I’ll run you through the top and bottom line results, break down each company’s combustibles and non combustibles segments, and take a look at their dividend policies.

Top and bottom line results

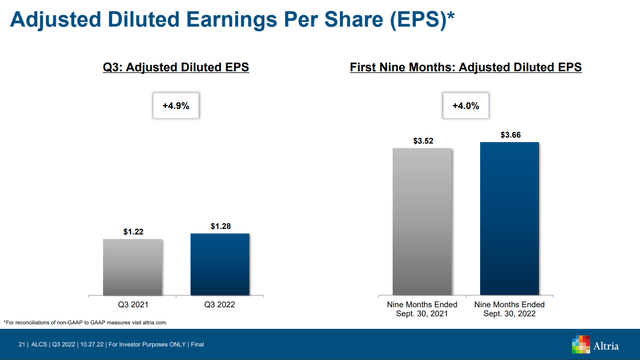

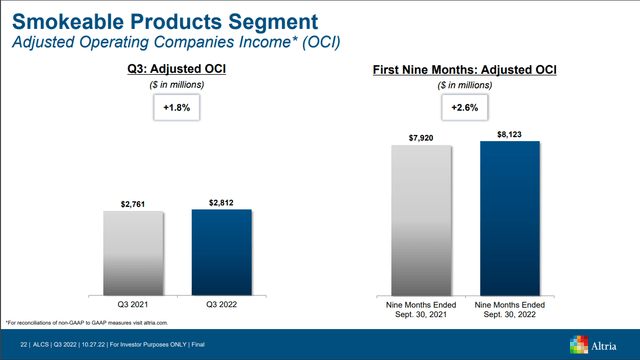

Altria’s revenues were down 2.15% YoY in Q3. This follows a 2.2% YoY decline in Q2, and a 3.2% decline in Q1.

Nonetheless, as is nearly always the case with Altria, they manage to pare damage to revenues by increasing prices.

This somehow consistently leads to 4-5% increases in EPS.

While the EPS numbers are comforting, as we’ll see later Altria’s failed execution in the smokeless categories leaves a lot to be desired.

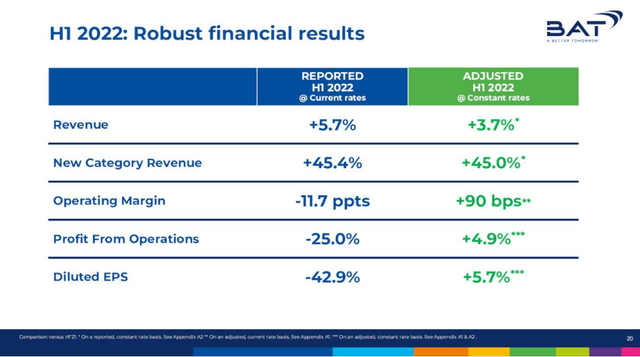

BTI has, increased revenues by 3.7% and EPS by 5.7% if you exclude their write-offs in Russia.

The Russian exposure was a one-time hit, which could not have been planned.

I believe it is more reasonable to look at the adjusted numbers, as MO also adjusts their numbers.

At a glance, BTI wins on this front. Not only is the company growing its top line, it’s growing its bottom line faster than MO.

Combustibles

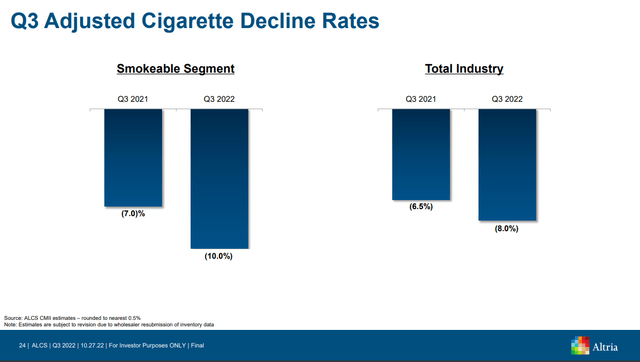

Altria’s trick has been to increase prices, banking on cigarettes lack of price elasticity to ensure growing income in a declining market.

But since 2021, this has led to declining revenues despite still leading to an increase in profits.

As MO continues to witness its cigarette decline rates outpace the industry, one takes note of how important it is for the company to have alternative smokeless products to replace cigarettes.

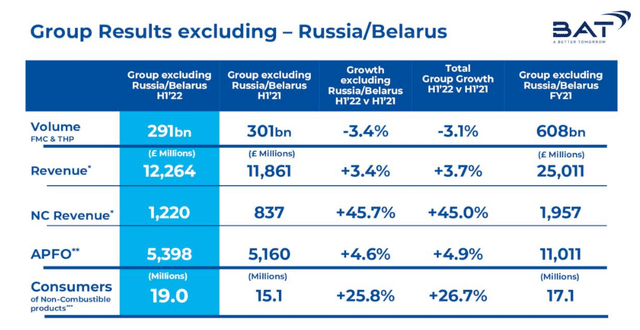

BTI doesn’t explicitly present combustible and non combustible data. But we can tell from the declining volumes in the table below (which include heated products) that the smokable segment is also seeing reduced volumes in their end markets.

Like MO they make up for it with price increases.

In the first half of 22, combustible sales remained flat vs the previous year.

The company is at a stage where its combustible sales are still holding steady, giving the platform for its non-combustibles to grow.

I’d say the companies are tied here, although a slight edge goes to BTI which is still exposed to markets with some combustible growth which is enabling revenues to remain flat for now rather than be down.

Non-Combustibles

Altria has been a mess in the non combustible segments.

Its 35% stake in JUUL was made at an inflated price which was an extremely poor mistake by management. I’ve been writing it off as unlikely to go anywhere for years.

Altria have finally owned up to this, and have worked their way out of their non-compete clause in the vapor e-cig segments. They are now developing other products and not relying on Juul moving forward.

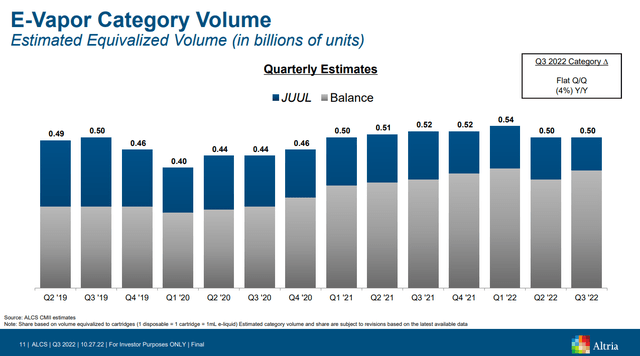

This sloppy investment and the bad execution from JUUL have led the company to be flat in terms of volumes during the past 3 years in the e-cig segment, despite the industry growing at double digit rates.

They missed out here.

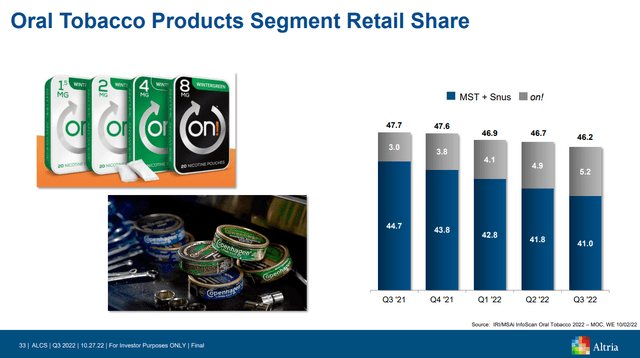

The company try and push their success with their On! oral tobacco gaining market share in its segment, but these gains have not been enough to offset the company’s loss of market share from its MST and Snus products.

That’s without mentioning that after a few years of mid single digit growth, the oral tobacco industry has flatlined in the US, raising questions about future profitability and demand for the segment.

Then there is the IQOS fiasco.

Altria had teamed up with PM to bring IQOS to the market in 2019. Given that Altria owns the rights to the Marlboro brand in the US, so this made sense.

The roll out was supposed to be slow at first, then expand. It was expecting to expand presence just as Covid hit, curtailing the potential to do so. Then, the product got banned from sales in the US because of patent infringement.

Last quarter, the company decided to sell back the rights of IQOS to Philip Morris, which will be able to bring the product back to market in the US within 18 months, but without access to the Marlboro brand, which does leave a gap in the market.

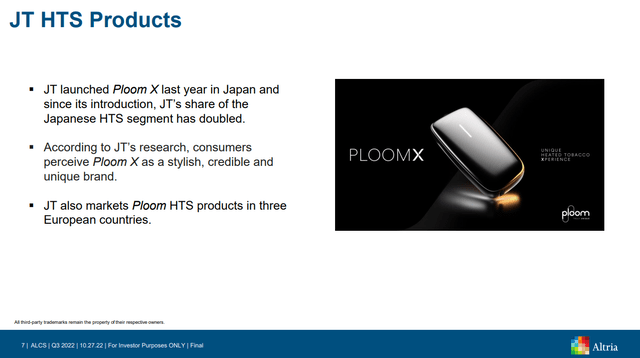

Altria has decided to partner with Japan Tobacco to bring their Ploom X device, a competing heated tobacco product, to the US.

However, a PMTA is not expected before 2025, which means that both PM and MO will not enter the heated tobacco segment for another couple of years.

This suggests that BAT could bring back its Eclipse (now named Neocore) heat not burn device which exists since 2014 but which was shelved in 2015, as it is the only product that has an FDA approval in the category following the IQOS ban in the US.

Yet, management seem to not be in a rush to go to market in this segment in the US, with vapor products leading the market.

We had assumed 3 years ago, that IQOS had similar potential for success in the US as in other markets. We’re getting an indication now that this might not be the case, and there might not be significant competition in the space before a couple of years.

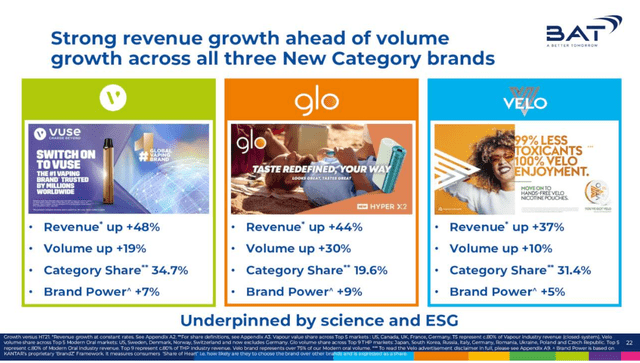

BAT has yet to enter the market in the US, but has seen success abroad, where its GLO HnB product is second behind IQOS with 20% market share in the category.

The company has been much more successful with its e-cigs, with the Vuse brand seeing lots of success in the US, Canada, the UK among other markets.

Whereas Altria has been just fumbling at every turn in the non-combustible segment, BTI has been making strong progress, and is at least competing in the space.

BTI wins hands down in the race to smokeless here, although it remains a distant second to PM.

The Dividend

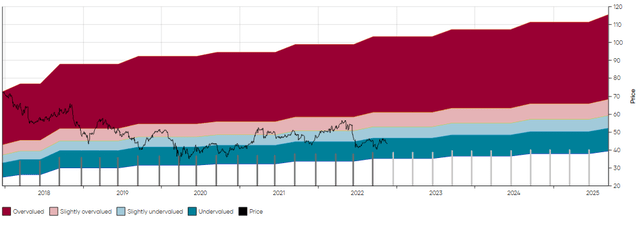

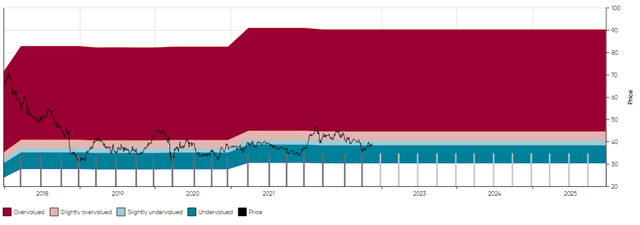

For both stocks, I’ll look at 5 year MAD Charts rather than 10 year ones, as valuations in the tobacco sector have been severely degraded over the course of the past 5 years, and historical comparisons would shed very little light on the current valuations of these two stocks.

Altria currently yields 8.6%, vs a median 7% yield during the past 5 years. The core 50% of the time the yield was between 6% and 8%, which is represented by the pink and light blue areas below.

(For more on MAD Charts click here).

MO 5 year MAD Chart (Dividend Freedom Tribe)

The dividend has been growing at a 7% CAGR during the past year, and grew 4.4% this year.

On the other hand BTI yields 7.6%. The dividend has also been growing every year, but you do not necessarily see this on the chart below because of the currency differences coming from the fact that it is a British stock and the chart is showing the ADR dividends.

It has been growing a lot less though in GBP growing at 0.5% per annum over the past 5 years, and just 1% this year.

BTI 5 year MAD Chart (Dividend Freedom Tribe)

You might ask why does Altria have a higher yield despite having displayed better dividend growth?

The answer is of course because the market is continuing to price the risks in MO which we highlighted above.

And I must say that I do question MO’s ability to compete in the smokeless category given its constant streak of failures in the space.

Conclusion

It has been our opinion for the past few years that an investment in MO was a good contrarian bet.

If you look at our coverage of the stock here on Seeking Alpha, it has beaten the S&P 500 in total returns in 6 of our 9 articles thanks to the big dividend, which has contributed massively to Altria being an OK investment.

However, I do question the company’s ability to grow the dividend at this rate unless it manages to create a killer product in the e-cig category, or be successful marketing a heat not burn device.

In 2020, I said that:

Depending on the number of future [price] increases, this effectively gives the company a 3 to 5 year runway before price increases would result in lower revenues.

Unfortunately, I think the reality is likely on the shorter end of that range.

For this reason Altria needs one of its new segments to truly take off within the next 5 years.

This has now happened in 2022. Revenues are dropping, but no segment looks like it’s going to be the next “it” product.

PM has succeeded in doing this. BTI is also seeing some success.

As a consequence, I’ve decided that I will be moving half of my MO position into BTI, and potentially use any increases in MO’s stock price or new bad news in upcoming quarters to further transition the position.

The reduced dividend growth and dividend yield do come as a hit, but I believe that ultimately doing so reduces the risk for investors, as MO has some unanswered questions concerning its future.

Be the first to comment