Scott Olson

Altria (NYSE:MO) has seen its stock pressured this year despite boasting healthy cash flows and an outsized dividend yield. That pressure intensified in recent weeks as JUUL announced intentions to declare bankruptcy. While that risk has moderated at least for now, I continue to question whether investing in MO is the best use of capital. The valuation is admittedly more attractive than it has been in quite some time and my bearish case may still take many years to take place. Yet, in this case, it is the difficulty of material upside which makes the potential downside all too important.

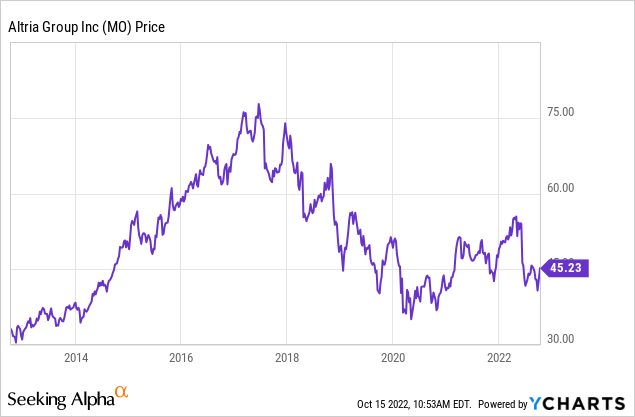

MO Stock Price

After trading to nearly $80 per share in 2017, MO has dipped down to trade at around $45 per share.

I last covered MO in July, where I recommended avoiding the stock, though it has since delivered double-digit returns amidst a choppy market. My bearish assessment remains and has increased after the increased prospects for a JUUL bankruptcy.

MO Stock Key Metrics

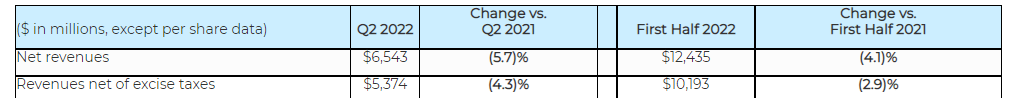

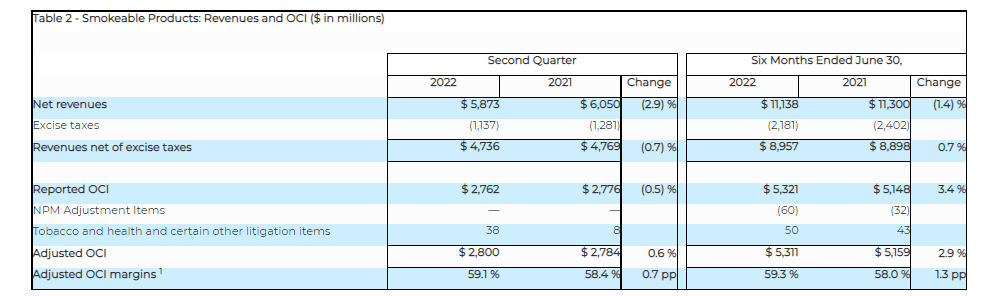

The latest quarter saw MO deliver 5.7% year-over-year declines in net revenues, or 4.3% declines net of excise taxes.

2022 Q2 Press Release

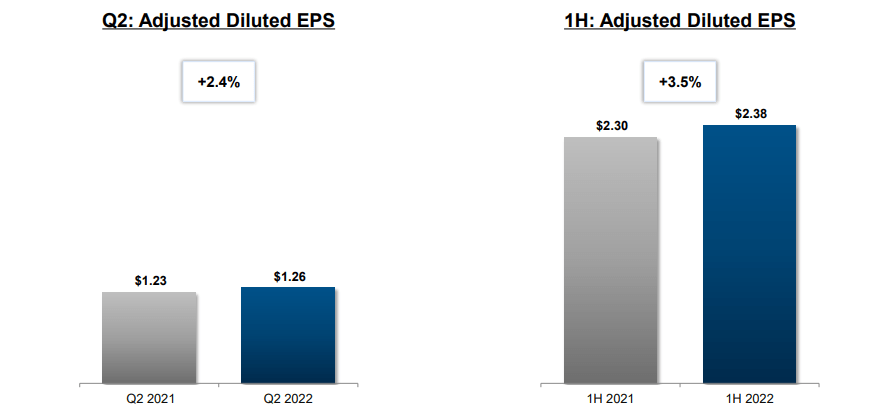

Yet, due to the effect of share repurchases, MO was still able to deliver a slight increase in adjusted earnings per share.

2022 Q2 Presentation

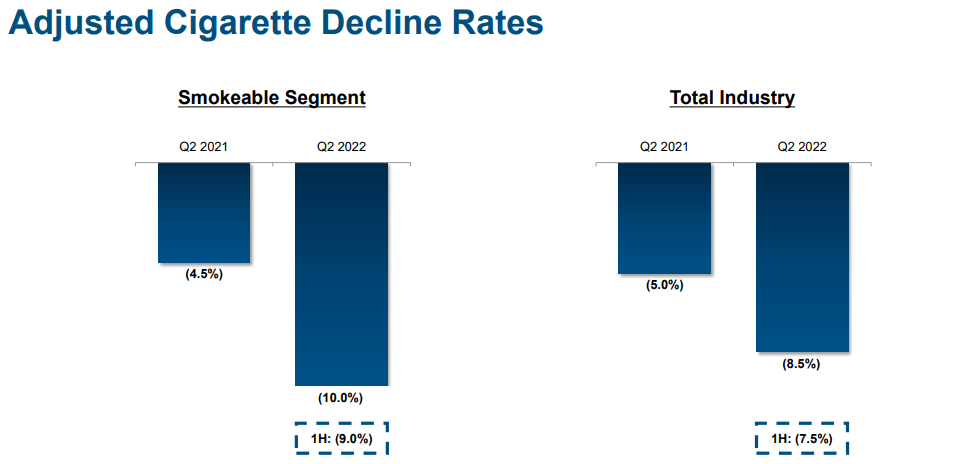

As usual, cigarette shipment volumes continued to decline.

2022 Q2 Presentation

Yet, due to increased pricing, MO was able to still increase operating income from smokeable products.

2022 Q2 Press Release

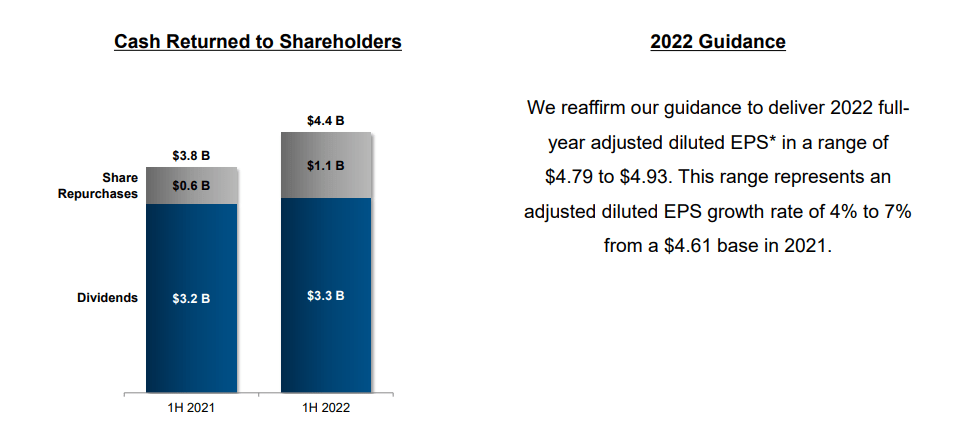

MO remains a shareholder return story as the company has returned $4.4 billion to shareholders through the first half of this year, representing a 5.3% shareholder yield. MO reaffirmed full-year guidance of up to $4.93 in adjusted EPS.

2022 Q2 Presentation

MO ended the quarter with $27.7 billion of debt versus $2.6 billion of cash, representing a debt-to-EBITDA ratio of 2.3x.

Is Juul Going Bankrupt?

MO shareholders were briefly spooked after reports surfaced that e-cigarette maker JUUL was considering bankruptcy proceedings. But those concerns appear to be eased, at least for now, after JUUL refinanced some debt and announced plans for layoffs.

Is Juul Owned By Altria?

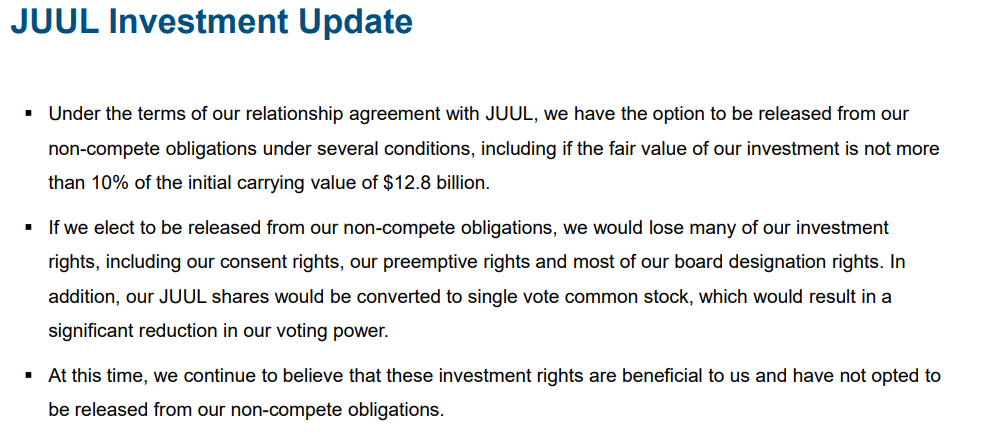

MO had previously made a $12.8 billion investment in JUUL, giving them a 35% stake. As of the latest quarter, that investment was worth only $450 million, representing a drawdown of 96%.

How Much Did Altria Invest In Juul?

After its $12.8 billion investment in JUUL, the companies initially had a non-compete agreement which stipulated that MO cannot develop its own e-vapor products.

2022 Q2 Presentation

On the conference call, management affirmed its intentions to maintain the non-compete agreement in order to maintain investment rights.

But on September 30th, MO disclosed in an SEC filing that it planned to end that non-compete agreement.

What Is The Long-Term Prediction For MO Stock?

The impact of any JUUL bankruptcy is more based on sentiment than direct financial impact. Sure, MO still has $450 million that it can write off as impairments, but impairments do not negatively impact current cash flows. Instead, a JUUL bankruptcy may negatively impact sentiment in terms of valuation multiples. This is because JUUL had previously fulfilled an important role in easing fears of disruption to the traditional tobacco industry. The investment in JUUL served as some sort of hedge against disruption from e-vapor products. Sure, now that MO has ended its non-compete agreement with JUUL, it will be able to develop its own e-vapor products, but that may take two or even three years before rolling out on shelves.

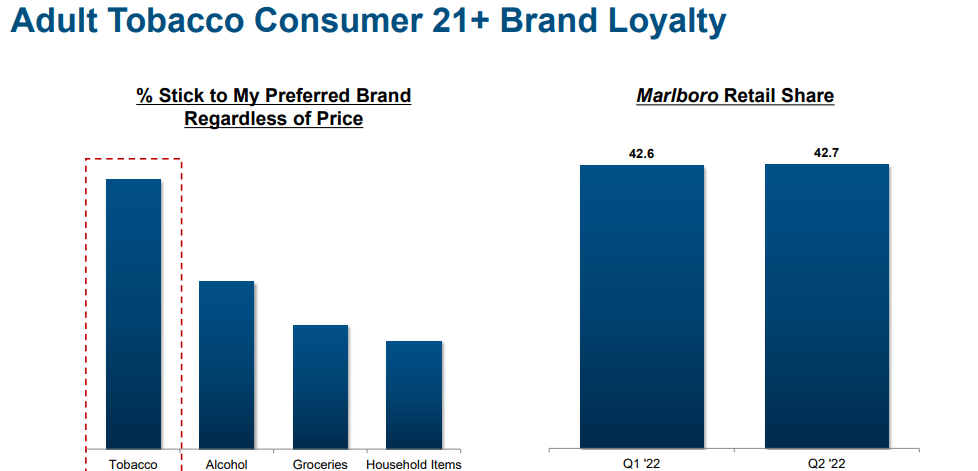

In the meantime, MO believes that tobacco is an industry in which consumers will stick with name brand products even as prices continue to increase.

2022 Q2 Presentation

That view has proven true in the past as evidenced by the company’s 52 consecutive years of dividend growth. But past performance should not be taken as a prediction of future performance. I continue to express the view that there will be a certain price at which consumers would either switch brands or quit smoking altogether. Given the high rates of inflation and rising interest rates, that moment may be as near as ever.

It should also be noted that Philip Morris (PM) is set to enter the United States through its acquisition of Swedish Match. Price competition is likely to heat up, hurting MO’s ability to continue increasing prices. If MO is unable to increase prices as aggressively as it has in the past, then it might be unable to offset declines in shipment volumes, leading to evidence of secular declines in cash flow.

Is MO Stock A Buy, Sell, Or Hold?

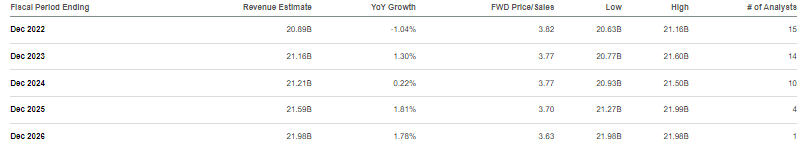

MO is not obviously expensive here at 9.4x earnings but it should be noted that consensus estimates call for minimal top-line growth over the next few years.

Seeking Alpha

In my experience, the best prediction sign of a future declining business is slow growth rates. Sure, the 8.3% yield may be attractive even in a rising interest rate environment. It is also difficult to project my anticipated bearish scenarios to happen even within five years. But if one believes that it is inevitable for smoking to reach a breaking point (when prices are too high), then one must factor in tail-end risk in the stock price. I could see MO trading down to as low as 3x to 5x earnings in such a scenario on account of the sizable leverage position. If it takes many years before this scenario plays out, then the ongoing dividend payments can still enable the stock to deliver positive total returns, but I am doubtful that MO can beat the market over long time horizons even accounting for the elevated dividend yield. While volatility is always possible, I am doubtful that MO can see a significant re-rating due to the intuitive appeal of the bearish thesis – just as one wouldn’t count on the rise of cable television or the movie theater business, it is equally difficult to count on the rise of cigarette smoking. This is a moment in which I have to continue avoiding the stock even if my bearish view is not validated in the near term, as the risk-reward proposition is insufficient today.

Be the first to comment