Falcor

While the general market has been pummeled over the past year, with its correction exceeding 27%, the Gold Miners Index (GDX) has suffered the most damage, with investors enduring a 52% correction from the 2020 highs. Given that bear markets take both time and damage to eradicate bullish sentiment completely, the more fertile ground for looking for new ideas is in the gold sector, where the 22-month cyclical bear market has ground any remaining optimism to fine dust. I believe this has created a rare opportunity to buy high-quality businesses at mouth-watering valuations. One name that fits this bill is Osisko Gold Royalties (NYSE:OR) – a ~90% margin business trading at a 20% discount to estimated net asset value.

Unless otherwise stated, all figures are in United States Dollars, with a C$ for Canadian Dollar figures.

Q3 Results

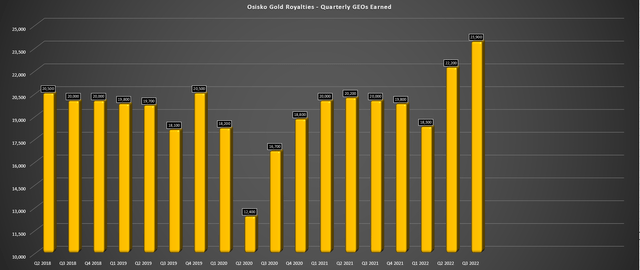

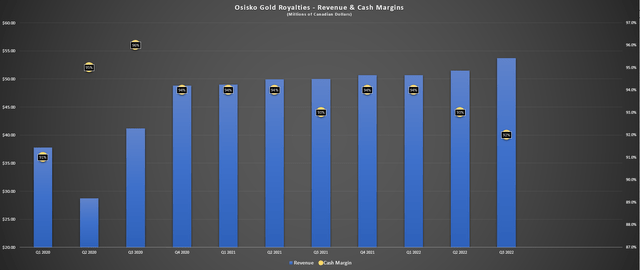

Osisko Gold Royalties (“Osisko”) released its preliminary Q3 results last week, reporting record gold-equivalent ounce [GEO] volume of ~23,900, a nearly 20% increase from the year-ago period. The main contributors, as usual, were the company’s Mantos Silver Stream (which is ramping up to targeted throughput and recovery rates with its expansion), the Canadian Malartic Mine, and the Eagle Gold Mine in the Yukon. The result of the record GEOs earned in the period was that Osisko reported preliminary revenue of C$53.7 million with a cost of sales of just C$4.4 million, translating to a 92% cash margin in the period, well above its royalty/streaming peers. The company also had a busy quarter retiring shares opportunistically with the market weakness, purchasing ~1.3 million shares (0.7% of outstanding shares) at an exceptional average price of C$12.77 [US$9.80].

Osisko Gold Royalties – Quarterly Gold-Equivalent Ounce Volume (Company Filings, Author’s Chart)

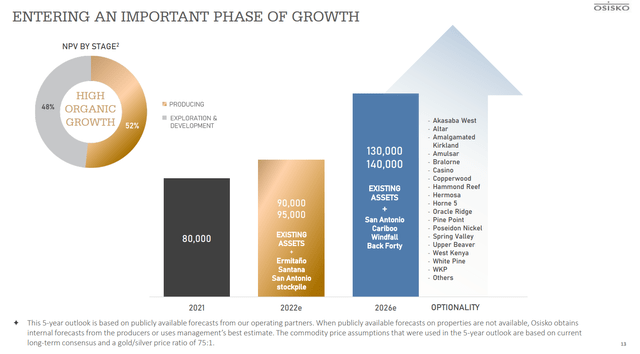

As shown in the chart below, Osisko’s revenue from royalties and streams hit a new high in the period despite the pullback in metals prices and maintained its impressive cash margin of 90%+. Notably, the GEO volume in the period that was slightly below my estimates was impacted by an 850 GEO headwind from the higher gold/silver price ratio, which was obviously out of the company’s control. Given that one of Osisko’s core producing royalties has its strongest quarter ahead in Q4, and the company has earned ~64,400 GEOs year-to-date, I expect Osisko to deliver into its 90,000 – 95,000 GEO guidance with another record quarter in Q4.

Osisko Gold Royalties – Revenue & Cash Margins (Company Filings, Author’s Chart)

While the financial results and growth in GEO volumes are solid, the developments across the portfolio are worth focusing on and are what makes the Osisko Gold Royalties story so special. In addition to a solid quarter from Santana in Mexico (a newly producing royalty asset for Osisko) and the fact that Capstone Copper (OTCPK:CSCCF) is exploring a further expansion at Mantos, which could add an incremental 3,000 GEOs per annum to Osisko’s attributable production profile, the exploration success, and progress at key assets is worth highlighting. In this update, we’ll look at Canadian Malartic and Windfall while we await study results from Upper Beaver, but the intercepts coming out of the latter project in the Kirkland Lake Camp are also very encouraging and worth highlighting in a later update.

Canadian Malartic

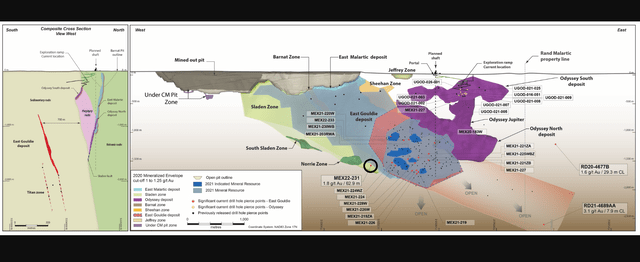

The Odyssey Underground Project (transitioning from open-pit to underground for the next two decades) is on schedule and budget, with shaft sinking set to begin before year-end and mining at the upper zones of Odyssey expected to begin early next year. However, it’s the exploration success at this asset that is the most exciting, with massive step-outs up to the east of the current resource base and at depth, strong infill drill results at Odyssey South and East Gouldie (7.40 meters at 19.11 grams per tonne of gold, 33.24 meters at 5.03 grams per tonne of gold), and East Gouldie could also be growing to the west, where there are no current resources between East Gouldie and the Norrie Zone (intercepted circled in black on the below map which hit 62.9 meters at 1.8 grams per tonne of gold).

The major takeaways are that infill drilling is meeting and exceeding expectations, and the total resource is growing at a brisk pace, with a ~61% compound annual resource growth rate (2016-2021).

Canadian Malartic – Open-Pit & Odyssey Underground (Company News Release)

At the recent Denver Gold Forum, Yamana Gold’s Executive Chairman, Peter Marrone, stated the following:

“We expect to be able to get from this mine close to or even in excess of 1.0 million ounces per year coming from a possible second shaft into East Gouldie and some of the surface areas we continue to explore”.

While Yamana’s partner Agnico Eagle (AEM) has not been as vocal about this potential given that it tends to be more conservative, it’s clear that both companies are extremely bullish on Malartic’s future, with twenty drills active on the property. For those unfamiliar, Odyssey Underground was approved based on just half of the known resources and is expected to produce an average of ~550,000 ounces of gold per annum (100% basis), with the first production from the upper zones of Odyssey expected in Q1 2023. However, this is based on utilizing less than one-third of the mill capacity (19,000 tonnes per day), with the mill designed for 60,000+ tonnes per day, given that was initially built to be a massive low-grade open-pit operation.

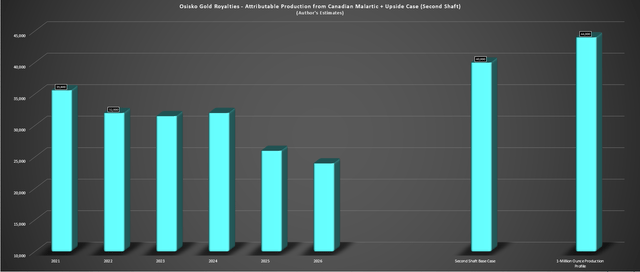

If Yamana is correct in its assessment that the Canadian Malartic partnership (Agnico/Yamana) will eventually pursue the sinking of a second shaft, the current mine plan (2023-2039) significantly understates this asset’s true potential. The reason is that there’s 41,000 tonnes per day of excess capacity at the mill, which can be partially filled by additional mine production (second shaft) and from additional areas on the property. If the asset increases production to 925,000 to 1.0 million ounces per annum with a focus on East Gouldie, Osisko’s attributable production would increase from ~33,000 ounces in FY2023 to 40,000 to 45,000 ounces per annum. The result is an incremental $13 million – $21 million in revenue per annum at a $1,800/oz gold price.

Osisko Gold Royalties – Attributable Production from Canadian Malartic + Future Upside Case (Company Filings, Author’s Chart & Estimates)

The above chart shows what Osisko’s attributable production profile would look like if this were the case, and I don’t believe that Yamana is being too aggressive here. In fact, it makes complete sense to bulk up the production profile and bring cash flow forward if this is truly a 22.0+ million-ounce resource, and it’s certainly looking this way with underground resource growth from ~1.43 million ounces to ~15.5 million ounces from 2016 to 2021 alone, and likely growth to 20.0+ million ounces across all categories on deck by Q1 2025.

Odyssey Underground Mine (Osisko GR 3.0% – 5.0% NSR) (Agnico Eagle Presentation)

I cannot come close to doing this asset justice in just a few paragraphs, but my previous update goes into a little more detail on the opportunity here and why this is a game-changer for Osisko. In my view, this massive royalty (4.0% – 5.0% plus per tonne royalty on ore sourced outside royalty boundaries) on a Tier-1 jurisdiction asset held by two of the top-10 largest producers makes Osisko a must-own royalty/streaming company, especially at the current valuation. This is because the royalties on this asset could potentially be worth over $5.00 per share alone compared to prices paid for other assets, placing a value on Osisko’s other 160+ royalties/streams of just $4.70 per share.

Windfall

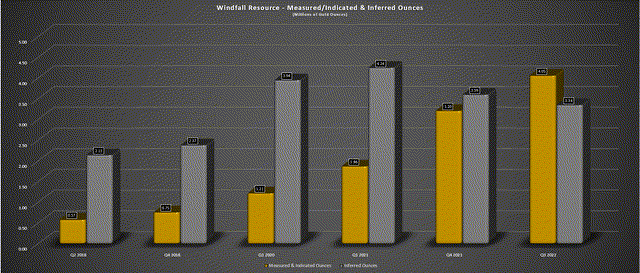

At Osisko Mining’s (OTCPK:OBNNF) Windfall Project (not to be confused with Osisko Gold Royalties), Osisko Mining continues to report outstanding drill results and has grown its resource substantially. In August, the company released an updated mineral resource estimate on the main deposits (Lynx, Main Zone) in the Eeyou-Itschee James Bay territory of Quebec, with measured & indicated resources increasing to 4.1 million ounces at 11.4 grams per tonne of gold. This was a meaningful increase from the previous update at higher grades, and the total resource now sits at ~7.6 million ounces of gold.

Windfall Lake Resource – Measured/Indicated & Inferred Ounces (Company Filings, Author’s Chart)

However, with considerable upside at depth, given that the resource lies within only a 1,200-meter vertical depth, I would not be surprised to see 12.0+ million ounces ultimately proven up at Windfall. There is also additional upside from a regional standpoint, with multiple untested targets. Finally, there is upside from a grade standpoint with a three-step capping strategy that looks to be understating the asset’s true grade, which looks to be confirmed by bulk samples that are coming in miles above predicted grades. Once in production, this asset should produce just shy of 380,000 ounces over its first six years, translating to annual attributable revenue to Osisko Gold Royalties of ~$14.0 million at a $1,825/oz gold price assumption (2026-2031).

Windfall Mineralization (Company Presentation)

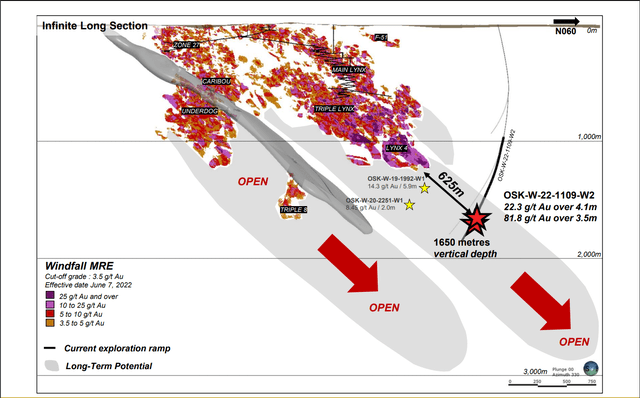

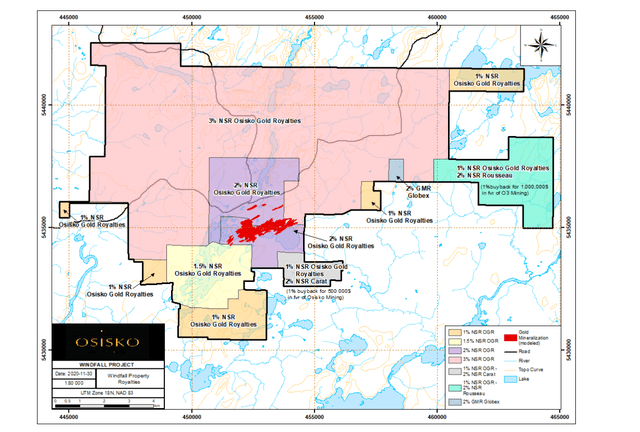

The most recent development from Osisko Mining at Windfall is quite exciting, with drill-hole OSK-22-1109-W2 that was targeting the down-plunge extension of Lynx 4 at 1,670-meter depths hitting 3.5 meters at 81.8 grams per tonne gold, and 4.1 meters at 22.3 grams per tonne gold. This is a big deal, not only because it points to considerable resource growth still on deck at world-class grades but also because these intercepts are likely adding more ounces on 3.0% NSR ground, with the bulk of Osisko Mining’s ounces at Windfall on 2.0% NSR ground (3.0% NSR ground is shown in pink vs. 2.0% in purple on the second image below).

Windfall Resources & Recent Step Out (Company News Release) Windfall Project Royalties (Company Technical Report)

Overall, this is great news for Osisko Gold Royalties, with each ounce mined on 3.0% NSR ground having 50% more value than ounces mined on the 2.0% NSR ground. However, the bigger takeaway is that the company is not missing, and with several targets still to be followed up on and Lynx continuing to over-deliver, this asset could be in production well into the 2050s and deliver over $300+ million in revenue to Osisko Gold Royalties even at conservative gold price assumptions. The $300.0 million revenue assumption assumes Osisko Gold Royalties is delivered an average of ~6,700 ounces per year (~7.70 million ounces produced at 2.15% average NSR) from 2026-2050 at $1,850/oz+ gold price.

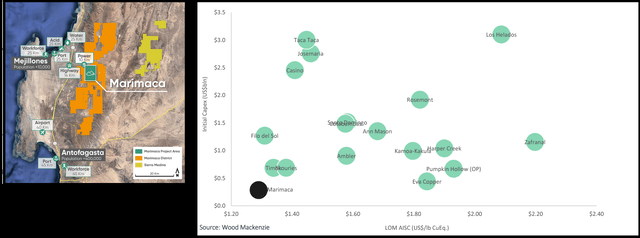

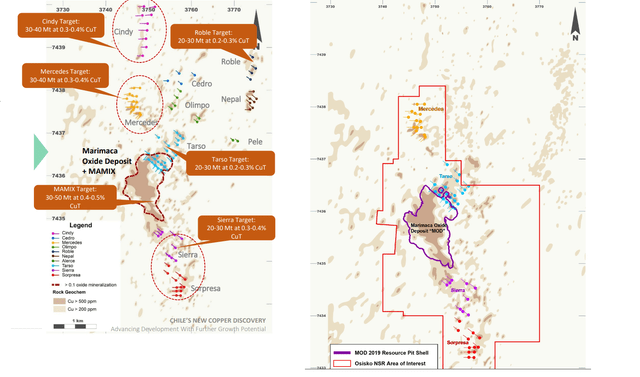

Marimaca Copper Project

Finally, it’s worth noting that Osisko Gold Royalties recently added a new 1.0% NSR covering currently known mineralization and prospective exploration areas (1,300+ hectares) at the Marimaca Copper Project in Antofagasta, Chile. This 1.0% NSR was acquired for $15.5 million with excellent timing and patience from the Osisko team led by CEO Sandeep Singh to acquire when the market is out of favor to get the best bang for its buck. The company also secured certain rights, including a right of first refusal concerning any royalty, stream, or similar interest in connection with financing the Marimaca project.

Maricama Project Mineralization (Company Website)

While Marimaca is not yet in production, it’s a simple low-strip, open-pit oxide copper project near key infrastructure that hosts one of the largest copper discoveries in the past decade. This deal completed in September was prescient given that Marimaca just reported a 98% increase in measured & indicated resources to 140 million tonnes at 0.48% (~665,000 tonnes of contained copper) and a 92% increase in inferred resources to 83 million tonnes at 0.39% (~323,000 tonnes of contained copper). Importantly, this significant resource growth supports looking at larger production scenarios or 50,000 and 60,000 tonnes per annum (vs. sub 40,000 tonnes per annum contemplated in the 2020 PEA).

Maricama – Capex vs. Operating Costs & Location Map (Company Presentation)

As shown in the above map and chart, the Marimaca Project is one of a kind. Not only does it have industry-leading estimated all-in sustaining costs of below $1.40/lb in the previous lower production scenario that was explored, but it has very modest upfront capex, leading to an industry-leading return on invested capital in the development peer space for copper projects. Meanwhile, it sits within 25 kilometers of water, power, transportation, and a skilled workforce. Overall, this suggests the project should be relatively easy to permit and finance.

The bonus for Osisko Gold Royalties is that with industry-leading project economics, we could see a takeover of Marimaca Copper down the road, and a larger producer would be able to support a higher exploration budget and potentially look at larger production scenarios. This is one of the benefits of acquiring royalties/streams on world-class projects, which isn’t the case for mediocre projects. That said, Marimaca Copper has a very strong team led by Michael Haworth (co-founder of Greenstone Resources) and Hayden Locke (CEO of Emmerson PLC and Head of Corporation for Papillon Resources), as well as Leonard Hermosilla, who was former Director of Projects and Growth South America for the world’s second-largest gold producer.

Marimaca Copper Project Resource Upside & NSR Area of Interest (Marimaca Copper, Osisko Gold Royalties)

To summarize, I think the Marimaca royalty addition was a brilliant move for Osisko. This is because it adds some additional copper exposure with the potential for $3.5 million in revenue per annum starting in 2027, even at conservative copper prices ($8,000/tonne). Most importantly, though, the company got a phenomenal price for an asset that could have a 20+ year mine life. The patience to wait for the right deals at the right time is a clear differentiator for Osisko vs. some smaller companies in the industry that have paid for growth at any price and on projects that I would consider to be more marginal or higher risk.

Outside of these core producing/development assets, the company continues to see progress elsewhere in the portfolio at projects I have not modeled in the company’s future growth:

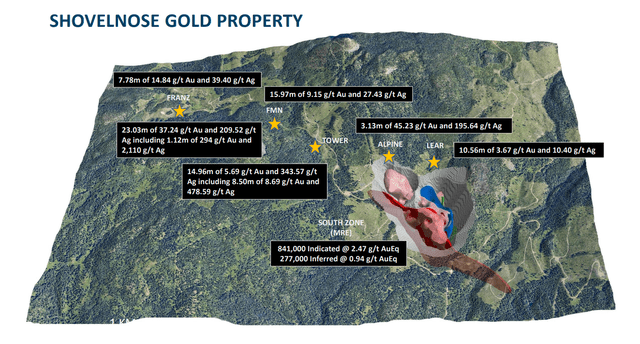

- Westhaven (OTCPK:WTHVF) received further validation of its Shovelnose Project in British Columbia from Franco-Nevada (FNV), subscribing for shares and a royalty, an asset where Osisko holds a 1.0% NSR (excluding buyback right), or 1,300+ GEOs per annum – but it is likely a post-2028 opportunity.

- South32 (OTCPK:SOUHY) has expanded its budget at Hermosa in Arizona and plans to make a final investment decision in 2023. This looks to be a post-2026 opportunity and could add over 4,000 GEOs per annum attributable to Osisko (1.0% NSR on lead/zinc).

- Red River is looking to process Liontown polymetallic mineralization at its already operating Thalanga Mill in Western Australia, which lies 107 kilometers away. This looks like it could head into production by next year, and Osisko has a 0.80% NSR on the high-grade project (~13.0% zinc-equivalent).

- Shanta Gold (OTCPK:SAAGF) has begun pre-feasibility work on West Kenya as of Q2 2022, an asset that could contribute over 1,500 GEOs per annum to Osisko’s attributable volume post-2026 based on its 2.0% NSR.

Shovelnose Gold Property (Westhaven Presentation)

When combined with the considerable upside at Osisko’s existing producing/development-stage royalties and streams and the much more attractive environment for completing new deals (low equity prices, expensive debt), I am confident in Osisko’s ability to reach the mid-point of its 130,000 – 140,000 GEO outlook by FY2026. However, I’m just as bullish on the opportunity for the remainder of the decade, with several assets not in guidance that might narrowly miss this timeline that could come online later in the decade. Hence, I continue to see this as one of the best growth stories in the sector.

Osisko Gold Royalties – Organic Growth (Company Presentation)

Valuation

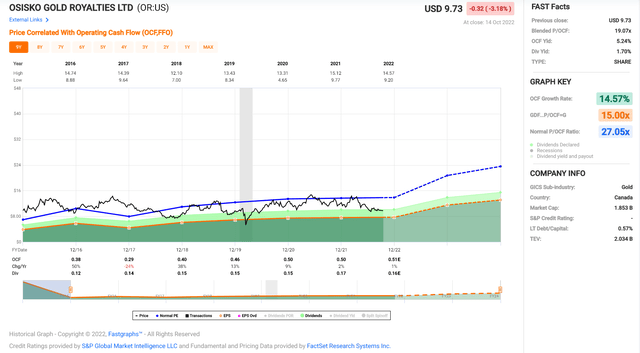

While growth is great, the key is paying the right price for growth to ensure one is baking in a meaningful margin of safety. In Osisko’s case, the price one is paying for this growth is ridiculous, with the stock trading at ~13.8x FY2023 cash flow estimates ($0.70) vs. a historical multiple of ~27.0. Based on what I believe to be a more conservative multiple of 26.0, which reflects its industry-leading jurisdictional profile and best-in-class margins (cash costs: sub $120/oz vs. large-scale peers at ~$325/oz), I see a fair value for the stock of US$18.20.

Osisko Gold Royalties – Historical Cash Flow Multiple (FASTGraphs.com)

On a P/NAV basis, and using a very conservative multiple of 1.40 (which should re-rate above 1.80 as more assets progress towards construction), I see a fair value of US$17.60. So, with a blended fair value near $18.00 per share and a current share price of $9.70, this points to an 84% upside from current levels. It’s also worth noting that this upside is higher on a total return basis, with Osisko paying a nearly 1.80% dividend yield at current prices. As cash flow increases with new assets coming online, I would not be surprised to see a US$0.30 dividend long-term (US$0.18 currently), allowing investors to lock in ~3.1% forward yield on cost at current levels, which is more than double that of the average dividend yield in the royalty/streaming space.

Combined with nearly a 1.50% return to shareholders from buybacks (an estimated 2.80 million shares to be repurchased in 2022), the dividend and buyback yield sits closer to 3.2%, representing an industry-leading level of shareholder returns among small-cap gold mining stocks.

Summary

Occasionally the market becomes so mispriced that investors get a fat pitch down the middle, and with a low-risk and inflation-resistant business with considerable growth trading at ~0.80x P/NAV, Osisko Gold Royalties is a clear example of an opportunity that doesn’t come around very often. I believe this is a business that could easily trade at 1.70x P/NAV once it surpasses the 120,000+ GEO per annum mark. Importantly, Osisko’s net asset value is likely to continue to grow (as it re-rates to a higher multiple) with over 1.2 million meters being drilled per year across its properties where it holds royalties/streams, and considerable liquidity to deploy in an environment ripe for doing deals.

Given the expected growth in net asset value, the considerable upside, and still untested potential with royalties on world-class high-grade assets (Windfall Lake, Canadian Malartic, Island Gold, Upper Beaver, and Hermosa), I would not be surprised to see the stock trade above US$25.00 long-term. So, for investors looking for precious metals exposure with steadily growing cash flow/dividends per share irrespective of the gold price due to its strong organic growth profile, I see Osisko Gold Royalties as a steal below $9.70 per share.

Be the first to comment