simonkr/E+ via Getty Images

I discussed Philips (NYSE:PHG) in my October 2021 article on Seeking Alpha and mentioned that investors would need patience with this stock. But, no one could have imagined how this company has tested investors’ patience since then. I rated the stock as a buy when my article was published at $47.96. I own shares at an average cost of $32.24. I made a disastrous call in October 2021, but the company’s long-term future is still intact. The company’s management has to execute with precision and consistency in the future. So far, the company’s management has lacked the consistency required to deliver excellent returns. In its defense, many medical devices and technology companies have suffered mightily in the past couple of years, including Medtronic (MDT) and Boston Scientific (BSX). Philips has a long runway of mid-single-digit growth ahead of it, and the company has a good moat. Philips is trading at a discount to its long-term average, and I took this opportunity to add to my holding at $19.99. I plan to hold on to the stock until 2025 or beyond. I am confident this stock can be a winner in that time horizon.

Promised Revenue Growth is Achievable

For years the company has promised sales growth of 3%-5% annually but has failed to achieve it in the past. The company’s troubles and product recall associated with its Respironics product, the pandemic, and supply chain disruptions are to blame for the lackluster growth during the past couple of years. But the company has a good order backlog and continues to see a boost in orders. Philips can see an increase in revenue if it can get past the supply chain issues and deliver these orders. The company could also fully adjust product prices for future orders to reflect the actual cost of inflation. In Q1 FY 2022, the company saw a 4% decline in sales, mainly due to a 21% decline in sales at its Connected Care segment, which owns the Respironics product. The company saw inflation and reduced volume account for a 290 basis points decline in its adjusted EBITA margin. Its adjusted EBITA declined from 9.5% in Q1 FY 2021 to 6.2% in Q1 FY 2022. One positive in the Q1 earnings; the company reduced its cost structure and delivered a 60 basis points benefit to the adjusted EBITA margin. The cost reductions are a significant focus for the management, and it is heartening to see them progressing. In Q2 FY 2022, the company saw a 7% decline in sales and an adjusted EBITA margin of 5.2%.

Expect a Few More Years of Pain at its Connected Care Segment

The Connected Care segment continued to suffer with a sales decline of 13%, and supply chain shortages impacted the Diagnosis and Treatment segment, where sales declined by 4%. The company’s diagnosis and treatment business saw sales growth of 8% in 2021, and its Personal Health segment saw an increase of 9%. The company’s EBITA margin was 12.6% in Q2 FY 2021. The company’s EBITA margin was reduced by 700 basis points due to supply chain shortages, product recall, and lower sales from China and Russia. The Respironics recall and litigation hang over the company. The company projects that it cannot estimate its potential exposure on personal injury claims before the end of 2023. So, the company will have to endure a few more years of financial uncertainty due to the litigation. The company is forecasting full-year FY 2022 sales growth of 1-3% and an adjusted EBITA margin of about 10%. That forecast should put revenues between €17.3 and €17.6 billion and EBITA at approximately €1.7 billion. The company is essentially trading at 10x EBITA, which is cheap for a company in the medical devices business. The company is trading at a forward EV to EBITDA multiple of 9.3x compared to its five-year average of 11.5x and an industry average of 14.3x. Philips is trading at a very favorable valuation at this time.

Philips Can Generate Good, Steady Financial Returns

Even under these difficult circumstances, the company continues to generate a profit. It has enough operating cash flows to cover its dividend payments and can continue doing more share buybacks. But, the company can improve its return on equity [ROE]. In 2021, the ROE was an excellent 23%, but the company got a boost in net income due to the gain in selling its domestic appliance business. So, the 2021 ROE was artificially boosted by that financial gain. Between 2017 and 2020, the company’s ROE averaged 11.3%. The company’s weighted average cost of capital [WACC] is about 7% [author calculation], so even when things are not going well, the company is generating an ROE higher than WACC. One should expect the WACC to increase in the coming years as interest rates have gone up substantially in 2022. The company can potentially increase its ROE to 15% – 16% in the coming years with a combination of cost cuts, revenue, and price increases. It would be exceptional if the company could consistently achieve an ROE of between 14% and 16%. Philips operates in a protected market with high barriers to entry, so it is possible to generate an excellent financial return provided the management can execute well.

Share Buybacks and Dividends

Since 2017, the company has spent $5 billion in share buybacks, reducing the share count by 3.2%. The stock offers a rich dividend of 4.5%, but the company does not spend a lot on dividend payments, spending just $482 million in cash dividends in 2021. The Dutch dividend withholding tax of 15% is a negative for the dividends paid in cash. The yield drops to 3.8% when you account for the Dutch tax on dividends. Shareholders can elect to receive their dividends in shares, and about 38% of its shareholders have elected to do so. The company issued 6,345,968 shares as dividends in 2021, leading to a 0.7% dilution in outstanding shares. The company pays its dividend annually and has a stable rating on its debt.

A Wide Moat Protects Philips

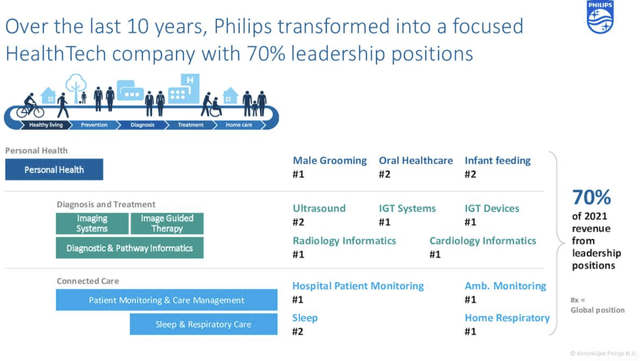

The company operates in the part of the healthcare market with high barriers to entry. It is in an oligopolistic market with Siemens (OTCPK:SIEGY) and General Electric (GE) as the only two competitors. The products that Philips offers to hospitals have a level of stickiness. As Philips’ products and software get more ingrained in the hospital, the more the company gains from its steady subscription and services revenue. For example, the company offers a subscription service for its MRI product. The company has world-leading products in many segments it operates in [Exhibit 1]. The Respironics product recall is a serious issue, but the company should be able to get past it and rebuild its reputation by 2025.

Exhibit 1: Philips Offers Essential, World-leading Medical Products

Philips Offers Industry Leading Products (Philips Investor Presentation)

Cash-Secured Put Strategy to Acquire Shares

If there is any short-term volatility in the shares or the market, selling a cash-secured put may provide a good premium and an attractive entry point for the stock. The September 16, ‘22, $17.50 put last traded for $0.40 and has a current bid and ask of $0.15 and $0.25 [Exhibit 2]. It may be worthwhile to consider selling a put with at least a 1% premium, so any premium at or above $0.18 with a strike price of $17.50 could be considered. The total cash outlay for the cash-secured put would be manageable at about $1,750 even if it got assigned. At a per share price of $17.50, the stock would yield a dividend of 4.4% after the Dutch withholding tax or 5.2% if the investor opts for the share dividend.

Exhibit 2: Cash-Secured Put Strategy For Philips

Cash-Secured Put Strategy For Philips (E*Trade)

Conclusion

A unique set of circumstances [COVID-19, semiconductor shortage, inflation] have affected all medical device companies, including Philips. After the disruptions caused by the pandemic, hospitals are slowly returning to normal operations. The aging demographics also favor the medical device companies such as Philips, Medtronic, and Boston Scientific. The sell-off in Philips shares offers a once-in-a-lifetime opportunity to acquire a world-leading device company at a discount. But, investors should be prepared to hold this stock for many years to see good returns.

Be the first to comment