Wolterk

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on July 31st, 2022.

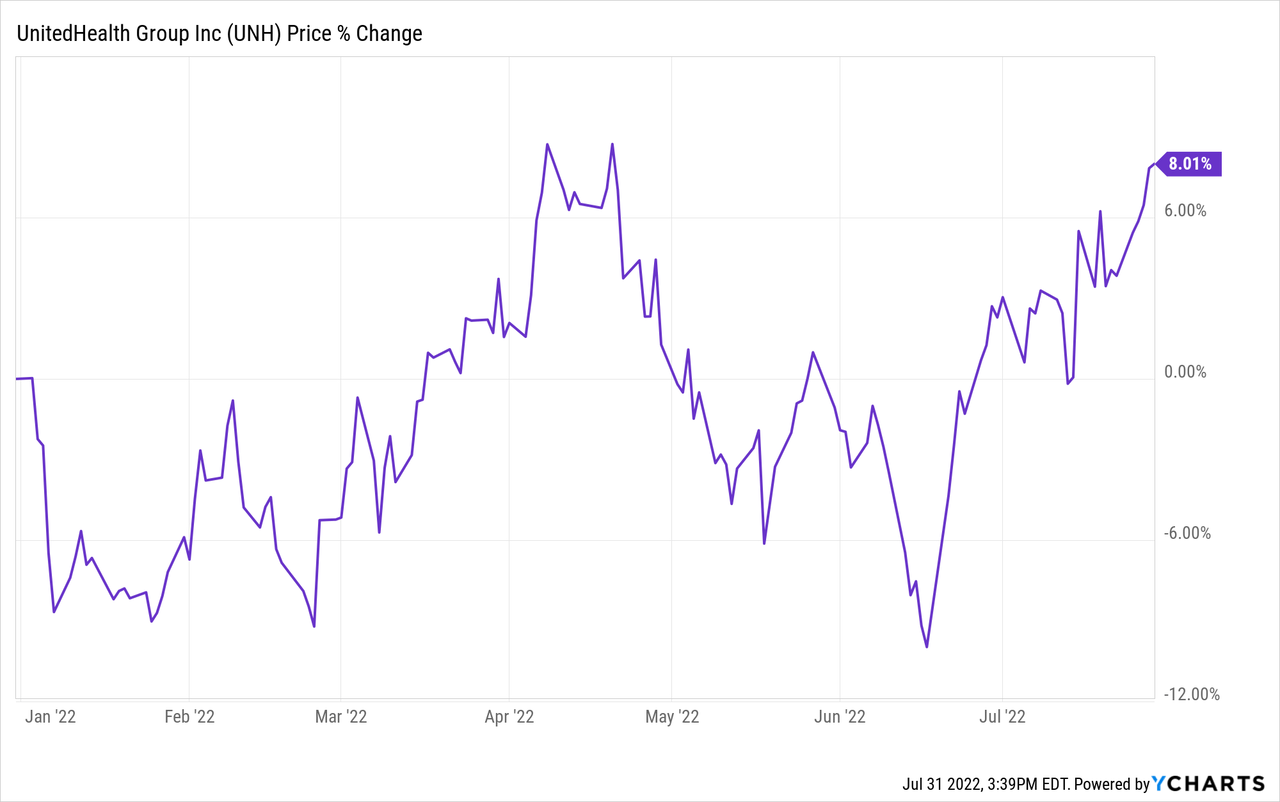

I’m beginning to sound like a broken record; UnitedHealth Group (NYSE:UNH) has done it again. With their latest earnings, they have beat estimates and raised guidance. That’s precisely how I started out the previous update on this healthcare behemoth. They continue to deliver quarter after quarter. UNH is one of the areas in my portfolio that provide a reprieve from some of the downsides. On a YTD basis, shares are up around 8%.

Ycharts

Latest Earnings And Valuation

Here are the main stats from their latest Q2 results:

- Q2 non-GAAP EPS of $5.57

- Revenue came in at $80.3 billion

- a 12.6% year-over-year growth in revenue

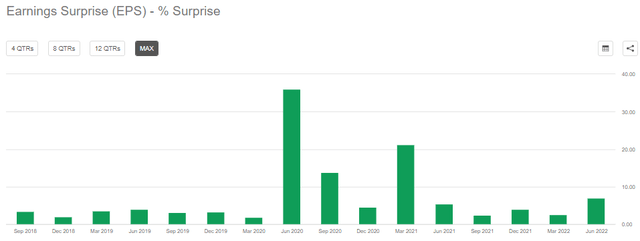

UNH Earnings Surprise (Seeking Alpha)

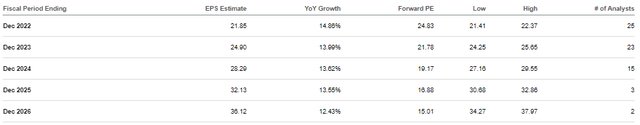

Investors should love to see consistency in earnings and growth from a stock. Over the next 5 years, analysts expect UNH to continue growing its EPS by an average of 13.7%. However, the other side of this is generally a consistently elevated stock in terms of valuation.

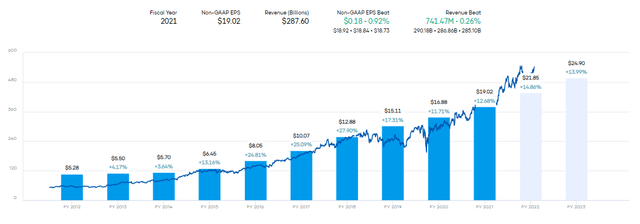

UNH raised its own adjusted net earnings for the full year from $21.40 to $21.90. That increased from the prior outlook of $21.20 to $21.70. If they hit the midpoint of their guidance, that’s an increase of 13.83% from fiscal 2021’s EPS of $19.02.

UNH EPS Growth (Portfolio Insight)

Helping drive these earnings and revenue are the total people that UNH is serving. Medicaid offerings grew substantially.

People served by our Medicaid offerings grew by 180,000 in the second quarter. At this point, we anticipate the impact to Medicaid enrollment as a result of state redetermination activities will be experienced next year. We continue to prepare resources to help people find uninterrupted access to appropriate coverage as this transition occurs.

Source: Earnings call

They expect to serve 800k Medicare Advantage for seniors for the year. However, they also added 250k to their domestic commercial plans over the last year. They are seeing a strong growth of new business across the board.

Optum continues to be a strong driver of this growth, with a revenue increase of 18% year-over-year. That was quite close to the 18.9% revenue growth they were seeing in the previous quarter. Revenue grew 32% in the Optum Health business, a particularly fast-growing division.

Optum Health revenue grew by over $4 billion or 32% in the second quarter. Revenue per consumer increased 30%, led by growth in patients served under value-based arrangements. Earnings from operations rose 24% even as we accelerated investments in our care delivery practices to support value-based expansions. We also saw strong contributions from Optum’s ambulatory surgery centers, which continue to advance the scope and complexity of procedures performed in these optimal settings, all while delivering a superior patient and surgeon experience and high-quality clinical outcomes. Our centers have nearly tripled the number of high-acuity joint, spine and cardiovascular procedures performed compared to just 2 years ago. Care providers increasingly recognize the benefits these centers offer, and consumers place high value on the care quality and experience, with an NPS consistently in excess of 90.

Optum Insight revenue grew 11%, and Optum Rx revenue grew 10%. The UnitedHealthcare business revenue grew 12%. That really highlights the growth across the entire business. All of this was noted in the latest earnings call.

The growth has been quite substantial in the latest quarters. That hasn’t been the only time, though. This company is now going on several years of tremendously strong growth that has been pushing the stock price up quite considerably. So much so that the stock has been pushed well above what would be considered its fair value.

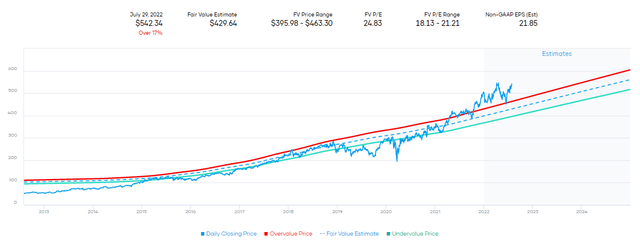

UNH Fair Value (Portfolio Insight)

The stock is only off around 2% of its 52-week high, which is also the stock’s all-time high. The latest earnings had pushed the share price back up. I’d say that, along with the overall market rising through the month of July, that would have certainly helped lift the stock higher too.

A fair value estimate of around $430 based on its historical P/E range could suggest some downside if an investor were to be buying at this level.

Alternatively, the growth in earnings can also reduce the stock’s valuation. If we wanted to get closer to around the 19x P/E that the stock has shown as its historical range, we could wait around for a couple of years. At least based on analysts’ earnings projections, we would see ~19 P/E in 2024 if they grow EPS to $28.29. Based on their regular history of beating estimates, it isn’t too much of a stretch to think it could happen sooner.

UNH EPS Estimates (Seeking Alpha)

Either way, though, based on these projections here, it would appear UNH is expensive. That’s why I see UNH as a candidate to only add to if you are a longer-term investor and want to dollar-cost average. Going all in at this current level would seem to be setting one up for losses.

On the other hand, analysts seem to be a bit more liberal in their price target. Based on their calculations, the average fair value of UNH shares comes in at $572.72. That has a high of $632 per share and a low of $402. The consensus of analysts also believes the stock is firmly in the “Buy” territory.

UNH Analysts’ Price Target (Seeking Alpha)

Dividend And Buybacks

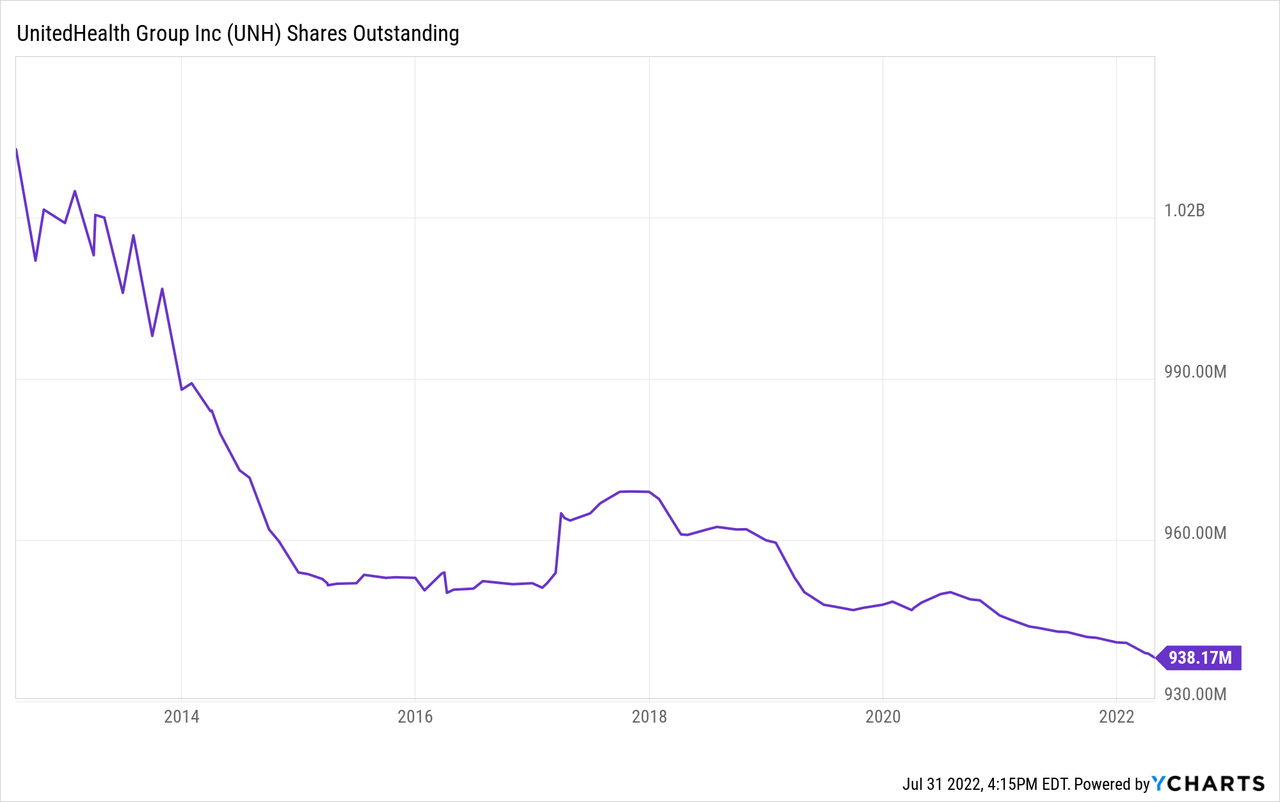

It might also be worth noting that UNH is a buyer of their own shares too. Of course, that has the impact of reducing the total outstanding shares and pumping up that EPS figure.

These repurchases have worked to provide a trend of shrinking total outstanding shares over the years. A buyback is great, but some companies utilize a buyback merely to absorb the shares they provide as compensation. In this case, we see that the share count is indeed on a downward slope.

Ycharts

They noted that they returned $8 billion back to shareholders through dividends and repurchases in the first half of the year. That’s against $24 billion in anticipated full-year cash flows from the company. So if we see another $8 billion returned through the end of the year, they should be well supplied in the cash department to pull it off.

Also, we can’t forget that they are investing in the business, too; that resulted in them spending $7 billion.

Our capital capacities remain strong. Second quarter cash flows from operations were $6.9 billion or 1.3x net income, and we continue to expect full year cash flows of about $24 billion. In the first half of this year, we returned nearly $8 billion to shareholders through dividends and share repurchase. In June, our Board increased the dividend by 14%, and we deployed more than $7 billion in capital to enhance our care delivery capacity and consumer strategies to improve outcomes and experiences for the people we serve and for the benefit of the broader health system.

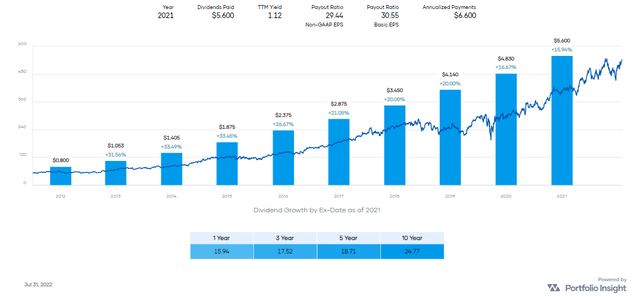

This type of free cash flow and growth has meant they’ve been able to raise their dividend quite aggressively over the years.

UNH Dividend Growth (Portfolio Insight)

The latest raise was good for 13.8%, which was announced back in June. That took the annual dividend payout to $6.60 per share. That was slower than what we’ve seen historically. However, it’s also fairly consistent with where they anticipate EPS to grow. That will keep the payout ratio about flat.

Based on the $21.65 midpoint of their anticipated guidance, that puts the payout ratio around 30.5%. Certainly not in dangerous territory, while leaving the balance sheet with plenty of capacity to invest back into their business. If a recession is coming up, a healthier balance sheet also doesn’t hurt with having greater flexibility.

Conclusion

UNH continues to put up some fantastic numbers. However, the valuation is also at a “fantastic” level. I’ll continue seeing UNH as a “Buy,” but cautiously. That’s also only under the realization that further upside could be limited from here. We could move sideways over the next couple of years or even lower. The stock is near its all-time high, and that’s generally not a time when you want to be buying a position.

Despite the impressive growth, unless they can meaningfully pull off even faster growth, it would seem difficult that the stock could push higher from these levels. I think that is even considering that they have had a string of raising guidance. The raises haven’t been quite aggressive enough to make this stock cheap again.

Therefore, buying this name would only appear appropriate if you are a long-term investor and want to utilize a dollar-cost averaging method to move into the stock. Otherwise, this stock would probably be a hold or even avoid for most investors.

Be the first to comment