LeventKonuk

The investment thesis

Our investment philosophy is heavily influenced by Ray Dalio and Warren Buffett. Ray Dalio taught us how to diversify at a grand level and how the macroscopic economic forces work IN PRACTICE, not in theory as we learned in classrooms. And to Warren Buffett, we own much we know about individual stocks.

Indeed, my last article on Altria (NYSE:MO) and British American Tobacco (NYSE:BTI), co-produced with Envision Research, focused on the Dalio perspective. That article explained why we only own BTI even though we like both. In a nutshell, BTI offers better geographical diversification for our portfolio and more exposure to emerging markets.

In this article, I will shift gear to be more Buffett-oriented and compare them as two individual stocks. We had great fun researching and writing the Dalio-oriented article, and I find the Buffet perspective quite interesting too. Especially if you consider that Buffett used to love tobacco stocks and then he stopped buying them. In his earlier investment days, he commended why he like the business:

It costs a penny to make. Sell it for a dollar. It’s addictive. And there’s fantastic brand loyalty.

But later (in the later 1980s), he declined when he was invited to participate in a large tobacco deal (involving RJR Nabisco). He commented:

I’m wealthy enough that I don’t need to own a tobacco company and deal with the consequences of public ownership.

So, to me, the reason Buffett stopped investing in tobacco companies has more to do with reputation risks than the economics of the industry. I am not going to spend too much time on the ethical issues of investing in this article. To me, it is a personal judgment to decide where the line is, and I respect the whole spectrum of decisions. Some investors could decide they are ok, some could decide to avoid them, while some could even go a step further and not only avoid tobacco stocks but also avoid retailer stocks that sell tobacco.

The thesis of this article will focus on the economics and investment risks. And in this regard, the thesis is quite simple. You will see that the comments Buffett made about their economics decades ago are still valid today. Both BTI and MO still enjoy spectacular profitability and extremely light -capital requirement. Furthermore, their current valuation (around 7x EBT) makes them equivalent to 14% equity bonds with excellent prospects of coupon growth at the same time.

MO, BTI, and Buffett’s 10x EBT rule

If you’re a devout Buffett cultist like this author, you must have noticed or heard that the grandmaster paid ~10x pretax earnings for many of his largest and best deals. The list is a really long one, ranging from Coca-Cola, American Express, Walmart, Burlington Northern, and the more recent Apple purchase. Buffet himself also mentioned and discussed the 10x pretax multiple times in his shareholder meetings and Q&A sessions. An example quote is provided below (highlighting was added by me):

Buffett: “Geico would be valued differently than Gen RE and other insurance businesses because it’s rational to assume a large underwriting profit and significant growth. You cannot say that about many insurance businesses. I would love to buy a new bunch of operating businesses with similar competitive positions to the ones we own now at nine to ten times pretax earnings.”

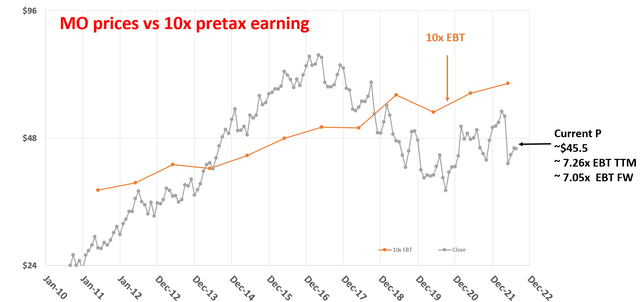

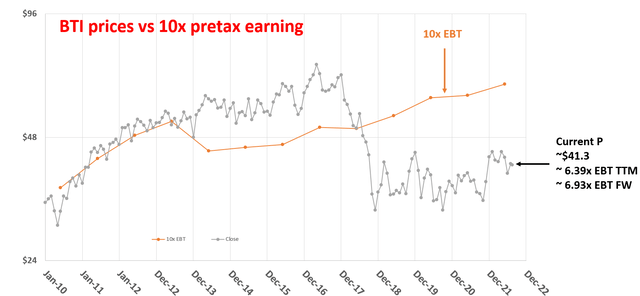

Assuming the economics of the tobacco businesses have not changed (and I think it is a very good assumption as to be detailed in the later part of this article), the next two charts show that MO and BTI are now a perfect fit for the 10x EBT rule. As you can see, historically, it has been fantastic times to buy both when their prices dropped significantly below 10x EBT. And vice versa, it has been a good idea to sell when the opposite occurred.

To wit, currently, MO is the price at 7.26x EBT on a TTM basis and 7.05x EBT on an FW basis. Such valuation is equivalent to purchasing an equity bond yielding 14.2% on an FW basis. The picture for BTI is quite similar as you can see from the second chart below. It’s currently valued at 6.39x EBT on a TTM basis and 6.93x EBT on an FW basis. Such valuation is equivalent to purchasing an equity bond yielding 14.4% on an FW basis.

Source: author based on Seeking Alpha data Source: author based on Seeking Alpha data

10x EBT rule: warning and clarification

Since this is such a powerful concept and we’ve received (and answered) many questions, we have a blog article summarizing all the details and Q&As. The gist is very briefly summarized here:

Out of all the earning metrics, EPS, operation income, free cash, dividend, etc., why do we favor the pretax earnings? There are at least two good reasons.

1. After-tax earnings do not reflect business fundamentals. Taxes can change from time to time due to factors that have no relevance to business fundamentals, such as tax law changes and capital structure changes. Plus, there are plenty of ways to lower the actual tax burden of a company.

2. Pretax earnings are easier to benchmark, say against bond earnings. The best equity investments are bond-like, and when we speak of bond yield, that yield is pretax. So a 10x EBT would provide a 10% pretax earnings yield, directly comparable to a 10% yield bond.

As such, if we buy a business with staying power at 10x EBT and even if the business stagnates forever, I am already perfectly happy to be making a 10% return pretax. Any growth is a bonus – which is how I see both MO and BTI here. A strong warning before we move on. I am NOT suggesting you go out and start buying every/any stock that is below 10x EBT. As also detailed in our blog article:

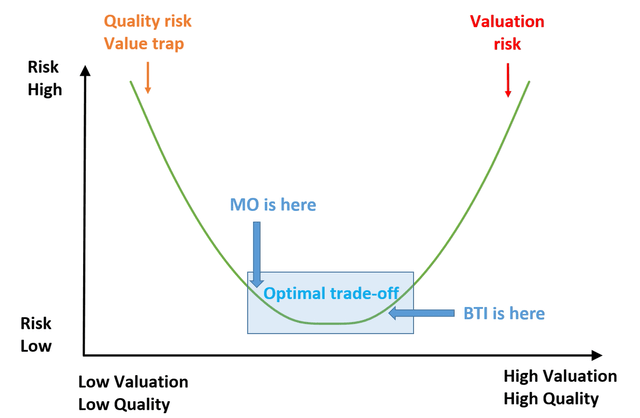

As investors, two of the major risks we face are A) quality risk or value trap, i.e., paying a bargain price for something of horrible quality, and B) valuation risk, i.e., paying too much for something of superb quality. The 10x pretax rule is mainly to avoid the type B risk AFTER the type A risk has been eliminated already. The optimal zone lies in the middle as shown, which represents an optimal trade-off between quality and valuation and hence reduces risks.

Overall, I see both MO and BTI near the optimal trade-off zone now. And between MO and BTI, I see that BTI offers even lower quality risks (and also slightly lower valuation risks). The main reason here is that BTI offers better geographical exposure. The U.S. market is only a relative minority for BTI (thus making it less sensitive to U.S. policy and economic conditions).

Now, let’s see if we can eliminate risk A, the quality risk, for both of them next.

Do they have existential issues?

I really do not see any existential issue for either MO or BTI either in the short run or the long run. I will just be brief and go through my thought process here and then move on to focus on the growth perspective. A shortcut to looking into this issue is the dividend. The dividend is one of the most reliable and indicative metrics of a business in the short term.

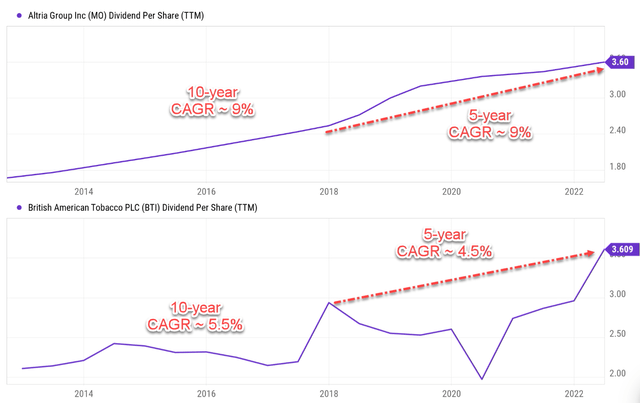

As you all know, MO is one of the dividend champions. In recent years, it has been growing its dividends consistently at a respectable 9% CAGR (both in the past 5 and 10 years). Its latest annual dividend raise was announced in August 2021, raising its quarterly dividend to $0.90 per share, a 5% from the last year. Although the 5% is a bit lower than the 9% CAGR in recent years, it is still a healthy increase. And as we will see next, the safety is consistent with historical levels too.

The dividend payouts from BTI varied a bit as you can see from the bottom panel in the chart. However, once you look past the short-term fluctuations, the payouts showed an overall growth at a healthy pace too. It has been growing its dividends at a healthy 5.5% CAGR in the past 10 years and at 4.5% in the past 5 years.

And remember, when we pay a price below 10x EBT, we are already holding a bond with a 10%+ yield. Any growth is a bonus.

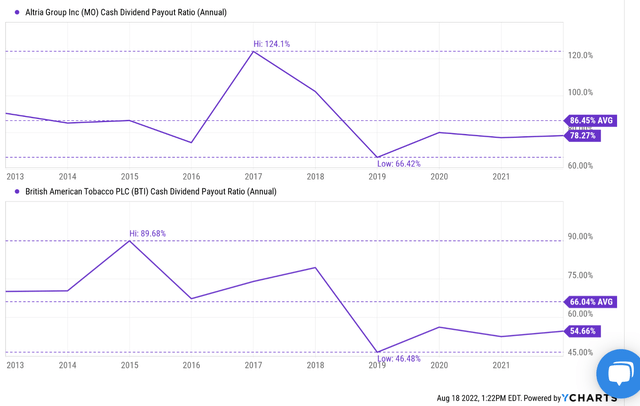

The payouts from both businesses are well managed in the long term. The following chart shows the cash given payouts in the past decade. And you can see that both of their payout ratios are below the historical average. More specifically, the payout ratio for MO has been quite stable and fluctuated in a quite narrow range between about 66% to about 90% except in 2016. Its long-term average is about 86% in the past 10 years. Its current payout ratio of 78% is safely below its long-term average.

The picture for BTI is quite similar, probably even better. Its payout ratio has been also stable and also displaying an improving trend. The payout fluctuated in a range between about 70% to about 90% in the early part of the decade. And it has declined to be below 60% since 2018. Its long-term average is about 66% in the past 10 years. And its current payout ratio of 54% is again safely below its long-term average.

What are their perpetual growth prospects?

If any of us think them has issues surviving in the long term, it is probably because of the secular decline in demand for their traditional products. I am not too concerned here and have explained my thoughts in detail in my earlier articles. In brief, both have shown the pricing power to keep revenue stable or even increasing. Furthermore, both have been very actively developing new products (more on this later).

Instead, I see good growth prospects for both in the long term. In the long run (like 10 years or more), the growth rate is simply:

Longer-Term Growth Rate = ROCE * Reinvestment Rate

ROCE stands for the return on capital employed, the most important profitability metric in my view because ROCE considers the return of capital ACTUALLY employed. It, therefore, provides insight into how much additional capital a business needs to invest in order to earn a given extra amount of income.

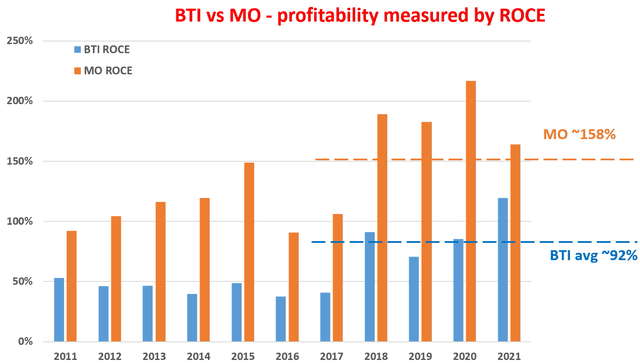

The ROCE of MO and BTI are shown below. As seen, MO has been consistently enjoying ROCE above ~100% in recent years. And BTI’s ROCE has been consistently around 100% in recent years. To wit, MO’s average ROCE in the past 5 years between 2017 and 2021 has been 158%, and BTI’s average has been 92%. To put things under perspective, the average ROCE for the FAANG group is about 60% in recent years. And the ROCE for Apple, the one with the best ROCE among the FAANG group, is “only” about 100% in recent years on average.

So as mentioned earlier, to me, it is a very good assumption that the economics of the tobacco businesses have not changed much since Buffett made his comments decades ago.

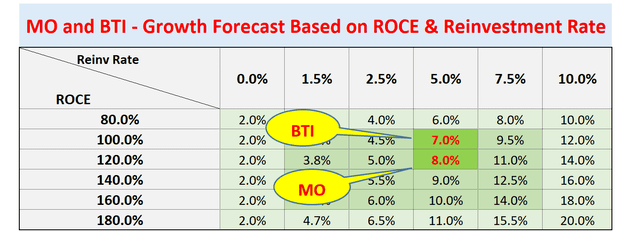

And for the reinvestment rate, my estimate is that both BTI and MO have been maintaining a reinvestment rate of around 5% in recent years thanks to their light capital requirements.

Now with both ROCE and reinvestment rate estimated, we can estimate the long-term growth rate, as shown in the next chart. This table shows the long-term growth rate at different combinations of ROCE and reinvestment rate. The darker the background color, the more probable the scenario is expected to materialize. The numbers highlighted in red are the most likely scenario given the average ROCE in the past decade and the reinvestment rates that make sense to me. Note that in this table, I also added 2% of inflation to the growth rate. I think this is justified as both have demonstrated in the past it has the pricing power to at least adjust for inflation. As seen, the long-term growth rates are projected to be in the upper single-digit range, about 7.0% for BTI and about 8.0% for MO.

Now to put the pieces together and conclude:

- Paying 10x EBT for a business that will stagnate forever is like owning a bond with a 10% yield.

- In MO’s case here, the current valuation is about 7.05x FW EBT, equivalent to purchasing an equity bond yielding 14.2%. In BTI’s case, its valuation is 6.93x FW EBT, equivalent to an equity bond yielding 14.4%.

- At the same time, there is a good prospect of a high single-digit organic growth rate (about 7.0% to 8.0% for both).

- So an investment in either is similar to owning an equity bond with a 14%+ yield and coupon growth built in at the same time, leading to very favorable odds of annual total shareholder returns in the high-teens.

Final thoughts and risks

The reasons that Buffett loved tobacco stocks decades ago are still valid today (and of course, so are the moral concerns). In terms of economics, they still cost pennies to make and sell for dollars. Such economics are reflected in the ROCE Of MO and BTI. Both have been demonstrating consistent ROCE at astronomical levels. The average ROCE in the past 5 years has been 158% for MO and 92% for BTI, while the average ROCE for the FAANG group is about 60%.

Given their current valuation compression, these stocks provide very favorable odds for annual total returns in the high teens in the long term. The returns consist of about 14% from pretax earnings yield plus a few percent from organic growth.

Finally, risks. As aforementioned, the secular decline of the traditional combustible products is a risk to both MO and BTI, and even more so for MO given its single-market exposure in the U.S. The tobacco business constantly faces regulatory pressure too, and again such risks are even larger for MO given its single-market exposure and the U.S.’s more stringent regulations. Although such risks are also substantial for BTI too. BTI’s geographical exposure is more diverse and the U.S. is a relative minority (representing 47%) of its total sales. But 47% is a quite large exposure in absolute terms. Finally, both are developing new products and BTI has been showing promising signs on this front. But the ultimate success of this transition remains uncertain. MO’s recent failure with its JUUL business provides a good example, and a similar setback could happen to BTI too.

Be the first to comment