Michael Vi/iStock via Getty Images

Co-produced by Austin Rogers for High Yield Landlord

In a recent report on the multifamily (apartment) sector of real estate, CRE services group Walker & Dunlop (WD) declared the current moment a “golden age” for apartments. Even a cursory glance at the sector reveals why this is so:

- Rents are soaring, up ~20% year-over-year in 2021.

- Vacancy rates are hitting multi-decade lows.

- High construction costs and shortages of labor are hindering apartment supply from catching up to demand.

- Cap rates are lower than ever as investor appetite for apartment properties is higher than ever.

- Rapidly rising home values are pricing many renters out of homeownership.

- Over half of young adults aged 18-24 and nearly 1/6th of adults aged 25-34 lived with their parents in 2021, providing ample pent-up demand for apartments.

- Recovery in the job market has just begun, and wages are rising at a much faster pace than before the pandemic.

All of these factors combine to bolster our view that apartments are one of the best inflation hedges available to investors. After all, rent and housing costs are a primary component of the consumer price index (“CPI”) used by the government to measure inflation.

Given the confluence of the above factors, apartments appear poised to remain in this “golden age” of high rent growth and low vacancy rates for at least a few more years. It is an attractive asset type to own for the foreseeable future.

Apartment community (BSR REIT)

Of course, the picture isn’t entirely rosy. There are risks to consider in the multifamily sector. We will address these. But overall, the data points we are seeing make us happy to maintain considerable weight in not just apartments but also manufactured housing.

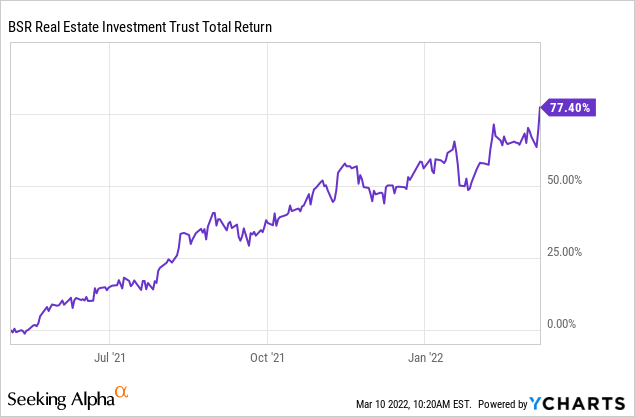

Our largest apartment REIT investment, BSR REIT (OTCPK:BSRTF/ HOM.U), just recently reported its full-year results and noted that its NAV per share had risen by 61% in a single year! Since we first invested in the company less than a year ago, we have already earned a near 80% return and we expect more gains in 2022:

BSR REIT surges in value in 2021 (YCHARTS)

Other apartment REITs like Mid-America (MAA) and Essex (ESS) have also performed very well.

Let’s dive in to better understand the golden age of apartments:

Update On The Apartment Sector

There have been few greater whiplashes from one year to the next when it comes to the rental market. In 2020, residential vacancies spiked and rents dropped as millions of jobs disappeared and many renters could only afford to pay rent with the help of stimulus checks.

Then, in 2021, millions of jobs rushed back as the economy emerged from lockdowns and crippling fear of viral spread. Renters exhibited unprecedented levels of demand for apartments and other residential properties. Rents surged, and the residential vacancy rate whipsawed back down.

In the third quarter of 2021, the nationwide apartment vacancy rate sat at 4.1%, down 130 basis points from Q2 and 330 basis points from the prior year. For “market rate” apartments (with rents set at the market rate), vacancy rates were below 2.5% – a record low.

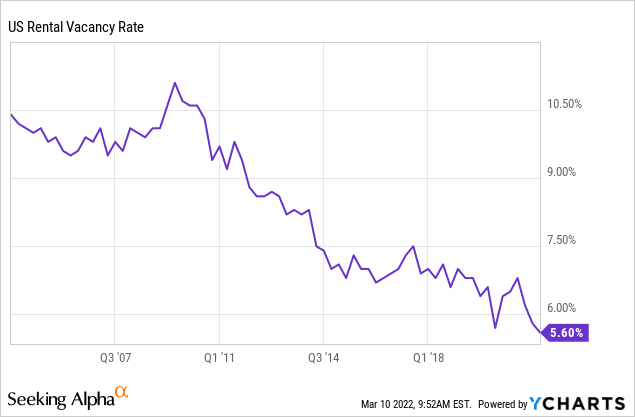

For all residential housing (including single-family and manufactured housing), the US vacancy rate sits at 5.8% as of the latest reading, near its lowest point since the early 1980s.

US rental vacancy rate (YCHARTS)

In the wake of the protracted shift toward work-from-home, renters have been moving into housing that will be more amenable to home work stations. Vacancy rates for 2 and 3 bedroom apartments are about 100 basis points lower than for studio apartments for that reason.

Recent data from RealPage (as reported by Globe Street) shows net demand for market-rate apartments in 2021 at 673,000 units, higher than the previous record set in 2000 by a staggering 66%. Comparing net demand to the nearly 360,000 units completed in 2021, we find that demand overwhelmed supply by about 87% last year. It would have been more if vacancy rates hadn’t reached such low levels.

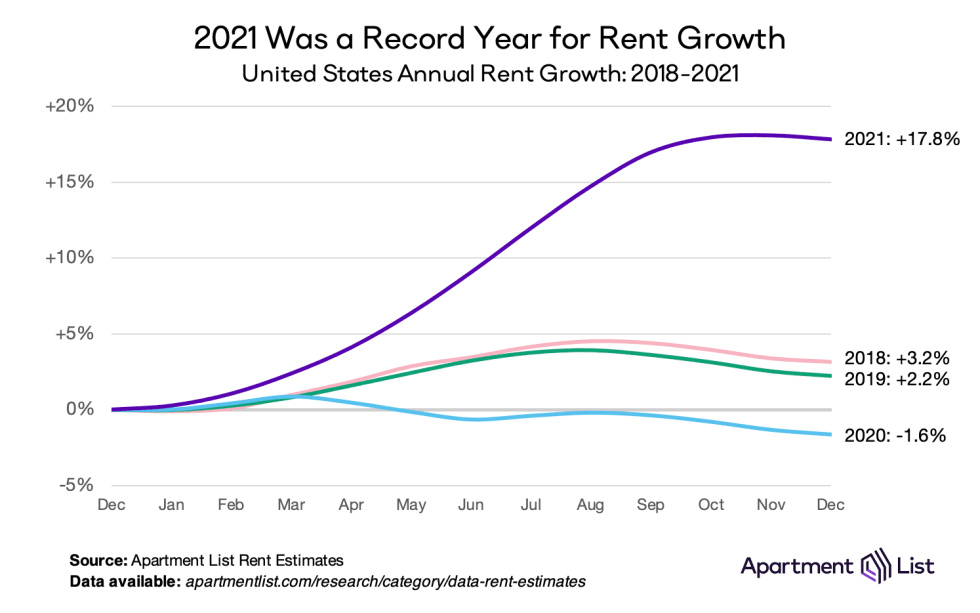

No wonder, then, that rents surged ~20% in 2021. Most of the rent growth occurred between January and September, though the Winter months tend to be seasonally weak for rent growth.

2021 was a record year for rent growth (Apartment List National Rent Report)

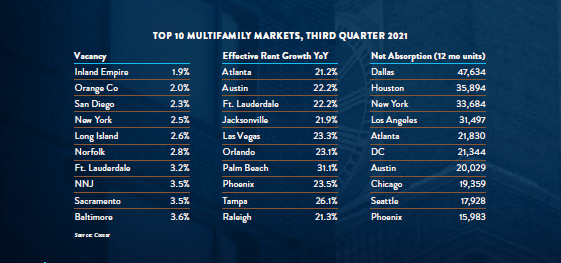

We saw effective rents in the top ten multifamily markets climbing up to 31% in a single year:

Top rental markets (Economic Overview: Fall Multifamily Outlook)

Notice anything about the top ten markets for rent growth? They are all located in the Sun Belt. So are half of the top ten markets for net absorption.

The natural question to ask is: Where is supply? Why aren’t developers building more apartment buildings to meet this massive wave of demand?

Well, for much of 2020 and 2021, supply growth was hindered by soaring construction costs and labor shortages. Prices for multifamily construction, for instance, were up 10%+ in 2021. And over half of multifamily development projects were running behind schedule and over budget.

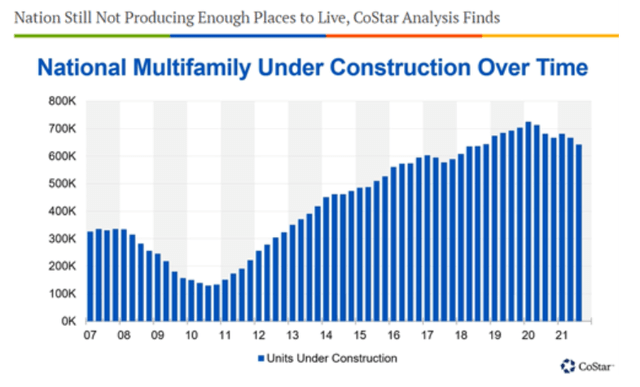

Hence we find that, according to CoStar (CSGP), the number of multifamily units under construction dipped in 2020 and 2021.

Multifamily construction by quarter (Costar)

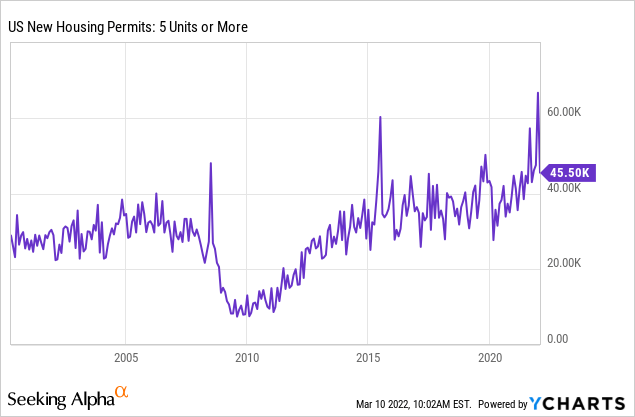

But that seems to be changing. Since the beginning of the pandemic, new multifamily housing permits have been rising higher and higher, and now they sit near their highest level at any point in the last two decades.

US new housing permits (YCHARTS)

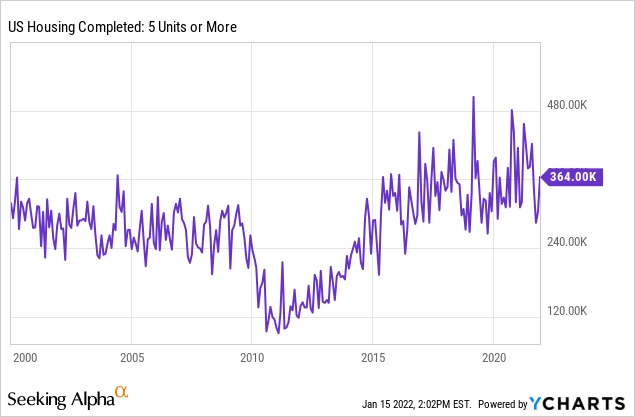

Multifamily housing completions, however, are still running behind their average level from the past few years, largely due to COVID era delays. Although they are quickly making a comeback.

US housing completed (YCHARTS)

In fact, the RealPage data, as reported by Globe Street, shows:

Nearly 360,000 market-rate apartment units completed in 2021. That’s the biggest addition in more than three decades. Another 682,000 units are under construction. Of those, roughly 426,000 are scheduled to complete in 2022-marking the first time since 1987 supply will top the 400,000-unit mark.

Deliveries of completed market-rate apartments should rise over 18% in 2022. Marcus & Millichap agree with the RealPage report, although they give a more conservative estimate of multifamily deliveries in 2022 of around 400,000. Notably, the Sun Belt, which has enjoyed most of the in-migration over the last two years, is set to receive about 1/4th of the new supply of apartments in 2022.

So, does this mean that the brief golden age of apartments is over, just a year or so after it began? No, we do not think so. In what follows, we’ll explain why we believe U.S. apartments and other forms of housing can look forward to many years of higher demand than supply.

Years Of High Apartment Demand Ahead

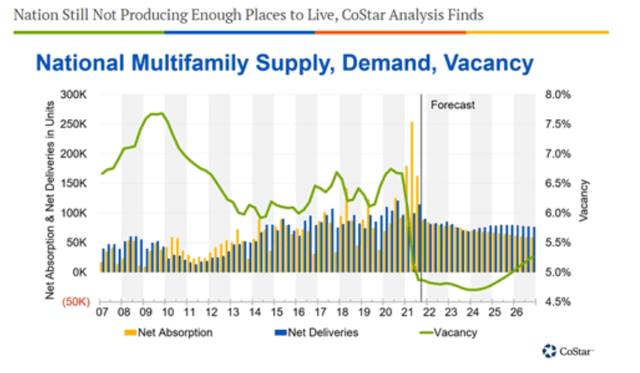

Commercial real estate services group CoStar recently forecast that demand for multifamily units should remain elevated for years to come, and net absorption should match whatever amount of completed units developers are realistically able to deliver.

In this chart, notice that net absorption (yellow bars) far outstripped net deliveries in 2021.

Apartment vacancy rate (Costar)

With demand still ultra-high for apartments, it appears that renters will be ready to absorb virtually everything developers are able to deliver in the next few years, keeping vacancy rate suppressed at very low levels during that time.

CoStar doesn’t foresee net deliveries rising above net absorption until 2024.

This is a recipe for record low vacancy rates and elevated rent growth for at least another few years. But considering that the multifamily vacancy rate may not return to its pre-pandemic level of around 6.25% until the late 2020s, rent growth above the pre-pandemic average could continue for most of the decade.

But why should apartment demand remain so elevated in the years ahead?

Consider a few points:

Lack of Home Affordability

First, consider the affordability (or lack thereof) of homeownership in today’s world. When mortgage rates fell, it set off a wave of home buying that caused home prices to soar by double-digits in 2020 and 2021.

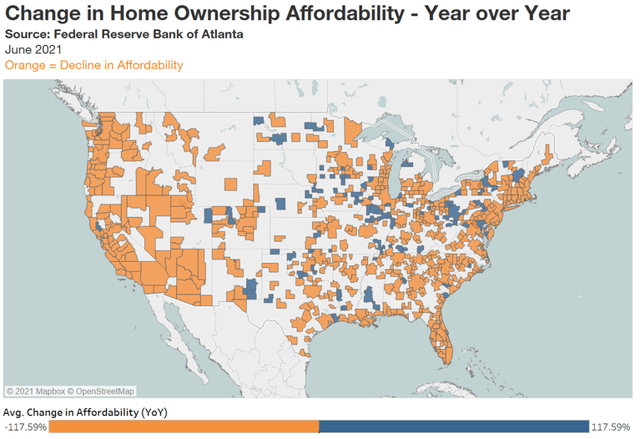

According to the Atlanta Fed, affordability of homeownership declined for the vast majority of the country last year.

Home affordability declining (OpenStreetMap)

In fact, the median American household would need to spend 32.6% of its income on a mortgage payment in order to buy a median-priced home in 2021. That is down only slightly from the 34% number from November 2008 when homeownership was at its least affordable moment in US history.

The huge rise in home prices has been especially burdensome for first-time homebuyers – the people who want to go from renting to owning a home. Zillow reports that it now takes first-time homebuyers a year longer than it did five years ago to save up a down payment to purchase a home.

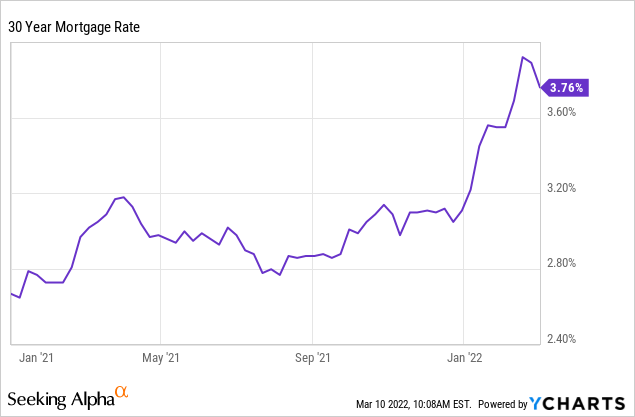

As mortgage rates rise this year and home prices remain elevated, many would-be first-time homebuyers are priced out of the market and forced to continue renting. Consider the effect that rising home prices and rising mortgage rates will have on home affordability going forward.

30 year mortgage rate (YCHARTS)

Long-Term Shortage of Homes

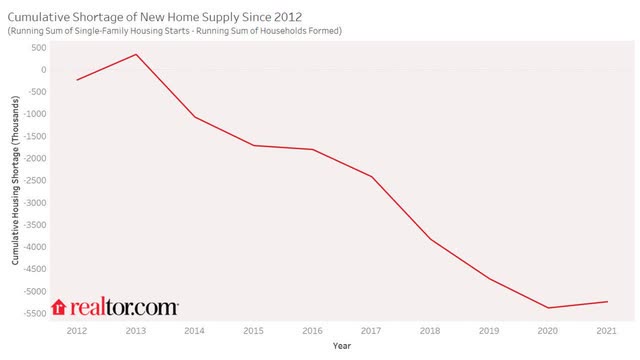

Looking out to a longer timeframe, it’s important to note that the cumulative shortage of homes has reached about 5 million as of the middle of 2021.

Shortage of homes (Realtor)

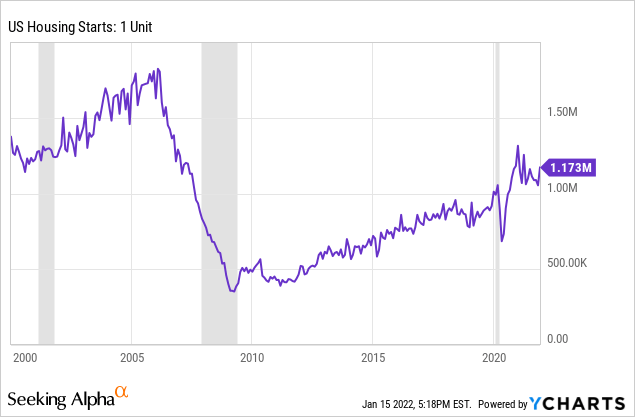

And though the number of single-family house starts jumped in the latter months of 2021, the total amount of new single-family housing remains well below its levels from before the Great Recession of 2008-2009:

US housing starts (YCHARTS)

To some degree, this lower single-family home construction makes sense, since US population growth is slowing. But for the time being, it also has the effect of causing home prices (and apartment rents) to rise.

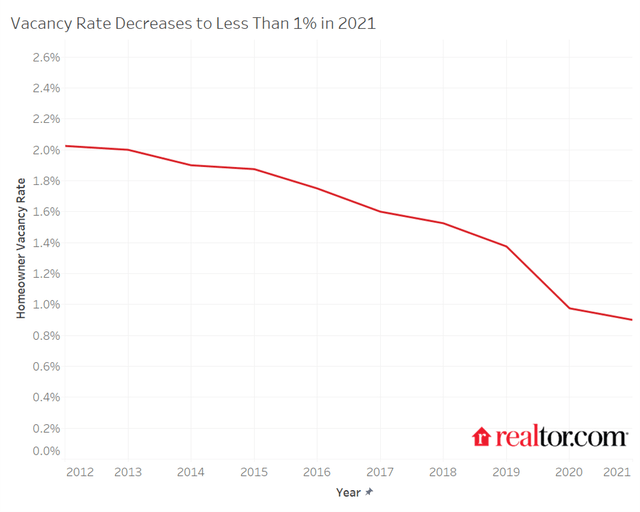

Emblematic of this home shortage is the fact that the homeowner vacancy rate fell to less than 1% in 2021.

Homeowner vacancy rate (Realtor)

Job And Wage Growth

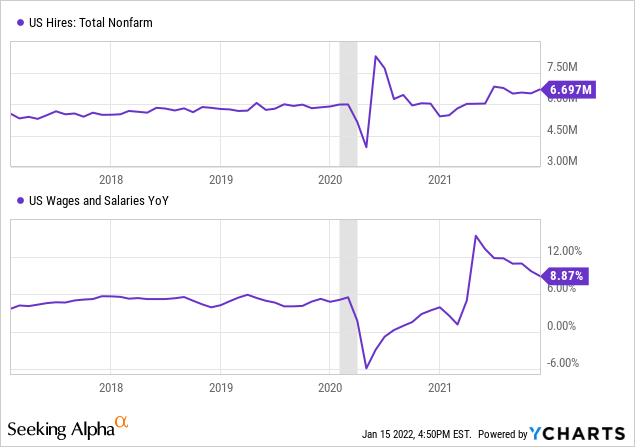

Consider also the fact that the US continues to add jobs and show rising wages. Put aside the total size of the labor force, which is smaller than before the pandemic due mostly to early retirements. Focus instead on the number of people getting hired for new jobs and the wage growth being enjoyed by those with jobs.

Though many jobs were lost during the pandemic, the number of hires for jobs in the wake of the pandemic continues to be higher than their level before it.

US hires and wages (YCHARTS)

What’s more, as you can see in the second panel above, wage & salary growth continues to be well above its pre-pandemic level.

More people getting hired into new jobs and higher wage growth at those jobs spur demand for apartments.

Household Formation Remains Strong

The core component of demand for housing, whether owned or rented, is household formation – that is, new individuals and families entering the housing market.

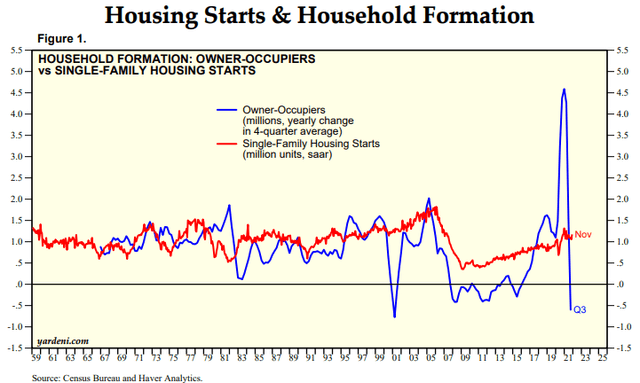

When we look at household formation for owner-occupiers (people buying homes), we see a massive spike occur in 2020, shortly after mortgage rates dropped.

Owner-occupied housing demand (Census Bureau and Haver Analytics)

But in 2021, as home prices soared higher, demand for homes from new buyers plummeted and turned negative in the third quarter. According to CNN, in November 2021 the share of first-time homebuyers sank to 26%, compared to 32% in the same month a year prior. That is around the lowest level of first-time buyers since the National Association of Realtors began tracking this statistic in 2008.

This should come as no surprise, given that housing inventories are extremely low and prices are still rising. The affordability of homeownership is simply slipping out of reach for many Americans.

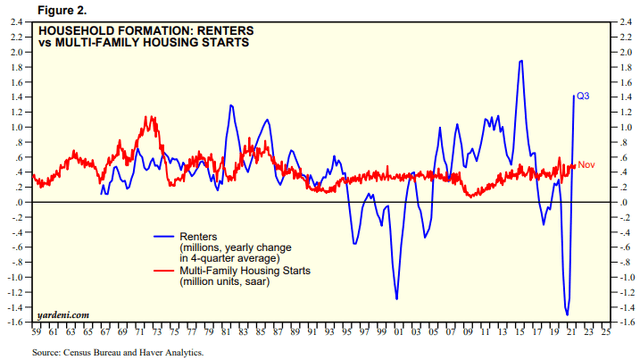

Year-over-year change in renters followed a mirror opposite pattern as owner-occupiers in 2020-2021. When mortgage rates dropped, many renters who had wanted to buy a home pounced on the opportunity. But as home affordability slipped out of reach, the growth in the renter base surged in 2021.

Renter demand vs housing deliveries (Census Bureau and Haver Analytics)

Census Bureau data shows that 58% of young adults aged 18-24 lived at home with their parents in 2021, while 17% of adults aged 25-34 lived with their parents. For most young adults (not to mention the parents!), this is a less-than-ideal living situation. Thus, these millions of young adults living with their parents represent substantial pent-up demand for apartments in the coming years.

Moreover, RealPage reports that the national average renter income was $70,116 in 2021, up 11% from its pre-pandemic number. This has kept the average rent to renter income ratio in the low 20% range. Anything below 30% rent-to-income is considered healthy, leaving further room for rent growth.

Bottom Line

Green Street recently projected that apartment REITs would enjoy net operating income growth of 13.5% in 2022. Meanwhile, the National Association of Realtors forecasts that rents will rise another 7% in 2022 – less than 2021’s 18% but still stronger than pre-pandemic rates of rent growth. And Freddie Mac forecasts vacancy rates remaining flat in 2022 and nationwide rent growth of 4%, with rents rising faster in Sun Belt states.

All of the above makes us bullish on the apartment sector, especially those located in fast-growing Sun Belt markets like Tampa, Florida; Austin, Texas; and Phoenix, Arizona.

Today, we own 6 different apartment REITs at High Yield Landlord to capitalize on this opportunity.

Be the first to comment