Kimberly White

Thesis

This is our second article comparing British American Tobacco p.l.c. (NYSE:BTI) and Altria Group, Inc. (NYSE:MO). We wrote our first article back in March (March 28, 2022, to be precise). The article explained our thinking on BTI and MO, and why we like both but only hold BTI.

The key considerations are quoted below,

As you will see, the primary reason is that BTI offers better geographical diversification of our portfolio relative to our other holdings. As a secondary reason, we like BTI better because its current owners’ earning yield plays a larger role in its long-term return projection, making BTI more of a conservative investment and MO more of a growth investment – in relative terms against each other.

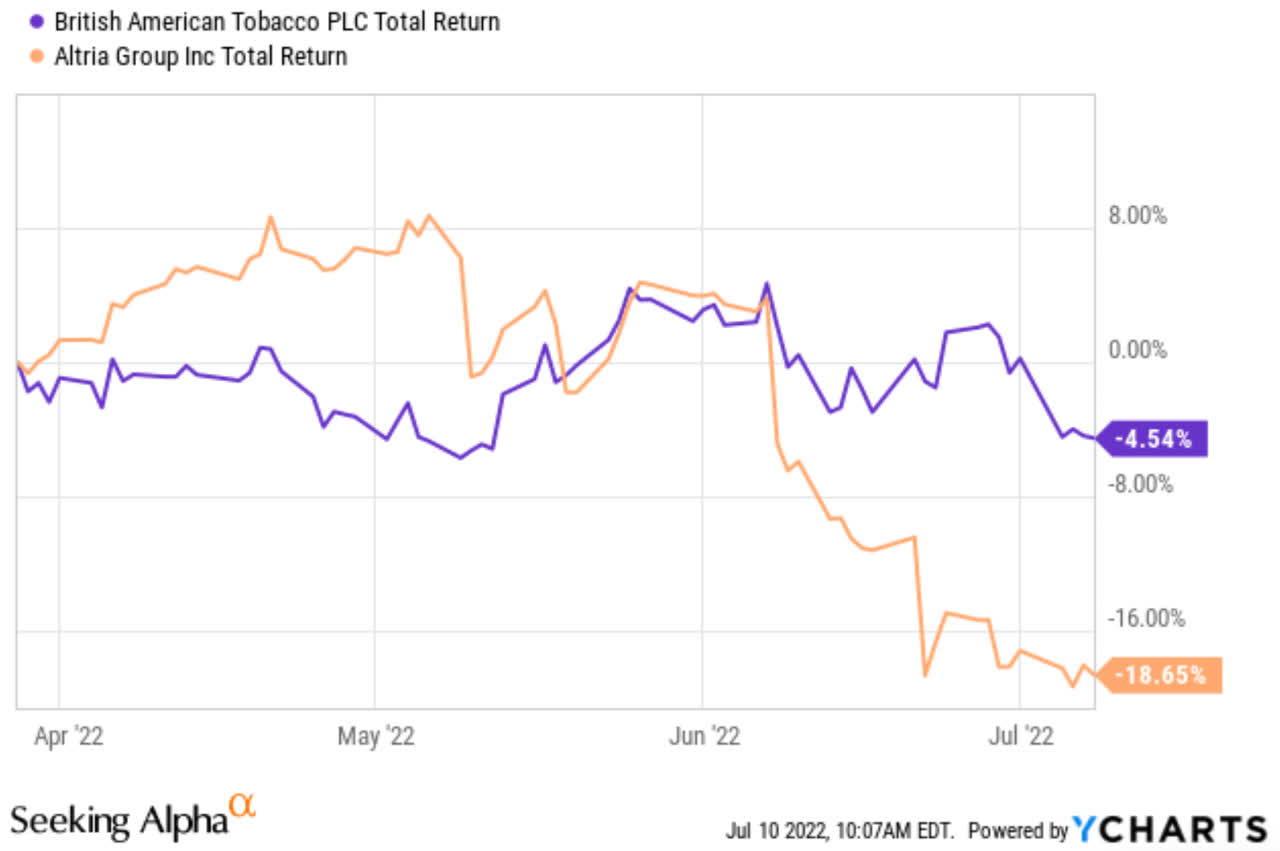

Indeed, the price actions following the publication of that article seem to illustrate the conservative nature of BTI. As you can see from the chart below, since then, the price of MO has suffered a correction of almost 19% (due to JUUL developments, more on that later). Meanwhile, BTI held relatively stable and only suffered a minor correction of 4.5% amid the broader market panic.

Our last article focused more on the aspect of the owner’s earnings yield. In this article, we will focus more on the aspect of geographical diversification. You will see why we will keep holding onto BTI despite the large price correction in MO (which made its owners’ earning yield more attractive). You will see the U.S. market is only a relative minority for BTI (thus making it less sensitive to U.S. policy and economic conditions). Furthermore, BTI’s sales enjoy substantial exposure to the emerging markets, which is where Ray Dalio has been allocating his positions.

BTI provides geographical diversification

Our readers probably could tell that my investment philosophy is heavily influenced by Ray Dalio in many ways. The need for really long-term thinking, the need to draw insights beyond our immediate lifetime experiences, and the need to understand macroeconomics forces are all crucial in my investment thinking.

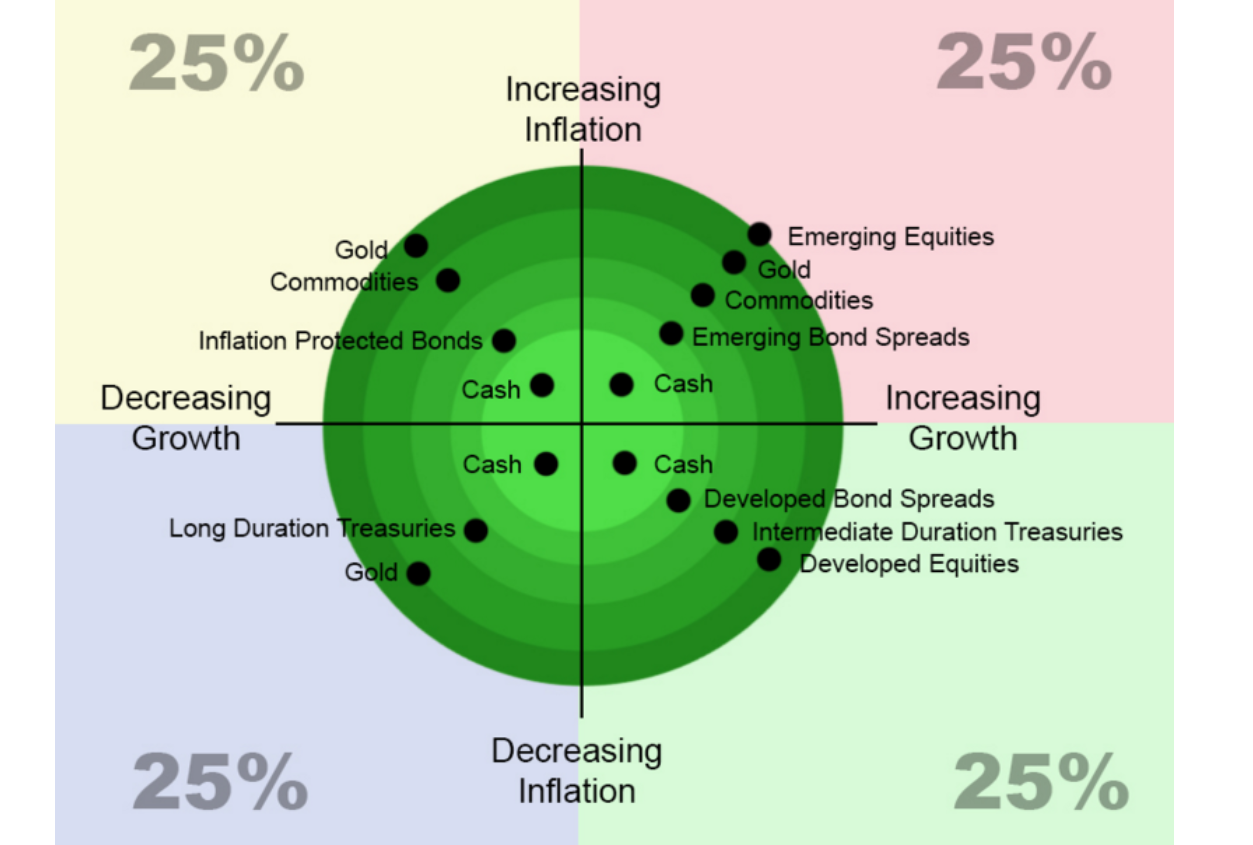

Today, I will focus on one insight: the role of diversification. I am sure everyone reading this article knows the importance of sector diversification and knows that owning 15 banking stocks does not help diversification. However, proper diversification goes deeper than sector. Proper diversification requires, of course, sector diversity, but that is the LAST detail. The grand picture starts with isolating your risk exposures using a barbell model, followed by assets that respond differently to fundamental economic forces as shown in the chart below, then followed by geographical diversity.

Source: macro-ops.com

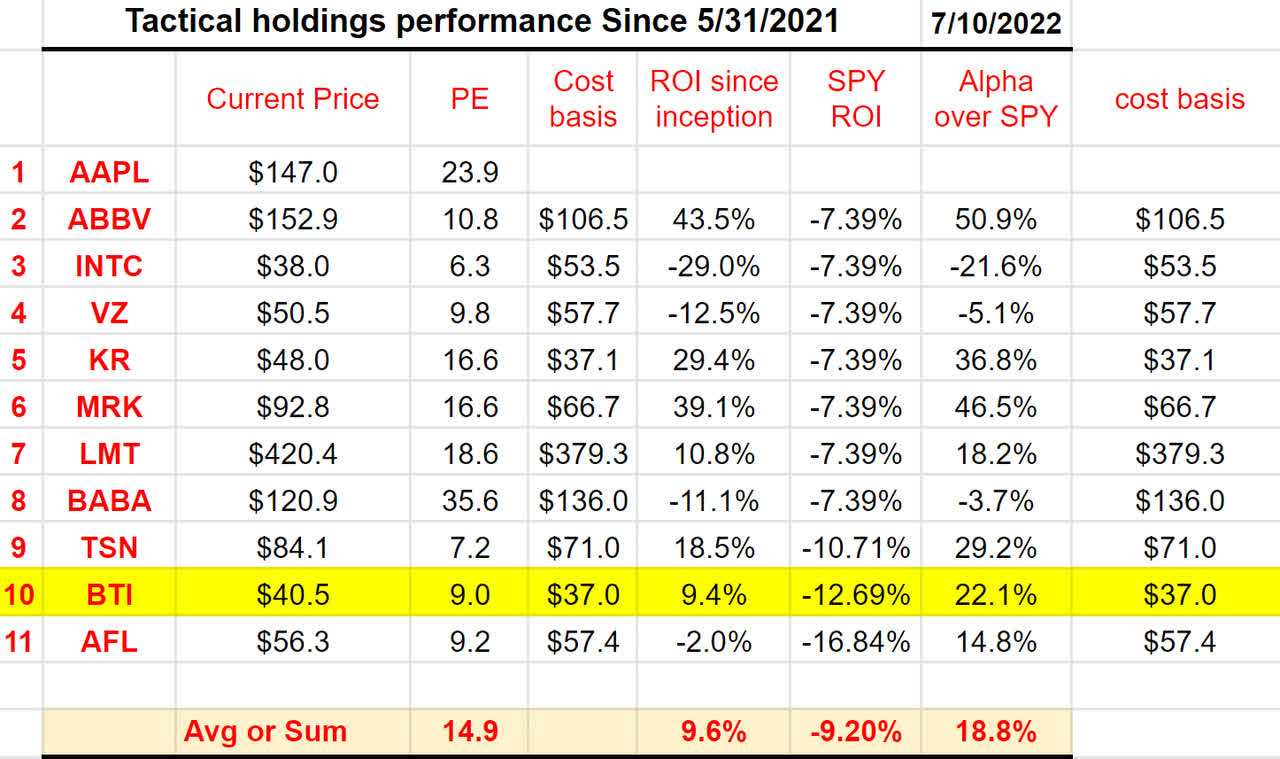

Within this context, you can see why we hold BTI but not MO. Our stock holdings are shown in the table below. And as commented in our earlier article,

BTI offers better geographical diversification of our portfolio relative to our other holdings. We always tell our members that no holding is bad or good by itself. It has to be always discussed under the context of what else is already in the portfolio.

You can also see that our concentrated holdings (only 11 of them) not only span different business sectors, but also different geographical exposures (e.g., BABA, AFL, and BTI) beyond the U.S. They are also selected to perform differently under different macroeconomic conditions. AAPL and INTC would benefit from a growth cycle more, while LMT and the staples such as TSN and KR would be more resilient to inflation and recession (more on this later when we analyze Dalio’s positions).

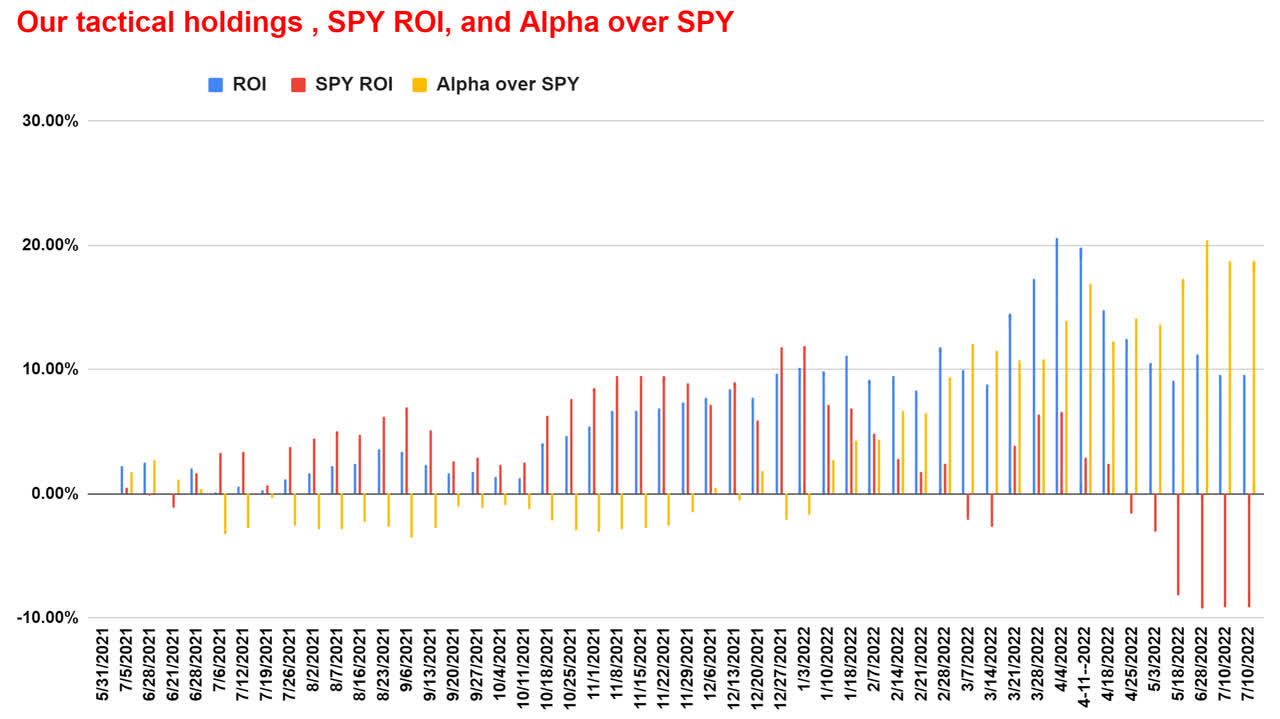

As a result of such diversification at multiple levels, as you can see from the next chart, by holding FEWER but well-understood stocks, we not only generated higher returns but also lower volatility. Using the date I first published it on 5/31/2021 as the inception date (and I might also add that there had been no turnover at all since then), our holdings are leading the S&P 500 by 18.8%. Also:

Note that AAPL has been a legacy holding and its returns are not included in these charts (otherwise, it will completely dominate the picture). Also note that these returns did not include dividends, so the actual returns from our holdings are slightly better than reported here.

BTI and MO’s Revenue exposure

Now let’s dive in and examine the revenue exposure of BTI and MO more closely. The picture for MO is quite simple. It derives most of its revenues (almost 88%) from its smokable products, while its other products (such as oral tobacco, wine, and smokeless) contribute about 12% combined. Also, Altria only sells its tobacco products in the United States (although it has vested interests in other companies that sell products worldwide).

Merrill Edge

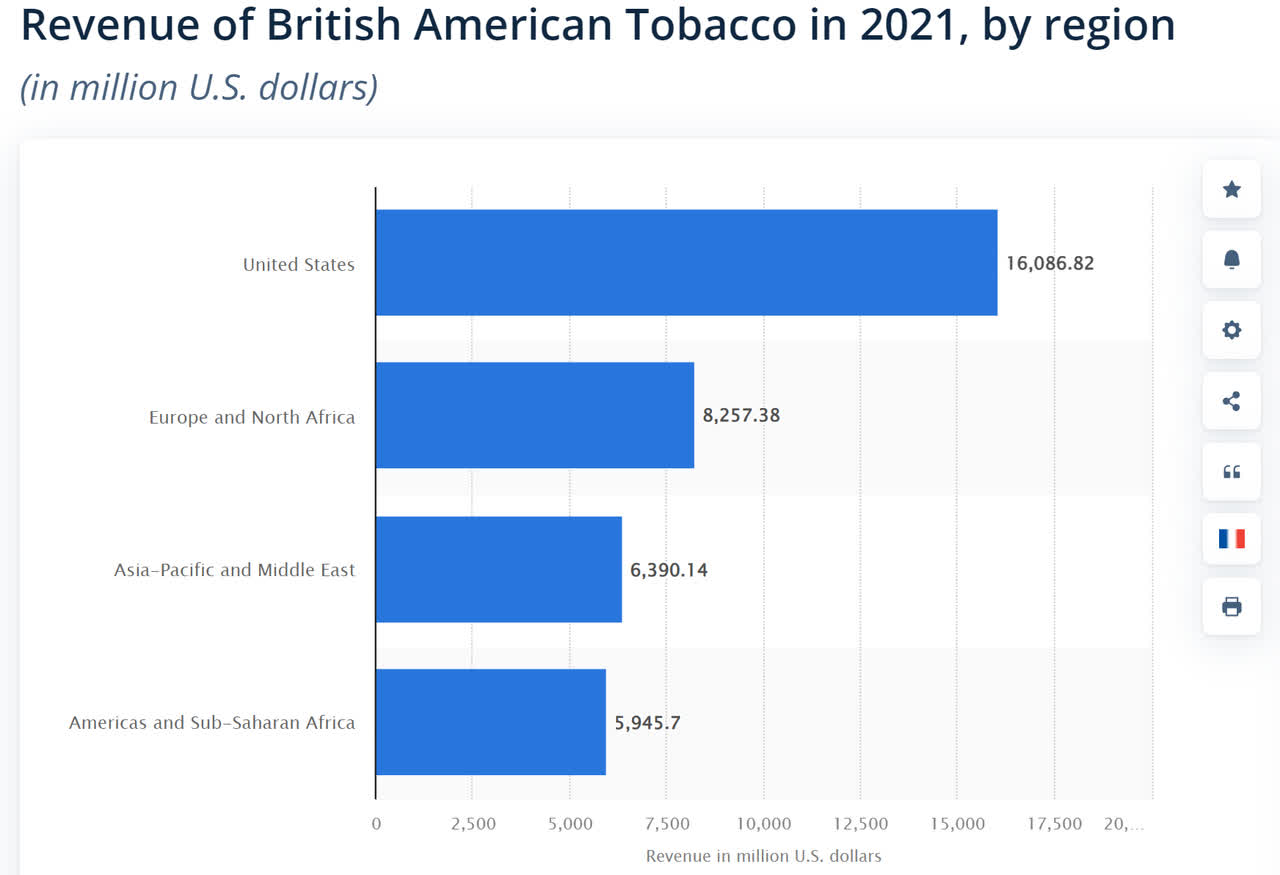

The picture for BTI is very different, in contrast. The following chart shows the revenue distribution of British American Tobacco in 2021 by region. As seen, the United States contributed the largest share of its revenue ($16.1B). But to put things in perspective, the United States’ contribution is a relative minority – it represents only 47%, less than half, of its total revenue. The next largest contributor comes from Europe and North Africa ($8.2B), about 24% of its total sales. The third-largest contributor is the Asia-Pacific and Middle East region (about $6.39B) or 18% of its total sales.

Note that many are the above geographic exposures are in the emerging markets, which is another reason why we prefer BTI, as detailed immediately next.

Statista

Role of geographical diversification and Ray Dalio positions

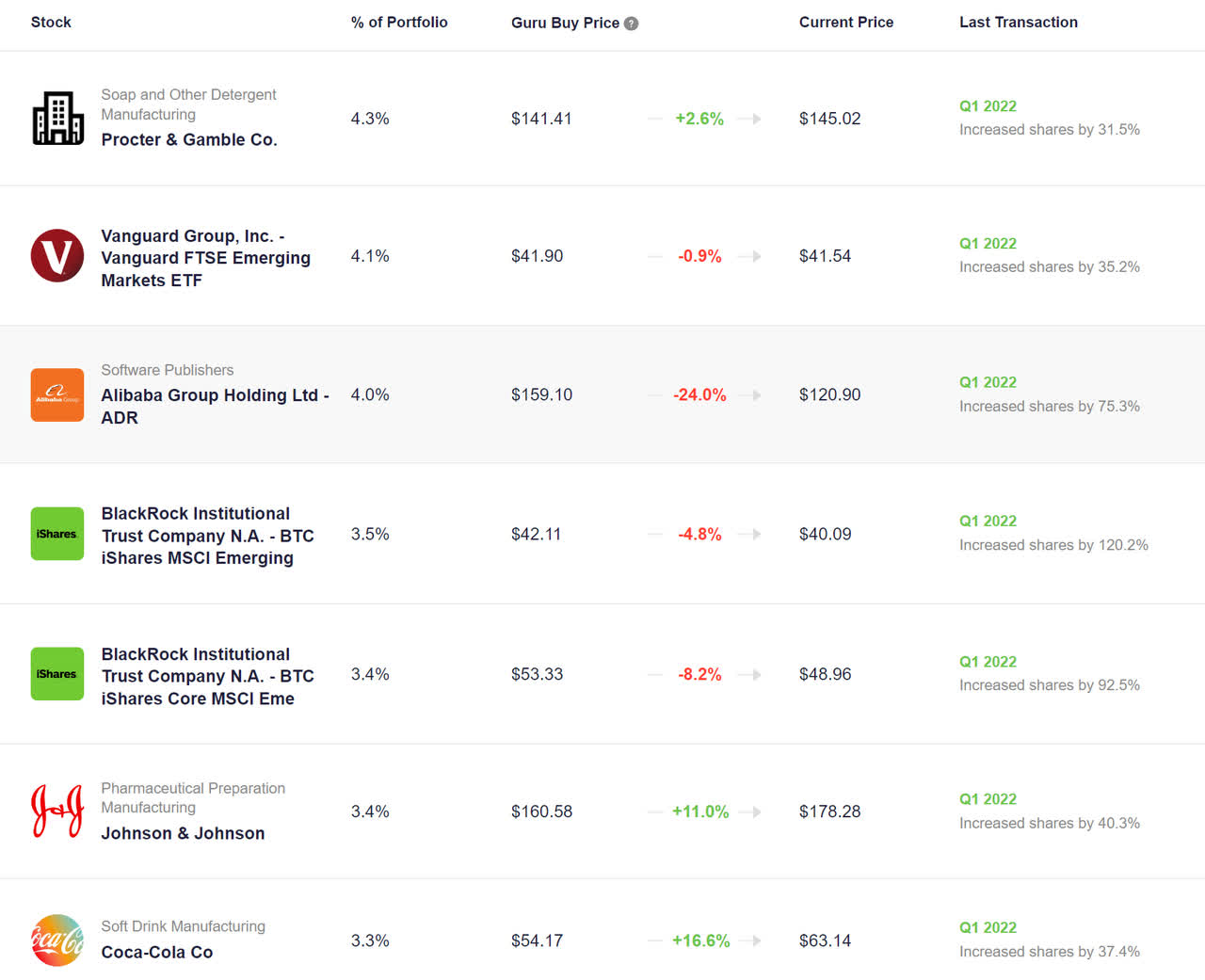

Perhaps Ray Dalio’s own positions illustrate his thinking on diversification more clearly than his writings. The following chart shows the last positions of his Bridgewater positions according to the latest 13F disclosure filed in Q1 of 2022.

As seen, the Vanguard FTSE Emerging Markets Index Fund ETF Shares (VWO) is the second-largest single holding, representing about 4.1% of the total portfolio. Further, he also holds other merging market funds besides VWO, so his exposure to emerging markets is substantially higher than 4.1%. As you can see, he also holds the iShares Core MSCI Emerging Markets ETF (IEMG) with an allocation of about 3.5%, followed by the iShares MSCI Emerging Markets ETF (EEM) with an allocation of about 3.4%. If you also include his 4% BABA position as exposure to the emerging market, emerging markets represent about 15% of his portfolio. You can also see that his recently increased exposure to all these positions substantially gains more exposure to the emerging market.

And for us, the geographical diversification provided by BTI, especially to emerging markets, is very consistent with the above Dalio philosophy.

Source: stockcircle.com

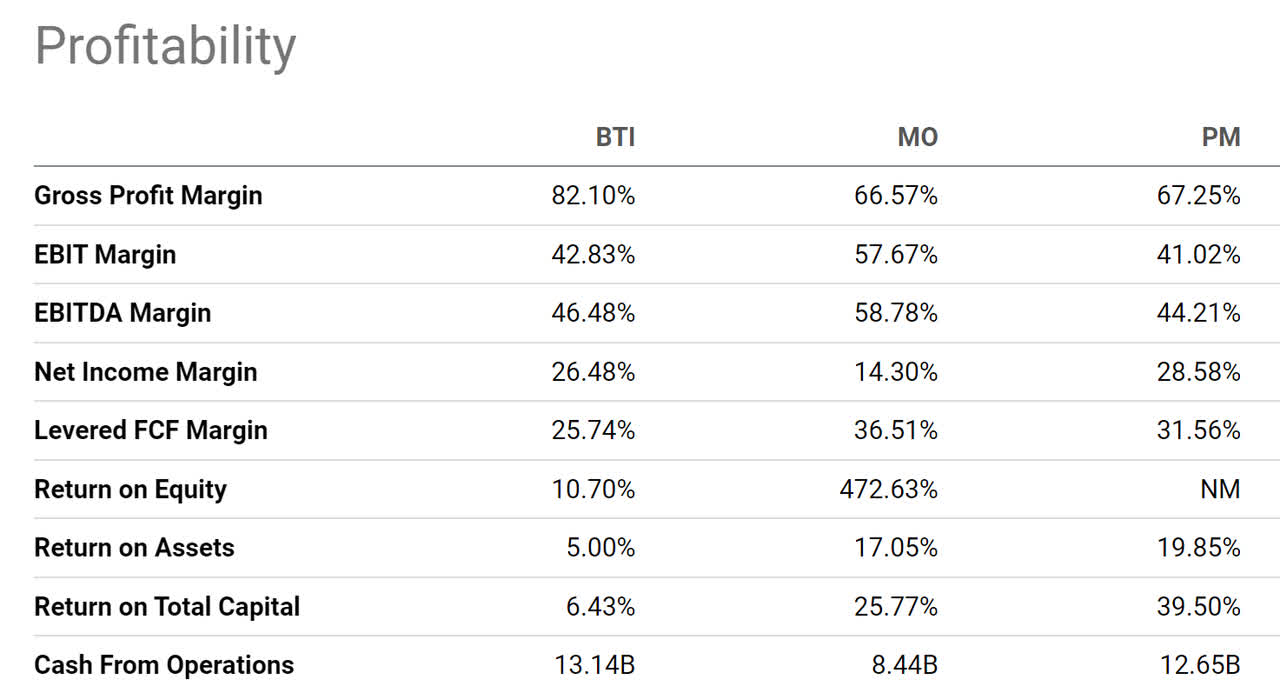

BTI and MO’s Profitability

In terms of profitability, both are terrific businesses (and that is why we like both of them). As you can see from the following chart, both enjoy strong profitability. Comparing profitability is ultimately subjective but my overall takeaway here is that their profitability is very similar and both remarkable. To cite a few key metrics, BTI enjoys an outsized gross margin of 82%, considerably higher than MO’s 66% (which is already superb in its own right). Moving on to net margin, BTI’s net margin is about 26% again substantially higher than MO’s 14% (which is again already higher than the overall economy by about 2x). To sum things up, MO enjoys considerably better EBIT margin, EBITDA margin, and also FCF margin. Note that the return on equity metric is not applicable here and should be ignored because of the differences in their capital structure.

Finally, also note that BTI is also larger in absolute sizes ($13.1B of operation cash) than MO ($8.44B). With about $12.6 operation cash, Philip Morris (PM) is similar in absolute size to BTI. A larger scale adds another layer of safety.

Seeking Alpha

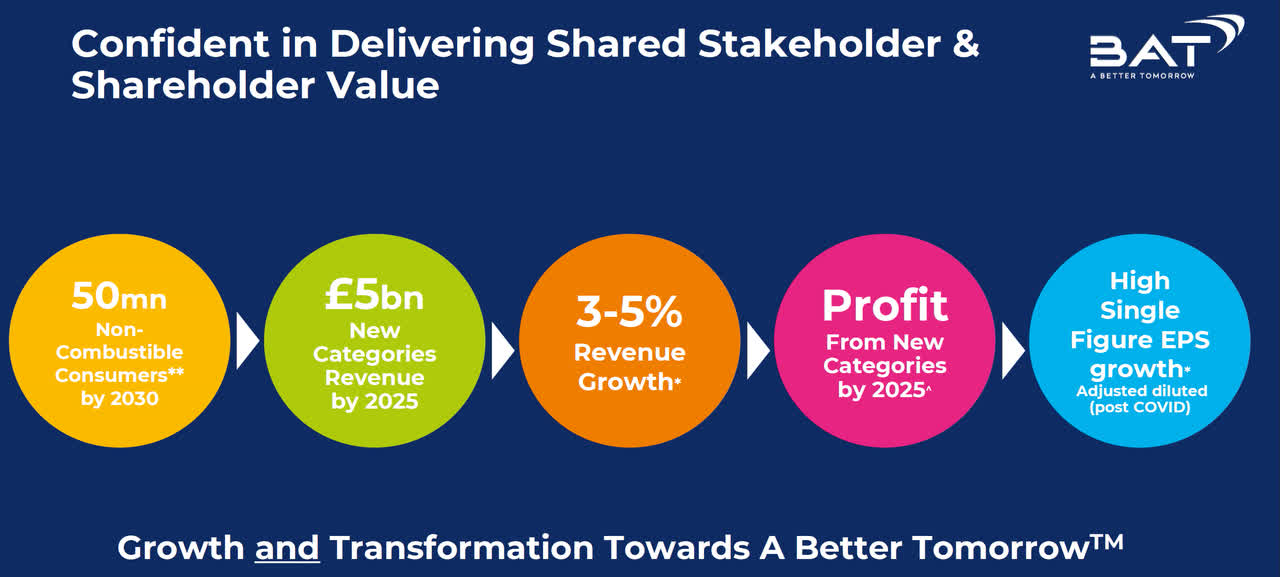

Looking forward, both BTI and MO recognize the secular decline of their traditional smokable products. And both have been actively developing new categories. BTI’s progress is smoother so far, and MO has been facing quite a bit of policy uncertainties regarding its JUUL products (More on this in the risk section). In contrast, BTI’s Vuse, glo, and Velo have all been gaining momentum globally, as commented by BTI CEO Jack Bowles during the most recent earnings report (abridged and emphases added by me),

We are transforming BAT at speed to a high growth, Multi-category CPG, led by the growing New Category volume … and reducing our impact on public health…. I am delighted that our established consumer-centric multi-category strategy has delivered excellent growth in the first half of 2021. New Category revenue was up 40% at current rates and 50% at constant rates. We added 2.6 million New Category consumers in H1, our highest ever increase, to reach 16.1 million consumers of our non-combustible products. This was driven by our powerful global brands, Vuse, glo and Velo, underpinned by strong innovation. We are leveraging our existing strengths and new digital capabilities in the

BTI earnings report

Dividends and Valuation

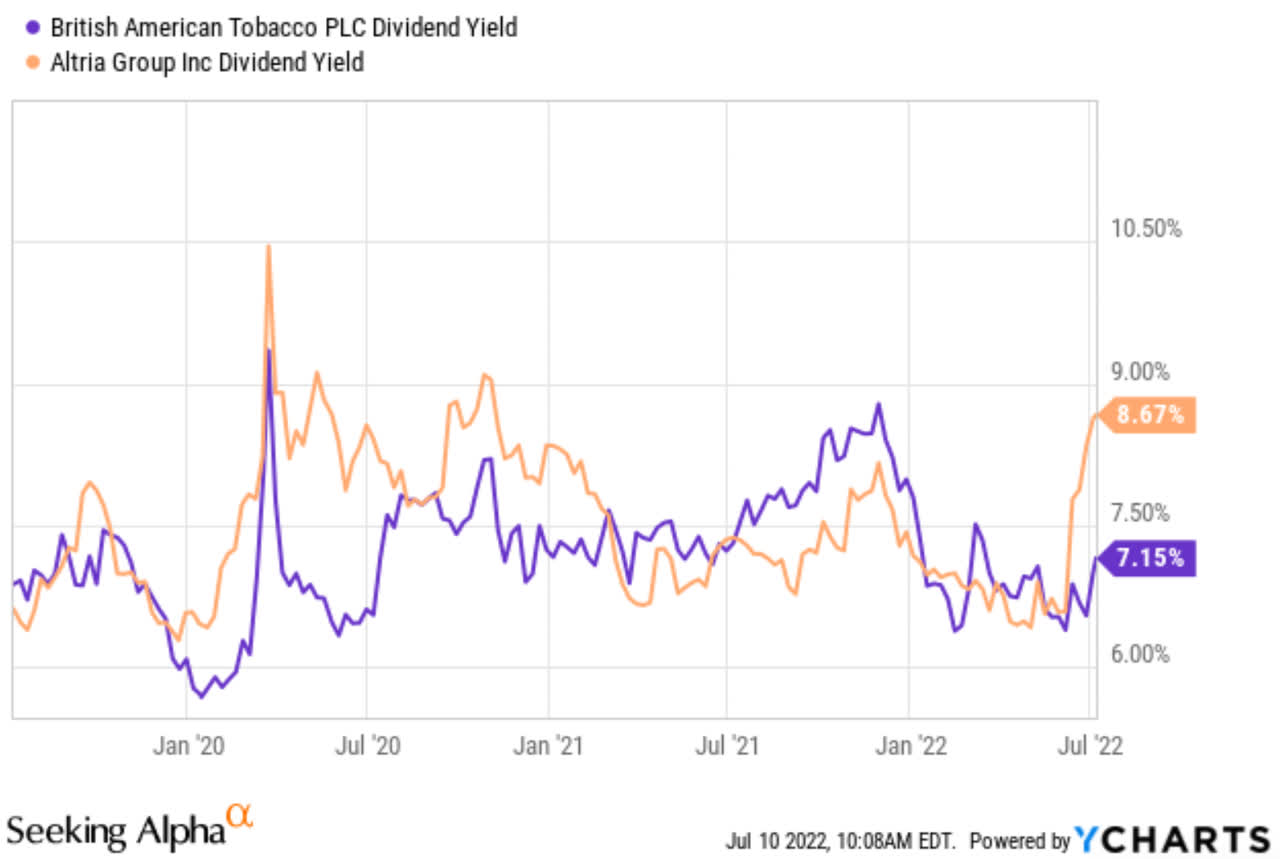

On to valuation. The recent large correction has certainly made MO attractively valued. In terms of dividends, it is yielding 8.7%, near the highest level in 3 years as you can see from the following chart. To put things under perspective, MO’s yield has fluctuated in the past 3 years between 6.29% and 10.4% with an average of 7.5%. Therefore, its current dividend yield by 16%. In contrast, BTI’s dividend yield is slightly below its historical average. Its yield fluctuated in the past 3 years between 5.68% and 9.35% with an average of 7.2%. Therefore, its current 7.15% dividend yield is slightly below its historical average.

Seeking Alpha

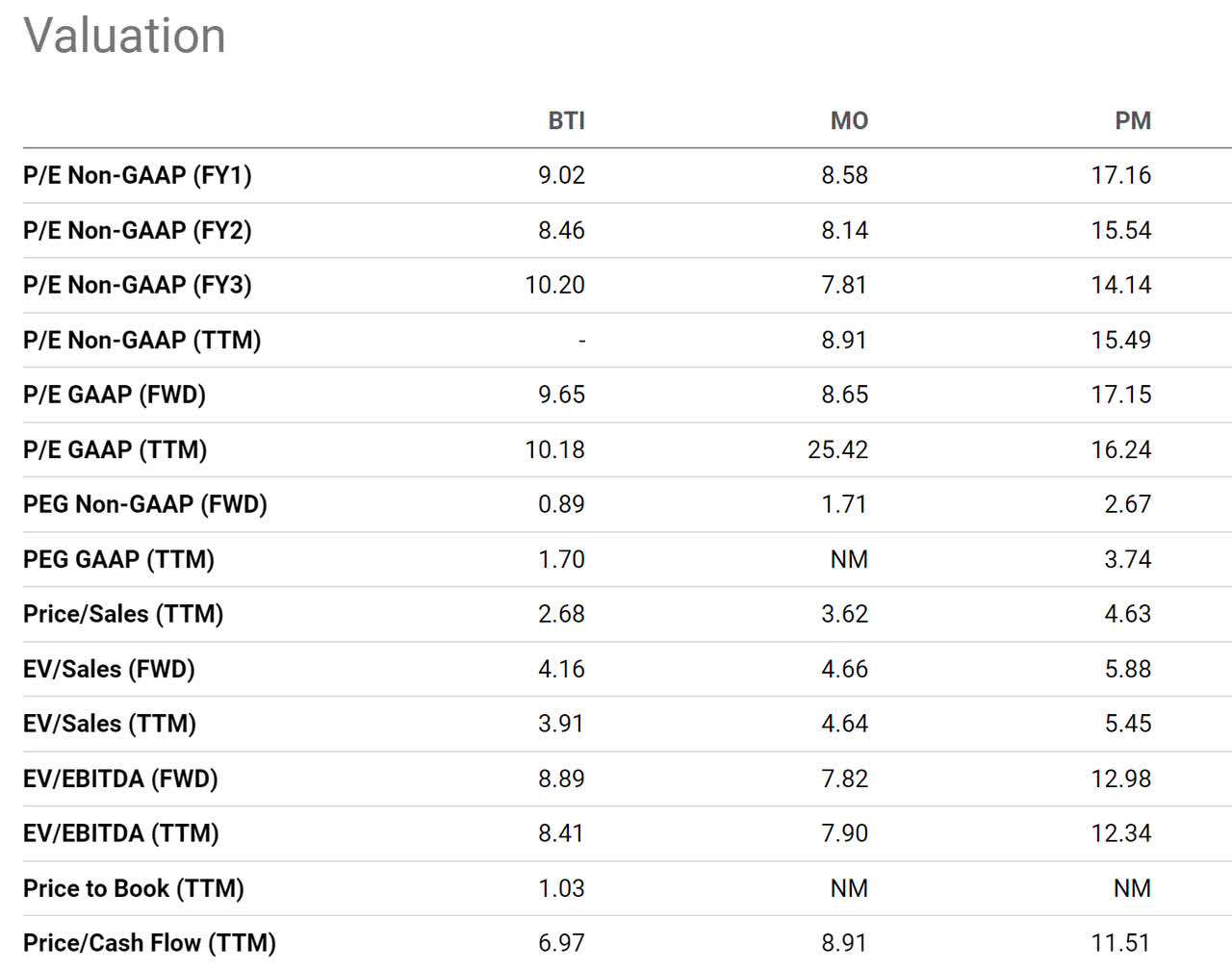

Although in other valuation metrics, both BTI and MO are quite attractive. As you can see from the following chart, both are attractively valued in terms of P/E multiples. BTI’s FY1 P/E is about 9x, within less than 5% difference from MO’s 8.58x (and both about ½ of PM’s 17x P/E). In terms of topline metrics, BTI’s price-to-sales ratio is only 2.68, compared to MO’s 3.62x and PM’s 4.63x. Lastly, BTI’s price/cash flow multiple is also at a sizable discount (only about 7x) compared to both MO and PM.

Seeking Alpha

Final thoughts and risks

For many of us, our portfolios are probably disproportionally exposed to the U.S. market, for good reasons. It is never a good idea to bet against the U.S. However, adding some geographic exposure can help to isolate risks and capture growth. Such considerations are the main reason why we own BTI but not MO, even though both are superbly profitable businesses. BTI provides investors an indirect opportunity (or direct opportunity depending on your view) to capitalize on the global market, especially the emerging markets. And with the majority of its revenues coming from the rest of the world, it is better shielded from policy and economic uncertainties in the U.S.

Although as aforementioned, no holding is bad or good by itself. The discussion has to be always under the context of what else you also hold. In case your other holdings already provide sufficient geographical diversification, MO is a great stock too. And I share Dalio’s view about consumer staples under the current inflationary conditions. As you can recall from the chart showing Ray Dalio’s positions, he also increased his exposure to consumer staple stocks substantially (such as PG and JNJ). These stocks, just like MO and BTI, have demonstrated pricing power and resilience against inflation.

Finally, risks. The secular decline of the traditional combustible products is a fundamental risk to both MO and BTI. Their new categories, even though showing high growth, especially for BTI, still only represent a relatively minor part of their overall profit. The ultimate success is uncertain and can be subject to policy and regulation changes. A recent example involves MO’s JUUL e-Cigarettes. The Wall Street Journal reported two weeks ago that the FDA may order JUUL off the U.S. market, and the report has triggered a large price plunge for MO. Similar regulatory changes could happen to BTI, too.

Be the first to comment